Latin America On-demand Delivery Services Market Size, Share, Trends and Forecast by Service Type, End User, and Country, 2025-2033

Latin America On-demand Delivery Services Market Overview:

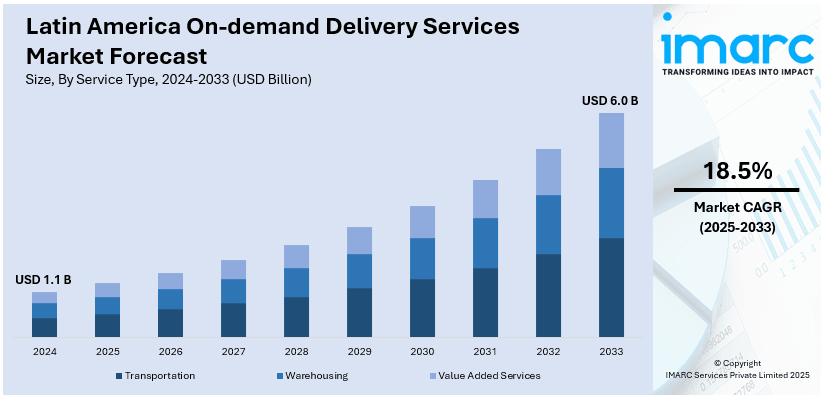

The Latin America on-demand delivery services market size reached USD 1.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.0 Billion by 2033, exhibiting a growth rate (CAGR) of 18.5% during 2025-2033. The market is propelled by the increasing smartphone penetration and internet accessibility, an expanding middle class with higher disposable incomes, growth in e-commerce and digital payment options, and supportive government policies promoting digital economies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.1 Billion |

| Market Forecast in 2033 | USD 6.0 Billion |

| Market Growth Rate 2025-2033 | 18.5% |

Latin America On-demand Delivery Services Market Trends:

Increasing Smartphone Penetration and Internet Accessibility

The rise in smartphone penetration and internet accessibility is accelerating the growth of on-demand delivery services in Latin America. With internet access reaching 78% in 2023, even remote country are gaining connectivity. Affordable devices and expanded network coverage have enabled a larger population to access delivery platforms, broadening the customer base. Consumers increasingly rely on these apps for the convenience of doorstep deliveries, spanning food, groceries, and retail items. Urban areas, in particular, have seen a surge in adoption, with digital platforms becoming an integral part of everyday life. Additionally, growing financial inclusion through digital payments has further supported this shift. As more individuals experience the benefits of quick and reliable service, demand continues to rise. The accessibility of digital solutions is not only enhancing consumer convenience but also fostering opportunities for delivery service providers to expand their reach, establishing a solid foundation for long-term market growth.

Growing Shift toward Affordable Electric Mobility in Urban Transport

Electric vehicle adoption is accelerating in urban transport systems, driven by partnerships that make EVs more accessible to drivers. Competitive pricing and flexible financing options are reducing upfront costs, encouraging wider EV usage. Additionally, support services like discounted charging, maintenance, and insurance enhance affordability. This shift not only reduces carbon emissions but also aligns with clean energy goals, making sustainable mobility a practical choice for ride-hailing and delivery services. Latin America and Europe are witnessing increased investments in electrified fleets, reinforcing the movement toward greener, more efficient urban transportation. As financial and logistical barriers decrease, more drivers are expected to embrace electric vehicles, contributing to lower emissions and improved air quality. For instance, in July 2024, Uber and BYD announced a strategic partnership to introduce 100,000 BYD electric vehicles (EVs) to Uber's platform, starting in Europe and Latin America. This initiative aims to provide Uber drivers with competitive pricing and financing options for EVs, reducing ownership costs and promoting sustainable transportation.

Latin America On-demand Delivery Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on service type and end user.

Service Type Insights:

- Transportation

- Warehousing

- Value Added Services

The report has provided a detailed breakup and analysis of the market based on the service type. This includes transportation, warehousing, and value added services.

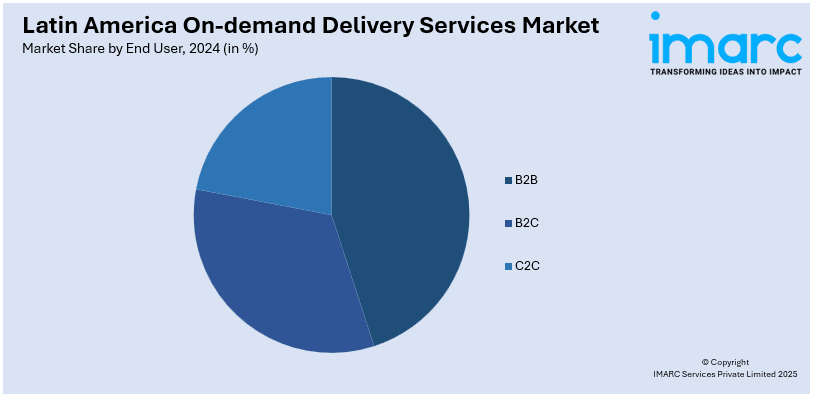

End User Insights:

- B2B

- B2C

- C2C

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes B2B, B2C, and C2C.

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major country markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America On-demand Delivery Services Market News:

- In August 2024, Professional football club FC Barcelona launched a new on-demand food delivery service in Latin America. The project is being undertaken in collaboration with Rappi, the premier home-delivery service in Latin America. Rappi would also serve as the official delivery partner of FC Barcelona.

- In July 2024, iFood, the largest on-demand food delivery service in Latin America, established a strategic partnership with Kevel, a North Carolina-based software firm. As part of this collaboration, iFood introduced a unique self-serve option that doubled its ad revenue.

Latin America On-demand Delivery Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Transportation, Warehousing, Value Added Services |

| End Users Covered | B2B, B2C, C2C |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America on-demand delivery services market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America on-demand delivery services market on the basis of service type?

- What is the breakup of the Latin America on-demand delivery services market on the basis of end user?

- What are the various stages in the value chain of the Latin America on-demand delivery services market?

- What are the key driving factors and challenges in the Latin America on-demand delivery services?

- What is the structure of the Latin America on-demand delivery services market and who are the key players?

- What is the degree of competition in the Latin America on-demand delivery services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America on-demand delivery services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America on-demand delivery services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America on-demand delivery services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)