Latin America Renewable Energy Infrastructure Market Size, Share, Trends and Forecast by Energy Source, Component, Application, and Country, 2026-2034

Latin America Renewable Energy Infrastructure Market Summary:

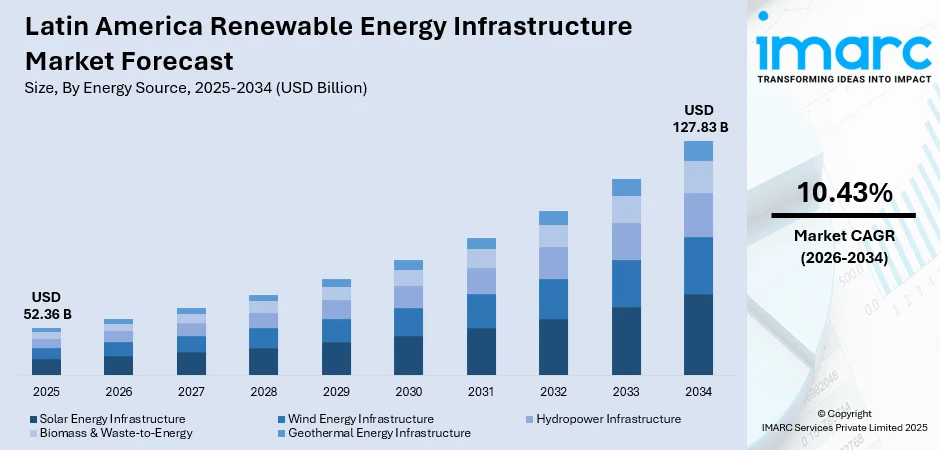

The Latin America renewable energy infrastructure market size was valued at USD 52.36 Billion in 2025 and is projected to reach USD 127.83 Billion by 2034, growing at a compound annual growth rate of 10.43% from 2026-2034.

The Latin America renewable energy infrastructure market is experiencing robust expansion driven by ambitious decarbonization commitments, declining renewable technology costs, and abundant natural resources across the region. Governments throughout Latin America are implementing supportive policy frameworks, including competitive energy auctions, tax incentives, and renewable portfolio standards that attract substantial private investment. The region's exceptional solar irradiance in the Atacama Desert, world-class wind resources in Patagonia and northeastern Brazil, and extensive hydropower legacy create favorable conditions for accelerated renewable deployment and grid modernization initiatives, strengthening the Latin America renewable energy infrastructure market share.

Key Takeaways and Insights:

-

By Energy Source: Solar energy infrastructure dominates the market with a share of 44% in 2025, driven by declining photovoltaic module costs, abundant solar resources, and favorable net metering policies across key markets.

-

By Component: Power generation equipment leads the market with a share of 37% in 2025, supported by expanding utility-scale solar and wind project pipelines requiring turbines, panels, and inverters.

-

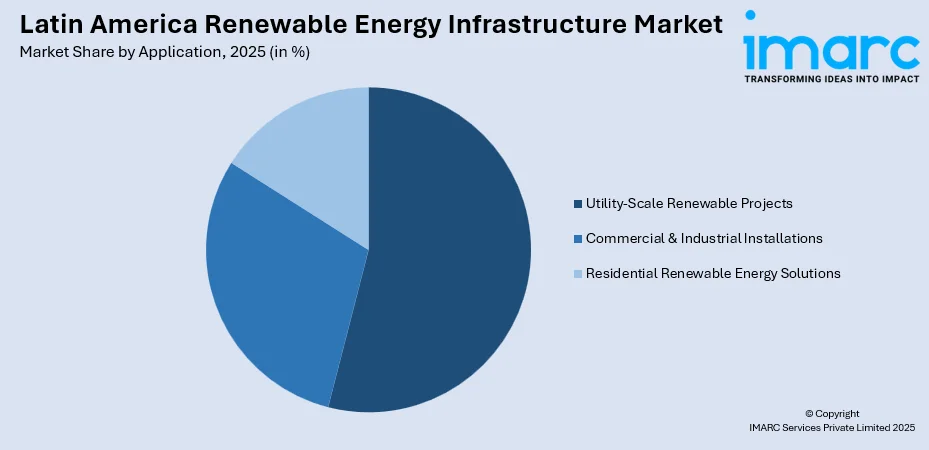

By Application: Utility-scale renewable projects represent the largest segment with a market share of 54% in 2025, fueled by government-sponsored renewable auctions and corporate power purchase agreements.

-

By Country: Brazil exhibits clear dominance with a 38% share of the total market in 2025, leveraging its vast renewable resources, established regulatory framework, and strong investor confidence.

-

Key Players: The Latin America renewable energy infrastructure market exhibits a moderately competitive landscape characterized by the presence of multinational energy corporations, regional utilities, and specialized developers competing across solar, wind, and storage segments through technology partnerships, project development expertise, and localized supply chain capabilities.

To get more information on this market Request Sample

Latin America's renewable energy infrastructure market is undergoing transformative growth as the region leverages its exceptional natural resources to accelerate the clean energy transition. The market benefits from strong governmental support, with 16 countries participating in the Renewables in Latin America and the Caribbean initiative targeting at least 70% renewable electricity generation by 2030. Investment momentum continues strengthening across the region, with clean energy spending demonstrating significant growth compared to prior years. Brazil's installed solar capacity has expanded rapidly, establishing solar power as the country's second-largest electricity source and representing a substantial share of total installed capacity. The region's competitive electricity prices, particularly favorable industrial tariffs in countries like Brazil and Paraguay, attract substantial investment from data center operators and industrial consumers seeking to decarbonize operations while reducing energy costs.

Latin America Renewable Energy Infrastructure Market Trends:

Accelerated Battery Energy Storage System Deployment

Energy storage deployment is experiencing unprecedented momentum across Latin America as countries address grid integration challenges and renewable curtailment issues. Chile has emerged as the regional leader with over 1 GW of installed battery energy storage capacity and is expected to surpass its 2030 target of 2 GW by early 2026 according to industry analysis. Argentina's inaugural AlmaGBA battery storage tender attracted overwhelming market response, with bids significantly exceeding the original target and ultimately awarding substantial capacity for strategic grid nodes in the Buenos Aires Metropolitan Area. Brazil is preparing to launch its first standalone storage auction to contract battery capacity with multi-hour discharge capability.

Data Center Demand Driving Renewable Infrastructure

The explosive growth of data center development is creating substantial new demand for renewable energy infrastructure throughout the region. Brazil's digital infrastructure market is projected to attract investments over the next decade to position the country as Latin America's premier hyperscale data center hub. In August 2024, Scala Data Centers and Serena announced the largest renewable energy supply agreement in Latin America's data center industry, securing wind power from two facilities in Bahia state with combined installed capacity of 393 MW. This partnership demonstrates how data center operators are increasingly integrating renewable energy sources to meet sustainability commitments while capitalizing on the region's competitive electricity pricing.

Green Hydrogen Emerging as Strategic Priority

Green hydrogen production is gaining strategic importance as Latin American countries position themselves for future clean fuel exports and industrial decarbonization. Chile leads regional ambitions with its National Green Hydrogen Strategy targeting competitive production costs by the end of the decade, leveraging exceptional solar and wind resources. Brazil has implemented a comprehensive regulatory framework introducing financial incentives, technological support, and certification systems to accelerate hydrogen industry development. Industry organizations have identified numerous green hydrogen projects across the region in various development stages, attracting substantial international investment interest.

Market Outlook 2026-2034:

The Latin America renewable energy infrastructure market demonstrates strong growth potential supported by expanding project pipelines, improving regulatory frameworks, and increasing private sector investment. The region has approximately 319 GW of utility-scale solar and wind capacity either announced, in pre-construction, or under construction, representing potential to increase large-scale renewable capacity by more than 460 percent by 2030. This robust development pipeline reflects growing investor confidence and sustained commitment to clean energy transition across major markets. The market generated a revenue of USD 52.36 Billion in 2025 and is projected to reach a revenue of USD 127.83 Billion by 2034, growing at a compound annual growth rate of 10.43% from 2026-2034.

Latin America Renewable Energy Infrastructure Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Energy Source | Solar Energy Infrastructure | 44% |

| Component | Power Generation Equipment | 37% |

| Application | Utility-Scale Renewable Projects | 54% |

| Country | Brazil | 38% |

Energy Source Insights:

- Solar Energy Infrastructure

- Wind Energy Infrastructure

- Hydropower Infrastructure

- Biomass & Waste-to-Energy

- Geothermal Energy Infrastructure

The solar energy infrastructure dominates with a market share of 44% of the total Latin America renewable energy infrastructure market in 2025.

Solar energy infrastructure has emerged as the dominant energy source segment driven by exceptional solar resources, rapidly declining photovoltaic costs, and favorable policy frameworks across the region. Brazil has established itself as a global solar powerhouse, reaching 55 GW of installed capacity by March 2025, ranking as the country's second-largest electricity generation source. The distributed generation segment accounts for approximately 37.4 GW of this total, demonstrating strong adoption across residential, commercial, and industrial sectors. Brazil's installed capacity growth reflects the success of net metering policies and tax incentives that have attracted substantial investment from both domestic and international developers seeking to capitalize on the country's abundant solar resources.

The utility-scale solar segment continues expanding through competitive auction mechanisms that have secured long-term power purchase agreements at increasingly competitive prices. Brazil added substantial solar capacity through numerous new power plants, contributing significantly to record total capacity additions according to the National Electric Energy Agency. Chile's Atacama Desert region offers some of the highest solar irradiance levels globally, attracting major project developments including the Copiapó solar plant with integrated battery storage being developed by Atlas Renewable Energy. The segment's growth trajectory reflects both resource availability and improving project economics across Latin America.

Component Insights:

- Power Generation Equipment

- Solar Panels

- Wind Turbines

- Hydroelectric Dams

- Grid Infrastructure

- Energy Storage Systems

- Battery Storage

- Pumped Hydro Storage

- Smart Grid & Digital Solutions

The power generation equipment leads with a share of 37% of the total Latin America renewable energy infrastructure market in 2025.

Power generation equipment maintains market leadership driven by expanding solar panel, wind turbine, and hydroelectric component demand across major Latin American markets. Brazil's record-breaking additions included numerous solar photovoltaic plants and wind projects, requiring substantial procurement of generation equipment including modules, inverters, turbines, and balance-of-system components. The segment benefits from established manufacturing presence, with Brazilian solar panel production capacity expanding to meet domestic demand. In December 2025, Casa dos Ventos and Vestas announced partnership for the 828 MW Dom Inocêncio Wind Complex in Brazil, featuring 184 V150-4.5 MW turbines with total investment exceeding BRL 5 Billion.

Wind energy equipment deployment is accelerating across the region, with Latin America's onshore wind capacity projected to double from current levels over the coming decade according to industry analysis. Brazil maintains its position as the regional leader, expected to contribute the majority of total growth through the forecast period. Chile recently inaugurated the Horizonte Wind Farm constructed by Colbun SA, representing one of the largest wind installations in Latin America. The power generation equipment segment continues benefiting from technology cost reductions, with average wind energy contract prices in Brazil achieving competitiveness with conventional fossil fuel alternatives.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Utility-Scale Renewable Projects

- Commercial & Industrial Installations

- Residential Renewable Energy Solutions

The utility-scale renewable projects exhibit a clear dominance with a 54% share of the total Latin America renewable energy infrastructure market in 2025.

Utility-scale renewable projects represent the largest application segment, driven by competitive auction mechanisms, corporate power purchase agreements, and government decarbonization mandates across Latin American markets. Brazil's renewable energy auction system has proven highly effective at attracting private investment, with transparent competitive bidding processes securing long-term contracts that provide revenue certainty for project developers. The segment benefits from economies of scale in project development, enabling cost-competitive electricity generation that increasingly undercuts conventional thermal alternatives.

Major utility-scale developments continue advancing across the region, with industry analysts tracking substantial utility-scale solar and wind capacity in various development stages. Brazil's Vista Alegre solar complex in Minas Gerais represents one of the largest solar projects built in a single phase nationally, securing a long-term power purchase agreement with aluminum producer Albras. Chile's utility-scale solar development benefits from exceptional resources in the Atacama region, where projects are increasingly integrating battery storage to maximize value capture and address curtailment challenges.

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Brazil holds the largest share with 38% of the total Latin America renewable energy infrastructure market in 2025.

Brazil maintains clear regional dominance as Latin America's largest economy and most developed renewable energy market. The country's electricity mix is predominantly renewable, with wind and solar contributing a substantial share of total demand according to state energy agency EPE. Brazil's installed power capacity increased by a record 10.9 GW in 2024, the highest annual growth since 1997, with over 91% representing renewable additions. The country's strong regulatory framework, established auction mechanisms, and abundant natural resources continue attracting substantial domestic and international investment.

Brazil's transmission infrastructure expansion supports continued renewable deployment, with recent auctions raising substantial capital to construct thousands of kilometers of new transmission lines. The country's Fuel of the Future Law passed in late 2024 is expected to unlock significant annual investments for sustainable fuels including green diesel, biogas, and sustainable aviation fuel. Brazil is projected to add considerable solar capacity in 2025, further expanding cumulative installed capacity according to ABSolar projections, maintaining its position as one of the world's largest solar markets alongside China, the United States, and India.

Market Dynamics:

Growth Drivers:

Why is the Latin America Renewable Energy Infrastructure Market Growing?

Supportive Government Policies and Investment Frameworks

Government policy support across Latin America is creating favorable conditions for renewable energy infrastructure investment through competitive auction mechanisms, tax incentives, and clear regulatory frameworks. Brazil's well-established renewable energy auction system continues attracting substantial private capital, with transparent bidding processes providing long-term revenue certainty for developers. Chile's energy storage and electromobility legislation passed in 2022 created profitable conditions for standalone storage operations, enabling the country to emerge as Latin America's battery storage leader. Mexico's new administration under President Claudia Sheinbaum has established a 45% renewable target by 2030, signaling renewed openness to private sector investment.

Declining Technology Costs and Improving Project Economics

Continued cost reductions across solar, wind, and storage technologies are improving renewable project economics and enabling competitiveness with conventional generation sources. Solar photovoltaic module prices have declined substantially over the past decade, enabling Brazil to add record capacity while maintaining competitive electricity prices. Wind energy costs in Brazil are undercutting many fossil fuel alternatives and driving substantial deployment across the country's northeastern and southern regions. Battery energy storage system costs continue declining globally, with lithium-ion pack prices falling to USD 108 per kilowatt-hour and stationary storage reaching USD 70 per kilowatt-hour in 2025, representing a 45 percent decrease from the prior year according to industry analysis. These cost improvements enhance project bankability and expand the addressable market for renewable infrastructure across diverse applications.

Growing Corporate and Industrial Decarbonization Demand

Corporate sustainability commitments and industrial decarbonization requirements are generating substantial demand for renewable energy infrastructure through power purchase agreements and direct investment. Major mining companies operating in Chile, Peru, and Brazil are increasingly contracting renewable electricity to reduce operational carbon footprints, with Chilean mining giant Codelco signing significant power purchase agreements from renewable sources. Data center developers are driving significant renewable infrastructure investment to meet hyperscaler sustainability requirements, with the Latin American data center market projected to experience substantial growth over the coming years. The region's competitive industrial electricity tariffs, combined with available renewable resources, create attractive conditions for energy-intensive industries seeking to decarbonize while maintaining cost competitiveness.

Market Restraints:

What Challenges the Latin America Renewable Energy Infrastructure Market is Facing?

Transmission Infrastructure Bottlenecks and Curtailment

Inadequate transmission infrastructure continues constraining renewable energy integration across Latin American markets, leading to significant curtailment of available generation capacity. Chile curtailed renewable electricity in 2024, representing substantial increase from the prior year as solar and wind additions outpaced grid expansion. Brazil faces similar challenges with transmission bottlenecks limiting the ability to move renewable generation from resource-rich northeastern regions to major demand centers. These infrastructure gaps reduce project profitability and create uncertainty for developers.

High Capital Costs and Financing Challenges

The region faces significant financing challenges stemming from macroeconomic conditions, currency volatility, and limited access to long-term capital. Latin America receives only approximately five percent of global private investment in clean energy despite its substantial resource potential. High interest rates across major markets increase project development costs and reduce returns for investors. Debt servicing costs have increased substantially across the region, with Brazil and Mexico constraining public sector capacity to support infrastructure development.

Regulatory Fragmentation and Policy Uncertainty

Inconsistent regulatory frameworks across the region create challenges for developers seeking to deploy projects at scale. Energy storage regulations remain underdeveloped in several major markets including Brazil, where the first national battery storage auction is planned for 2025. Mexico's evolving electricity market structure under successive administrations has created uncertainty for private sector participants. The lack of harmonized standards and contracting practices across borders limits regional integration opportunities and increases complexity for multinational developers.

Competitive Landscape:

The Latin America renewable energy infrastructure market demonstrates moderate concentration with a mix of global energy majors, regional utilities, and specialized developers competing across technology segments. International players maintain significant presence through operational assets and development pipelines across multiple countries. Regional developers have established strong market positions through local expertise and strategic partnerships. Equipment suppliers also compete for wind turbine contracts, while solar module suppliers benefit from strong demand across both utility-scale and distributed generation segments. The competitive landscape is characterized by increasing vertical integration, with developers often securing long-term equipment supply agreements and operation and maintenance contracts.

Recent Developments:

-

November 2025: Engie Chile completed the energization of its 116 MW, 660 MWh Tocopilla Battery Energy Storage System in the Antofagasta region. Located on the site of a former coal-fired power plant, the project represents Engie's first large-scale standalone battery storage facility in Chile

Latin America Renewable Energy Infrastructure Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Energy Sources Covered | Solar Energy Infrastructure, Wind Energy Infrastructure, Hydropower Infrastructure, Biomass & Waste-to-Energy, Geothermal Energy Infrastructure |

| Components Covered |

|

| Applications Covered | Utility-Scale Renewable Projects, Commercial & Industrial Installations, Residential Renewable Energy Solutions |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Latin America renewable energy infrastructure market size was valued at USD 52.36 Billion in 2025.

The Latin America renewable energy infrastructure market is expected to grow at a compound annual growth rate of 10.43% from 2026-2034 to reach USD 127.83 Billion by 2034.

Solar energy infrastructure dominated the market with a 44% share in 2025, driven by declining photovoltaic costs, abundant solar resources across the region, and supportive net metering policies that have accelerated both distributed and utility-scale deployment.

Key factors driving the Latin America renewable energy infrastructure market include supportive government policies and competitive auction mechanisms, declining technology costs improving project economics, growing corporate decarbonization demand, and expanding transmission infrastructure investment.

Major challenges include transmission infrastructure bottlenecks leading to significant renewable energy curtailment, high capital costs and limited access to long-term financing, regulatory fragmentation across different national markets, and the need for improved grid modernization and energy storage integration.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)