Latin America Paper Packaging Market Size, Share, Trends and Forecast by Product Type, Grade, Packaging Level, End-Use Industry, and Country, 2026-2034

Latin America Paper Packaging Market Overview:

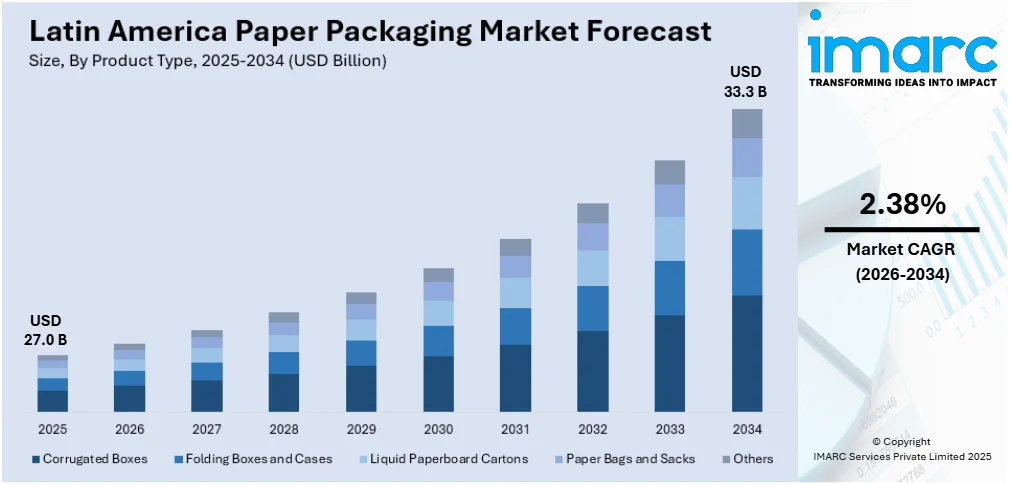

The Latin America paper packaging market size reached USD 27.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 33.3 Billion by 2034, exhibiting a growth rate (CAGR) of 2.38% during 2026-2034. The market is growing due to rising sustainability demands, e-commerce expansion, and government regulations on plastic reduction. Key players focus on recyclable and biodegradable solutions. Brazil and Mexico lead production, with increasing investments in innovation, lightweight materials, and circular economy initiatives to enhance environmental and economic efficiency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 27.0 Billion |

| Market Forecast in 2034 | USD 33.3 Billion |

| Market Growth Rate 2026-2034 | 2.38% |

Latin America Paper Packaging Market Trends:

Surge in Eco-Friendly Packaging Demand

The demand for sustainable and environmentally friendly paper packaging has substantially grown in Latin America. The public and private sectors are highly conscious about the ecological footprints of conventional packaging and shifting towards more eco-friendly alternatives. With rising ecological awareness, paper packaging made of recycled, biodegradable, and renewable material is being taken up by firms on a growing scale. According to the sources, in December 2024, Tetra Pak won the ‘Resource Efficiency’ Award at the Sustainable Packaging News Awards for its paper-based barrier innovation. This breakthrough reduces the carbon footprint of aseptic cartons by one-third, enhancing sustainability with up to 90% renewable content. Moreover, governments are also moving to strengthen regulations to stem plastic waste, which in turn is hastening the shift towards paper-based alternatives. Paper packaging, as it is recyclable and biodegradable, has become a first choice for a variety of products ranging from food and drink to personal care. The increasing demand for green packaging, both due to consumer requirements and regulatory compliance, is likely to continue influencing the paper packaging sector in Latin America. The movement is not unique to big organizations but is shared by small- and medium-scale businesses that look to minimize their ecological impact.

To get more information on this market Request Sample

Growth of E-Commerce and Online Retail Packaging

The growth of e-commerce in Latin America has created more demand for customized packaging solutions for online shopping. With more and more consumers buying goods online, there is a growing demand for packaging that protects products while they are delivered to the consumers. Paper packaging like corrugated boxes and folding cartons is very common in e-commerce because it is strong, can be recycled, and can be customized for different types of products. The e-commerce sector is also interested in having a positive unboxing experience with branded and customized packaging, increasing the need for paper packaging solutions. The eco-friendly e-commerce companies are also using sustainable paper packaging to fulfill their green strategies and reach environmentally conscious customers. The growing popularity of online shopping in Latin America and the demand for packaging that is in sync with trends of sustainability are likely to keep driving demand for paper packaging solutions in the future.

Innovation in Paper Packaging for Food and Beverages

Latin American food and beverage (F&B) industry is embracing paper packaging, fueled by customer demand for convenience, sustainability, and better product preservation. Developments in materials such as liquid paperboard and coated paperboard are gaining popularity as they provide efficient packaging for liquids and perishable items with quality and shelf-life extension. The transition towards environmentally friendly alternatives, like paper packaging for liquids and snacks, is picking up steam among consumers searching for sustainable choices. Also, the application of cutting-edge coating technologies means that paper packaging can prevent products from getting moisture, light, and oxygen damage, maintaining their freshness without using plastic. With consumer tastes focusing more and more on sustainability, paper packaging becomes a crucial element in F&B products. This movement is set to continue as advances in paper-based packaging solutions provide greater product protection and environmental sustainability.

Latin America Paper Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, grade, packaging level, and end-use industry.

Product Type Insights:

- Corrugated Boxes

- Folding Boxes and Cases

- Liquid Paperboard Cartons

- Paper Bags and Sacks

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes corrugated boxes, folding boxes and cases, liquid paperboard cartons, paper bags and sacks, and others.

Grade Insights:

- Solid Bleached

- Coated Recycled

- Uncoated Recycled

- Others

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes solid bleached, coated recycled, uncoated recycled, and others.

Packaging Level Insights:

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

The report has provided a detailed breakup and analysis of the market based on the packaging level. This includes primary packaging, secondary packaging, and tertiary packaging.

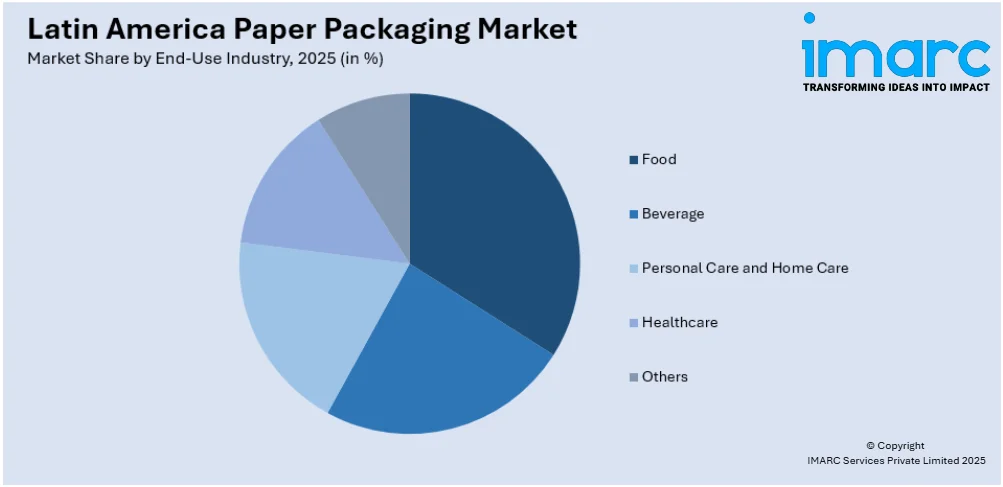

End-Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Food

- Beverage

- Personal Care and Home Care

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes food, beverage, personal care and home care, healthcare, and others.

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Paper Packaging Market News:

- In October 2023, the Smurfit Kappa-WestRock merger was completed, creating Latin America's largest packaging producer with a 14.5% regional capacity share, surpassing Klabin. The merger leveraged Brazil and Mexico’s strategic advantages in pulp production and consumer proximity, significantly impacting the containerboard and packaging markets in these countries.

- In July 2023, Amcor introduced its AmFiber™ Performance Paper packaging in Latin America. This recyclable, high-barrier paper-based solution, initially for the confectionery market, now extends to dry culinary and beverage applications, featuring over 80% paper fiber content.

Latin America Paper Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corrugated Boxes, Folding Boxes and Cases, Liquid Paperboard Cartons, Paper Bags and Sacks, Others |

| Grades Covered | Solid Bleached, Coated Recycled, Uncoated Recycled, Others |

| Packaging Levels Covered | Primary Packaging, Secondary Packaging, Tertiary Packaging |

| End-Use Industries Covered | Food, Beverage, Personal Care and Home Care, Healthcare, Others |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America paper packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America paper packaging market on the basis of product type?

- What is the breakup of the Latin America paper packaging market on the basis of grade?

- What is the breakup of the Latin America paper packaging market on the basis of packaging level?

- What is the breakup of the Latin America paper packaging market on the basis of end use industry?

- What is the breakup of the Latin America paper packaging market on the basis of country?

- What are the various stages in the value chain of the Latin America paper packaging market?

- What are the key driving factors and challenges in the Latin America paper packaging?

- What is the structure of the Latin America paper packaging market and who are the key players?

- What is the degree of competition in the Latin America paper packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America paper packaging market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America paper packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America paper packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)