Latin America Online Travel Market Size, Share, Trends, and Forecast by Service Type, Platform, Mode of Booking, Age Group, and Region, 2026-2034

Latin America Online Travel Market Overview:

The Latin America online travel market size reached USD 37.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 84.0 Billion by 2034, exhibiting a growth rate (CAGR) of 9.41% during 2026-2034. The increasing demand for online travel agencies and booking platforms, which enable travelers to compare prices across different airlines, hotels, and other travel services, thereby facilitating informed decision-making and ensuring transparency in pricing, is primarily driving the regional market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 37.4 Billion |

| Market Forecast in 2034 | USD 84.0 Billion |

| Market Growth Rate (2026-2034) | 9.41% |

Access the full market insights report Request Sample

Latin America Online Travel Market Trends:

Technological Advancements and Accessibility Driving Online Travel Growth

The Latin America online travel booking market growth is witnessed remarkably because more people have gained internet access. For instance, as of January 2024, over 80% of South Americans had internet access, with mobile devices being the primary means of connection. The spread of internet technology across Latin America gives people simple access to many different travel information portals and booking websites. People can now book travel arrangements through affordable smartphones combined with low-cost data plans from their home locations. In addition to this, the combination of convenience and quick access has transformed the traveling planning process where people can immediately evaluate rates and reviews for better trip assessment. Moreover, the integration of artificial intelligence (AI) and machine learning (ML) technologies has enhanced the user experience by making it more efficient. Besides this, travel platforms benefit from analyzing how travelers behave which enables them to customize their recommendation system to give individualized options to customers. Furthermore, advanced technology platforms are expanding travel opportunities for Latin American customers by providing easier access to services and user-friendly interfaces which is propelling the market forward.

Changing Consumer Preferences and the Rise of Peer-to-Peer Models

The Latin America online travel market share is witnessing fundamental changes because customers now choose customized and varied options. In line with this, the growing demand for peer-to-peer lodging services has begun to strongly impact traditional hotel and accommodation businesses in the market. Moreover, travelers now choose Airbnb, as this platform provides them with more flexible and less expensive housing choices over traditional hotels. Concurrently, individuals want unique authentic experiences instead of traditional accommodations because they suit both wallets of cost-conscious travelers and those who want cultural immersion. For example, over two-thirds (68%) of Latin American travelers are planning short domestic trips (one to four nights), indicating a preference for local experiences. Additionally, the digitally native generation who consult social media is actively participating in this development. Through social media, people develop wanderlust while they publish experiences that change both their travel destinations and their travel habits. As a result, travelers in Latin America are increasingly seeking out immersive experiences, driving demand for new types of accommodations and travel services. These changing preferences, combined with ongoing technological advancements, are boosting the South America online travel market size.

Expanding Reach of Online Travel Agencies

In Latin America, online travel agencies (OTAs) have rapidly become a key driver of digital travel bookings. Their appeal lies in convenience, price transparency, and wide inventory coverage, which make them the go-to choice for travelers seeking both domestic and international options. Rising internet penetration and growing trust in online payments have fueled this shift, especially among younger demographics who prefer mobile-first platforms. OTAs are also benefiting from the fragmented nature of Latin America’s travel industry. Many smaller hotels and operators rely on OTAs to access broader markets, boosting visibility and bookings beyond their local reach. In turn, consumers gain access to a diverse mix of accommodations, flights, and tour packages all in one place. Competition among global and regional players has led to aggressive discounting, loyalty programs, and app-driven personalization, further cementing OTAs’ dominance. The market’s future growth will hinge on the continued adoption of smartphones and secure digital wallets, alongside investments in localized services tailored to language and cultural preferences. With these factors aligning, OTAs are set to play an increasingly central role in shaping how travelers in Latin America plan, compare, and purchase their trips online, making the online travel market South America a strong growth area influenced by online travel industry trends.

Latin America Online Travel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on service type, platform, mode of booking, and age group.

Service Type Insights:

To get detailed segment analysis of this market Request Sample

- Transportation

- Travel Accommodation

- Vacation Packages

The report has provided a detailed breakup and analysis of the market based on the service type. This includes transportation, travel accommodation, and vacation packages.

Platform Insights:

- Mobile

- Desktop

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes mobile and desktop.

Mode of Booking Insights:

- Online Travel Agencies (OTAs)

- Direct Travel Suppliers

The report has provided a detailed breakup and analysis of the market based on the mode of booking. This includes online travel agencies (OTAs), and direct travel suppliers.

Age Group Insights:

- 22-31 Years

- 32-43 Years

- 44-56 Years

- Above 56 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 22-32 years, 32-43 years, 44-56 years and above 56 years.

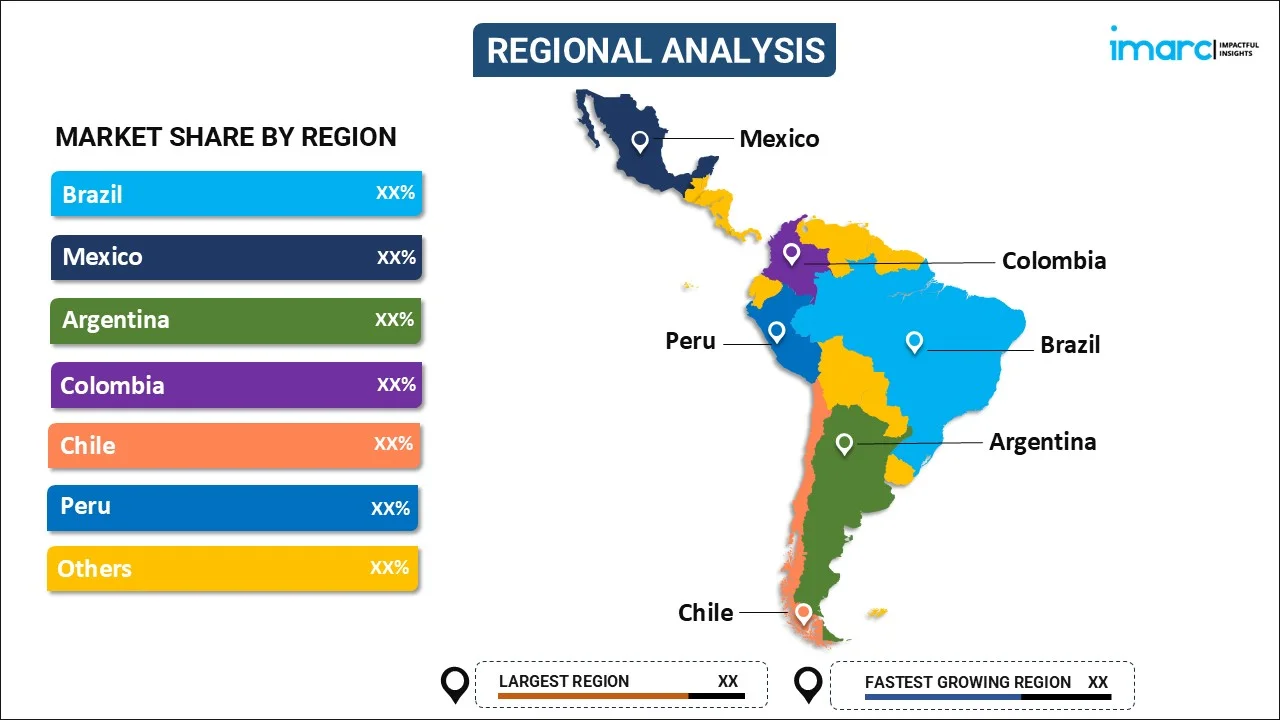

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Online Travel Market News:

- In August 2025, SiteMinder expanded its Latin American presence by opening a new office in Mexico, its largest regional market. The hub supports properties from vacation rentals to resorts across key destinations and extends operations to Colombia, Peru, Chile, and Costa Rica, strengthening local partnerships and boosting hotel connectivity.

- In December 2024, Dutch technology investor Prosus NV agreed to acquire Latin American online travel agency Despegar.com Corp for approximately $1.7 billion in cash. This acquisition aims to expand Prosus's services in the region and integrate Despegar with its regional businesses, such as iFood and Sympla, to create synergies.

- In September 2024, TUI Group introduced a digital platform to offer holiday packages to customers in Latin American countries. This strategic initiative leverages TUI’s technology and the expertise of its Spain & Portugal team, enabling significant expansion in the region while providing vacation experiences customized for the LATAM market.

- In July 2024, TravelgateX officially expanded into Latin America, offering a single API that connects travel businesses to over 500 accommodation providers and +250 buyers, including OTAs and tour operators. With EUR 4 Billion in transactions and 50,000 daily bookings, the platform enhances supplier connectivity, market access, and regional growth opportunities.

Latin America Online Travel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Transportation, Travel Accommodation, Vacation Packages |

| Platforms Covered | Mobile, Desktop |

| Mode of Bookings Covered | Online Travel Agencies (OTAs), Direct Travel Suppliers |

| Age Groups Covered | 22-32 Years, 32-43 Years, 44-56 Years, Above 56 Years |

| Regions Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America online travel market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America online travel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America online travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Latin America online travel market was valued at USD 37.4 Billion in 2025.

The Latin America online travel market is projected to exhibit a CAGR of 9.41% during 2026-2034, reaching USD 84.0 Billion by 2034.

The Latin America online travel market is driven by growing internet penetration, mobile adoption, rising disposable incomes, expanding middle-class population, improved digital payment systems, and increased demand for affordable travel options. Social media influence and aggressive marketing by online travel agencies also fuel market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)