Latin America Electric Vehicle (EV) Charging Stations Market Size, Share, Trends and Forecast by Charging Station Type, Vehicle Type, Installation Type, Charging Level, Connector Type, Application, and Region, 2026-2034

Latin America Electric Vehicle (EV) Charging Stations Market Overview:

The Latin America electric vehicle (EV) charging stations market size reached USD 1.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 8.8 Billion by 2034, exhibiting a growth rate (CAGR) of 21.35% during 2026-2034. The Latin America electric vehicle (EV) charging stations market is driven by government policies promoting sustainable mobility, increasing EV adoption due to cost incentives, expanding charging infrastructure investments, collaborations between automakers and energy providers, and advancements in fast-charging technology, ensuring wider accessibility and reducing range anxiety for EV users across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.5 Billion |

| Market Forecast in 2034 | USD 8.8 Billion |

| Market Growth Rate (2026-2034) | 21.35% |

Access the full market insights report Request Sample

Latin America Electric Vehicle (EV) Charging Stations Market Trends:

Government Policies and Initiatives

Latin American governments are proactively fostering the shift toward electric mobility via policies and regulations. This involves decreasing greenhouse gas emissions, lessening reliance on fossil fuels, and encouraging sustainable urban growth. In Mexico, for example, the government has implemented regulations for incorporating EV charging infrastructure into the National Electrical System. This has involved creating battery disposal standards as well as having General Administrative Provisions on electromobility. These provisions deal with the establishment of a smart electrical network and the control of charging station prices. Furthermore, Mexico has launched a project to produce low-cost electric vehicles under the "Olinia" brand, which belongs to the state. The program focuses on developing cheap electric vehicles at prices between 4,400 and 7,300 USD, aimed at providing electric mobility to the masses. This step not only charges for the expansion of the infrastructure but also a rapid boost to the demand. These initiatives, launched by the government, play a key role in the environment contributing to the expansion of EV chargers. Governments investing in projects for the creation of regulatory policies and the development of infrastructure are leading to the increasing absorption of electric vehicles.

Increasing Adoption of Electric Vehicles

The rising presence of electric cars on Latin American roads is a key impetus for the growth of charging infrastructure. As consumers become environmentally conscious and cognizant of the economic advantages of EVs, demand for dependable and extensive charging stations grows. In Mexico, the government's plan to manufacture low-cost electric vehicles under the "Olinia" brand is likely to increase EV uptake considerably. Through the provision of affordable EVs designed for urban use, the project seeks to offer a substitute for conventional motorbikes. This foreseen rise in EV ownership requires the establishment of a strong charging infrastructure to sustain the escalating number of electric vehicles. In addition, the inclusion of the charging infrastructure in the National Electrical System, as the recent rules have required, guarantees the ability of the electrical grid to handle the additional load from EV charging. This integration is critical to ensure grid stability and ensure quality charging services for EV users. In conclusion, the combined efforts of Latin American governments through favorable policies and initiatives, along with the growing use of electric vehicles, are the main drivers of the growth in EV charging stations in the region. Such developments are opening doors to a sustainable and electrified future of transportation in Latin America.

Latin America Electric Vehicle (EV) Charging Stations Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on charging station type, vehicle type, installation type, charging level, connector type, application, and region.

Charging Station Type Insights:

-charging-stations-market.webp)

To get detailed segment analysis of this market Request Sample

- AC Charging

- DC Charging

- Inductive Charging

The report has provided a detailed breakup and analysis of the market based on the charging station type. This includes AC charging, DC charging, and inductive charging.

Vehicle Type Insights:

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes battery electric vehicle (BEV), plug-in hybrid electric vehicle (PHEV), and hybrid electric vehicle (HEV).

Installation Type Insights:

- Portable Charger

- Fixed Charger

A detailed breakup and analysis of the market based on the installation type have also been provided in the report. This includes portable charger and fixed charger.

Charging Level Insights:

- Level 1

- Level 2

- Level 3

A detailed breakup and analysis of the market based on the charging level have also been provided in the report. This includes level 1, level 2, and level 3.

Connector Type Insights:

- Combines Charging Station (CCS)

- CHAdeMO

- Normal Charging

- Tesla Supercharger

- Type-2 (IEC 621196)

- Others

A detailed breakup and analysis of the market based on the connector type have also been provided in the report. This includes combines charging station (CCS), CHAdeMO, normal charging, tesla supercharger, type-2 (IEC 621196), and others.

Application Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential and commercial.

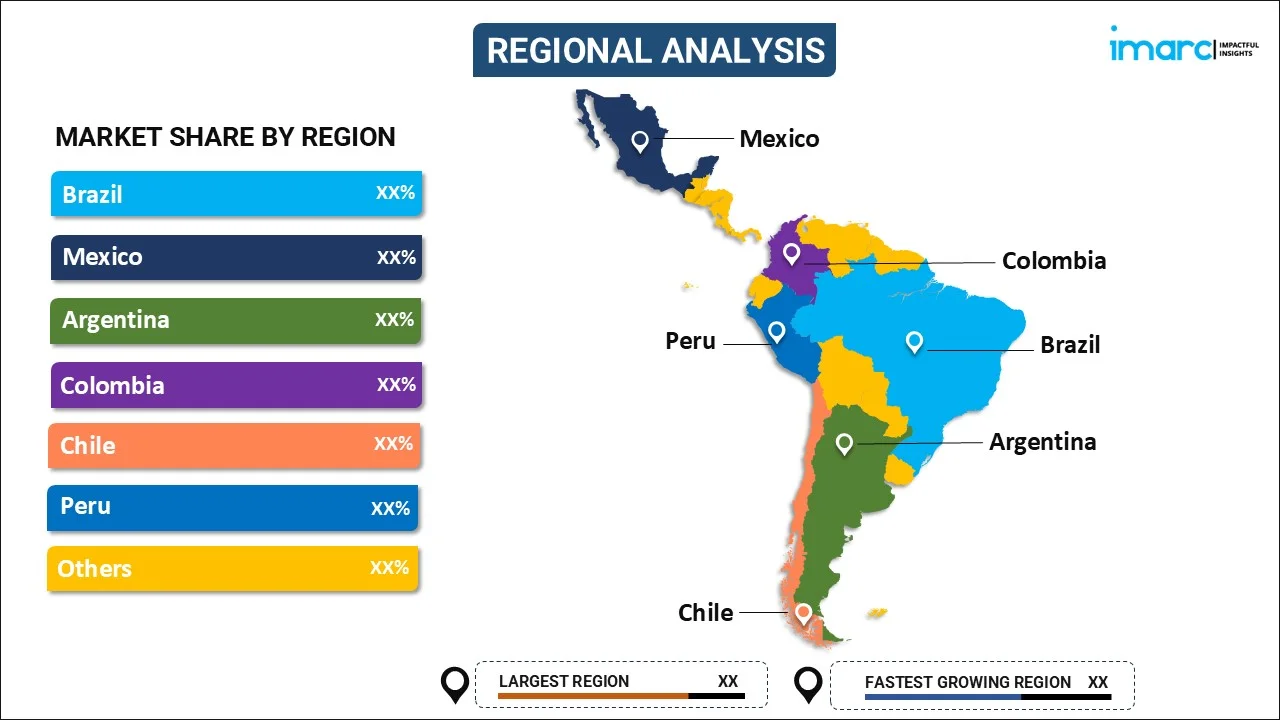

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Electric Vehicle (EV) Charging Stations Market News:

- August 2024: MG Motor revealed intentions to set up a manufacturing facility and research center in Mexico, enhancing local electric vehicle production. This growth amplified the demand for a strong charging infrastructure to facilitate the anticipated surge in EV adoption, further driving the Latin America electric vehicle (EV) charging stations.

- May 2024: Vemo collaborated with BYD to broaden GBT chargers in Mexico, with the goal of doubling its charging infrastructure by 2025. This growth enhanced the accessibility of compatible chargers for Chinese electric vehicles, fostering the region's rising EV adoption. Consequently, the market for EV charging stations in Latin America witnessed rapid infrastructure growth.

Latin America Electric Vehicle (EV) Charging Stations Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Charging Station Types Covered | AC Charging, DC Charging, Inductive Charging |

| Vehicle Types Covered | Battery Electric Vehicle (BEV), Plug-in Hybrid Electric Vehicle (PHEV), Hybrid Electric Vehicle (HEV) |

| Installation Types Covered | Portable Charger, Fixed Charger |

| Charging Levels Covered | Level 1, Level 2, Level 3 |

| Connector Types Covered | Combines Charging Station (CCS), CHAdeMO, Normal Charging, Tesla Supercharger, Type-2 (IEC 621196), Others |

| Applications Covered | Residential, Commercial |

| Regions Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America electric vehicle (EV) charging stations market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America electric vehicle (EV) charging stations market on the basis of charging station type?

- What is the breakup of the Latin America electric vehicle (EV) charging stations market on the basis of vehicle type?

- What is the breakup of the Latin America electric vehicle (EV) charging stations market on the basis of installation type?

- What is the breakup of the Latin America electric vehicle (EV) charging stations market on the basis of charging level?

- What is the breakup of the Latin America electric vehicle (EV) charging stations market on the basis of connector type?

- What is the breakup of the Latin America electric vehicle (EV) charging stations market on the basis of application?

- What are the various stages in the value chain of the Latin America electric vehicle (EV) charging stations market?

- What are the key driving factors and challenges in the Latin America electric vehicle (EV) charging stations market?

- What is the structure of the Latin America electric vehicle (EV) charging stations market and who are the key players?

- What is the degree of competition in the Latin America electric vehicle (EV) charging stations market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America electric vehicle (EV) charging stations market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America electric vehicle (EV) charging stations market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America electric vehicle (EV) charging stations industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)