Latin America Smart Water Management Market Size, Share, Trends and Forecast by Component, Application, and Region, 2026-2034

Latin America Smart Water Management Market Overview:

The Latin America smart water management market size reached USD 1.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 4.0 Billion by 2034, exhibiting a growth rate (CAGR) of 12.11% during 2026-2034. Rising water scarcity, aging infrastructure, IoT adoption, government regulations, smart metering, AI-driven analytics, climate change impact, increased investments, public-private partnerships, and demand for efficiency improvements are fueling the Latin America smart water management market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.4 Billion |

| Market Forecast in 2034 | USD 4.0 Billion |

| Market Growth Rate (2026-2034) | 12.11% |

Access the full market insights report Request Sample

Latin America Smart Water Management Market Trends:

Adoption of Smart Metering Technologies

The implementation of smart water meters is revolutionizing water management across Latin America. These devices provide real-time monitoring of water consumption, enabling utilities to detect leaks promptly, reduce non-revenue water losses, and enhance billing accuracy. The transition from traditional to smart metering systems is a response to the pressing need for efficient water usage and conservation in the face of increasing urbanization and water scarcity. The integration of Advanced Metering Infrastructure (AMI) is gaining traction. AMI meters, which offer two-way communication between the meter and central systems, accounted for 63.7% of the smart water management market in 2022. This technology enables utilities to collect data remotely and in real-time, facilitating proactive management of water resources. The adoption of smart metering technologies is not only improving operational efficiency for utilities but also empowering consumers with detailed insights into their water usage, promoting conservation efforts across the region. Brazil is leading the region in smart meter deployments. The country plans to deploy approximately 3 million smart water meters by 2025, significantly enhancing its water management capabilities.

Investments in Water Infrastructure

Significant investments are being made in Latin America's water infrastructure to update systems and solve issues including old pipes and inadequate treatment facilities. These expenditures are critical for improving water quality, minimizing losses, and guaranteeing a reliable water supply to satisfy the needs of rising people and enterprises. For example, public-private partnerships are transforming Brazil's water industry. The Canada Pension Plan Investment Board (CPP Investments) has secured a majority stake in Igua Saneamento, a major water and sewage service provider in Brazil. This investment demonstrates confidence in the country's continuing efforts to universalize water and sewage treatment systems. Furthermore, Latin America's water sector is attracting international investors due to its potential for expansion and reform. CPP Investments, which manages around C$36 billion in Latin America, sees Brazil's developing water and sewage treatment reforms as a big opportunity, signaling a bright future for the region's water infrastructure development. These significant expenditures are likely to improve the efficiency and dependability of water services, lower operating costs, and increase access to clean water, consequently propelling the smart water management market in Latin America.

Latin America Smart Water Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on component, application, and region.

Component Insights:

To get detailed segment analysis of this market Request Sample

- Devices

- Advanced Water Meters

- Meter Read Technology

- Software Solutions

- Asset Management

- Distribution Network Monitoring

- Supervisory Control and Data Acquisition (SCADA)

- Meter Data Management (MDM)

- Advance Analytics

- Others

- Services

- Managed Services

- Professional Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes devices (advanced water meters and meter read technology), software solutions (asset management, distribution network monitoring, supervisory control and data acquisition (SCADA), meter data management (MDM), advance analytics, and others), and services (managed and professional services).

Application Insights:

- Residential

- Commercial and Industrial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, and commercial and industrial.

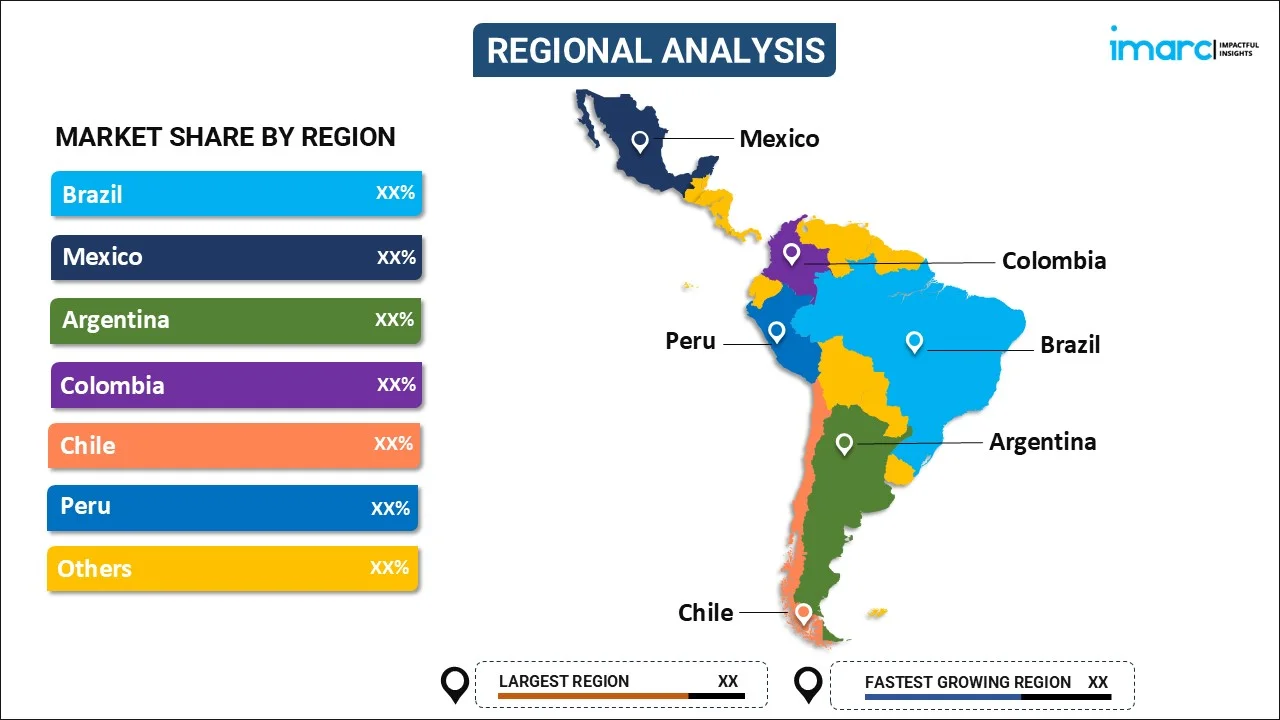

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Smart Water Management Market News:

- October 2024: ST Engineering planned to deliver its smart water platform for Aegea, Brazil's largest private sanitation firm. The platform connected water meter infrastructure across Aegea's concessions, increasing water management efficiency, allowing for data-driven optimization, and lowering non-revenue water.

- January 2024: Mexico's Secretariat of Agriculture and Rural Development (SADER) established a computerized system for monitoring water and fertilizer usage in agriculture, with the goal of promoting sustainable practices and reducing water footprints. The initiative's goal is to increase water usage efficiency and assure correct fertilizer management through soil monitoring and analysis.

Latin America Smart Water Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Applications Covered | Residential, Commercial and Industrial |

| Regions Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America smart water management market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America smart water management market on the basis of component?

- What is the breakup of the Latin America smart water management market on the basis of application?

- What are the various stages in the value chain of the Latin America smart water management market?

- What are the key driving factors and challenges in the Latin America smart water management market?

- What is the structure of the Latin America smart water management market and who are the key players?

- What is the degree of competition in the Latin America smart water management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America smart water management market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America smart water management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America smart water management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)