Latin America Environmental Monitoring Market Size, Share, Trends and Forecast by Component, Product Type, Sampling Method, Application, and Country, 2025-2033

Latin America Environmental Monitoring Market Overview:

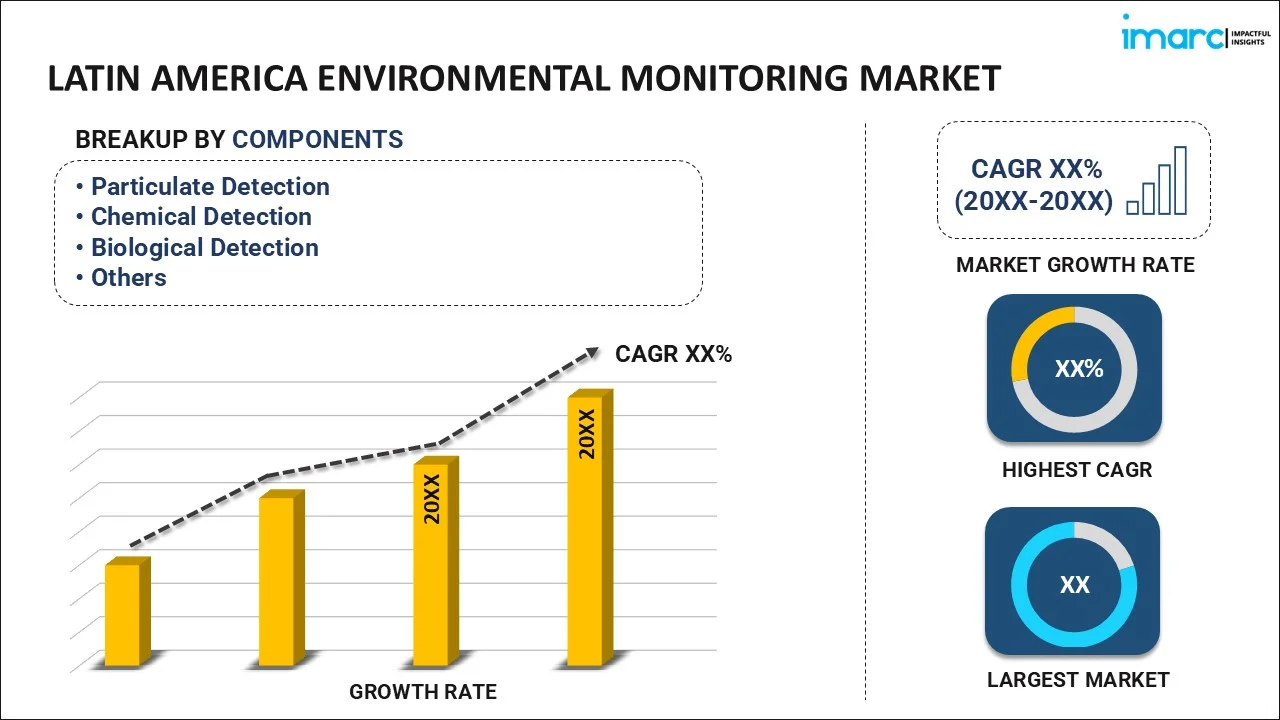

The Latin America environmental monitoring market size reached USD 1.40 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.38 Billion by 2033, exhibiting a growth rate (CAGR) of 6.08% during 2025-2033. The growing frequency and severity of extreme weather events, increasing implementation of policies that necessitate continuous monitoring of key environmental parameters, and rising development of green infrastructure projects are some of the major factors positively impacting the Latin America environmental monitoring market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.40 Billion |

| Market Forecast in 2033 | USD 2.38 Billion |

| Market Growth Rate (2025-2033) | 6.08% |

Latin America Environmental Monitoring Market Trends:

Strengthening of Regional Environmental Policies

Several countries in the Latin American region are increasingly developing environmentally important policies in response to the growing concerns caused by climate change and ecological degradation. These evolving policies necessitate continuous monitoring of key environmental parameters, such as air quality, water purity, biodiversity, and resource usage. Governments are implementing these regulations, thereby encouraging industries and municipalities to adopt total environmental monitoring solutions for compliance. Such systems allow proper measurement and reporting of environmental data which help identify risks and intervene timely. These solutions also help the promotion of sustainable practices in several sectors in relation to climate change mitigation. In 2023, during a ministerial meeting in San José, Costa Rica, the EU and Latin American and Caribbean countries enhanced their cooperation on climate change, pollution, and biodiversity loss. The countries are now committed to transitioning to low-carbon, circular, and nature-positive economies. The meeting also focused on addressing deforestation and promoting sustainable finance to support resilient economies.

Increasing Development of Green Infrastructure Projects

The growing investment in green infrastructure projects, which are designed to promote sustainability and mitigate environmental impacts, is positively influencing the Latin America environmental monitoring market outlook. Such projects span a huge sample of activities, including energy-efficient buildings, sustainable transport systems, and eco-friendly urban development. All these require environmental monitoring systems that measure their effectiveness. The monitoring technologies play a key role in quantifying such initiatives' environmental advantages, especially in areas of reduced energy consumption, carbon emissions, and waste. In addition, these systems enable real-time tracking of resource efficiency and environmental performance, and the captured data becomes relevant in optimizing project outcomes. The monitoring solutions is helpful in ensuring that green infrastructure meets its environmental aspirations, thereby reducing the possible adverse impact of urbanization and industrial development. In 2024, the memorandum of understanding (MoU) signed by the Asian Infrastructure Investment Bank (AIIB) with Brazil's Bank Nacional de Desenvolvimento Econômico e Social (BNDES) aimed at developing sustainable infrastructure in Latin America and Asia, as part of an effort to co-finance green projects, develop regional cooperation, and build sustainable economic development.

Growing Focus on Climate Change Mitigation

The increasing occurrence of environmental complications due to climate change is bolstering the Latin America environmental monitoring market growth. These environmental issues are encouraging governing bodies, non-governmental organizations (NGOs), and corporations to prioritize climate change mitigation strategies. Environmental monitoring systems help monitor the effects on ecosystems, air quality, and water resources and furnish data that help organizations make informed policies and interventions. They are extremely instrumental as monitoring tools for substantiating the impact of climate initiatives to provide transparency and accountability in achieving climate goals. Increased occurrences of extreme weather triggered by climate change and other phenomena, such as El Niño, are thus increasing the demand for the sale of environmental monitoring systems throughout Latin America. Also, in 2024, the World Meteorological Organization (WMO) reported that 2023 became the hottest year in history in Latin America and the Caribbean due to combined El Niño and climate changes. Droughts, heatwaves, floods, and wildfires ravaged these, along with health and food security issues, affecting economic growth. The report calls for better weather and climate services to minimize the impacts.

Latin America Environmental Monitoring Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component, product type, sampling method, and application.

Component Insights:

- Particulate Detection

- Chemical Detection

- Biological Detection

- Temperature Sensing

- Moisture Detection

- Noise Measurement

The report has provided a detailed breakup and analysis of the market based on the component. This includes particulate detection, chemical detection, biological detection, temperature sensing, moisture detection, and noise measurement.

Product Type Insights:

- Environmental Monitoring Sensors

- Environmental Monitors

- Environmental Monitoring Software

- Wearable Environmental Monitors

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes environmental monitoring sensors, environmental monitors, environmental monitoring software, and wearable environmental monitors.

Sampling Method Insights:

- Continuous Monitoring

- Active Monitoring

- Passive Monitoring

- Intermittent Monitoring

The report has provided a detailed breakup and analysis of the market based on the sampling method. This includes continuous monitoring, active monitoring, passive monitoring, and intermittent monitoring.

Application Insights:

- Air Pollution Monitoring

- Water Pollution Monitoring

- Soil Pollution Monitoring

- Noise Pollution Monitoring

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes air pollution monitoring, water pollution monitoring, soil pollution monitoring, and noise pollution monitoring.

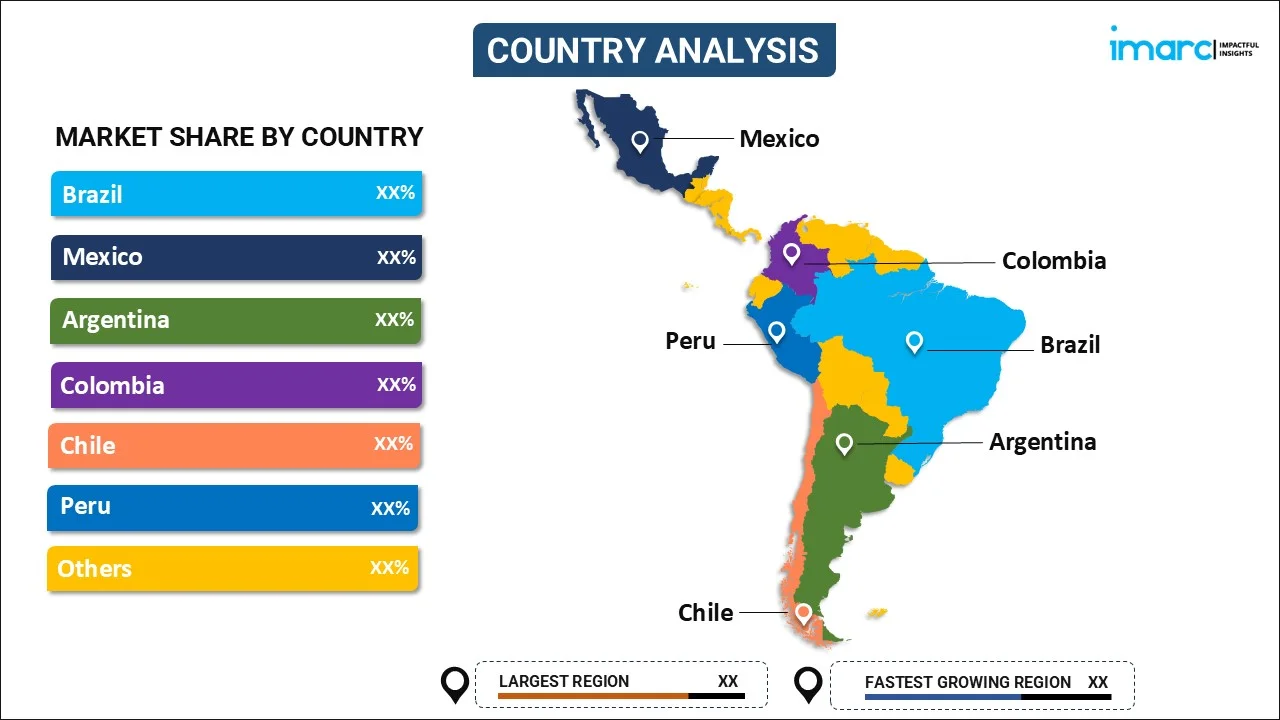

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Environmental Monitoring Market News:

- September 2024: The United Nations Development Programme (UNDP) and the Inter-American Development Bank (IDB) agreed to improve the collection of climate and weather data in Latin America and the Caribbean by signing an agreement. This project, supported by the Systematic Observations Financing Facility (SOFF), seeks to enhance regional climate adaptation and early warning systems. The IDB President also mentioned that by enhancing evidence and data for climate and environmental monitoring, the partnership with SOFF will help generate crucial information for improving the preparedness of the countries to tackle climate change.

- June 2024: SpaceX fulfilled its commitment by launching NOAA's GOES-U satellite with the last satellite in the Geostationary Operational Environmental Satellites series prepared by NOAA. This satellite further enhanced monitoring of the weather and environment through its imagery and enabled severe weather events to be spotted more rapidly in the Western Hemisphere, including Latin America.

Latin America Environmental Monitoring Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Particulate Detection, Chemical Detection, Biological Detection, Temperature Sensing, Moisture Detection, Noise Measurement |

| Product Types Covered | Environmental Monitoring Sensors, Environmental Monitors, Environmental Monitoring Software, Wearable Environmental Monitors |

| Sampling Methods Covered | Continuous Monitoring, Active Monitoring, Passive Monitoring, Intermittent Monitoring |

| Applications Covered | Air Pollution Monitoring, Water Pollution Monitoring, Soil Pollution Monitoring, Noise Pollution Monitoring |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America environmental monitoring market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America environmental monitoring market on the basis of component?

- What is the breakup of the Latin America environmental monitoring market on the basis of product type?

- What is the breakup of the Latin America environmental monitoring market on the basis of sampling method?

- What is the breakup of the Latin America environmental monitoring market on the basis of application?

- What is the breakup of the Latin America environmental monitoring market on the basis of country?

- What are the various stages in the value chain of the Latin America environmental monitoring market?

- What are the key driving factors and challenges in the Latin America environmental monitoring?

- What is the structure of the Latin America environmental monitoring market and who are the key players?

- What is the degree of competition in the Latin America environmental monitoring market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America environmental monitoring market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America environmental monitoring market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America environmental monitoring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)