Latin America Legal Tech Market Size, Share, Trends and Forecast by Software Type, Deployment Model, Organization Size, Legal Vertical, End-User, and Region, 2025-2033

Latin America Legal Tech Market Overview:

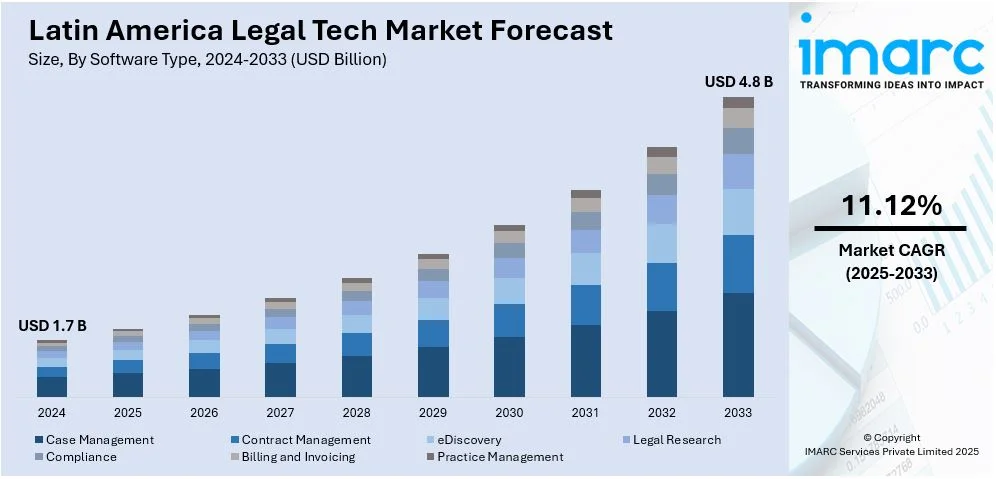

The Latin America legal tech market size reached USD 1.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.8 Billion by 2033, exhibiting a growth rate (CAGR) of 11.12% during 2025-2033. The market share is expanding, driven by rapid digital transformation, rising demand for remote legal solutions and data security, and the growing adoption of artificial intelligence (AI), which assists in identifying patterns in case outcomes and provides data-oriented insights to clients.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.7 Billion |

| Market Forecast in 2033 | USD 4.8 Billion |

| Market Growth Rate 2025-2033 | 11.12% |

Latin America Legal Tech Market Trends:

Surge in Legal Process Automation and Digitalization

The increasing applications in automating routine processes like contract management, billing, and e-discovery are impelling the Latin America legal tech market growth. For instance, according to the industry reports, Pix, the Brazilian real-time payments system owned by Brazil's Central Bank, recorded nearly 42 Billion electronic transactions in 2023, highlighting the growing adoption of electronic billing in Brazil. Legal departments and firms are further implementing digital tools to streamline operations, cut costs, and enhance service efficiency. Automation allows legal professionals to manage high caseloads effectively, minimizing manual tasks and operational errors. This trend is especially prominent in Brazil and Mexico where firms are heavily investing in technology to improve client outcomes. Furthermore, as legal tech becomes more accessible, mid-sized and smaller firms are employing these solutions, thereby making automated workflows a foundational component of Latin America’s legal industry transformation.

Increasing Need for Data Security and Compliance Solutions

The growing implementation of data privacy regulations like Brazil’s General Data Protection Law (LGPD) has heightened the demand for legal tech solutions prioritizing data security and regulatory compliance. Companies are wagering on secure document storage, encrypted communications, and compliance tools to protect against the growing risks of cyberattacks and severe data breach penalties. For instance, according to the World Law Group, Brazil, and Mexico ranked among the most affected countries in the region, with Brazil accounting for 43% of cyberattacks and Mexico 17% in 2023. However, adopting compliance-focused technologies extends beyond law firms to sectors heavily regulated in Latin America, such as finance, healthcare, and energy. As organizations strive to maintain client trust and adhere to stringent regulations, investment in data protection tools has become integral, making data security a dominant trend in the industry.

Rise of AI and Analytics in Legal Decision-Making

The growing usage of AI and data analytics is offering a favorable Latin America legal tech market outlook. Their high adoption aids in transforming decision-making and case management. Legal professionals are utilizing AI-oriented tools for predictive analytics, risk assessment, and document review, helping them to manage complex cases with greater precision. In countries like Argentina, Chile and Brazil firms are employing AI to enhance legal research, identify patterns in case outcomes, and provide data-driven insights to clients. For instance, according to industry reports, in 2023, 66 AI systems were in operation, providing crucial assistance in tackling the 82.6 Million pending cases in Brazilian courts. Additionally, this integration of AI not only improves efficiency but also enhances strategic planning in legal proceedings, positioning AI and analytics as essential components for firms looking to gain an advantage in the marketplace.

Latin America Legal Tech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on software type, deployment model, organization size, legal vertical, and end-user.

Software Type Insights:

- Case Management

- Contract Management

- eDiscovery

- Legal Research

- Compliance

- Billing and Invoicing

- Practice Management

The report has provided a detailed breakup and analysis of the market based on the software types. This includes case management, contract management, eDiscovery, legal research, compliance, billing and invoicing, and practice management.

Deployment Model Insights:

- On-Premises

- Cloud-Based

- SaaS

A detailed breakup and analysis of the market based on the deployment models have also been provided in the report. This includes on-premises, cloud-based, and SaaS.

Organization Size Insights:

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization sizes. This includes small and medium-sized enterprises (SMEs) and large enterprises.

Legal Vertical Insights:

- Corporate Law

- Litigation

- Intellectual Property

- Real Estate

- Tax

A detailed breakup and analysis of the market based on the legal verticals have also been provided in the report. This includes corporate law, litigation, intellectual property, real estate, and tax.

End-User Insights:

.webp)

- Law Firms

- Corporate Legal Departments

- Government Agencies

- Legal Aid Organizations

The report has provided a detailed breakup and analysis of the market based on the end-users. This includes law firms, corporate legal departments, government agencies, and legal aid organizations.

Regional Insights:

- Brazil

- Mexico

- Argentina

- Columbia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Columbia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Legal Tech Market News:

- In December 2024, discovermarket, an Insurtech firm based in Singapore and Switzerland, officially launched in Latin America, starting with the creation of a legal entity in Brazil. Through this expansion, the firm intended to reshape the future of embedded insurance in the region by introducing cutting-edge insurance solutions, technology, and expertise to Latin America’s swiftly changing Insurtech environment.

- In September 2023, Cuatrecasas, a Spanish law firm, released "Cuatrecasas Expert Legal AI," a generative AI tool developed with Harvey AI, becoming the first firm to implement this technology across Latin America. Available to its lawyers across 27 offices, the tool streamlined drafting, document revision, and precedent searches. This innovation aimed to support Cuatrecasas’ strategy to boost efficiency and deliver sophisticated client services without replacing human input.

Latin America Legal Tech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Software Types Covered | Case Management, Contract Management, eDiscovery, Legal Research, Compliance, Billing and Invoicing, Practice Management |

| Deployment Models Covered | On-Premises, Cloud-Based, SaaS |

| Organization Sizes Covered | Small and Medium-Sized Enterprises (SMEs), Large Enterprises |

| Legal Verticals Covered | Corporate Law, Litigation, Intellectual Property, Real Estate, Tax |

| End-Users Covered | Law Firms, Corporate Legal Departments, Government Agencies, Legal Aid Organizations |

| Regions Covered | Brazil, Mexico, Argentina, Columbia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America legal tech market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America legal tech market on the basis of software type?

- What is the breakup of the Latin America legal tech market on the basis of deployment model?

- What is the breakup of the Latin America legal tech market on the basis of organization size?

- What is the breakup of the Latin America legal tech market on the basis of legal vertical?

- What is the breakup of the Latin America legal tech market on the basis of end-user?

- What are the various stages in the value chain of the Latin America legal tech market?

- What are the key driving factors and challenges in the Latin America legal tech market?

- What is the structure of the Latin America legal tech market and who are the key players?

- What is the degree of competition in the Latin America legal tech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America legal tech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America legal tech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America legal tech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)