Latin America Organic Textile Market Size, Share, Trends and Forecast by Type, Quality Type, Application, and Country, 2025-2033

Latin America Organic Textile Market Overview:

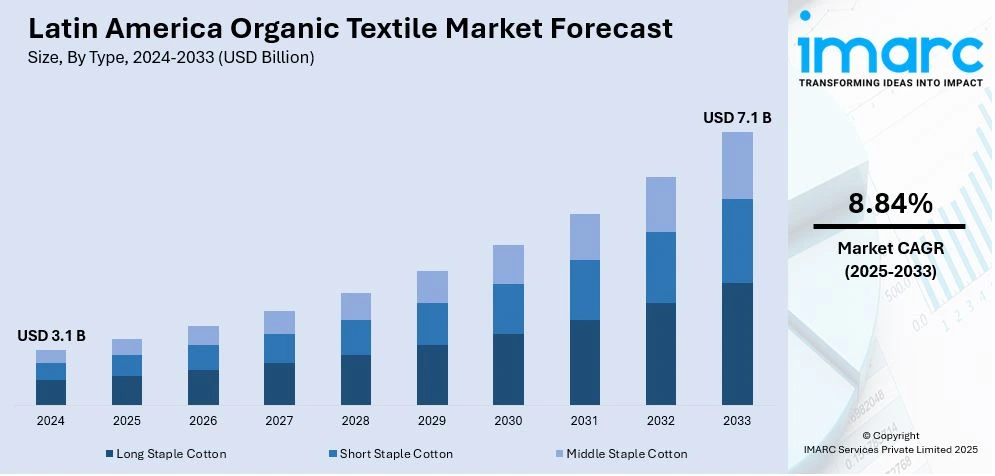

The Latin America organic textile market size reached USD 3.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.1 Billion by 2033, exhibiting a growth rate (CAGR) of 8.84% during 2025-2033. The market is expanding steadily with rising awareness of sustainability, increased demand for eco-friendly apparel, and supportive government policies. Additionally, a shift in consumer preferences towards organic materials, the influence of social media promoting sustainable lifestyles, and advancements in organic farming practices that enhance supply chains are acting as other factors contributing to the Latin America organic textile market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 7.1 Billion |

| Market Growth Rate 2025-2033 | 8.84% |

Latin America Organic Textile Market Trends:

Rising Demand for Sustainable Fashion

The Latin American organic textile market share is expanding due to increased demand for sustainable fashion, driven by growing environmental awareness and ethical consumerism. Consumers are seeking eco-friendly alternatives, prompting brands to adopt organic materials including cotton and wool that minimize the environmental impact. The fashion brands in the region are increasingly focusing on transparency and sustainability throughout their supply chains, from raw material sourcing to production processes. For instance, according to industry reports, in 2023, environmentally conscious consumers, who prioritize sustainable and eco-friendly products, make up 18% of the total population and account for a USD 15 Billion market in consumer goods in Latin America, highlighting rapid growth influenced by sustainability-driven purchasing habits in the market. This change is revolutionizing the fashion industry in the region, with both established and new players embracing organic materials to attract ecologically conscious customers. This trend is driving product development and business growth.

Government Support and Regulations

Latin American governments are playing a crucial role in the expansion of the organic textile market by introducing policies and regulations that encourage sustainable practices. Incentives for organic farming and stricter regulations on conventional textile manufacturing are helping to enhance the organic textile sector. Additionally, various certification programs for organic products are becoming more prominent, allowing producers to gain consumer trust and comply with international standards. For instance, in October 2023, the Food and Agriculture Organization (FAO) and Brazil's Cooperation Agency hosted Cotton Week in Brasília to celebrate World Cotton Day. The event highlights the South-South +Cotton Cooperation Project, promoting initiatives in seven Latin American countries to strengthen the cotton value chain. Activities include a Ministerial Forum, a fashion show featuring cotton from family farmers, and discussions on sustainable practices. The +Cotton Project has supported over 14,000 families in improving cotton production over the past decade. This regulatory support is fostering growth in organic textile production while encouraging manufacturers to adopt environmentally friendly practices, aligning with global sustainability goals and helping the market position itself competitively on the global stage.

Growing Consumer Awareness and Ethical Buying

The increasing consumer awareness of environmental issues is significantly shaping the Latin America organic textile market outlook. Consumers are becoming more educated about the environmental and social impact of conventional textile production, leading to a rising preference for organic and ethically produced textiles. This shift in consumer behavior is driving demand for products made from organic materials, such as cotton and bamboo, which are grown without harmful chemicals. In 2023, the textiles industry in Latin America experienced growing interest in sustainable and environmentally friendly fashion, according to industry reports. In Colombia, 75% of the population is aware that their consumption decisions have a powerful impact on the environment. In addition, one in three households of one or two individuals are identified as eco-active, a trend that is particularly prevalent in Argentina, where over 50% of these households are included in this group. And 44% of the consumers will no longer purchase products due to their negative environmental impact. Consequently, brands and retailers have reacted with greener alternatives, greater transparency of sourcing, and the capacity to market cleaner habits. This pattern is likely to keep on developing the market's growth as buyers become more and more concerned about ethical and environmentally friendly consumption.

Latin America Organic Textile Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, quality type, and application.

Type Insights:

- Long Staple Cotton

- Short Staple Cotton

- Middle Staple Cotton

The report has provided a detailed breakup and analysis of the market based on the type. This includes long staple cotton, short staple cotton, and middle staple cotton.

Quality Type Insights:

- Supima

- Giza

- Upland

A detailed breakup and analysis of the market based on the quality type have also been provided in the report. This includes supima, giza, and upland.

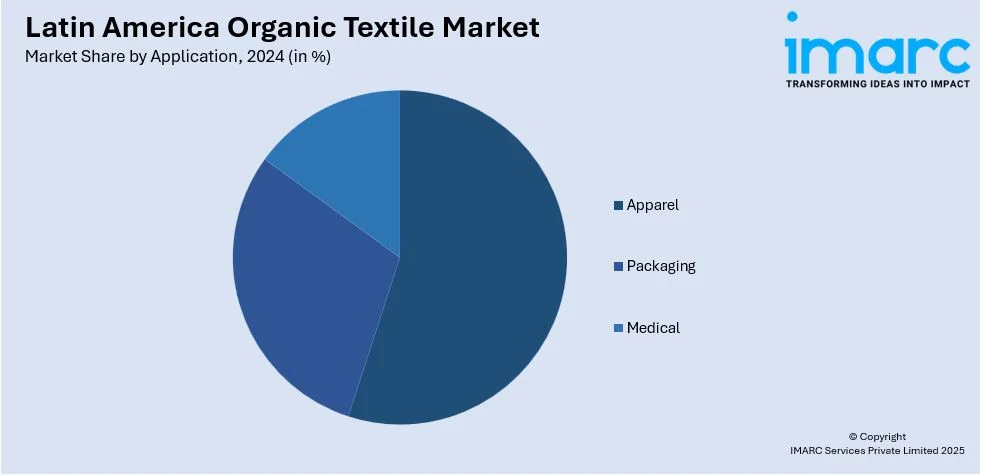

Application Insights:

- Apparel

- Packaging

- Medical

The report has provided a detailed breakup and analysis of the market based on the application. This includes apparel, packaging, and medical.

Countries Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Organic Textile Market News:

- In October 2024, DOORS NYC and Universo MOLA launched the sustainable Latin American fashion pop-up in SoHo, showcasing collections from designers Pacatus, Tania Orellana, and Feel Nomade. The event featured sustainability-focused discussions with industry leaders and a presentation by ecological journalist Cata Droguett, aiming to elevate ethical Latin American fashion and foster global cultural exchange.

Latin America Organic Textile Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Long Staple Cotton, Short Staple Cotton, Middle Staple Cotton |

| Quality Types Covered | Supima, Giza, Upland |

| Applications Covered | Apparel, Packaging, Medical |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America organic textile market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America organic textile market on the basis of type?

- What is the breakup of the Latin America organic textile market on the basis of quality type?

- What is the breakup of the Latin America organic textile market on the basis of application?

- What is the breakup of the Latin America organic textile market on the basis of country?

- What are the various stages in the value chain of the Latin America organic textile market?

- What are the key driving factors and challenges in the Latin America organic textile market?

- What is the structure of the Latin America organic textile market and who are the key players?

- What is the degree of competition in the Latin America organic textile market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America organic textile market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America organic textile market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America organic textile industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)