Latin America Electric Vehicles Market Size, Share, Trends and Forecast by Component, Charging Type, Propulsion Type, Vehicle Type, and Region, 2026-2034

Latin America Electric Vehicles Market Summary:

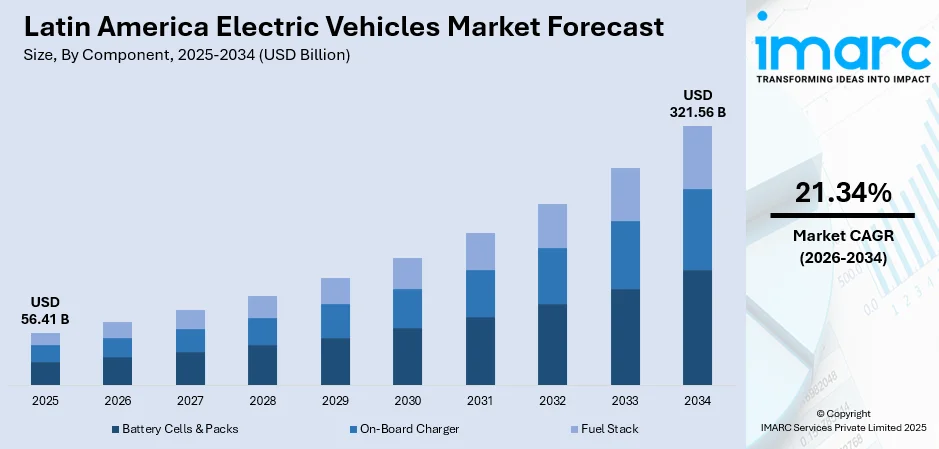

The Latin America electric vehicles market size was valued at USD 56.41 Billion in 2025 and is projected to reach USD 321.56 Billion by 2034, growing at a compound annual growth rate of 21.34% from 2026-2034.

The Latin America electric vehicles market is gaining strong momentum as countries accelerate clean mobility initiatives and expand renewable energy integration. Growing consumer awareness, supportive regulations, and improved charging ecosystems are strengthening adoption. Advancements in battery technologies, rising urban electrification, and increasing interest in sustainable transportation are reshaping mobility patterns, positioning the region as an emerging hub for next-generation electric mobility solutions.

Key Takeaways and Insights:

- By Component: Fuel stack components hold the largest market share at 42%, establishing themselves as the leading driver of efficiency and performance in Latin America’s EVs.

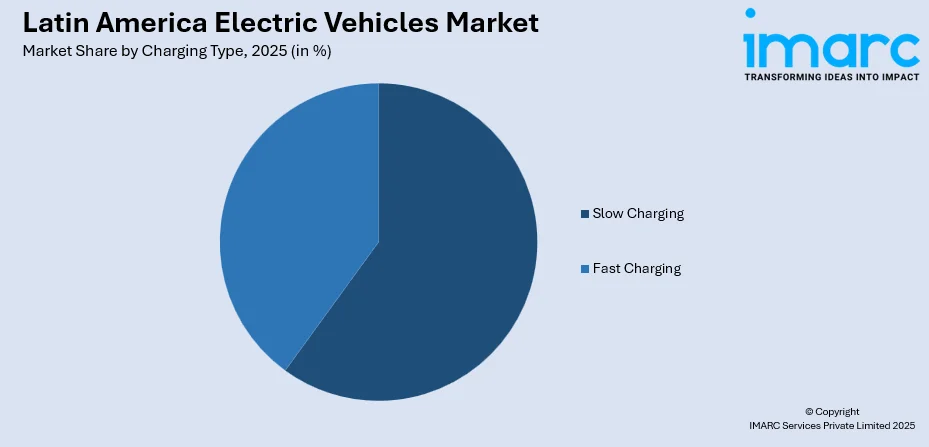

- By Charging Type: Slow charging is dominating the market with 60% share, enabling widespread residential and workplace EV adoption across the region’s expanding electric mobility ecosystem.

- By Propulsion Type: Battery electric vehicles (BEVs) are the largest segment, commanding 75% market share, underscoring Latin America’s commitment to fully electric, zero-emission transportation solutions.

- By Vehicle Type: Passenger vehicles hold the largest share at 70%, reflecting a strong consumer preference for electric cars over commercial vehicle types in Latin America.

- Key Players: The Latin America EV market is highly competitive, with leading manufacturers expanding model lineups, improving vehicle performance, investing in charging infrastructure, and forming strategic partnerships to dominate market share and advance sustainable mobility across the region.

To get more information on this market, Request Sample

The Latin America electric vehicles market is advancing as governments, industries, and consumers embrace cleaner mobility solutions and sustainable energy use. A major driver shaping this progress is the region’s growing focus on renewable power, which supports the long-term viability of electric transportation. For example, BYD — one of the leading EV manufacturers in Latin America — began production in 2025 of its compact EV BYD Seagull in its Brazilian plant located at Camaçari, marking the company’s first locally-built small-EV model for the region. Policy encouragement, expanding charging networks, and rising interest in low-emission mobility are contributing to a more favorable environment for EV adoption. Improving battery technologies and increasing awareness of lifecycle benefits further strengthen demand across urban and intercity applications. As cities pursue modernization and invest in efficient mobility systems, electric vehicles are becoming an integral part of transportation strategies, promoting reduced environmental impact and enhanced energy efficiency. This momentum is positioning the region as an emerging participant in the global shift toward electrified mobility.

Latin America Electric Vehicles Market Trends:

Growing Preference for Eco-Friendly Mobility

Latin America is witnessing a rising shift toward cleaner mobility as consumers and fleets increasingly adopt electric vehicles to reduce environmental impact. For instance, the number of light electric vehicles in Latin America and the Caribbean soared from about 155,000 at end-2023 to over 444,000 by December 2024 — a 187% year-on-year increase, according to OLADE. Government incentives, expanding charging networks, and sustainability-focused urban policies are encouraging broader acceptance of EVs across major cities and emerging urban corridors.

Expansion of Regional EV Manufacturing

Local manufacturing and assembly of electric vehicles are gaining momentum as countries work to strengthen domestic capabilities. For example, BYD — a major EV maker — rolled out its first locally manufactured EV in Latin America when the “Dolphin Mini” (marketed in Brazil) came off the line at its new plant in Camaçari, Bahia in July 2025. Investments in electric powertrain technologies, battery integration, and component localization are helping build a more resilient EV ecosystem while promoting innovation and supporting long-term industry competitiveness in the region.

Advancements in Charging Infrastructure

Latin America is rapidly enhancing its charging infrastructure to support broader EV adoption. Public and private sectors are installing fast-charging hubs, integrating smart energy management systems, and improving grid readiness. These developments are making EV ownership more convenient and accessible across diverse urban and intercity routes.

Market Outlook 2026-2034:

Latin America’s electric vehicle market is poised for steady advancement, supported by policy continuity, expanding charging ecosystems, and rising consumer interest. The market generated a revenue of USD 56.41 Billion in 2025 and is projected to reach a revenue of USD 321.56 Billion by 2034, growing at a compound annual growth rate of 21.34% from 2026 to 2034. Increasing domestic manufacturing capabilities, coupled with cleaner mobility targets, are expected to drive higher revenue streams and foster a more competitive, mature, and sustainable EV landscape across the region.

Latin America Electric Vehicles Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component | Fuel Stack | 42% |

| Charging Type | Slow Charging | 60% |

| Propulsion Type | Battery Electric Vehicle (BEV) | 75% |

| Vehicle Type | Passenger Vehicles | 70% |

Component Insights:

- Battery Cells & Packs

- On-Board Charger

- Fuel Stack

The fuel stack segment accounted for a revenue share of 42% of the total Latin America electric vehicles market in 2025.

The Latin American electric vehicle market is witnessing significant advancements in vehicle components, particularly in the fuel stack domain. Governments and manufacturers are investing in localized production of high-efficiency electric motors, battery management systems, and energy storage solutions. Improved component standardization is helping reduce costs, enhance reliability, and accelerate the adoption of EVs across urban and regional transport networks. In 2025, WEG — a major Latin American electric-mobility parts and motor maker — announced a BRL 1.1 billion investment plan to expand its production capacity in Brazil.

Battery technology and fuel stack integration remain a key focus for automakers in the region. Innovations in modular designs allow easier replacement and upgrading of components, ensuring long-term sustainability. By optimizing the interaction between the electric drive system and energy storage, vehicles achieve higher efficiency and performance, encouraging consumers to transition from conventional internal combustion engines to electric mobility.

Charging Type Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Slow Charging

- Fast Charging

The slow charging accounted for the largest revenue share of approximately 60% in the Latin America electric vehicles market in 2025.

Slow charging continues to play a pivotal role in Latin America’s EV adoption, particularly for residential and small-scale commercial users. Public and private initiatives are installing low-cost, user-friendly charging units in apartments, offices, and parking lots. This approach allows vehicle owners to charge overnight or during long idle periods, enhancing convenience and reducing dependency on high-capacity infrastructure. For example, as of end-2024, the region had roughly 18,594 public EV charging stations, but 92% of these were concentrated in just three countries: Brazil, Mexico and Chile.

While fast-charging networks are expanding in major corridors, slow chargers remain critical for routine daily use. They help optimize energy consumption from the grid, particularly in regions where renewable power penetration is moderate. By integrating slow charging with smart metering and mobile apps, users can manage charging times and costs efficiently, further supporting EV acceptance across diverse consumer segments.

Propulsion Type Insights:

- Battery Electric Vehicle (BEV)

- Fuel Cell Electric Vehicle (FCEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

The battery electric vehicle (BEV) segment accounted for a revenue share of 75% of the total Latin America electric vehicles market in 2025.

Battery Electric Vehicles (BEVs) are the dominant propulsion choice in Latin America’s EV landscape, offering zero-emission mobility and lower operating costs compared with hybrid alternatives. Advancements in lithium-ion and emerging solid-state batteries are enabling longer ranges, shorter charging times, and improved vehicle performance. BEVs are increasingly seen as viable for both private owners and fleet operators in urban and semi-urban regions.

Automakers are focusing on optimizing BEV drivetrains for energy efficiency, heat management, and regenerative braking. The regional push toward BEVs is also reinforced by supportive government policies, tax incentives, and urban sustainability programs. As battery costs decline and energy density improves, BEVs are expected to become the mainstream choice, reshaping consumer preferences and fleet electrification strategies.

Vehicle Type Insights:

- Passenger Vehicles

- Commercial Vehicles

- Others

The passenger vehicles accounted for the largest revenue share of approximately 70% in the Latin America electric vehicles market in 2025.

Passenger vehicles form the largest segment of Latin America’s electric vehicle market, driven by rising consumer awareness and urban mobility demands. Compact cars, sedans, and crossover SUVs are increasingly offered in electric variants to meet daily commuting needs. Governments are encouraging adoption through purchase incentives, preferential registration, and parking benefits, making EVs more accessible to middle-class consumers. According to sources, EV penetration in Latin America doubled in 2024 — with sales of electric cars reaching nearly 125,000 in Brazil alone, and the electric‑car share across the region rising substantially.

Urbanization, traffic congestion, and air quality concerns are motivating consumers to switch from conventional vehicles to electric passenger models. Automakers are focusing on designing affordable, efficient, and stylish EVs with sufficient range and connectivity features. By prioritizing comfort, safety, and affordability, passenger electric vehicles are positioned to lead the regional EV transformation over the coming decade.

Regional Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Brazil is accelerating EV adoption through government incentives, expanding charging networks, and growing interest in sustainable mobility. Urban EV sales are rising, with automakers introducing diverse passenger and commercial models.

Mexico’s EV market is growing as infrastructure expands and regulatory support strengthens. Consumer awareness and corporate fleet electrification are increasing, fostering adoption of battery electric vehicles across major cities and industrial hubs.

Argentina is gradually embracing electric mobility with pilot programs, urban EV initiatives, and incentives for clean transportation. Charging infrastructure development and policy support are encouraging wider adoption in metropolitan areas.

Colombia focuses on sustainable transport through EV subsidies, public fleet electrification, and charging infrastructure projects. Government programs aim to reduce emissions while promoting electric passenger vehicles in major cities.

Chile’s EV market is supported by renewable energy integration, government incentives, and expanding charging networks. Urban adoption is growing, with both private and fleet operators exploring electric mobility solutions.

Peru is promoting EV adoption via import benefits, fiscal incentives, and pilot charging projects. Awareness campaigns and urban initiatives are driving interest in battery electric vehicles among individuals and businesses.

Market Dynamics:

Growth Drivers:

Why is the Latin America Electric Vehicles Market Growing?

Rising Clean Energy Adoption

Latin America’s accelerating transition toward renewable power is strengthening the long-term foundation for electric mobility. Countries are steadily integrating solar, wind, and hydropower into their national grids, making EV charging cleaner and more sustainable. According to sources, in June 2025, electricity generation in Latin American Energy Organization (OLADE) member countries reached 71% from renewables — the highest level recorded for 2025 so far. This expanding clean energy mix is reducing reliance on fossil fuels and supporting broader climate goals across the region.

As renewable capacity grows, consumers and industries are increasingly motivated to shift toward low-emission transportation solutions. The availability of cleaner electricity not only enhances the environmental appeal of EVs but also helps create a more resilient energy ecosystem. This momentum is reinforcing confidence in electric transportation as a practical and future-ready option for Latin America.

Expanding Charging Infrastructure

Public-private collaboration is driving the rapid expansion of fast-charging corridors across major urban centers and key intercity routes in Latin America. Governments are prioritizing interoperable and user-friendly networks that enable smoother long-distance travel and help reduce range-related concerns among EV users. These efforts are steadily improving convenience and accessibility across the region.

Recent steps to broaden charging availability, such as Chile’s initiative to add more public charging stations, have further reinforced the region’s long-term infrastructure development plans. As more countries adopt similar measures, charging networks are becoming more reliable, visible, and efficient, supporting the overall growth of electric mobility across diverse markets.

Supportive Policy Landscape

Fiscal incentives, import benefits, and regulatory support are encouraging individuals, businesses, and fleet operators to shift toward electric mobility in Latin America. Governments are introducing measures that lower ownership costs, ease EV acquisition, and make charging solutions more accessible across regions. For instance, under Brazil’s Programa Nacional de Mobilidade Verde e Inovação, launched in June 2024, automakers receive generous tax incentives and research and development credits, spurring significant investment into EV manufacturing. These initiatives are helping build confidence in cleaner transport options.

Countries are also refining long-term mobility standards that prioritize sustainability and energy efficiency. Updated guidelines for vehicle emissions, charging interoperability, and clean transport planning are shaping a more supportive environment for EV adoption. As these policies evolve, they continue to strengthen the foundation for widespread electric mobility across Latin America.

Market Restraints:

What Challenges the Latin America Electric Vehicles Market is Facing?

High Initial Vehicle Costs

The upfront price of electric vehicles remains significantly higher than conventional vehicles in Latin America, limiting adoption among price-sensitive consumers. While long-term operational savings exist, many buyers are hesitant to invest without clear short-term financial incentives or affordable financing options. This cost barrier slows broader market penetration.

Limited Charging Accessibility

Despite ongoing infrastructure development, many regions still face insufficient charging stations, particularly in rural and semi-urban areas. Range anxiety and inconvenient access discourage potential buyers, affecting EV adoption rates. The lack of a comprehensive, reliable charging network continues to challenge seamless travel across the region.

Battery Supply and Technology Constraints

Limited local battery manufacturing and dependency on imports increase costs and create supply chain vulnerabilities. Technological constraints, such as battery lifespan, efficiency, and recycling challenges, further restrict market growth. These factors can slow production, raise prices, and reduce consumer confidence in long-term EV performance.

Competitive Landscape:

The Latin America electric vehicles market is becoming increasingly competitive as manufacturers expand their presence across the region. Companies are focusing on diversifying model offerings, improving vehicle performance, and enhancing affordability to attract a wider customer base. Competition is also driven by investments in charging infrastructure, battery technologies, and localized production, enabling faster adoption of EVs. Strategic partnerships and collaborations are fostering innovation, accelerating product launches, and improving after-sales support. As a result, market players are continually refining their strategies to strengthen market share, improve customer experience, and capitalize on the region’s growing shift toward sustainable mobility.

Recent Developments:

- In May 2025, GAC Motor entered the Brazilian market with five new energy vehicles (NEVs), including both pure EVs and hybrids — AION V, AION Y, HYPTEC HT MPV, GS4 HEV, and AION ES sedan. The launch is part of GAC’s “Brazil Action” strategy, with plans to build local plants by 2026.

- In November 2025, Leapmotor entered South America with two SUV models, C10 and B10, in Brazil and Chile, and showcased the larger C16 at the São Paulo auto show. The company plans expansion into Argentina, Colombia, and Ecuador, leveraging Stellantis’ distribution network. This reflects growing Chinese EV presence in the region.

Latin America Electric Vehicles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Battery Cells & Packs, On-Board Charger, Fuel Stack |

| Charging Types Covered | Slow Charging, Fast Charging |

| Propulsion Types Covered | Battery Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV), Plug-In Hybrid Electric Vehicle (PHEV), Hybrid Electric Vehicle (HEV) |

| Vehicle Types Covered | Passenger Vehicles, Commercial Vehicles, Others |

| Regions Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Latin America electric vehicles market size was valued at USD 56.41 Billion in 2025.

The Latin America electric vehicles market is expected to grow at a compound annual growth rate of 21.34% from 2026-2034 to reach USD 321.56 Billion by 2034.

Slow charging, holding the largest revenue share of 60%, remains pivotal for Latin America’s EV adoption, enabling convenient daily use, energy-efficient charging, and cost management, while supporting residential, commercial, and diverse consumer segments.

Key factors driving the Latin America electric vehicles market include supportive government policies, expanding charging infrastructure, growing environmental awareness, rising adoption by fleets and consumers, advancements in EV technology, and increased investments in local manufacturing and assembly of electric vehicles.

Major challenges include high upfront vehicle costs, limited charging infrastructure in remote areas, inconsistent government incentives, long battery replacement times, supply chain constraints, and low consumer awareness about electric mobility benefits.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)