Latin America Online Education Market Size, Share, Trends and Forecast by Type, Provider, Technology, End Use, and Country, 2025-2033

Latin America Online Education Market Overview:

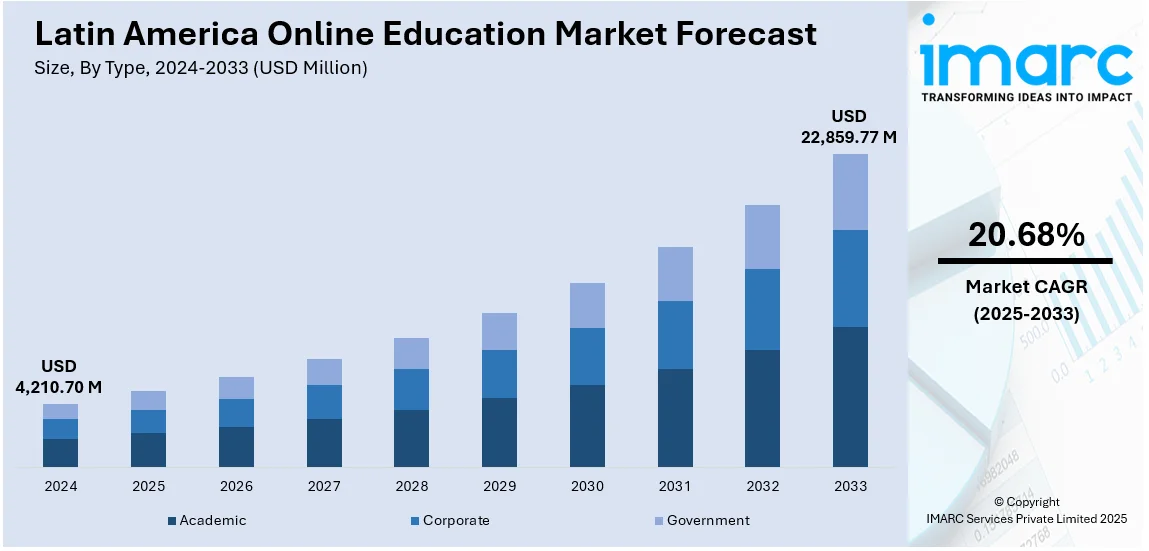

The Latin America online education market size reached USD 4,210.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 22,859.77 Million by 2033, exhibiting a growth rate (CAGR) of 20.68% during 2025-2033. The Latin America online education market share is expanding, driven by the increasing internet and mobile penetration, which is providing easy access to digital courses and allowing learners to learn from the comfort of their homes, along with the rising implementation of favorable government initiatives supporting online education.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,210.70 Million |

| Market Forecast in 2033 | USD 22,859.77 Million |

| Market Growth Rate (2025-2033) | 20.68% |

Latin America Online Education Market Trends:

Growing Internet and Mobile Penetration

The rapid expansion of internet connectivity and mobile device usage is offering a favorable Latin America online education market outlook. In January 2024, Brazil had 187.9 Million individuals using the internet, according to the datareportal. At the beginning of 2024, the internet penetration rate in Brazil was 86.6 percent of the overall population. Due to continual improvements in the internet infrastructure and the implementation of cost-effective data plans, there is a considerable rise in the number of students and professionals utilizing online educational platforms. The easy access to educational content is being enhanced by the wide availability of smartphones and tablets, allowing learners to participate in courses at any time and in any place. Nations, such as Brazil, Mexico, and Argentina, are witnessing a notable increase in internet users, leading to increased engagement in e-learning courses. This is also encouraging professionals within sectors like technology, finance, and healthcare to advance their skill sets and recognize the importance of staying competitive in a continuously changing job market. Moreover, this trend is significantly affecting the rural regions across Latin America where conventional educational resources are scarce.

Rising Implementation of Government Initiatives

The increasing execution of government initiatives that support digitalization and digital learning is impelling the Latin America online education market growth. In September 2024, the Government of Brazil launched an ambitious initiative for digital transformation, backed by an investment of R$ 186.6 Billion aimed at revitalizing its industrial sector. The center of this initiative was the Missão 4 da Nova Indústria Brasileira (NIB), which set ambitious goals for the industrial digitization of the nation. Besides this, government agencies are endorsing online education as a way to narrow educational disparities and enhance access to high-quality learning. Several efforts have been started to encourage digital education, especially in remote and disadvantaged regions. Government agencies are collaborating with private education providers and international organizations to increase the accessibility of online courses and resources. Furthermore, certain countries have developed national online learning portals to provide educational content to students and professionals, either free of charge or with financial assistance. Such support plays a critical role in enhancing digital literacy and improving access to education across various socioeconomic groups. These efforts are leading to increased adoption and creativity within the education sector.

Latin America Online Education Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, provider, technology, and end use.

Type Insights:

- Academic

- Higher Education

- Vocational Training

- K-12 Education

- Corporate

- Large Enterprises

- SMBs

- Government

The report has provided a detailed breakup and analysis of the market based on the types. This includes academic (higher education, vocational training, and K-12 Education), corporate (large enterprises and SMBs), and government.

Provider Insights:

- Content

- Services

A detailed breakup and analysis of the market based on the providers have also been provided in the report. This includes content and services.

Technology Insights:

- Mobile E-learning

- Rapid E-learning

- Virtual Classroom

- Others

The report has provided a detailed breakup and analysis of the market based on the technologies. This includes mobile e-learning, rapid e-learning, virtual classroom, and others.

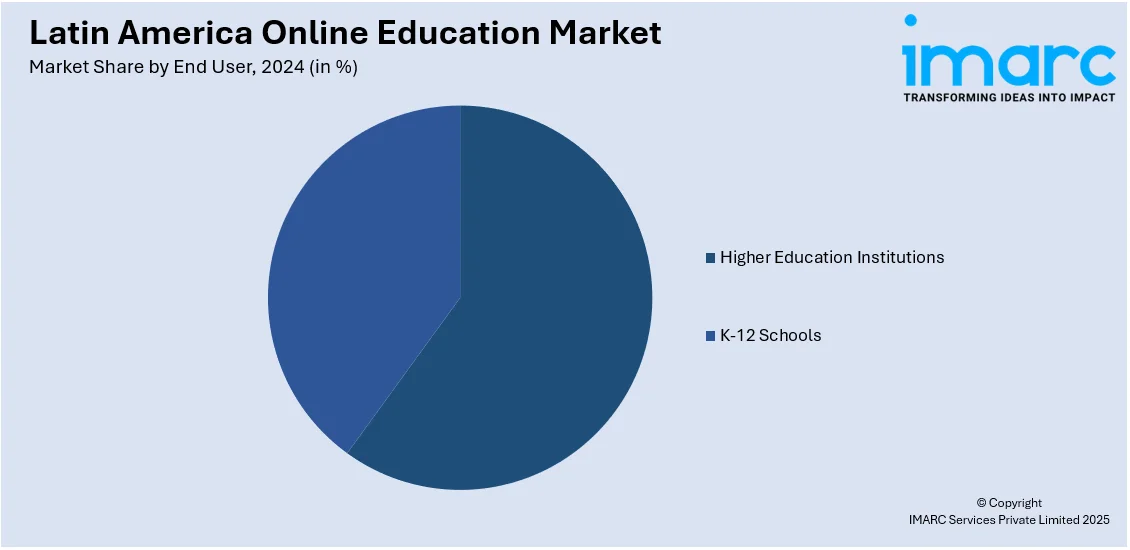

End User Insights:

- Higher Education Institutions

- K-12 Schools

A detailed breakup and analysis of the market based on the end users have also been provided in the report. This includes higher education institutions and K-12 schools.

Country Insights:

- Brazil

- Mexico

- Argentina

- Columbia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Columbia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Online Education Market News:

- In December 2024, Teachy, the Brazilian ed-tech company, raised USD 7 Million in a Series A funding round headed by Goodwater Capital. The company stated that the money was to be used to enhance its AI-driven product, designed to assist educators in locating curriculum resources that meet local standards and tailoring them to the requirements of students. This funding would enable the firm to become one of the top technology teams in Brazil.

- In June 2023, Open English, a well-known online English-learning platform in the Latin American and US Hispanic markets, initiated Open Mundo, broadening its services to feature live tutoring in Spanish, Portuguese, Italian, and French. Open Mundo sought to assist companies in improving their employee benefits offerings by providing language learning as an optional perk, which aimed to enhance employee retention and happiness. Accessible around the clock with native-speaking instructors, the platform intended to fulfill personal and career objectives.

Latin America Online Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Providers Covered | Content, Services |

| Technologies Covered | Mobile E-learning, Rapid E-learning, Virtual Classroom, Others |

| End Users Covered | Higher Education Institutions, K-12 Schools |

| Countries Covered | Brazil, Mexico, Argentina, Columbia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America online education market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America online education market on the basis of type?

- What is the breakup of the Latin America online education market on the basis of provider?

- What is the breakup of the Latin America online education market on the basis of technology?

- What is the breakup of the Latin America online education market on the basis of end user?

- What are the various stages in the value chain of the Latin America online education market?

- What are the key driving factors and challenges in the Latin America online education?

- What is the structure of the Latin America online education market and who are the key players?

- What is the degree of competition in the Latin America online education market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America online education market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America online education market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America online education industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)