Latin America Smart Manufacturing Market Size, Share, Trends and Forecast by Component, Technology, End Use, and Region, 2025-2033

Latin America Smart Manufacturing Market Size and Share:

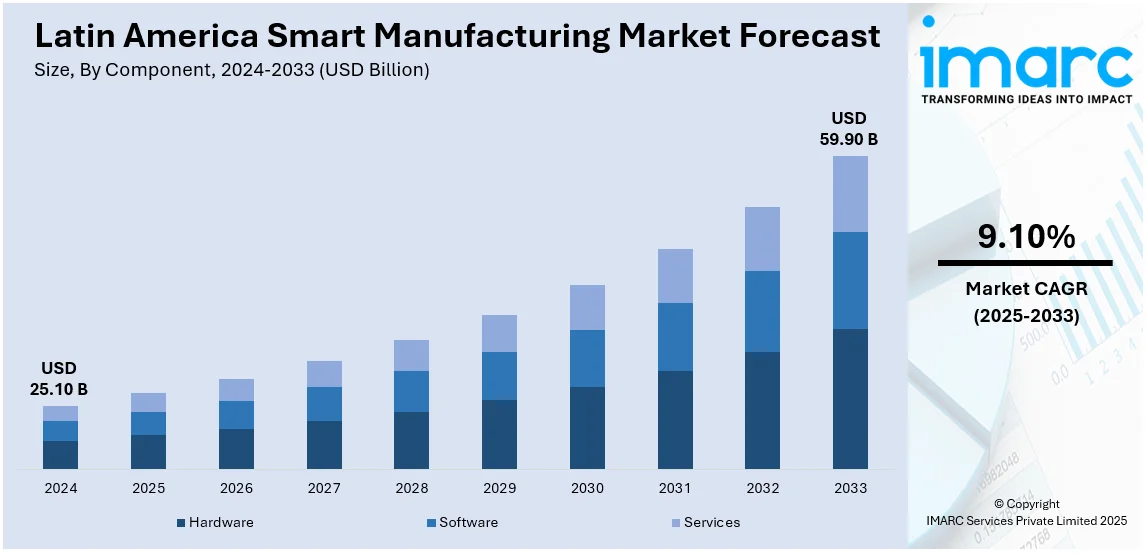

The Latin America smart manufacturing market size reached USD 25.10 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 59.90 Billion by 2033, exhibiting a growth rate (CAGR) of 9.10% during 2025-2033. The Latin American manufacturing market share is increasing due to artificial intelligence (AI) adoption to enhance efficiency, predictive maintenance, and quality control, rising collaboration with international tech providers for advanced technologies, and investment in smart factory infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 25.10 Billion |

| Market Forecast in 2033 | USD 59.90 Billion |

| Market Growth Rate (2025-2033) | 9.10% |

Latin America Smart Manufacturing Market Trends:

Growing Adoption of Artificial Intelligence (AI)

The adoption of artificial intelligence (AI) in Latin American manufacturing is transforming the industry, with significant growth. According to the United Nations, on 24 September 2024, Chile’s National Center for Artificial Intelligence (CENIA) and the Economic Commission for Latin America and the Caribbean (ECLAC) revealed the findings from the second edition of the Latin American Artificial Intelligence Index (ILIA 2024). This study, spearheaded by CENIA, assessed the AI adoption in 19 countries of the region. Chile secured the highest position in the ranking with 73.07 points out of a possible 100, followed by Brazil with 69.30 points, and Uruguay with 64.98 points. Moreover, the changes driven by AI transformed other key parameters such as predictive maintenance by helping the manufacturers detect the probable failure of equipment before it happens thereby reducing downtime. This ensured high-precision identification of defects that offered consistent quality in the products. As the demand from the market increased, companies were relying upon AI to meet growing market demands across the region.

Collaboration with Global Technology Providers

Numerous local companies are establishing collaborations with global tech enterprises that focus on automation, AI, robotics, and IoT technologies. Such collaborations introduce advanced technologies and industry standards to Latin America, enabling local manufacturers to adopt leading-edge smart manufacturing systems. Collaborating with international providers allows Latin American firms to tap into the newest innovations without needing to make significant investments in research and development (R&D) on their own. Additionally, these collaborations enable manufacturers to swiftly incorporate cutting-edge technologies into their processes, enhancing their competitive stance worldwide. With the growth of multinational corporations in the region, the exchange of knowledge and technology speeds up the integration of smart manufacturing, resulting in enhanced industrial modernization and efficiency throughout Latin American markets. In 2023, Critical Manufacturing, a leading supplier of manufacturing execution systems (MES) for worldwide, multi-site operations, extended its presence into Mexico. This action highlighted the firm's commitment to providing cutting-edge discrete solutions and fostering digital transformation across the Latin American manufacturing industry.

Increasing Investment in Smart Factory Infrastructure

Numerous producers in the area are pouring resources into cutting-edge technology, including IoT-integrated devices, automated production lines, and sophisticated robotics, to enhance manufacturing efficiency. These investments allow businesses to establish connected systems that optimize operations, enhance resource management, and improve decision-making in real time. Enhanced connectivity enables smart factories to remotely track key performance indicators (KPIs), minimizing operational inefficiencies and optimizing uptime. As producers acknowledge the lasting cost reductions and enhanced competitiveness associated with upgraded infrastructure, they are allocating more resources to develop these advanced production settings. This trend is speeding up the digital shift in Latin America's manufacturing industry, enabling firms to gain enhanced operational flexibility and lower overhead expenses. In 2023, Nokia revealed that Jacto had chosen it to deploy the first industrial-grade private wireless 4.9G/LTE and 5G network for the agricultural machinery sector in Latin America. Jacto, a Brazilian multinational in the machinery industry, established a 5G smart factory in Pompeia, situated in the Sao Paulo region of Brazil. It spanned 96,000 square meters, and this facility included advanced technology, such as an automated painting system, self-driving vehicle management, and an automated storage solution. The factory also featured a state-of-the-art training center.

Latin America Smart Manufacturing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component, technology, and end use.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services.

Technology Insights:

- Machine Execution Systems

- Programmable Logic Controller

- Enterprise Resource Planning

- SCADA

- Discrete Control Systems

- Human Machine Interface

- Machine Vision

- 3D Printing

- Product Lifecycle Management

- Plant Asset Management

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes machine execution systems, programmable logic controller, enterprise resource planning, SCADA, discrete control systems, human machine interface, machine vision, 3D printing, product lifecycle management, and plant asset management.

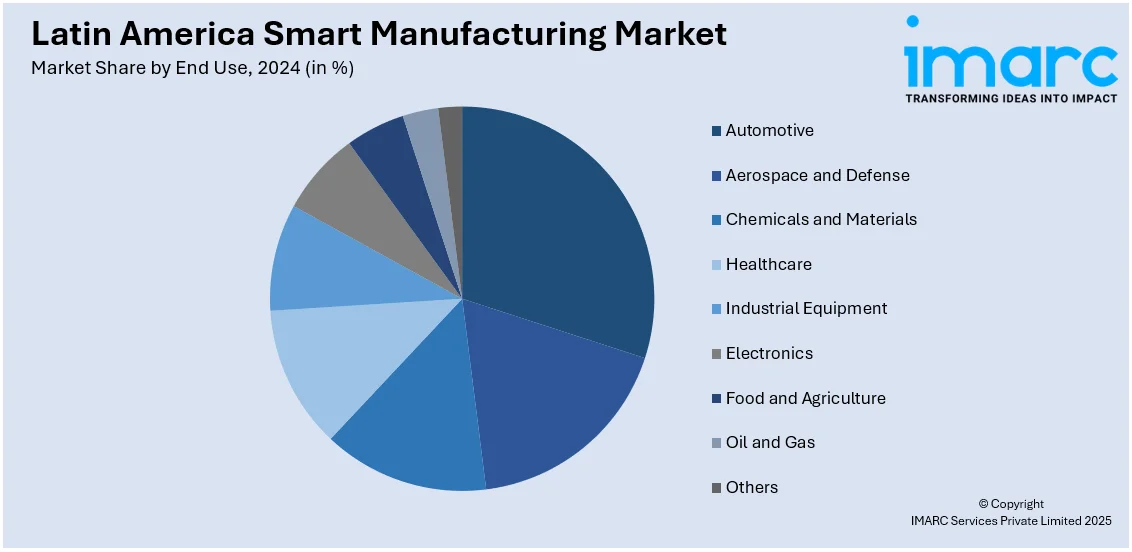

End Use Insights:

- Automotive

- Aerospace and Defense

- Chemicals and Materials

- Healthcare

- Industrial Equipment

- Electronics

- Food and Agriculture

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes automotive, aerospace and defense, chemicals and materials, healthcare, industrial equipment, electronics, food and agriculture, oil and gas, and others

Regional Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Smart Manufacturing Market News:

- In December 2024, Petrobras inaugurated LABi3D at its CENPES research facility in Rio de Janeiro, a state-of-the-art additive manufacturing laboratory focused on polymeric 3D printing for the oil and gas sector. In collaboration with 3DCRIAR and backed by major tech companies such as Siemens and Formlabs, the lab sought to enhance production and logistics for Petrobras. The initiative represented an important stride in promoting smart manufacturing within Brazil's energy sector.

- In November 2024, the China-CELAC Forum celebrated its 10th anniversary, showcasing advancements in cooperation between China and Latin America in areas such as aerospace, healthcare, agriculture, green energy, and smart manufacturing. Significant initiatives featured satellite creation, renewable energy programs, and progress in digital economy frameworks.

Latin America Smart Manufacturing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Technologies Covered | Machine Execution Systems, Programmable Logic Controller, Enterprise Resource Planning, SCADA, Discrete Control Systems, Human Machine Interface, Machine Vision, 3D Printing, Product Lifecycle Management, Plant Asset Management |

| End Uses Covered | Automotive, Aerospace and Defense, Chemicals and Materials, Healthcare, Industrial Equipment, Electronics, Food and Agriculture, Oil and Gas, Others |

| Regions Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America smart manufacturing market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America smart manufacturing market on the basis of component?

- What is the breakup of the Latin America smart manufacturing market on the basis of technology?

- What is the breakup of the Latin America smart manufacturing market on the basis of end use?

- What is the breakup of the Latin America smart manufacturing market on the basis of region?

- What are the various stages in the value chain of the Latin America smart manufacturing market?

- What are the key driving factors and challenges in the Latin America smart manufacturing market?

- What is the structure of the Latin America smart manufacturing market and who are the key players?

- What is the degree of competition in the Latin America smart manufacturing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America smart manufacturing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America smart manufacturing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America smart manufacturing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)