Latin America Drone Technology Market Size, Share, Trends and Forecast by Type, Payload, Autonomy Level, Application, End User, and Region, 2025-2033

Latin America Drone Technology Market Overview:

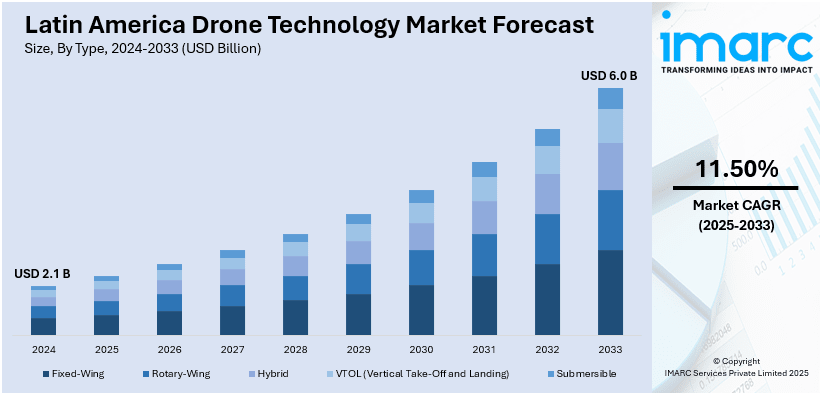

The Latin America drone technology market size reached USD 2.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.0 Billion by 2033, exhibiting a growth rate (CAGR) of 11.50% during 2025-2033. The market is primarily driven by the extensive use of drone technology in agriculture for crop monitoring and precision farming, rising infrastructure and development projects, and substantial governmental investments in drone technology for security and enhanced surveillance.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 6.0 Billion |

| Market Growth Rate 2025-2033 | 11.50% |

Latin America Drone Technology Market Trends:

Expansion in the Agricultural Industry

The rise in agricultural activities in Latin America has propelled the adoption of advanced technologies such as drones, crucial for precision farming and crop monitoring. These tools also support sustainable agricultural practices by optimizing resource use, including water and fertilizers. Thus, this is positively influencing the Latin America drone technology market share. On 30th September 2024, Hydrosat broadened its presence in Latin America by establishing four new commercial agreements, which will introduce its IrriWatch platform to Mexico and Guatemala. This satellite-driven crop monitoring system enables farmers to enhance water efficiency, enhance yields by as much as 50%, and decrease water usage by 30%. Additionally, the widespread adoption of drones facilitates the transition to more sustainable and environmentally friendly farming methods, vital in a region where environmental conservation is increasingly prioritized. This shift enhances crop yields and reduces the ecological footprint of farming operations, promoting a healthier ecosystem. Moreover, the implementation of drones in agriculture has fostered a new wave of technological enthusiasm and innovation in rural areas, often leading to local development and educational programs aimed at training farmers and agricultural technicians in drone operation and data analysis. This educational push helps cultivate a tech-savvy workforce, ready to harness the latest agricultural technologies to ensure long-term growth and sustainability in the sector. These efforts have facilitated the dissemination of drone technology across vast farmlands, allowing for detailed data collection and analysis that leads to more informed decisions on crop management and soil health. As a result, the agricultural drone market in Latin America is experiencing robust growth indicative of a broader regional trend where increased productivity and technological integration in agriculture are driving the Latin America drone technology market growth.

Supportive Government Investment in Security and Surveillance:

In regions including Mexico and Colombia, where security challenges such as drug trafficking and border incursions are prevalent, governments have significantly ramped up their investment in drone technology. Additionally, the widespread adoption of drone technology in security and surveillance includes advanced analytics capabilities, which transform raw aerial data into actionable intelligence. On 24th September 2024, BIRDS officially commenced operations in Brazil, introducing autonomous drone security solutions to prominent organizations throughout Latin America. Supported by Speedbird Aero, High Lander Aviation, and Cando Drones, the company provides round-the-clock surveillance, artificial intelligence-driven threat detection, and counter-drone functionalities extending up to 3 kilometers. In Mexico and Colombia, this capability allows for more effective deployment of law enforcement resources and better strategic planning to counteract criminal activities. Moreover, drones equipped with high-resolution cameras and other sensors can patrol hard-to-reach areas, providing a bird's-eye view that is critical for comprehensive surveillance. This technological leverage significantly enhances the operational efficiency of security forces, making it easier to manage large geographic areas with fewer personnel. Besides, the integration of drones into security strategies helps in direct surveillance, disaster response and traffic management, further broadening the scope and impact of drone technology in public safety operations across the region. Therefore, this is creating a positive Latin America drone technology market outlook.

Latin America Drone Technology Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, payload, autonomy level, application, and end user.

Type Insights:

- Fixed-Wing

- Rotary-Wing

- Hybrid

- VTOL (Vertical Take-Off and Landing)

- Submersible

The report has provided a detailed breakup and analysis of the market based on the type. This includes fixed-wing, rotary-wing, hybrid, VTOL (vertical take-off and landing), and submersible.

Payload Insights:

- Cameras

- Sensors

- Gimbal

- Payload Delivery

- Weaponry

A detailed breakup and analysis of the market based on the payload have also been provided in the report. This includes cameras, sensors, gimbal, payload delivery, and weaponry.

Autonomy Level Insights:

- Semi-Autonomous

- Autonomous

- Remotely Operated

The report has provided a detailed breakup and analysis of the market based on the autonomy level. This includes semi-autonomous, autonomous, and remotely operated.

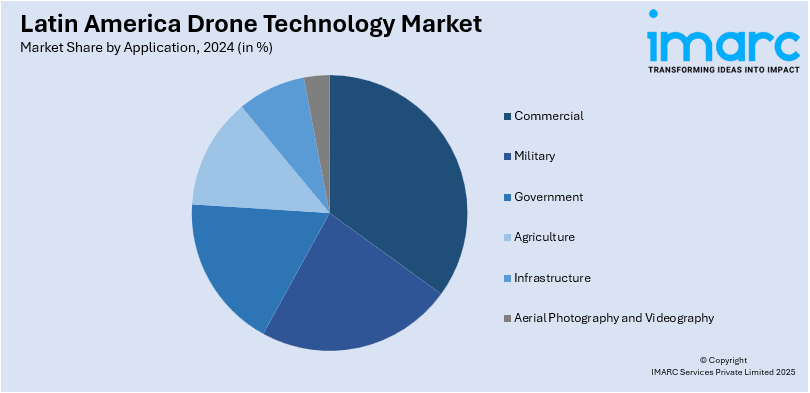

Application Insights:

- Commercial

- Military

- Government

- Agriculture

- Infrastructure

- Aerial Photography and Videography

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial, military, government, agriculture, infrastructure, and aerial photography and videography.

End User Insights:

- Enterprise

- Consumer

- Government and Military

The report has provided a detailed breakup and analysis of the market based on the end user. This includes enterprise, consumer, and government and military.

Regional Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Drone Technology Market News:

- On 12 July 2023, RigiTech's Eiger drone has embarked on a four-month pilot project in Uruguay, marking a significant advancement in drone delivery technology and the initiation of the first Beyond-Visual-Line-of-Sight (BVLOS) operation in Latin America. In collaboration with Spanish-Uruguayan firm CIELUM, engineer Franco Simini from the biomedical engineering nucleus at the Faculty of Engineering (UDELAR), and Tacuarembó Hospital (ASSE), the project is enhancing medical logistics across the Tacuarembó department by facilitating BVLOS deliveries.

- In March 2023, the UMILES Group declared its expansion into Chile, positioning it as an entry point into the Latin American market. This expansion includes its Drone Light Show business line, a Spanish leader in designing customized drone light displays, and its Commercial Services division which specializes in using unmanned aerial vehicles in the industrial sector.

Latin America Drone Technology Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed-Wing, Rotary-Wing, Hybrid, VTOL (Vertical Take-Off and Landing), Submersible |

| Payloads Covered | Cameras, Sensors, Gimbal, Payload Delivery, Weaponry |

| Autonomy Levels Covered | Semi-Autonomous, Autonomous, Remotely Operated |

| Applications Covered | Commercial, Military, Government, Agriculture, Infrastructure, Aerial Photography and Videography |

| End Users Covered | Enterprise, Consumer, Government and Military |

| Regions Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America drone technology market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America drone technology market on the basis of type?

- What is the breakup of the Latin America drone technology market on the basis of payload?

- What is the breakup of the Latin America drone technology market on the basis of autonomy level?

- What is the breakup of the Latin America drone technology market on the basis of application?

- What is the breakup of the Latin America drone technology market on the basis of end user?

- What is the breakup of the Latin America drone technology market on the basis of region?

- What are the various stages in the value chain of the Latin America drone technology market?

- What are the key driving factors and challenges in the Latin America drone technology market?

- What is the structure of the Latin America drone technology market and who are the key players?

- What is the degree of competition in the Latin America drone technology market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America drone technology market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America drone technology market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America drone technology industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)