Latin America Freight and Logistics Market Size, Share, Trends and Forecast by Logistics Function, End User Industry, and Country, 2025-2033

Latin America Freight and Logistics Market Overview:

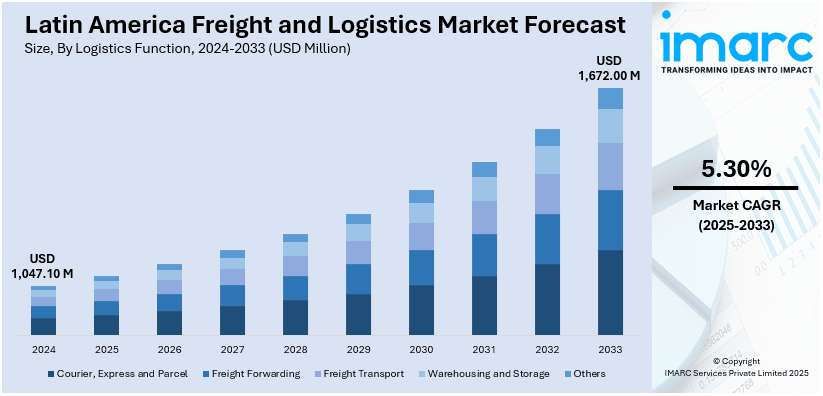

The Latin America freight and logistics market size reached USD 1,047.10 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,672.00 Million by 2033, exhibiting a growth rate (CAGR) of 5.30% during 2025-2033. The increasing demand for e-commerce, growing trade volumes, infrastructure improvements, ongoing technological advancements, rising consumer expectations for fast delivery, expanding international trade agreements, and a boost in regional manufacturing activities are some of the key factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,047.10 Million |

| Market Forecast in 2033 | USD 1,672.00 Million |

| Market Growth Rate 2025-2033 | 5.30% |

Latin America Freight and Logistics Market Trends:

E-commerce Growth

The rapid growth of e-commerce in Latin America, driven by increasing consumer demand for faster deliveries and cross-border shopping, is significantly contributing to the market expansion. This shift toward quicker gratification is pushing businesses to adopt more efficient shipping methods, like air freight, as it provides a fast and reliable solution, which in turn is driving the Latin America freight and logistics market share. The market expands because businesses have started using air cargo transportation to rapidly deliver manufactured goods which includes electronic items alongside fashion products and healthcare products. The rise of e-commerce applications along with websites promotes greater demand for transporting goods through the market. The market progress continues due to e-commerce success in delivering rapid delivery services and standardized cross-border distribution operations to satisfy consumer demands. For instance, in May 2024, The contract logistics division of DHL Group teamed up with a new cargo airline in Brazil to introduce a private air transport service as a more dependable option for domestic distribution of high-value goods in sectors like healthcare and automobiles than commercial passenger airlines and trucking.

Technological Advancements

The adoption of new technologies in air freight is transforming the industry by improving efficiency, transparency, and security. The integration of modern tracking technologies, the Internet of Things (IoT), and artificial intelligence (AI) has improved operational efficiency, allowing firms to follow shipments in real-time, optimize delivery routes, and reduce the risk of delays. According to the Latin America freight and logistics market forecast, these technological improvements are ensuring faster processing of shipments by facilitating seamless communication between airlines, logistics providers, and customers. Moreover, ongoing technological advancements in cargo aircraft have led to more fuel-efficient planes and larger cargo holds to meet the growing demand for air freight in the region. These innovations cut operational costs, helping airlines to improve their environmental footprint, and making air freight more attractive to businesses, which is supporting the market expansion. For instance, in February 2025, Azul Cargo Express plans to commence regional operations in Brazil with two Airbus A321-200 passenger-to-freighter (P2F) aircraft leased from AerCap. Azul Linhas Aéreas' logistics unit announced plans to fly between Viracopos International Airport (VCP) in Campinas and Manaus International Airport (MAO) in Brazil.

Growth in Regional Trade and Infrastructure Development

Latin America’s air freight sector is primarily driven by increased regional trade and enhanced infrastructure. Trade agreements like the Pacific Alliance and Bienvenidos al Mercado Común del Sur (MERCOSUR) are boosting economic ties between Latin American countries and encouraging cross-border shipments. As goods flow more freely between countries in the region, air freight plays an essential role in ensuring the timely delivery of perishable goods and high-value items. Additionally, continuous improvements in infrastructure, such as the modernization of airports and expansion of cargo handling facilities, are further boosting the region’s capacity to handle increased air freight traffic. These developments have made Latin America more attractive for domestic and international air cargo operations, creating a positive Latin America freight and logistics market outlook. For instance, in September 2023, Brazil's new air cargo system, CCT Import - Air Mode ("CCT Importação - Modal Aéreo"), aims to reduce clearance times from five days to a single day. The first import declaration was processed in just five hours. This new system was launched at all Brazilian international airports on August 2 via the SISCOMEX portal, replacing the old Mantra system that had been in use for the previous 30 years.

Latin America Freight and Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on logistics function and end user industry.

Logistics Function Insights:

- Courier, Express and Parcel

- Destination Type

- Domestic

- International

- Destination Type

- Freight Forwarding

- Mode of Transport

- Air

- Sea and Inland Waterways

- Others

- Mode of Transport

- Freight Transport

- Mode of Transport

- Air

- Pipelines

- Rail

- Road

- Mode of Transport

- Warehousing and Storage

- Temperature Control

- Non-Temperature Controlled

- Temperature Controlled

- Temperature Control

- Others

The report has provided a detailed breakup and analysis of the market based on the logistics function. This includes courier, express and parcel, (destination type (domestic and international)), freight forwarding (mode of transport (air, sea and Inland waterways, and others)), freight transport (mode of transport (air, pipelines rail, and road)), warehousing and storage (temperature control (non-temperature controlled and temperature controlled)), and others.

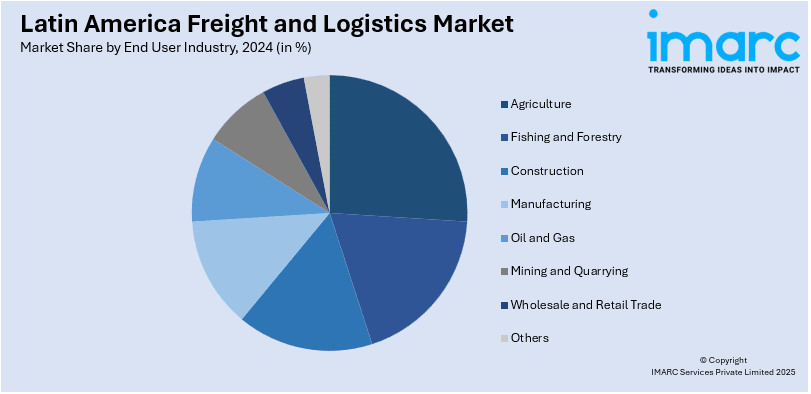

End User Industry Insights:

- Agriculture

- Fishing and Forestry

- Construction

- Manufacturing

- Oil and Gas

- Mining and Quarrying

- Wholesale and Retail Trade

- Others

A detailed breakup and analysis of the market based on the end user industry have also been provided in the report. This includes agriculture, fishing and forestry, construction, manufacturing, oil and gas, mining and quarrying, wholesale and retail trade, and others.

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Freight and Logistics Market News:

- In November 2024, FedEx Corporation joined the Latin American and Caribbean Air Transport Association (ALTA) as its newest associate member. It marked a significant step in the region's efforts to enhance its air transportation network, boost global trade, and strengthen economic connections with international markets.

- In September 2024, Scan Global Logistics acquired Blu Logistics Brazil, a provider of air and ocean freight services, including customs clearance, trucking, and cabotage, expanding its footprint in Latin America and enhancing its logistics capabilities in the region.

- In December 2024, a worldwide leader in logistics and supply chain solutions, DP World, plans to substantially expand its freight forwarding operation across Brazil over the next two years. By 2026, the business intends to create six additional offices, demonstrating its dedication to improving end-to-end supply chain solutions throughout Latin America.

Latin America Freight and Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Logistics Functions Covered |

|

| End User Industries Covered | Agriculture, Fishing and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale And Retail Trade, Others |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America freight and logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America freight and logistics market on the basis of logistics functions?

- What is the breakup of the Latin America freight and logistics market on the basis of end user industry?

- What is the breakup of the Latin America freight and logistics market on the basis of country?

- What are the various stages in the value chain of the Latin America freight and logistics market?

- What are the key driving factors and challenges in the Latin America freight and logistics market?

- What is the structure of the Latin America freight and logistics market and who are the key players?

- What is the degree of competition in the Latin America freight and logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America freight and logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America freight and logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America freight and logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)