Latin America E-Waste Management Market Size, Share, Trends and Forecast by Material Type, Source Type, Application and Region, 2026-2034

Latin America E-Waste Management Market Overview:

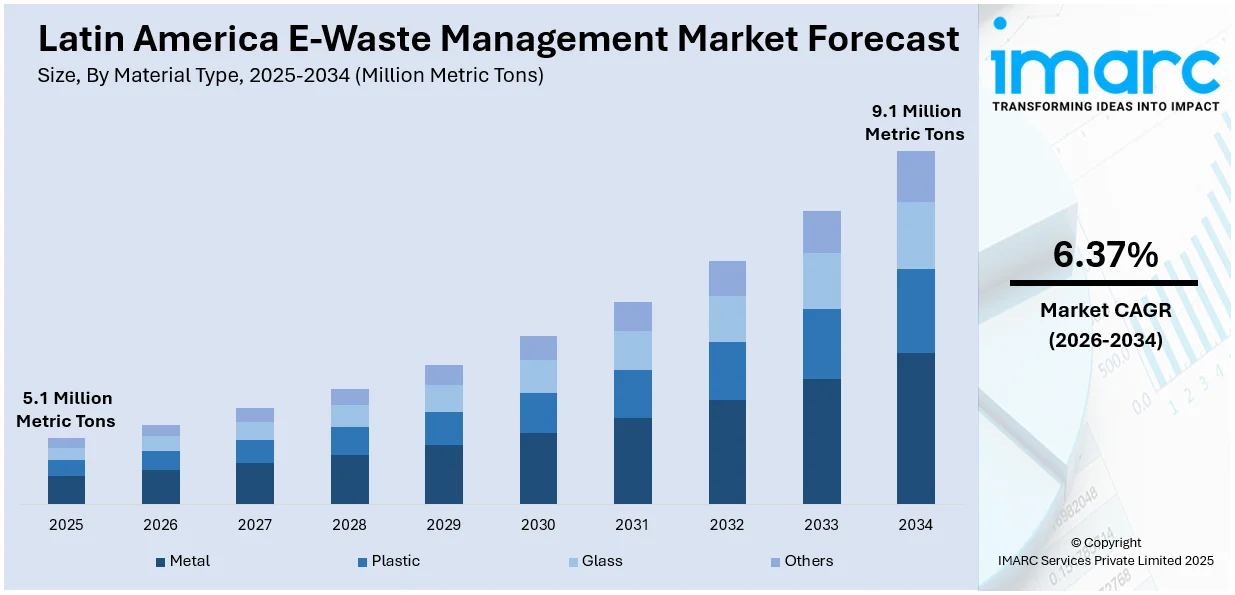

The Latin America e-waste management market size reached 5.1 Million Metric Tons in 2025. Looking forward, IMARC Group expects the market to reach 9.1 Million Metric Tons by 2034, exhibiting a growth rate (CAGR) of 6.37% during 2026-2034. The increasing demand for consumer electronics, stringent government regulations promoting recycling and responsible disposal, heightened awareness about environmental sustainability, the rise in urbanization, and technological advancements are some of the major factors driving the Latin America e-waste management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 5.1 Million Metric Tons |

| Market Forecast in 2034 | 9.1 Million Metric Tons |

| Market Growth Rate 2026-2034 | 6.37% |

Latin America E-Waste Management Market Trends:

Regulatory Frameworks and Government Initiatives

Regulatory bodies in Latin America are enforcing strict policies and regulations for ensuring responsible recycling and e-waste disposal. Programs like extended producer responsibility (EPR) regulations obligate producers to be responsible for the complete life cycle of their electronic products, ensuring proper recycling and limiting environmental effects. The regional implementation of Circular Economy (CE) at large is a crucial approach to managing e-waste since it encourages the recovery and reuse of waste by using the proper recycling of the precious materials that make up electronic products. This enables the recovery of precious metal such as gold, silver, and copper, which become feedstock to make room to produce new products, thus reducing the environmental impact. The Inter-American Development Bank (IDB) has invested funds to actively encourage the circular economy across the region, which is a major factor impelling the Latin America e-waste management market growth. Additionally, the United Nations Environment Program (UNEP) is collaborating with nations in Latin America and the Caribbean to develop strategies for efficient e-waste management and encourage CE principles in society. Consistent with this, there are numerous research activities underway that touch on the opportunities, challenges, threats, and strengths for electronic waste governance and management in the region.

To get more information on this market Request Sample

Growing Environmental Awareness

Heightened awareness about the environmental and health hazards associated with improper e-waste disposal is influencing the Latin America e-waste management market outlook. This awareness drives the demand for sustainable e-waste management practices, encouraging investment in recycling facilities and the development of innovative technologies to recover valuable materials from discarded electronics. In June 2023, the Swiss Embassy in Peru hosted the closing ceremony of the Sustainable Recycling Industries (SRI) project, marking the end of its operations in Peru and Colombia. This event celebrated 15 years of Swiss-Peruvian and Swiss-Colombian cooperation in developing a sustainable WEEE recycling sector. Both countries now have a thriving recycling industry supported by strong norms and standards. When the SRI project began in 2013, only a small fraction of e-waste was processed formally (1.1% in Peru, 1.5% in Colombia), posing environmental and health risks. By 2023, formal recycling rates reached 6.1% in Peru and 12% in Colombia, demonstrating significant progress in sustainable e-waste management.

Latin America E-Waste Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on material type, source type, and application.

Material Type Insights:

- Metal

- Plastic

- Glass

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes metal, plastic, glass, and others.

Source Type Insights:

- Consumer Electronics

- Industrial Electronics

- Others

A detailed breakup and analysis of the market based on the source type have also been provided in the report. This includes consumer electronics, industrial electronics, and others.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Trashed

- Recycled

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes trashed and recycled.

Regional Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America E-Waste Management Market News:

- In May 2024, the United Nations Industrial Development Organization (UNIDO) announced UNIDO’s first regional e-waste management project, where representatives from Latin America shared their insights. Key project outcomes included a media guide on e-waste communication and the Regional E-Waste Monitor for Latin America report. Developed by the Sustainable Cycles (SCYCLE) Programme, this report provides the UN’s first assessment of the region’s e-waste generation, legislation, and recycling infrastructure.

- In June 2023, Uruguay’s Environment Ministry partnered with Montevideo’s municipality and the recycling cooperative Volver a la Vida to expand WEEE recycling. Previously focused on bulky waste, the cooperative will now manage e-waste. The municipality provides facilities and collects waste, while the cooperative repairs salvageable products and disassembles devices for component reuse. This initiative promotes circular economy and social inclusion by employing and training vulnerable individuals in recycling.

Latin America E-Waste Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Metric Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Metal, Plastic, Glass, Others |

| Source Types Covered | Consumer Electronics, Industrial Electronics, Others |

| Applications Covered | Trashed, Recycled |

| Regions Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America e-waste management market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America e-waste management market on the basis of material type?

- What is the breakup of the Latin America e-waste management market on the basis of source type?

- What is the breakup of the Latin America e-waste management market on the basis of application?

- What are the various stages in the value chain of the Latin America e-waste management market?

- What are the key driving factors and challenges in the Latin America e-waste management market?

- What is the structure of the Latin America e-waste management market and who are the key players?

- What is the degree of competition in the Latin America e-waste management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America e-waste management market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America e-waste management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America e-waste management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)