Latin America Fintech Market Size, Share, Trends and Forecast by Deployment, Technology, Application, End User, and Region, 2026-2034

Latin America Fintech Market Summary:

The Latin America fintech market size was valued at USD 15.23 Billion in 2025 and is projected to reach USD 54.01 Billion by 2034, growing at a compound annual growth rate of 15.11% from 2026-2034.

Latin America's market represents a transformative shift in financial services delivery across the region, driven by widespread mobile adoption, expanding internet penetration, and persistent banking exclusion challenges that create opportunities for digital financial innovation and alternative service delivery models. Apart from this, the ecosystem addresses longstanding barriers to financial access through technology-enabled solutions that bypass traditional banking infrastructure limitations and respond to evolving consumer expectations for seamless digital experiences, thereby expanding the Latin America fintech market share.

Key Takeaways and Insights:

- By Deployment Mode: On-premises dominates the market with a share of 35.01% in 2025, reflecting institutional preferences for maintaining direct control over sensitive financial infrastructure and regulatory compliance frameworks within established banking environments.

- By Technology: Application programming interface leads the market with a share of 25.02% in 2025, enabled by its foundational role in connecting disparate financial systems and facilitating seamless data exchange between traditional institutions and emerging fintech platforms.

- By Application: Payment and fund transfer represent the largest segment with a market share of 45.05% in 2025, driven by widespread consumer demand for convenient digital payment alternatives and cross-border remittance solutions that address regional financial accessibility gaps.

- By End User: Banking exhibits clear dominance with a market share of 50.06% in 2025, as traditional financial institutions accelerate digital transformation initiatives to compete with agile fintech challengers and meet evolving customer expectations for frictionless banking experiences.

- Key Players: The Latin American fintech landscape demonstrates intense competitive dynamics, characterized by collaboration between established financial institutions and innovative technology startups, alongside increasing participation from global technology platforms seeking to capture market share in this high-growth region.

Latin America's fintech ecosystem has emerged as one of the world's most dynamic financial technology markets, propelled by unique regional characteristics including significant unbanked populations, widespread smartphone adoption outpacing traditional banking infrastructure, and progressive regulatory frameworks designed to encourage financial inclusion. Countries like Brazil and Mexico have become regional innovation hubs, fostering environments where digital payment platforms, alternative lending solutions, and blockchain-based financial services address long-standing barriers to financial access. The market benefits from favorable demographic trends, with digitally native younger generations embracing mobile-first financial services, while remittance flows from diaspora communities create sustained demand for efficient cross-border payment solutions that bypass traditional banking intermediaries. Brazil's PIX instant payment system exemplifies this transformation, processing over three billion transactions monthly since its launch, demonstrating how government-backed digital infrastructure can accelerate fintech adoption and fundamentally reshape consumer payment behaviors across entire national economies through zero-fee, real-time settlement capabilities accessible via smartphone applications. In 2025, Peru announced its plans to launch UPI like real-time digital payments system to make online payment procedures seamless. This convergence of technological readiness, regulatory support, and unmet financial service needs positions Latin America as a compelling environment for continued fintech innovation and market expansion.

Latin America Fintech Market Trends:

Regulatory Sandboxes Accelerating Innovation Cycles

Regulatory authorities across Latin America are establishing controlled testing environments that allow fintech companies to pilot innovative financial products without immediately complying with full regulatory requirements. These sandboxes enable startups to validate business models, gather customer feedback, and demonstrate compliance capabilities before scaling operations regionally. The approach reduces barriers to market entry while maintaining consumer protection standards, encouraging experimentation with emerging technologies like decentralized finance protocols, embedded banking services, and automated investment platforms that might otherwise face prolonged approval processes. In 2025, dLocal, the top payment platform linking international merchants to developing markets, and Félix, a U.S. chat-driven service enabling users to send remittances via WhatsApp, revealed a collaboration to provide instant remittance payouts in Mexico, Guatemala, Honduras, and El Salvador, using stablecoin funding. Félix sends funds in USD Coin (USDC), and dLocal converts the money into local currency for recipients’ bank accounts. During testing, transfers were received within minutes rather than the following day, with delivery generally taking less than two minutes and a success rate close to 99 percent. The method minimizes reliance on outdated correspondent delays and provides operators with a more consistent timeframe in busy corridors.

Open Banking Frameworks Reshaping Financial Data Ecosystems

Mandatory data-sharing initiatives are fundamentally altering competitive dynamics by requiring traditional banks to provide secure access to customer financial information through standardized interfaces. This regulatory shift empowers people to share their banking data with third-party providers, enabling personalized financial management tools, comparative product marketplaces, and seamless account aggregation services. The transition creates opportunities for fintech companies to deliver superior user experiences by leveraging comprehensive financial profiles, while challenging incumbent institutions to differentiate through enhanced digital capabilities rather than data monopolization. In 2025, EBANX broadened its application of network tokens to Colombia, Peru, and the Dominican Republic following trials that indicated significant reductions in fraud-related declines. The shift underscores how payment companies in developing markets are adopting tokenization to enhance transaction approval rates.

Biometric Authentication Enhancing Security Protocols

Financial technology providers are increasingly deploying facial recognition, fingerprint scanning, and voice authentication systems to strengthen identity verification processes and reduce fraud exposure. These biological identification methods address security concerns associated with password-based systems while improving user convenience by eliminating memorization requirements. The adoption reflects growing consumer comfort with biometric technology and addresses regional challenges related to identity documentation gaps, enabling financial inclusion for populations lacking traditional identification credentials through alternative verification approaches. In 2025, Belvo, the top provider of Open Finance infrastructure in Latin America, revealed the launch of Biometric Pix Payments. This innovative solution is set to transform instant payments in Brazil, offering enhanced security, speed, and convenience for both businesses and consumers.

Market Outlook 2026-2034:

The Latin American fintech market is positioned for sustained expansion throughout the forecast period, driven by accelerating digital transformation across financial services, persistent infrastructure gaps in traditional banking networks, and supportive regulatory environments fostering innovation. The ecosystem continues attracting substantial venture capital investment, enabling technology development and market expansion initiatives. Brazil's sophisticated digital payment infrastructure, Mexico's progressive fintech legislation, and Argentina's cryptocurrency adoption demonstrate diverse innovation pathways across the region. The market generated a revenue of USD 15.23 Billion in 2025 and is projected to reach a revenue of USD 54.01 Billion by 2034, growing at a compound annual growth rate of 15.11% from 2026-2034. Payment digitization initiatives, alternative credit scoring methodologies leveraging non-traditional data sources, and blockchain-based solutions addressing remittance inefficiencies represent key growth vectors.

Latin America Fintech Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Deployment Mode | On-premises | 35.01% |

| Technology | Application Programming Interface | 25.02% |

| Application | Payment and Fund Transfer | 45.05% |

| End User | Banking | 50.06% |

Deployment Insights:

To get detailed segment analysis of this market Request Sample

- On-premises

- Cloud Based

On-premises dominates with a market share of 35.01% of the total Latin America fintech market in 2025.

On-premises deployment maintains significant relevance within Latin America's fintech landscape despite accelerating cloud adoption trends, particularly among established financial institutions managing sensitive customer data and navigating complex regulatory compliance requirements. Traditional banks and insurance companies operating across multiple jurisdictions often prefer maintaining direct control over their technological infrastructure, enabling customized security protocols, data residency compliance, and integration with legacy systems accumulated over decades of operation. This deployment preference reflects institutional risk management philosophies prioritizing data sovereignty and operational continuity over potential cost efficiencies associated with cloud alternatives.

The on-premises approach provides financial institutions with granular oversight of system configurations, performance optimization, and disaster recovery capabilities that align with stringent regulatory expectations established by regional banking authorities. Organizations handling high-value transactions, managing extensive customer portfolios, or operating in jurisdictions with specific data localization mandates find on-premises infrastructure essential for demonstrating compliance and maintaining stakeholder confidence. Additionally, concerns regarding internet connectivity reliability in certain geographic areas, coupled with latency sensitivities for real-time transaction processing, reinforce the strategic value of locally hosted systems that minimize external dependencies and ensure consistent service availability.

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

Application programming interface leads with a share of 25.02% of the total Latin America fintech market in 2025.

Application Programming Interfaces represent foundational technological infrastructure enabling interoperability between disparate financial systems, facilitating the seamless data exchange and service integration that characterizes modern fintech ecosystems. APIs empower third-party developers to build applications leveraging existing financial infrastructure without requiring direct access to underlying databases or proprietary systems, accelerating innovation cycles while maintaining security boundaries. This architectural approach has become essential for open banking implementations, payment gateway integrations, and collaborative partnerships between traditional institutions and fintech startups seeking to deliver enhanced customer experiences through complementary capabilities.

The proliferation of API-driven architectures reflects fundamental shifts in financial services delivery models, transitioning from monolithic systems toward modular, service-oriented frameworks that promote flexibility and scalability. Financial institutions expose specific functionalities through standardized interfaces, enabling partners to access account information, initiate transactions, or retrieve customer data with appropriate authorization. This technology facilitates the emergence of aggregation platforms, embedded finance solutions, and marketplace models connecting consumers with diverse financial products through unified digital interfaces. Regulatory mandates requiring secure data sharing have accelerated API adoption, establishing technical standards that ensure consistent implementation across institutions while protecting consumer privacy and maintaining system integrity.

Application Insights:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

Payment and fund transfer exhibit a clear dominance with a 45.05% share of the total Latin America fintech market in 2025.

Payment and fund transfer applications have emerged as the cornerstone of Latin America's fintech revolution, addressing fundamental consumer needs for convenient, accessible, and cost-effective transaction capabilities that traditional banking infrastructure has historically underserved. Digital payment platforms have proliferated across the region, enabling person-to-person transfers, merchant payments, and bill settlement through mobile applications that bypass conventional banking intermediaries. The segment benefits from widespread smartphone adoption, expanding internet connectivity, and consumer preferences for immediate transaction confirmation rather than the delayed processing timelines characteristic of traditional banking systems.

Cross-border remittance flows represent a particularly significant driver within this application category, as millions of Latin Americans living abroad regularly transfer funds to family members in their countries of origin. Traditional remittance channels imposed substantial fees, unfavorable exchange rates, and extended delivery timeframes that fintech solutions have systematically addressed through competitive pricing models and near-instantaneous settlement capabilities. Digital wallet adoption has accelerated dramatically, with consumers embracing these platforms for everyday purchases, utility payments, and e-commerce transactions. The payment infrastructure development has created network effects, encouraging merchant adoption that further reinforces consumer usage patterns and establishes digital payments as the preferred transaction method across demographic segments.

End User Insights:

- Banking

- Insurance

- Securities

- Others

Banking leads with a share of 50.06% of the total Latin America fintech market in 2025.

Banking institutions represent the predominant end-user category within Latin America's fintech market, reflecting both defensive modernization strategies and proactive digital transformation initiatives designed to maintain competitive relevance amid disruption from agile technology-native challengers. Traditional banks possess established customer relationships, regulatory expertise, and capital resources that enable substantial technology investments, yet face mounting pressure to deliver digital experiences matching consumer expectations shaped by global technology platforms. Many institutions have embraced partnership strategies with fintech companies, leveraging specialized capabilities in areas like alternative credit scoring, automated customer service, and blockchain-based settlement systems.

The banking sector's fintech adoption encompasses both customer-facing innovations and operational efficiency improvements, with artificial intelligence-powered fraud detection, robotic process automation for back-office functions, and data analytics platforms optimizing risk management decisions. Neobanks have emerged as significant disruptors, offering fully digital banking experiences without physical branch networks, appealing to digitally native consumers seeking streamlined account opening, transparent fee structures, and superior mobile interfaces. Incumbent institutions respond through digital banking subsidiaries, modernized core banking platforms, and enhanced mobile applications that replicate features popularized by fintech challengers while maintaining the trust and stability associated with established financial brands.

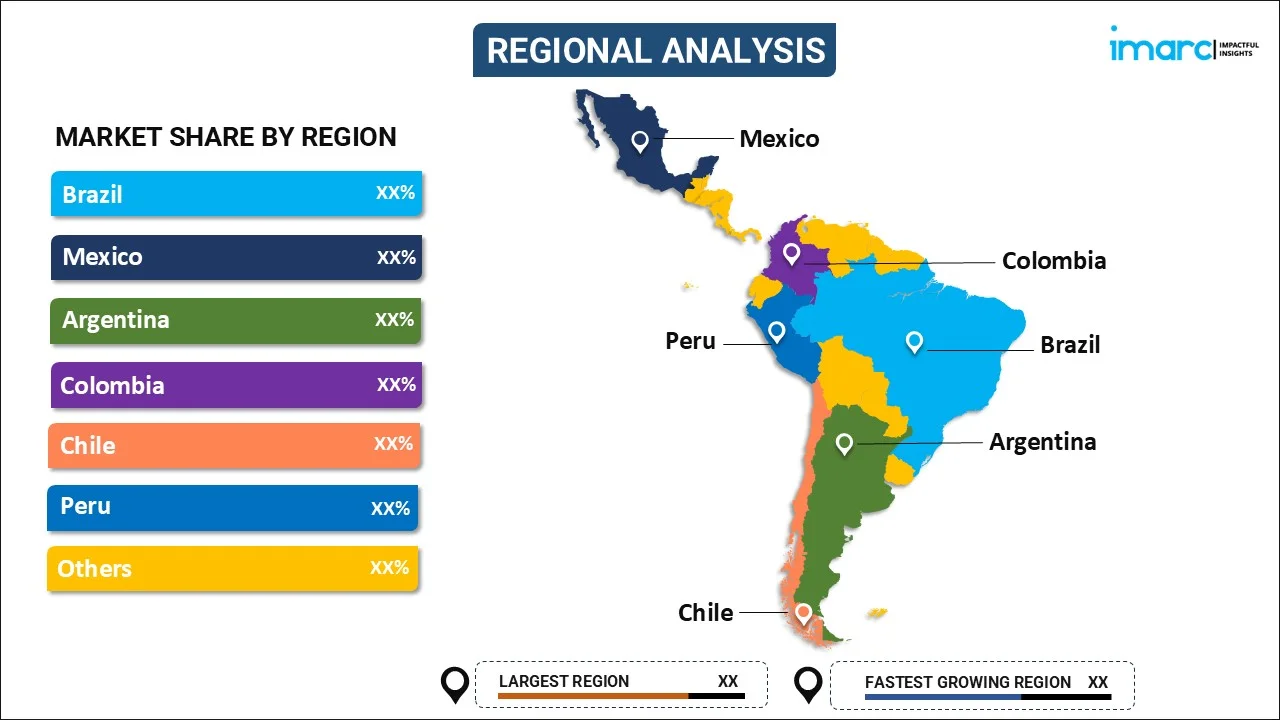

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Brazil dominates Latin America’s fintech market due to strong digital payments adoption, widespread smartphone usage, and PIX instant transfers. Fintech firms operate across digital banking, payments, credit, and insurance. A large unbanked population, active venture funding, and regulatory clarity continue to support rapid innovation and nationwide scaling.

Mexico’s fintech market benefits from a clear regulatory framework, high remittance inflows, and growing demand for financial inclusion. Digital wallets, BNPL, and SME-focused lending platforms are expanding. Fintechs address gaps in traditional banking by offering affordable credit, cross-border payments, and mobile-first financial services.

Argentina’s fintech growth is shaped by inflation, currency restrictions, and strong digital adoption. Consumers rely on digital wallets, payment apps, and crypto platforms for transactions and savings. Fintechs provide alternatives to traditional banking, though regulatory shifts and economic instability influence investment sentiment and long-term scalability.

Colombia is emerging as a fintech hub supported by government-backed inclusion programs and open banking progress. Growth is concentrated in digital payments, neobanks, and SME lending. A young, tech-savvy population and improving infrastructure attract startups and investors seeking scalable financial solutions across urban and semi-urban markets.

Chile’s fintech sector benefits from high financial literacy, strong internet penetration, and regulatory stability. Payments, wealthtech, and B2B fintech solutions dominate the market. Recent fintech legislation improves transparency and trust, encouraging collaboration between startups and banks while attracting foreign investment into innovative financial technologies.

Peru’s fintech market is expanding through mobile payments, digital lending, and wallet-based services targeting underserved users. Limited access to traditional banking supports fintech adoption. Partnerships between banks and startups are increasing, helping extend credit access, improve payment efficiency, and promote digital financial inclusion nationwide.

Other Latin American markets, including Ecuador, Uruguay, Bolivia, and Central America, show gradual fintech development. Growth focuses on payments, remittances, and micro-lending. Smaller populations limit scale, yet rising mobile access and regional platform expansion create steady opportunities for fintech adoption and cross-border service growth.

Market Dynamics:

Growth Drivers:

Why is the Latin America Fintech Market Growing?

Financial Inclusion Imperatives Driving Digital Service Adoption

Latin America faces persistent banking exclusion challenges, with substantial populations lacking access to traditional financial services due to geographic remoteness, documentation requirements, or minimum balance thresholds that exclude lower-income segments. Fintech platforms address these barriers through mobile-first service delivery models, simplified account opening processes leveraging alternative identity verification methods, and product designs accommodating irregular income patterns characteristic of informal economy participation. Digital financial services enable previously underserved populations to participate in formal financial systems, accessing savings mechanisms, credit facilities, and insurance products that support economic advancement and financial resilience. In 2025, Prometeo, a prominent fintech infrastructure firm linking global businesses with financial entities in Latin America (LatAm) and the United States (U.S.), unveiled its Borderless Banking service to facilitate business-to-business (B2B) financial transactions between the U.S. and LatAm markets. This product connects seamlessly with the banking systems in the U.S. and LatAm, offering companies a complete solution for handling their financial operations. Borderless Banking provides a unified platform for accessing local accounts to receive payments and automate collections, streamlines international payment disbursement with live tracking, and enhances global treasury management by ensuring visibility of balances across all accounts.

Cross-Border Remittance Optimization Creating Sustained Demand

Remittance flows into Latin America represent significant economic contributions, with diaspora communities regularly transferring funds to support family members in countries of origin. As stated in Coinchange’s 2025 LATAM Crypto Regulation Report, 12.1% of the population in Latin America (57.7 million individuals) possess digital currencies, with the adoption of crypto in the region rising 63% from mid-2024 to mid-2025, and usage escalating by 116% in 2024, positioning it among the quickest adopters of cryptocurrency globally. Traditional remittance channels imposed substantial costs through currency conversion fees, transfer charges, and unfavorable exchange rates that reduced amounts ultimately received by beneficiaries. Fintech solutions leveraging blockchain technology, peer-to-peer networks, and digital currency bridges dramatically reduce transaction costs while accelerating transfer speeds from days to minutes. These improvements capture market share from established money transfer operators while expanding overall market size by enabling smaller, more frequent transactions previously economically unviable through conventional channels.

Smartphone Penetration Exceeding Banking Infrastructure Development

Mobile device adoption has accelerated throughout Latin America at rates substantially exceeding physical banking infrastructure expansion, creating technological foundations supporting fintech service delivery at scale. In 2024, the smartphone market in Latin America increased by 15% to reach 137 million units, with Samsung, a Korean company, holding its spot as the top vendor in terms of shipments. People increasingly possess sophisticated smartphones with biometric authentication, secure payment processing capabilities, and consistent internet connectivity that enable financial service access without requiring physical branch visits. This technological infrastructure enables fintech companies to reach consumers in areas underserved by traditional banking networks, delivering comprehensive financial services through mobile applications that replicate and often exceed functionality available through conventional banking channels while dramatically reducing distribution costs.

Market Restraints:

What Challenges the Latin America Fintech Market is Facing?

Cybersecurity Vulnerabilities Undermining Consumer Confidence

Increasing digitization of financial services expands attack surfaces for sophisticated cybercriminals targeting platforms managing sensitive customer data and facilitating high-value transactions. Security breaches, data compromises, and fraud incidents erode consumer trust in digital financial platforms, particularly among populations with limited technology literacy or previous experiences with financial fraud. Building robust security architectures, implementing continuous monitoring systems, and educating users about digital security practices require substantial ongoing investments that strain resource-constrained startups while established institutions face reputational risks from security failures.

Regulatory Fragmentation Creating Compliance Complexity

Latin America's diverse regulatory landscape presents challenges for fintech companies seeking regional scale, as each jurisdiction maintains distinct licensing requirements, operational standards, and consumer protection frameworks. Navigating multiple regulatory regimes requires substantial legal expertise, extended approval timelines, and operational adaptations that increase market entry costs and delay expansion initiatives. Regulatory uncertainty regarding emerging technologies like cryptocurrencies, decentralized finance protocols, and artificial intelligence applications creates additional complexity, as companies must anticipate potential regulatory responses while developing innovative products.

Infrastructure Limitations Constraining Service Reliability

Despite improving connectivity, portions of Latin America continue experiencing inconsistent internet access, unreliable electrical power, and telecommunications infrastructure gaps that undermine digital financial service delivery. Transaction processing requires reliable connectivity for authorization, settlement, and confirmation, with service interruptions creating negative user experiences and operational challenges for fintech platforms. Infrastructure limitations particularly affect rural and remote areas where financial inclusion needs are most acute, creating geographic disparities in service quality that limit market addressability and reinforce existing economic inequalities.

Competitive Landscape:

The Latin American fintech competitive environment demonstrates dynamic interplay between venture-backed technology startups, established financial institutions pursuing digital transformation, and global technology platforms seeking regional expansion opportunities. Market participants employ diverse strategies ranging from niche specialization targeting specific customer segments or product categories to comprehensive platform approaches offering integrated financial services ecosystems. Partnership models have become increasingly prevalent, with traditional banks collaborating with technology providers to accelerate digital capability development while startups leverage banking licenses and distribution networks of established institutions. Competition intensifies around customer acquisition, with substantial marketing investments aimed at building brand recognition and establishing network effects that create defensible competitive positions. Regulatory compliance expertise, technological infrastructure sophistication, and customer trust represent critical competitive differentiators, alongside innovation velocity enabling rapid response to evolving consumer preferences and market opportunities.

Recent Developments:

- In December 2025, Mastercard unveiled Agent Pay, a revolutionary program designed to enable transparent, secure, and scalable AI-driven transactions across the payments ecosystem in Latin America and the Caribbean. Mastercard Agent Pay incorporates reliable, smooth payment experiences into personalized recommendations and insights available on conversational platforms, allowing digital agents to handle transactions, oversee, and enhance purchasing experiences for users.

- In November 2025, The IDB Group has introduced IDB Pay, an initiative designed to speed up the implementation of real-time, affordable digital payment systems across Latin America and the Caribbean to provide financial services to the 30% of the region's population that remains unbanked by 2030. IDB Pay seeks to assist nations in developing inclusive, interoperable, and secure Fast Retail Payment Systems (FRPS) and additional Digital Public Financial Infrastructures (DPFI).

Latin America Fintech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployments Covered | On- premises and Cloud Based |

| Technologies Covered | Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, Others |

| Applications Covered | Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management And Others |

| End Users Covered | Banking, Insurance, Security, Others |

| Regions Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Latin America fintech market size was valued at USD 15.23 Billion in 2025.

The Latin America fintech market is expected to grow at a compound annual growth rate of 15.11% from 2026-2034 to reach USD 54.01 Billion by 2034.

On-premises dominated the market with a share of 35.01% in 2025, reflecting institutional preferences among established financial organizations for maintaining direct infrastructure control, ensuring regulatory compliance, and managing sensitive customer data through internally hosted systems rather than cloud-based alternatives.

Key factors driving the Latin America fintech market include persistent financial inclusion challenges creating demand for accessible digital services, substantial cross-border remittance flows requiring cost-effective transfer solutions, widespread smartphone adoption enabling mobile-first service delivery, and supportive regulatory frameworks encouraging innovation.

Major challenges include escalating cybersecurity threats undermining consumer confidence in digital platforms, regulatory fragmentation across jurisdictions creating compliance complexity for regional expansion, infrastructure limitations affecting service reliability in underserved areas, and competitive pressures requiring sustained innovation investments while maintaining profitability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)