Latin America Logistics Market Report by Model Type (2 PL, 3 PL, 4 PL), Transportation Mode (Roadways, Seaways, Railways, Airways), End Use (Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, and Others), and Country 2026-2034

Latin America Logistics Market Overview:

Latin America logistics market size reached USD 366.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 580.1 Billion by 2034, exhibiting a growth rate (CAGR) of 5.25% during 2026-2034. The rapid economic growth in the Latin American region, ongoing expansion of the manufacturing sector, significant growth of the e-commerce sector, widespread infrastructure development, increasing integration of technology and rising number of free trade agreements represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 366.1 Billion |

|

Market Forecast in 2034

|

USD 580.1 Billion |

| Market Growth Rate 2026-2034 | 5.25% |

Access the full market insights report Request Sample

Logistics refers to the systematic process of organizing and implementing an operation that involves the movement of goods, services, information, and funds from the point of origin to the point of consumption. It encompasses a range of types, including transportation, warehousing, material handling, packaging, inventory management, supply chain management, and logistics network design. Logistics offer robust features, such as efficiency, reliability, scalability, and flexibility. It is widely used in retail management, e-commerce, manufacturing, international trade, healthcare, government and defense sectors, and agriculture, among others. Logistics aid in reducing costs, improving delivery performance, enhancing customer satisfaction, optimizing inventory levels, and increasing overall efficiency. In addition, it provides competitive advantage, risk mitigation, sustainability, global reach, and contribution to economic growth.

Latin America Logistics Market Trends:

Online Retail Growth Driving Logistics Demand

The surge in e-commerce across Latin America has placed new pressure on logistics providers to meet tighter delivery windows and support last-mile operations in urban and rural areas alike. Rising smartphone usage and digital payment adoption are encouraging more consumers to shop online, especially in Brazil, Mexico, and Colombia. This has pushed retailers and third-party logistics firms to upgrade infrastructure, expand warehousing, and use tech like route optimization and real-time tracking. Demand for fulfillment centers closer to major consumption zones is increasing, and startups are entering the market with niche solutions tailored to regional delivery challenges. The Latin America e commerce logistics market is expanding rapidly as businesses respond to evolving expectations for speed and transparency.

Trade Liberalization Fueling Regional Freight Flows

Latin America’s growing network of free trade agreements is making cross-border logistics smoother and more attractive for global supply chains. Agreements like the USMCA, Mercosur-EU deal (pending ratification), and various bilateral pacts have lowered tariffs and reduced regulatory barriers. As a result, countries in the region are seeing a rise in freight volumes, particularly along trade corridors connecting Mexico, Brazil, Argentina, and Chile. Improved customs procedures and regional collaboration are cutting clearance times, but bottlenecks remain at some key checkpoints. Logistics operators that can navigate these shifts and invest in multimodal connectivity are well-positioned to benefit from increased regional integration and South America freight and logistics opportunities.

Rising Industrial Output Reshaping Freight Needs

Latin America is experiencing a steady increase in manufacturing activity, particularly in sectors like automotive, consumer goods, and electronics. Governments are offering incentives to attract industrial investment, while companies look to diversify their global sourcing. This rise in production is reshaping freight movement patterns, boosting demand for both inbound raw materials and outbound finished goods logistics. The need for efficient transport links between factories, ports, and markets has led to investment in warehouse clusters, road and rail infrastructure, and digital logistics platforms. Countries like Brazil and Mexico are leading the way, but others like Peru and Colombia are also emerging as smaller industrial hubs requiring dependable freight networks and expanded Latin America supply chain services.

Nearshoring Accelerating Logistics Development

The shift toward nearshoring, relocating supply chain operations closer to end markets, is bringing significant logistics gains for Latin America, with Mexico at the forefront. Its geographic proximity to the US makes it a prime choice for manufacturers seeking to reduce lead times and minimize exposure to Asia-related disruptions. This has led to growing demand for industrial real estate along the northern border, increased trucking activity, and upgrades in rail connectivity. Companies are also looking for warehousing and distribution partners that can scale quickly and handle cross-border complexity. Mexico’s rise as a nearshoring hub is transforming it into a logistics bridge between North and Latin America, attracting both capital and technology. These developments are strengthening logistics in Latin America and positioning Mexico as a critical gateway.

Latin America Logistics Market Growth Factors:

Emergence of Logistica Solutions

A new wave of regional logistics providers is offering localized expertise under the umbrella of Latin America logistica, blending global best practices with deep knowledge of local delivery dynamics. These operators are increasingly able to handle complex routes and adapt to regulatory shifts quickly, especially in areas with limited infrastructure.

Digitization Driving Logistics Trends

Real-time visibility, automation, and route planning are defining logistics trends Latin America, with companies investing in digital platforms that enable more accurate tracking, streamlined inventory, and faster fulfillment. Startups and incumbents alike are racing to digitize processes to remain competitive in urban and rural delivery.

Logistics Investment Ramping Up

With infrastructure development accelerating in countries like Chile, Argentina, and Colombia, South America logistics is gaining momentum. Port expansions, rail upgrades, and multimodal corridors are reducing delays and enabling more reliable transport from inland industrial zones to export hubs.

Growth of 3 PL (Third Party Logistics) Services

Mid-sized and large enterprises are turning to 3 PL (third party logistics) providers to handle warehousing, inventory, and transportation needs, especially where in-house capabilities can’t scale. This model allows businesses to remain asset-light while meeting service-level expectations.

2 PL (Second Party Logistics) Remaining a Reliable Option

In specific sectors like FMCG and pharmaceuticals, 2 PL (second party logistics) providers continue to play a critical role by offering dedicated transportation with higher control and predictability for repetitive routes.

Rise of 4 PL (Fourth Party Logistics) Integration Models

Larger multinationals are increasingly adopting 4 PL (fourth party logistics) strategies, outsourcing their entire logistics management to lead operators who coordinate across multiple service providers. This approach is gaining popularity among firms seeking end-to-end supply chain orchestration.

Latin America Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on model type, transportation mode, and end use.

Model Type Insights:

To get detailed segment analysis of this market Request Sample

- 2 PL

- 3 PL

- 4 PL

The report has provided a detailed breakup and analysis of the market based on the model type. This includes 2 PL, 3 PL, and 4 PL.

Transportation Mode Insights:

- Roadways

- Seaways

- Railways

- Airways

A detailed breakup and analysis of the market based on the transportation mode have also been provided in the report. This includes roadways, seaways, railways, and airways.

End Use Insights:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others.

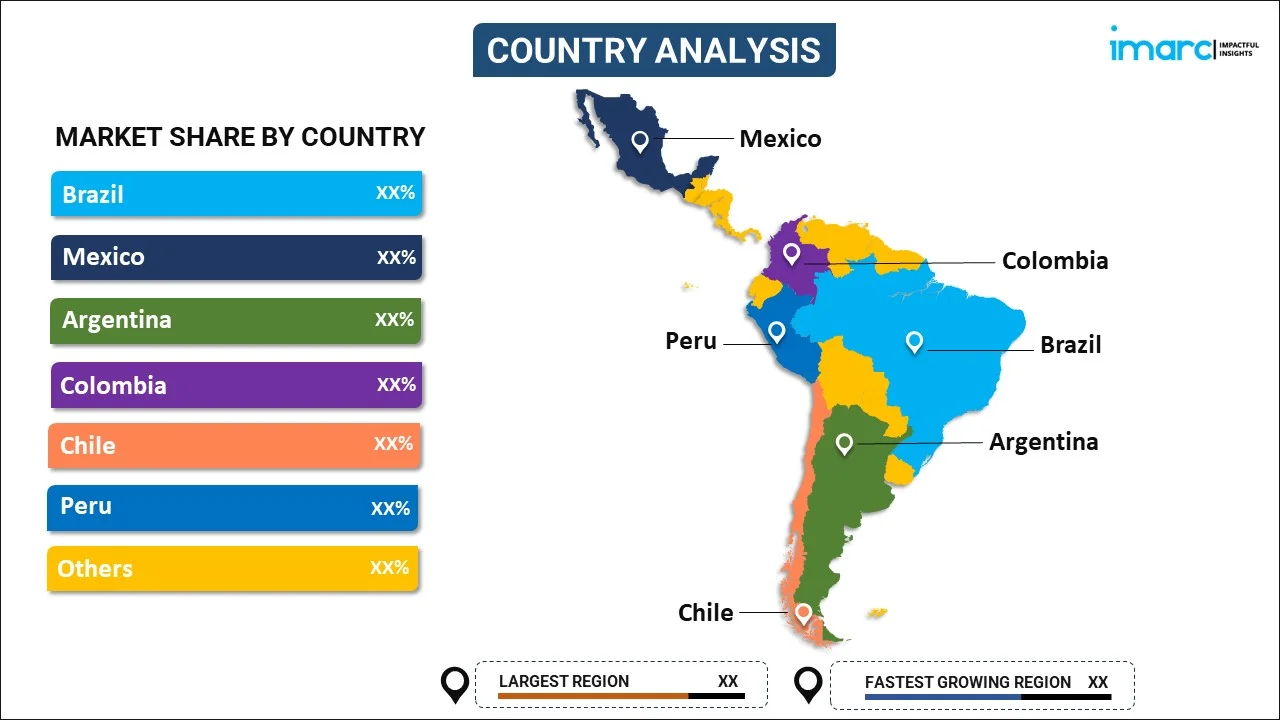

Country Insights:

To get detailed regional analysis of this market Request Sample

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Logistics Market News:

- In July 2025, DP World opened a new freight forwarding office in Mexico City as part of its strategy to strengthen supply chain resilience across Latin America. The move includes satellite offices in Guadalajara and Monterrey. The expanded footprint will support integrated logistics solutions throughout Mexico, North America, and Central America.

- In May 2025, CEVA Logistics launched a new deep-sea car carrier trade lane connecting the Far East with Central and South America. Three additional roll-on, roll-off vessels will serve ports in countries like Mexico, Panama, Colombia, and Chile. CEVA’s inland transport and vehicle compounds in Latin America would support end-to-end finished vehicle logistics, delivering directly into automaker networks and dealerships across the region.

Latin America Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Latin America logistics market was valued at USD 366.1 Billion in 2025.

The Latin America logistics market is projected to exhibit a CAGR of 5.25% during 2026-2034, reaching a value of USD 580.1 Billion by 2034.

Key factors driving the Latin America logistics market include rising e-commerce demand, improved infrastructure investments, cross-border trade growth, nearshoring trends, digital logistics adoption, and government initiatives supporting transport networks. Urbanization and expanding retail also fuel the need for efficient last-mile delivery across the region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)