Latin America Defense Market Size, Share, Trends and Forecast by Type, Armed Forces, and Country, 2025-2033

Latin America Defense Market Overview:

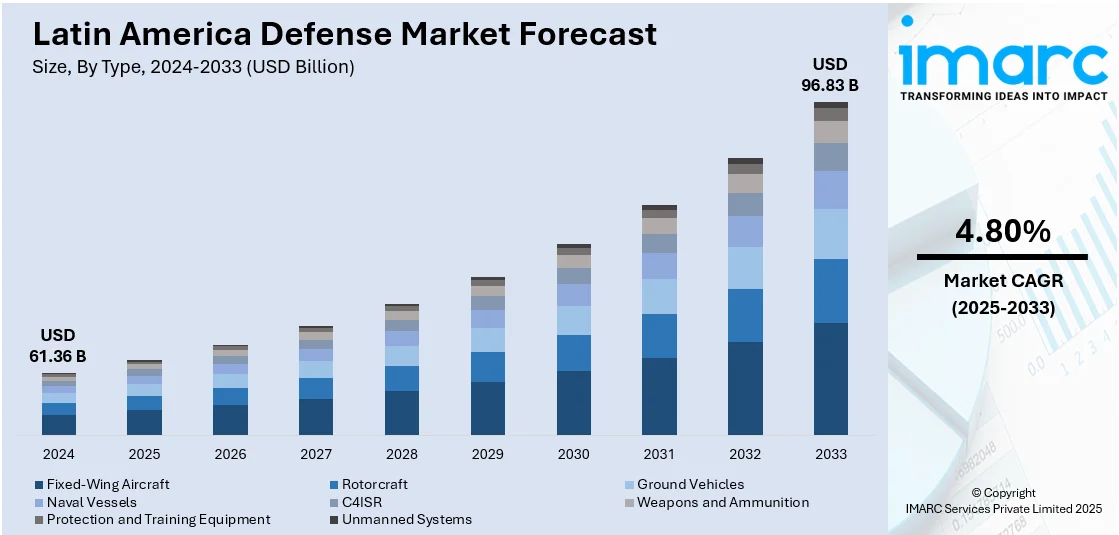

The Latin America defense market size was valued at USD 61.36 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 96.83 Billion by 2033, exhibiting a CAGR of 4.80% from 2025-2033. The growing allocation of government budgets for strengthening military capabilities and securing national borders, increasing initiatives to modernize military hardware and software, and rising threats posed by narcotics trafficking and organized crime are some of the factors impelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 61.36 Billion |

| Market Forecast in 2033 | USD 96.83 Billion |

| Market Growth Rate 2025-2033 | 4.80% |

Latin America Defense Market Trends:

Increased Government Defense Budgets and Strategic Partnerships

The increased allocation of government budgets toward strengthening military capabilities and securing national borders is impelling the Latin America defense market growth. Moreover, numerous countries in the region, such as Brazil, Mexico, and Colombia, are substantially ramping up their defense spending. This increment is largely due to rising concerns related to border security, organized crime, and regional instability. The administration of President Luiz Inácio Lula da Silva of Brazil submitted the Fiscal Year 2025 budget request in 2024. It stated that the 2025 budget proposals will increase defense spending by 5.9 percent, with money going toward major projects like the purchase of nuclear-powered submarines, armored vehicles, and helicopters.

Technological Advancements and Modernization Programs

Technological advancements are positively influencing the market with countries actively seeking to modernize their military hardware and software. The region is experiencing a rise in the procurement and deployment of sophisticated equipment, such as unmanned aerial vehicles (UAVs), cyber defense systems, and electronic warfare tools. In 2024, the Brazilian Army deployed a UAV named Nauru 500C, which was transported in an H-36 Caracal helicopter from the First Squadron of the Eighth Aviation Group (1º/8º GAV) – Falcão Squadron of the Brazilian Air Force. Nauru 500C is employed to map areas of interest under the guidance of the Amazon Protection System Management and Operations Center (CENSIPAM). New service and product launches are also emerging as pivotal in fulfilling these modernization goals. For instance, in 2023, Argentina introduced its second national cybersecurity strategy for combating cybercrime. With seven objectives, this strategy was expected to address the cybersecurity complications at the federal level and protect the nation’s critical infrastructure. According to the Latin America defense market outlook, this move marked a significant milestone for the country, signaling an important shift toward self-reliance in cybersecurity.

Counter-Narcotics and Internal Security Operations

The continuous threat posed by narcotics trafficking and organized crime is encouraging various Latin American nations to enhance their defense capabilities, focusing heavily on internal security measures. Counter-narcotics initiatives are driving the demand for new technologies and tactical equipment that enable more effective surveillance and border control. Colombia, a country notably impacted by organized crime, is significantly upgrading its defense framework. Moreover, product and service launches included advanced thermal imaging cameras and AI-powered analytics platforms for real-time data interpretation. Such innovations are proven essential for identifying and disrupting illegal activities before they escalate. Additionally, partnerships with international allies are facilitating access to specialized training programs focusing on intelligence gathering and rapid response strategies. Moreover, there is an increase in seizures of narcotics and interdiction operations in Latin, attributed to the deployment of these advanced defense tools. In 2023, Brazilian authorities took part in a series of capacity-building workshops coordinated by the International Narcotics Control Board (INCB) Global Rapid Interdiction of Dangerous Substances (GRIDS) Program. These courses were designed to improve officers' ability to combat the trafficking of non-medical synthetic opioids and harmful new psychoactive substances (NPS). This represents one pf the major factors increasing the Latin America defense market share.

Latin America Defense Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and armed forces.

Type Insights:

- Fixed-Wing Aircraft

- Rotorcraft

- Ground Vehicles

- Naval Vessels

- C4ISR

- Weapons and Ammunition

- Protection and Training Equipment

- Unmanned Systems

The report has provided a detailed breakup and analysis of the market based on the type. This includes fixed-wing aircraft, rotorcraft, ground vehicles, naval vessels, c4isr, weapons and ammunition, protection and training equipment, and unmanned systems.

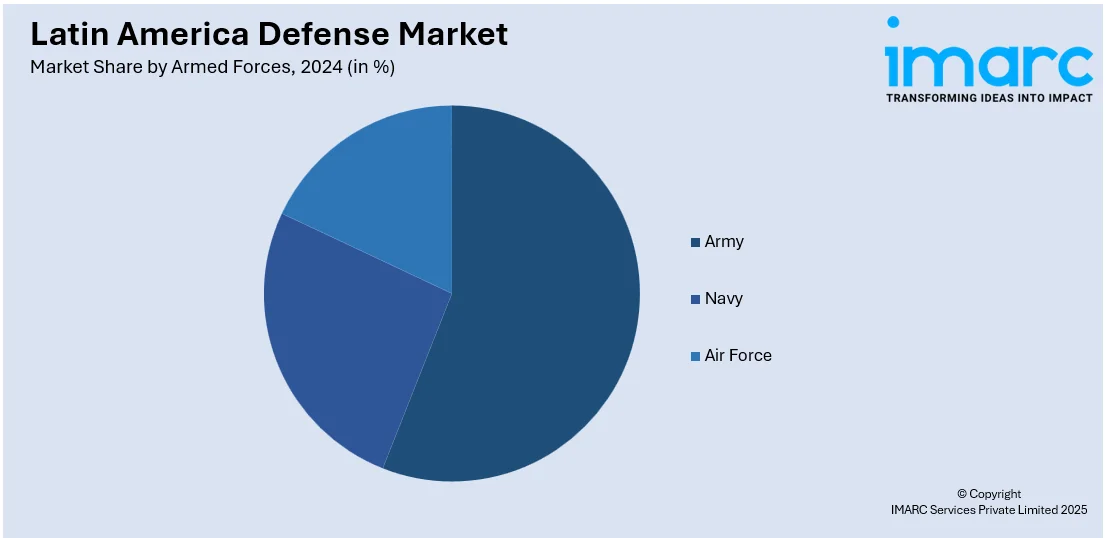

Armed Forces Insights:

- Army

- Navy

- Air Force

A detailed breakup and analysis of the market based on the armed forces have also been provided in the report. This includes army, navy, and air force.

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Defense Market News:

- In April 2023, The UAE’s defense conglomerate, Edge Group expanded their operations in the Latin American region by opening its new office in Brazil. The company planned to showcase its industry-leading advanced technology and defense solutions, forging new partnerships, and assisting in the development of national defense capabilities.

- In April 2023, Milrem robotics introduced its combat and firefighting ground drones to Latin America for supporting dismounted infantry missions under various weather conditions.

- In January 2025, adjutant generals and other senior National Guard leaders from 19 states, the District of Columbia, Puerto Rico, and the United States Virgin Islands met at U.S. Southern Command (SOUTHCOM) in Doral, Florida, to discuss their long-standing partnerships with countries in the Caribbean, Central America, and South America.

Latin America Defense Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed-Wing Aircraft, Rotorcraft, Ground Vehicles, Naval Vessels, C4ISR, Weapons and Ammunition, Protection and Training Equipment, Unmanned Systems |

| Armed Forces Covered | Army, Navy, Air Force |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America defense market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America defense market on the basis of type?

- What is the breakup of the Latin America defense market on the basis of armed forces?

- What is the breakup of the Latin America defense market on the basis of country?

- What are the various stages in the value chain of the Latin America defense market?

- What are the key driving factors and challenges in the Latin America defense market?

- What is the structure of the Latin America defense market and who are the key players?

- What is the degree of competition in the Latin America defense market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America defense market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America defense market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America defense industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)