Latin America Lithium Mining Market Size, Share, Trends and Forecast by Source, Type, and Country, 2026-2034

Latin America Lithium Mining Market Summary:

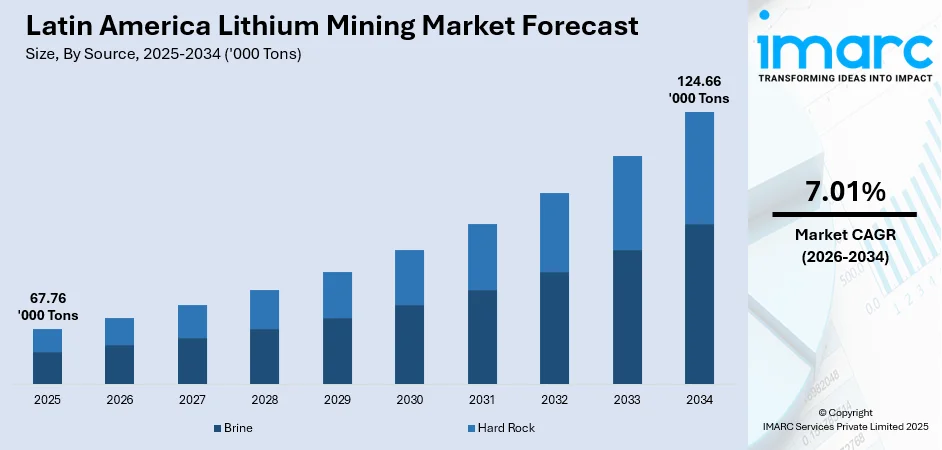

The Latin America lithium mining market size reached 67.76 Thousand Tons in 2025 and is projected to reach 124.66 Thousand Tons by 2034, growing at a compound annual growth rate of 7.01% from 2026-2034.

Latin America has emerged as a pivotal region in the global lithium supply chain, driven by the rich mineral deposits concentrated in the Lithium Triangle spanning Argentina, Chile, and Bolivia. The lithium mining market is experiencing robust expansion, fueled by surging demand from electric vehicle (EV) battery manufacturers and renewable energy storage systems. Strategic government initiatives aimed at promoting foreign investments, coupled with the region's favorable geological conditions for brine-based extraction, continue to strengthen its position as a dominant lithium supplier.

Key Takeaways and Insights:

-

By Source: Brine dominates the market with a share of 68% in 2025, owing to the exceptional concentration of lithium deposits in the region's salt flats, favorable arid climatic conditions enabling cost-effective evaporative extraction, and established infrastructure supporting large-scale production operations across Chile and Argentina.

-

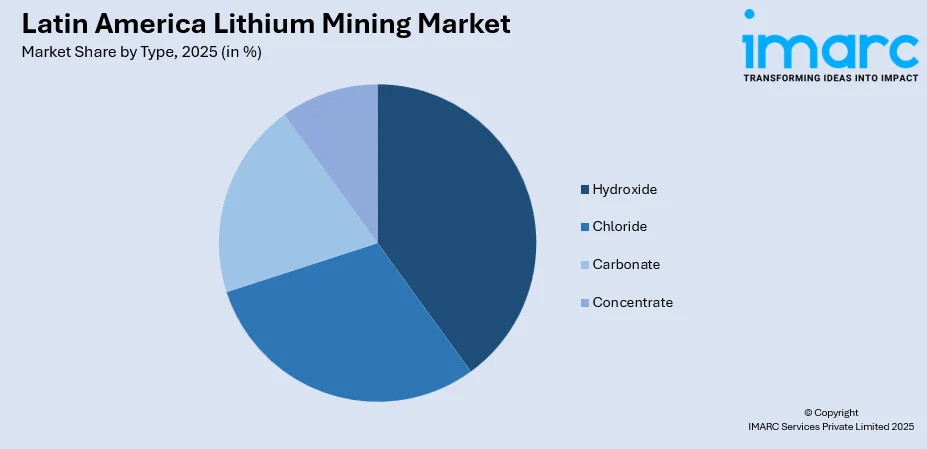

By Type: Hydroxide leads the market with a share of 35% in 2025, driven by escalating demand from high-nickel battery cathode manufacturers seeking superior energy density for EV applications and the growing preference for lithium hydroxide in premium battery production processes.

-

By Country: Argentina represents the largest country with 32% share in 2025, propelled by its investor-friendly regulatory environment, vast untapped lithium reserves in northern provinces, and aggressive expansion of mining operations attracting significant foreign capital inflows.

-

Key Players: Leading mining corporations are accelerating expansion through strategic partnerships, technological innovations in direct lithium extraction, and vertically integrated operations to enhance production efficiency while strengthening supply chain resilience across the Latin American lithium ecosystem.

To get more information on this market Request Sample

As electrification initiatives escalate and battery technology improvements create an unprecedented demand for high-purity lithium compounds, the Latin American lithium mining market is positioned for sustainable expansion. Compared to hard rock mining, which is common in other regional markets, Latin America’s competitive edge is its plentiful brine deposits, which allow more affordable extraction. In order to provide a dynamic working environment for multinational mining businesses, governments across major producing nations are progressively designing their policies to balance resource nationalism with foreign investment attraction. The Argentine government announced plans in June 2024 to raise output of lithium by 202,000 Metric Tons annually through four new mining operations. While downstream processing capacities are growing to capture more value within the regional supply chain, technological developments in direct lithium extraction are transforming production schedules and environmental sustainability criteria.

Latin America Lithium Mining Market Trends:

Adoption of Direct Lithium Extraction Technologies

Direct lithium extraction technologies, which promise quicker production cycles and less environmental footprints, are revolutionizing the lithium mining industry throughout Latin America. Unlike the conventional evaporative procedure, which takes many months, these novel techniques allow lithium recovery from brine in a matter of weeks. In order to improve operational efficiency and solve water consumption issues, mining corporations are making significant investments in the testing and expansion of these technologies. To encourage sustainable production methods, Chile's National Strategy for Lithium, which was introduced in 2023, made the use of novel lithium extraction technologies a top priority.

Strategic Public-Private Partnerships Reshaping Industry Structure

Lithium development is increasingly being structured by government-backed projects using frameworks for public-private partnerships that strike a balance between the objectives of the state and the expertise of the private sector. This cooperative approach is especially evident in Chile, where legislative reforms are requiring majority state participation in critical lithium assets while maintaining operational freedom for foreign partners. The partnership model seeks to attract foreign investments in exploration and production activities while ensuring long-term resource stewardship, maximizing domestic value capture, and maintaining competitive positioning in international markets.

Environmental Sustainability Driving Operational Transformation

As environmental scrutiny from foreign investors and regulatory bodies increases, sustainable mining techniques are becoming a top issue in the Latin American lithium mining industry. To lessen the ecological effects on fragile high-altitude ecosystems, mining enterprises are putting in place extensive water management systems, brine reinjection procedures, and community participation initiatives. In order to differentiate their products in areas where automakers are increasingly demanding traceable and ethically produced battery materials for their electrification programs, companies are pursuing certifications for sustainable lithium manufacturing.

Market Outlook 2026-2034:

The Latin America lithium mining market is poised for substantial expansion throughout the forecast period, as global EV adoption accelerates and energy storage deployment intensifies. The market size was estimated at 67.76 Thousand Tons in 2025 and is expected to reach 124.66 Thousand Tons by 2034, reflecting a compound annual growth rate of 7.01% over the forecast period 2026-2034. Strategic investments in production capacity expansion, technological innovations, and downstream processing capabilities will drive market growth while sustainability considerations and community relations management will remain critical success factors for operators seeking to capitalize on favorable demand dynamics.

Latin America Lithium Mining Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Source | Brine | 68% |

| Type | Hydroxide | 35% |

| Country | Argentina | 32% |

Source Insights:

- Brine

- Hard Rock

Brine dominates with a market share of 68% of the total Latin America lithium mining market in 2025.

Brine-based lithium extraction leads the Latin America lithium mining market due to the region’s vast salt flat resources with naturally high lithium concentrations. Brine deposits in areas, such as high-altitude Salars, enable large-scale production with comparatively lower operating costs than hard rock mining. Solar evaporation methods utilize advantageous weather conditions, decreasing energy requirements and enhancing economical lithium carbonate production for worldwide battery producers.

Additionally, brine extraction supports longer mine life and scalable production, making it attractive for long-term supply agreements. The process allows co-production of valuable byproducts, improving overall project economics. Growing technological improvements in direct lithium extraction are further enhancing recovery rates and water efficiency, strengthening brine-based operations’ competitiveness and reinforcing their leadership across the Latin America lithium mining market.

Type Insights:

Access the comprehensive market breakdown Request Sample

- Chloride

- Hydroxide

- Carbonate

- Concentrate

Hydroxide leads with a share of 35% of the total Latin America lithium mining market in 2025.

Hydroxide has emerged as the fastest-growing product segment, driven by its critical role in manufacturing high-nickel cathode materials for premium EV batteries. Battery manufacturers increasingly prefer lithium hydroxide for nickel-cobalt-manganese and nickel-cobalt-aluminum cathode chemistries that deliver superior energy density and extended driving range. The compound's processing advantages enable more efficient battery production at higher performance specifications demanded by leading automotive manufacturers transitioning their fleets to electrification.

Regional producers are expanding lithium hydroxide refining capabilities to capture greater value from raw material production and meet stringent battery-grade specifications. Latin American operations are strategically positioned to serve growing Asian and North American battery manufacturing hubs through established export infrastructure and competitive production costs derived from abundant feedstock availability, fueling the consumption of hydroxide.

Country Insights:

- Brazil Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Argentina exhibits a clear dominance with a 32% share of the total Latin America lithium mining market in 2025.

Argentina has positioned itself as the fastest-growing lithium producer in Latin America through its investor-friendly regulatory framework and vast untapped resources concentrated in the northwestern provinces of Salta, Jujuy, and Catamarca. As of March 2025, Argentina held the third position worldwide for lithium reserves, totaling 4 Million Metric Tons. Provincial governments maintain authority over mining concessions and have cultivated welcoming investment environments that have attracted major international mining corporations.

In addition, Argentina’s flexible permitting processes and openness to foreign ownership accelerate project development timelines compared to neighboring markets. Strong partnerships between provincial authorities and private investors support infrastructure development, including power, water, and transport links essential for brine operations. The country is also advancing downstream processing capabilities, aiming to move beyond raw lithium exports. Growing emphasis on sustainable extraction practices and community engagement further enhances investor confidence, reinforcing Argentina’s role as a key growth engine in the Latin America lithium mining market.

Market Dynamics:

Growth Drivers:

Why is the Latin America Lithium Mining Market Growing?

Surging Demand for EVs and Energy Storage

The surging demand for EVs and energy storage solutions is a primary driver of the Latin America lithium mining market. The National Automotive Association of Chile (ANAC) released its report for December 2024, indicating that EV sales in the nation rose by 183% from 2023, surpassing 4,500 units sold. Lithium-ion batteries, the core component of EVs and grid storage systems, require high-purity lithium compounds, creating substantial upstream demand. Government agencies are implementing stringent emission reduction policies, accelerating EV adoption and energy transition initiatives. Latin America, particularly the Lithium Triangle countries like Chile, Argentina, and Bolivia, offers abundant lithium reserves, positioning the region as a strategic supplier. Automotive manufacturers and battery producers are establishing long-term supply agreements with regional mining companies to secure reliable lithium sources. The growth of renewable energy storage, including utility-scale batteries and residential energy systems, further amplifies lithium requirements. These combined trends are driving exploration, expansion, and investment in lithium extraction projects across the region. The expanding EV and storage markets ensure sustained demand, incentivizing technological innovation, production efficiency, and downstream processing capabilities in the lithium mining industry in Latin America.

Abundant Lithium Reserves and Favorable Geology

Abundant lithium reserves and favorable geological conditions are significant growth drivers for the Latin America lithium mining market. The region hosts some of the world’s largest lithium deposits, particularly in salt flats and brine-rich basins, such as Salar de Atacama, Salar del Hombre Muerto, and Salar de Uyuni. High lithium concentration in these resources allows efficient extraction and lower production costs compared to hard rock deposits elsewhere. Favorable geology supports large-scale, long-term mining operations, attracting investment from global mining corporations and battery producers. The natural abundance enables Latin America to maintain a competitive edge in global supply, ensuring stable off-take agreements with international customers. Additionally, geological advantages allow the development of integrated mining and processing facilities, enhancing product quality and market responsiveness. As demand for lithium continues to grow, the region’s unique resource endowment sustains its position as a preferred supplier, driving expansion, technological adoption, and continued market leadership in lithium mining.

Strategic Investments and International Partnerships

Strategic investments and international partnerships are accelerating the growth of the market in Latin America. Global mining corporations, battery producers, and private equity investors are injecting capital into exploration, expansion, and modernization projects across the region. Joint ventures and long-term offtake agreements secure supply for major EV and energy storage manufacturers, ensuring revenue stability and operational scalability. International expertise and technology transfer improve extraction efficiency, environmental compliance, and operational safety. Infrastructure development, including roads, water management, and processing plants, is facilitated through strategic collaborations. These investments strengthen market resilience against supply chain disruptions and support sustainable project development. By aligning financial resources, technical know-how, and market access, strategic partnerships enhance production capacity and competitiveness. Continued inflow of capital and collaborative initiatives positions Latin America to meet growing global lithium demand while reinforcing its leadership in high-quality, sustainably produced lithium.

Market Restraints:

What Challenges is the Latin America Lithium Mining Market Facing?

Water Resource Constraints and Environmental Concerns

Lithium extraction operations face mounting pressure regarding water consumption in arid regions where local communities and fragile ecosystems depend on limited freshwater resources. Traditional evaporative processes consume substantial water volumes while competing with agricultural and domestic requirements in high-altitude desert environments. Regulatory authorities are implementing stricter extraction quotas and environmental monitoring requirements that may constrain production expansion timelines.

Lithium Price Volatility and Market Uncertainty

Significant price fluctuations in global lithium markets create investment uncertainty and compress operating margins for producers across the value chain. Lithium carbonate prices declined substantially from peak levels in late 2022 through 2024, forcing mining companies to reassess expansion plans and prioritize operational efficiency over growth initiatives. Persistent oversupply conditions and slower-than-anticipated EV adoption rates continue to pressure producer economics.

Infrastructure and Logistics Limitations

Remote mining locations in high-altitude regions present significant infrastructure challenges, including limited transportation networks, constrained power supply availability, and elevated operating costs. Difficult access conditions increase capital requirements for project development while creating operational complexities for equipment mobilization and product transport. Labor availability and specialized technical expertise remain constrained in isolated mining districts.

Competitive Landscape:

The Latin America lithium mining market exhibits a concentrated competitive structure, dominated by major international mining corporations with established operational footprints and substantial financial resources. Industry consolidation has accelerated through strategic acquisitions, as leading players seek to secure long-term lithium supply positions and leverage operational synergies across integrated asset portfolios. Companies are differentiating through technological innovations in extraction methodologies, sustainability credentials, and downstream processing capabilities to strengthen competitive positioning in increasingly sophisticated customer markets. Additionally, partnerships with automotive and battery manufacturers are enhancing market access and ensuring stable off-take agreements.

Recent Developments:

-

In August 2025, Lithium Argentina AG. and Ganfeng executed a framework agreement establishing a new joint venture consolidating three lithium brine projects in Salta Province. The combined operation targets production capacity of up to 150,000 Tons per annum of lithium carbonate equivalent through three phased expansions, representing approximately USD 1.8 Billion in existing investments and positioning the venture among the largest global lithium operations.

-

In May 2025, the Argentine government approved Rio Tinto's USD 2.5 Billion Rincon lithium mining project, located in the northern Salta province. It became the first mining project to receive approval under the incentive framework.

Latin America Lithium Mining Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | 000 Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Brine, Hard Rock |

| Types Covered | Chloride, Hydroxide, Carbonate, Concentrate |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Latin America lithium mining market reached a volume of 67.76 Thousand Tons in 2025.

The Latin America lithium mining market is expected to grow at a compound annual growth rate of 7.01% from 2026-2034 to reach 124.66 Thousand Tons by 2034.

Brine dominated the market with a share of 68%, driven by the exceptional concentration of lithium deposits in regional salt flats, favorable arid climatic conditions, and established extraction infrastructure across Chile and Argentina.

Key factors driving the Latin America lithium mining market include accelerating global EV adoption, favorable government policies and investment incentives across producing nations, expanding energy storage system deployments, and technological advancements in direct lithium extraction methodologies.

Major challenges include water resource constraints and environmental concerns in arid mining regions, significant lithium price volatility impacting producer margins, infrastructure and logistics limitations in remote high-altitude locations, community relations management requirements, and increasing regulatory scrutiny of extraction operations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)