Latin America Fourth Party Logistics (4PL) Market Size, Share, Trends and Forecast by Operating Model, End-User, and Region, 2026-2034

Latin America Fourth Party Logistics (4PL) Market Size and Share:

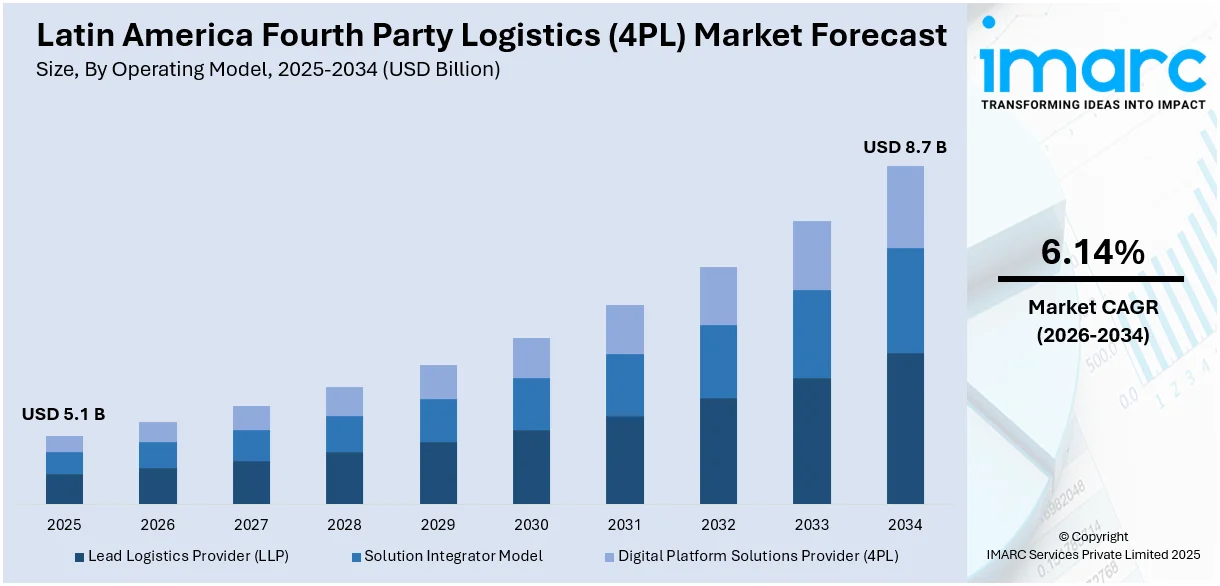

The Latin America fourth party logistics (4PL) market size was valued at USD 5.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 8.7 Billion by 2034, exhibiting a CAGR of 6.14% during 2026-2034. The market is expanding due to growing demand for integrated supply chain solutions, rising e-commerce activity, and the need for cost efficiency. Businesses are outsourcing logistics management to 4PL providers for end-to-end coordination. The region's improving infrastructure further supports Latin America fourth party logistics (4PL) market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5.1 Billion |

| Market Forecast in 2034 | USD 8.7 Billion |

| Market Growth Rate (2026-2034) | 6.14% |

The growth of the market is primarily driven by the increasing complexity of supply chains and the rising need for centralized logistics coordination. As businesses expand across borders, managing transportation, warehousing, and inventory across multiple vendors becomes challenging. 4PL providers offer end-to-end visibility and control over the entire supply chain, which helps companies improve operational efficiency and reduce costs. Additionally, the surge in e-commerce across Latin American countries like Brazil, Mexico, and Argentina is accelerating the demand for sophisticated logistics solutions that can handle higher volumes, faster deliveries, and greater customer expectations. As a result, more enterprises are turning to 4PL firms for their ability to optimize performance across fragmented supply chain networks.

To get more information on this market Request Sample

Another contributing factor is the increasing adoption of digital technologies and data-driven logistics strategies. 4PL providers in Latin America are integrating advanced tools such as AI, IoT, blockchain, and real-time analytics to enhance decision-making, demand forecasting, and supply chain transparency. For instance, Logiety, a Mexican technology firm, leverages machine learning to optimize taxation and international customs processes by automatically sorting and classifying imported and exported goods based on their size, material, and weight. These innovations allow for more agile responses to disruptions and improved risk management—particularly vital in a region prone to political and economic fluctuations. Furthermore, favorable government policies and infrastructure investments are supporting logistics improvements across ports, highways, and railways, which facilitate smoother operations for 4PL providers. Strategic partnerships between multinational logistics companies and local players are also fueling service expansion, enabling global expertise to be tailored to regional logistics challenges. This technological and infrastructural evolution significantly contributes to the sustained Latin America fourth party logistics (4PL) market growth.

Latin America Fourth Party Logistics (4PL) Market Trends:

Increasing complexity of the supply chain

One of the main factors driving the 4PL sector is the increasing complexity of supply chains in Latin America. Managing diverse suppliers, multi-tier supply chains, and changing market demands pose challenges for businesses. Due to this complexity, 4PL providers must offer advanced logistics solutions that integrate technology, strategic planning, and comprehensive supply chain management. Companies can increase supply chain visibility and control and facilitate more efficient operations by outsourcing to 4PL providers. This need for comprehensive oversight is especially significant in industries such as automotive, manufacturing, and retail, where supply chain disruptions can lead to significant financial losses. 4PL providers' ability to unify diverse logistics functions into a single, coordinated system is proving invaluable for organizations seeking to optimize efficiency, reduce risk, and achieve cost savings. For example, in September 2024, Modern Logistics, a Brazilian cargo company, announced plans to enter the US and Mexican markets and explore mergers and acquisitions. Having added two Boeing 737-800 Converted Freighters last year, it plans to acquire two more aircraft within 12 months to serve regional airports as part of its five-year growth plan.

Rapid expansion of e-commerce

The rise of e-commerce in Latin America is driving demand for advanced logistics services, including 4PL solutions. For instance, the e-commerce sector in Brazil is experiencing a rapid growth of 14.3% and is expected to surpass USD 200 Billion by 2026, according to the International Trade Administration. With consumers shifting toward online shopping, retailers and manufacturers are under pressure to streamline distribution networks and offer fast, reliable delivery options. Countries such as Brazil, Mexico, and Argentina have experienced substantial growth in online retail, driven by increased internet penetration, smartphone use, and digital payment solutions. This shift has led companies to rely more on specialized logistics partners to manage the multifaceted processes of warehousing, order fulfillment, transportation, and returns management. 4PL providers, equipped to coordinate these operations through cutting-edge technology and strategic partnerships, are essential in helping companies maintain competitive advantages in a rapidly evolving digital landscape. For example, with 218 million customers in 18 countries, MercadoLibre is expanding into the US, opening its first fulfillment center in Texas to integrate American sellers and expand its product offering for Mexican consumers, further solidifying its position as a global e-commerce leader. This e-commerce expansion requires sophisticated logistics frameworks and demands agile and scalable solutions that can adapt to seasonal peaks and changes in consumer preferences.

Latin America Fourth Party Logistics (4PL) Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Latin America fourth party logistics (4PL) market, along with forecasts at the regional and country levels from 2026-2034. The market has been categorized based on operating model and end-user.

Analysis by Operating Model:

- Lead Logistics Provider (LLP)

- Solution Integrator Model

- Digital Platform Solutions Provider (4PL)

Leading Logistics Providers (LLPs) play a foundational role in the Latin America 4PL market by offering specialized expertise and strategic oversight in managing complex supply chains. Their prominence stems from their ability to integrate multiple logistics services, including warehousing, transportation, inventory management, and distribution, into a unified operation. As Latin American companies expand regionally and globally, LLPs provide a single point of accountability, ensuring end-to-end supply chain efficiency. The growing need for cost optimization, reduced delivery times, and scalability is driving demand for LLPs. Furthermore, their ability to navigate regional logistics challenges and regulatory environments positions them as essential partners for businesses seeking seamless logistics coordination.

The integrative solutions model in Latin America's 4PL market is gaining traction as companies increasingly demand holistic and agile supply chain management. This model enables the orchestration of multiple logistics providers under a single framework, offering end-to-end visibility and enhanced decision-making capabilities. The integration of transportation, warehousing, and last-mile delivery under one system significantly boosts operational efficiency and responsiveness to market changes. As supply chains in Latin America face volatility due to political, economic, and infrastructural factors, the integrative model helps mitigate disruptions. Businesses are attracted to its scalability and flexibility, making it a core growth driver in the region’s evolving Latin America fourth party logistics (4PL) market trends.

Digital Platform Solutions Providers are becoming pivotal in the Latin America fourth party logistics (4PL) market by leveraging data analytics, artificial intelligence, and cloud technologies to drive supply chain intelligence. These platforms centralize logistics operations, offering real-time visibility, predictive analytics, and automation—all crucial in a region with varied logistical infrastructure. Their importance has grown with the e-commerce boom and the increasing complexity of demand patterns. By reducing manual processes and enhancing transparency, digital platforms empower businesses to make faster, data-driven decisions. The demand for scalable, tech-enabled logistics management is fueling investment in this segment, marking it as a key enabler of innovation and sustained Latin America fourth party logistics (4PL) market outlook.

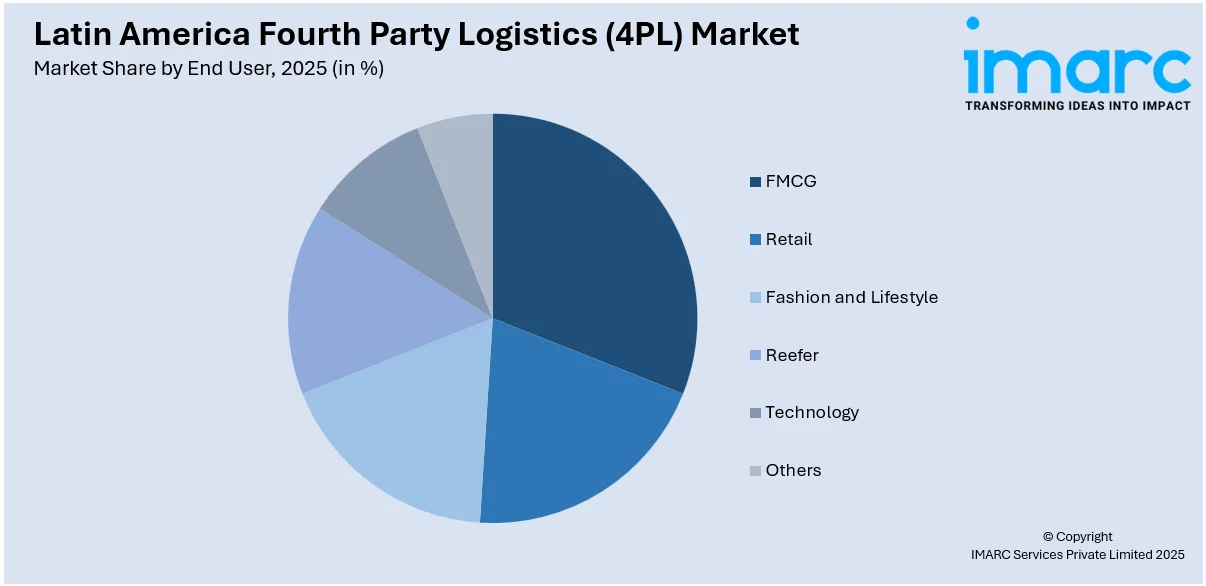

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- FMCG

- Beauty and Personal Care

- Home Care

- Retail

- Hypermarkets

- Supermarkets

- Convenience Stores

- E-commerce Channels

- Fashion and Lifestyle

- Apparel

- Footwear

- Reefer

- Fruits

- Vegetable

- Pharmaceuticals

- Meat

- Fish

- Seafood

- Technology

- Consumer Electronics

- Home Appliances

- Others

The fast-moving consumer goods (FMCG) segment is a major driver of the Latin America fourth party logistics (4PL) market due to its high-volume, high-frequency nature. FMCG companies rely on 4PL providers to manage complex supply chains that require constant replenishment, efficient inventory turnover, and last-mile delivery optimization. The growing urban population, rising consumer demand, and expansion of distribution networks across remote areas are pushing FMCG brands to seek scalable logistics solutions. 4PLs offer centralized coordination, reduce operational costs, and provide data-driven insights, which are vital for maintaining product availability and market competitiveness. Their ability to handle time-sensitive goods efficiently enhances their value in the dynamic FMCG environment across Latin America.

The retail sector holds a significant position in Latin America's 4PL market, driven by the rapid digitalization of commerce and evolving consumer expectations. As omnichannel retailing expands, retailers require agile and integrated supply chain solutions to synchronize physical stores, online platforms, and delivery services. 4PL providers enable this by orchestrating multi-modal logistics, inventory visibility, and demand forecasting across diverse retail channels. The rise of e-commerce, especially post-pandemic, has intensified the need for responsive logistics networks capable of managing peak seasons and returns. Retailers are increasingly turning to 4PL partners for strategic supply chain planning and execution, improving customer satisfaction and market penetration.

The fashion and lifestyle segment plays a dynamic role in the Latin American 4PL market, as it requires fast, flexible, and demand-sensitive logistics operations. With frequent product launches, seasonal collections, and high return rates, fashion brands benefit from 4PL services that provide end-to-end supply chain management, from sourcing and warehousing to last-mile delivery and reverse logistics. The growing influence of digital fashion retail and social media-driven consumer behavior further amplifies the need for real-time inventory updates and responsive logistics. 4PL providers help brands streamline operations, reduce lead times, and adapt quickly to trends. This strategic alignment enhances brand agility and strengthens competitiveness in a fast-paced market landscape.

Regional Analysis:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Brazil plays a dominant role in the Latin America fourth party logistics (4PL) market, driven by its expansive economy, large consumer base, and significant industrial output. As the region’s largest country, Brazil experiences substantial demand across sectors such as automotive, FMCG, retail, and agriculture—all of which require integrated logistics management. Infrastructure modernization initiatives and regulatory reforms aimed at improving logistics efficiency have made the country attractive to 4PL providers. Moreover, Brazil’s digital transformation in logistics, including the adoption of smart warehousing, IoT, and AI-based route optimization, is boosting operational agility. These factors, combined with Brazil’s strategic geographic position, reinforce its prominence as a key growth engine for Latin America’s 4PL market.

Mexico holds a critical position in the Latin American 4PL market due to its strong manufacturing base, close trade ties with the United States, and rapidly evolving e-commerce landscape. The country serves as a major nearshoring destination, driving demand for coordinated logistics and supply chain optimization. 4PL providers in Mexico support industries such as electronics, automotive, and consumer goods by offering centralized management, customs expertise, and multimodal transport solutions. Furthermore, government investment in logistics corridors and free trade zones enhances Mexico’s competitiveness. The need for end-to-end visibility, cost control, and digital logistics solutions in Mexico is accelerating the adoption of advanced 4PL services across sectors.

Argentina’s role in the Latin America 4PL market is expanding as businesses seek more efficient logistics operations amid a challenging economic environment. The country’s agriculture and food processing industries drive much of the demand for supply chain optimization, requiring seamless coordination from rural production zones to international markets. 4PL providers bring value by managing fragmented logistics networks, reducing overheads, and ensuring product traceability. Argentina’s growing e-commerce sector also contributes to the need for streamlined fulfillment and reverse logistics, which 4PLs effectively manage through integrated platforms. Although economic volatility presents hurdles, increased digitization and government focus on logistics infrastructure are creating new opportunities for 4PL adoption across key sectors.

Competitive Landscape:

The competitive landscape of the Latin America fourth party logistics (4PL) market is characterized by a mix of global logistics integrators and regional service providers striving to deliver end-to-end supply chain solutions. Companies compete by offering advanced digital platforms, AI-driven analytics, and integrated logistics networks to meet the rising demand for efficiency and visibility. The market is witnessing strategic alliances, technological investments, and expansion into underserved regions to gain competitive advantages. Service differentiation through vertical-specific expertise, particularly in FMCG, retail, and automotive sectors, is a key focus. Additionally, providers are enhancing last-mile capabilities and adopting sustainable logistics practices. The Latin America fourth party logistics (4PL) market forecast projects steady growth, fueled by innovation, infrastructure upgrades, and increasing demand for outsourced logistics strategies. For instance, in April 2024, XPO, a leading provider of end-to-end logistics solutions, entered a three-year partnership with global crop protection company UPL to deliver a comprehensive fourth-party logistics (4PL) service. Through its proprietary Key-PL® platform, XPO will manage tens of thousands of transport orders, aiming to boost operational efficiency and reduce costs.

The report provides a comprehensive analysis of the competitive landscape in the Latin America fourth party logistics (4PL) market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: J.B. Hunt Transport Services Inc., a provider of supply network solutions, including 4PL, established a partnership with BNSF Railway and Mexico’s GMXT to introduce the Quantum de México, a new multimodal solution for Mexican companies with service-sensitive cargo delivery.

- May 2025: TikTok Shop officially launched in Brazil, the in-built shopping service of the TikTok application. TikTok is expected to employ a 4PL model in Brazil, outsourcing its supply network management.

- November 2024: Kuehne+Nagel and Azul Linhas Aéreas launched a project to help Amazonian riverside communities by bringing small farmers closer to markets in Brazil and abroad. While Kuehne+Nagel offers its logistics expertise, fostering sustainable development and expanding market access, Azul offers freight discounts of up to 80% through the ARA Movement.

- September 2024: CEVA Logistics, which serves customers in the consumer goods and automotive sectors, opened two state-of-the-art warehouses in São Paulo and Mexico City. This move, which includes automation and eco-friendly features like energy-efficient lighting and solar panels, is part of CEVA's investment in Latin America to improve services and strengthen its position as an industry leader in logistics.

Latin America Fourth Party Logistics (4PL) Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Operating Models Covered | Lead Logistics Provider (LLP), Solution Integrator Model, Digital Platform Solutions Provider (4PL) |

| End Users Covered |

|

| Regions Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America fourth party logistics (4PL) market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America fourth party logistics (4PL) market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America fourth party logistics (4PL) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Latin America fourth party logistics (4PL) market was valued at USD 5.1 Billion in 2025.

The Latin America fourth party logistics (4PL) market is projected to exhibit a CAGR of 6.14% during 2026-2034, reaching a value of USD 8.7 Billion by 2034.

Key factors driving the Latin America fourth party logistics (4PL) market include rising demand for supply chain transparency, increasing e-commerce penetration, and the need for cost-efficient logistics. Technological advancements, infrastructure modernization, and growing outsourcing by FMCG and retail sectors further support market expansion across the region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)