Latin America Electronics Security Market Size, Share, Trends and Forecast by Product Type, Service Type, End-Use Sector, and Country, 2026-2034

Latin America Electronics Security Market Overview:

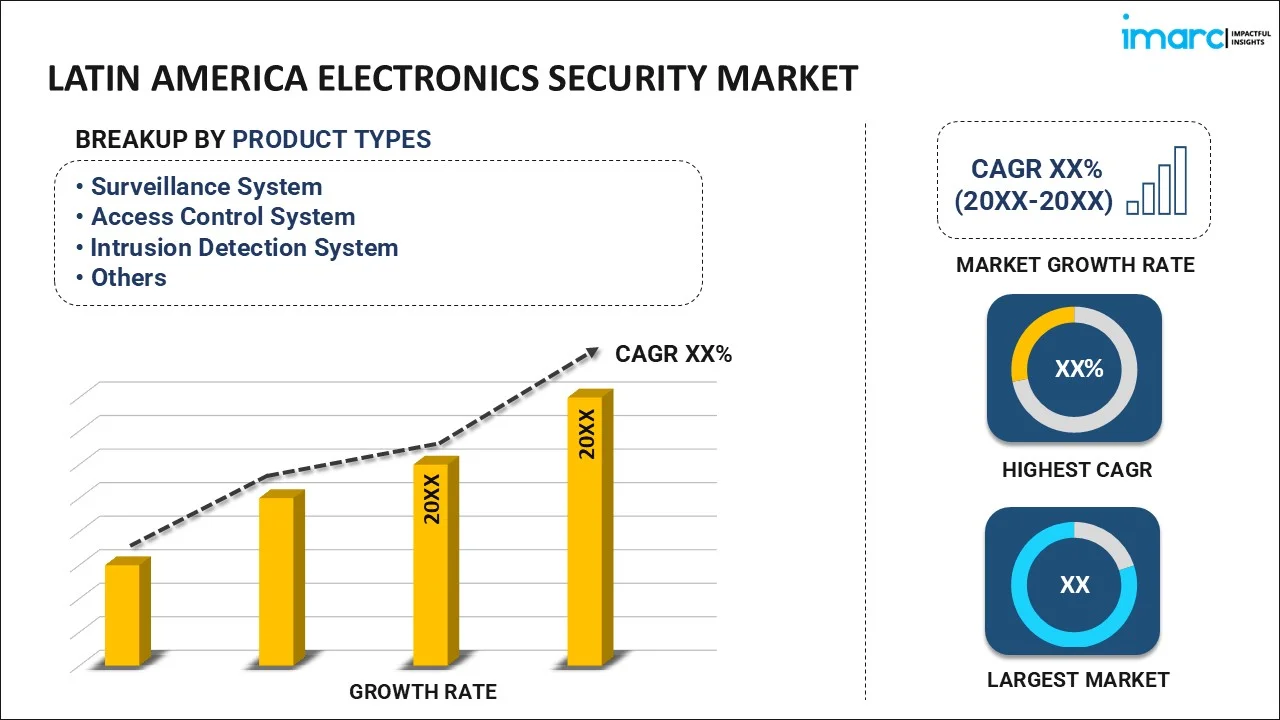

The Latin America electronics security market size reached USD 4.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 7.5 Billion by 2034, exhibiting a growth rate (CAGR) of 6.25% during 2026-2034. The market is expanding due to rising crime rates and increased digitization, with key growth driven by surveillance, access control, and alarming systems. Additionally, government initiatives and private investments are further propelling the demand across various sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.3 Billion |

| Market Forecast in 2034 | USD 7.5 Billion |

| Market Growth Rate (2026-2034) | 6.25% |

Access the full market insights report Request Sample

Latin America Electronics Security Market Trends:

Favorable Advancements and AI-Driven Surveillance Integration

Advanced surveillance technologies are growing in the Latin America electronics security market, which includes AI-powered cameras and analytics software. This trend is driven by heightened security concerns and the need to improve safety measures that would benefit the common citizen. By leveraging AI and machine learning, it can be analysed in real-time which can automatically suggest responses to the appropriate team members and allows real-time optimization of resource allocation. For instance, in 2024, the Brazilian government launched a USD 4 billion National Artificial Intelligence Plan, aligned with its G20 priorities, focusing on inclusive and sustainable development. Developed by 117 public, private, and civil society organizations, the plan includes 54 measures to be implemented over four years. The plan also aims to enhance AI infrastructure, governance, business innovation, and public services to strengthen the adoption of AI in various sectors, including security, boosting surveillance capabilities. This widespread adoption bolsters situational awareness and enforces safety protocols across urban hubs and critical infrastructure.

Growing Emphasis on Smart City Security Solutions

The development of smart cities in Latin America is fostering the adoption of integrated electronic security systems tailored for urban management and safety. This trend is part of broader efforts to improve urban infrastructure through smart technologies that enhance safety, traffic management, and resource allocation. For instance, in 2024, Brazil committed R$ 186.6 billion to digital transformation, combining public and private funding to enhance its industrial sector, focusing on semiconductors, robotics, AI, and IoT. The Missão 4 da Nova Indústria Brasileira (NIB) initiative aims for 25% of industrial companies to be digitized by 2026, rising to 50% by 2033. Public investment includes R$ 42.2 billion already provided, with an additional R$ 58.7 billion expected. The private segment will contribute R$ 85.7 billion by 2035. Moreover, the Brazil Semicon program allocated USD 7 billion yearly to the ICT industry. This initiative is developed to incentivize innovation and aid the expansion of domestic manufacturing in segments including smartphones, solar panels, and personal computers, along with other electronic devices requisite to the industry 4.0 movement. Moreover, integrated security solutions contribute to more resilient and responsive city systems capable of addressing a range of security challenges in real-time. The emphasis on smart city projects is driving demand for scalable, interoperable security platforms that can support long-term urban development plans.

Latin America Electronics Security Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on product type, service type, and end-use sector.

Product Type Insights:

To get detailed segment analysis of this market Request Sample

- Surveillance System

- Access Control System

- Intrusion Detection System

- Alarming System

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes surveillance system, access control system, intrusion, detection system, alarming system, and others.

Service Type Insights:

- Installation Services

- Managed Services

- Consulting Services

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes installation services, managed services, and consulting services.

End-Use Sector Insights:

- Government

- Residential

- Transportation

- Banking

- Hospitality

- Healthcare

- Retail

- Others

A detailed breakup and analysis of the market based on the end-use sector have also been provided in the report. This includes government, residential, transportation, banking, hospitality healthcare, retail, and others.

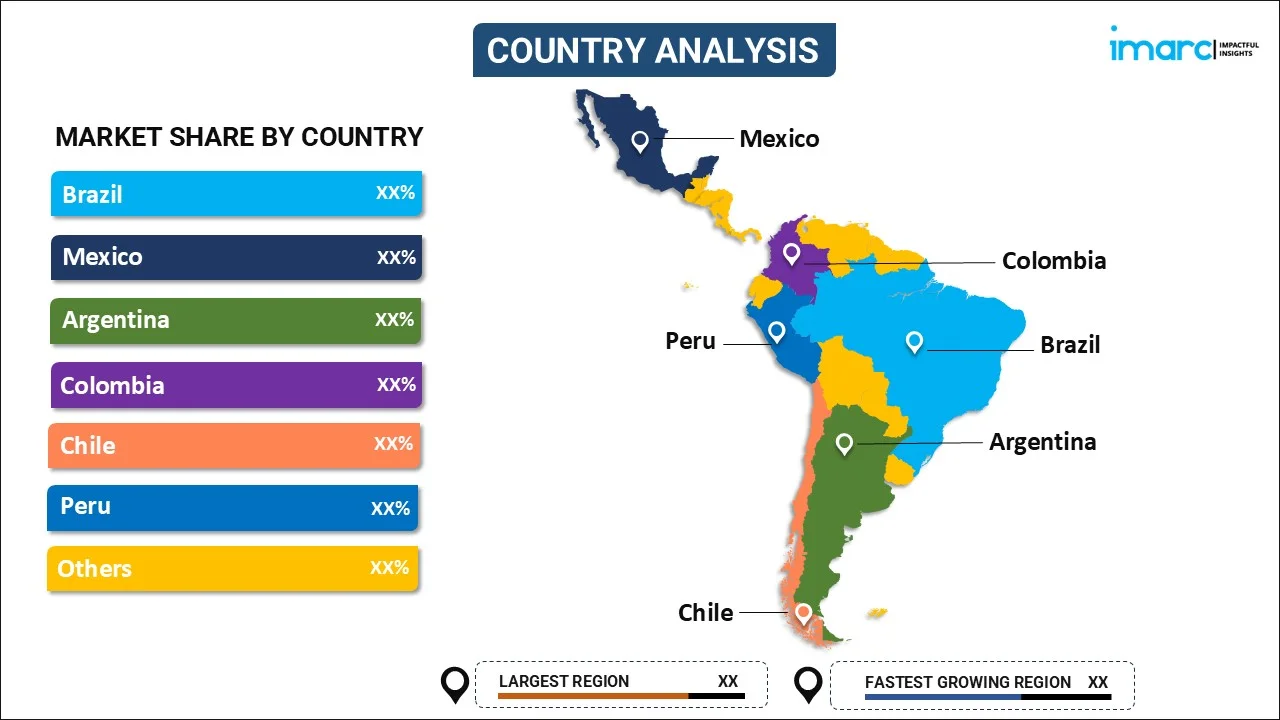

Country Insights:

To get detailed regional analysis of this market Request Sample

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Electronics Security Market News:

- In February 2025, Corero, a DDoS protection firm, announced expansion across Latin America by partnering with TechEnabler to facilitate the deployment of its SmartWall ONE solution for a prominent Brazil's telecommunication company.

- In July 2024, VSaaS.ai and Lenovo partnered with a major Latin American city to enhance its video surveillance, deploying hundreds of Lenovo ThinkEdge SE70 and ThinkSystem SE350 edge servers. These systems integrated with existing camera networks to enable AI-powered real-time video analysis. Unlike traditional human monitoring, which covers 16 feeds per 4-6 hour shift, AI now processes over 250 feeds simultaneously, detecting risks and accelerating response times, thereby lowering crime rates. The city aims to extend AI use for traffic management, license plate recognition, and public transport safety. The VSaaS.ai Smart City Surveillance Platform supports various applications with cloud-based control.

Latin America Electronics Security Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Surveillance System, Access Control System, Intrusion, Detection System, Alarming System, Others |

| Service Types Covered | Installation Services, Managed Services, Consulting Services |

| End-Use Sectors Covered | Government, Residential, Transportation, Banking, Hospitality, Healthcare, Retail, Others |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America electronics security market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America electronics security market on the basis of product type?

- What is the breakup of the Latin America electronics security market on the basis of service type?

- What is the breakup of the Latin America electronics security market on the basis of end-use sector?

- What is the breakup of the Latin America electronics security market on the basis of country?

- What are the various stages in the value chain of the Latin America electronics security market?

- What are the key driving factors and challenges in the Latin America electronics security market?

- What is the structure of the Latin America electronics security market and who are the key players?

- What is the degree of competition in the Latin America electronics security market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America electronics security market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America electronics security market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America electronics security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)