Latin America Solar Panel Market Size, Share, Trends and Forecast by Type, End Use, and Country, 2025-2033

Latin America Solar Panel Market Size and Share:

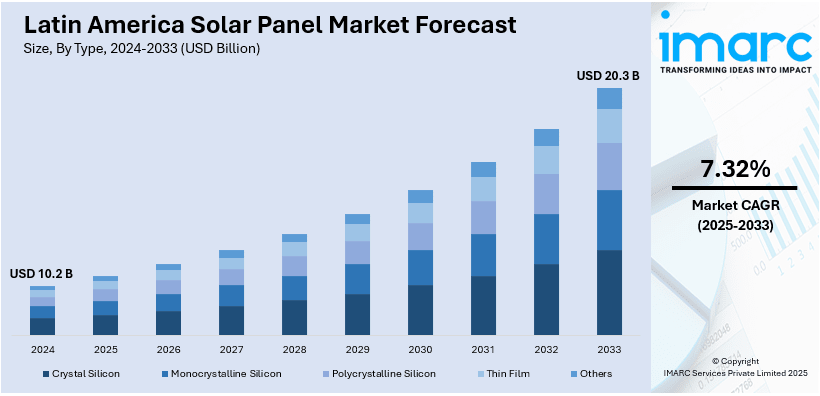

The Latin America solar panel market size reached USD 10.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 20.3 Billion by 2033, exhibiting a growth rate (CAGR) of 7.32% during 2025-2033. The increasing energy demand, government incentives promoting renewable energy, advancements in solar technology, rising electricity costs, and the growing awareness of climate change are some of the major factors positively impacting the Latin America solar panel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.2 Billion |

| Market Forecast in 2033 | USD 20.3 Billion |

| Market Growth Rate (2025-2033) | 7.32% |

Latin America Solar Panel Market Trends:

Growing Government Incentives and Policies

Governments across Latin America are increasingly implementing policies and incentives to promote the adoption of solar energy, which is supporting the Latin America solar panel market growth. Initiatives such as tax breaks, subsidies, and feed-in tariffs encourage both residential and commercial investments in solar panel systems. In May 2024, for example, the Colombian Ministry of Mines and Energy and the Institute for Planning and Promotion of Energy Solutions (IPSE) announced the opening of a hybrid power generation facility in Casuarito, a municipality of Puerto Carreño, Vichada. This new facility extends energy service hours for 239 homes in the area by combining photovoltaic (PV) panels, batteries, and a hybrid diesel backup system. A 132 KW backup diesel generator, 154 energy storage batteries with a combined capacity of 1,182.72 kWh, 810 solar panels with a total generation capacity of 372.6 KWp, and extended distribution networks are all part of the energy project. The Brazilian government also authorized proposals to increase import levies on wind turbines and solar modules in December 2023, which should encourage local manufacturing of renewable energy-generating equipment. The government removed an import tax subsidy on constructed solar panels because the nation produces comparable goods.

Significant Technological Advancements

Continual advancements in solar technology, such as energy storage solutions and improved photovoltaic efficiency, are enhancing the Latin America solar panel market outlook. Innovations have led to more efficient and cost-effective solar panels, thereby making them more accessible to a broader audience. Additionally, the integration of smart grid technologies enhances energy management and consumption, further increasing the appeal of solar solutions for both consumers and businesses seeking to reduce energy costs and carbon footprints. For instance, in October 2024, AES Andes SA, a utility company in Latin America officially launched the commercial operations of its Andes Solar IV power complex. This facility includes 211 MW of photovoltaic panels and a 130-MW battery energy storage system (BESS) in the heart of the Atacama Desert in the Antofagasta region of Chile. This power complex introduces 211 MW of photovoltaic panels and 130 MW of lithium battery energy storage for 5 hours, making it the largest operational battery system in Latin America. This technology serves as a key solution for alleviating transmission congestion in the National Electric System, as it enables solar energy to be stored during the day and released into the grid at night when demand peaks.

Latin America Solar Panel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type and end use.

Type Insights:

- Crystal Silicon

- Monocrystalline Silicon

- Polycrystalline Silicon

- Thin Film

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes crystal silicon, monocrystalline silicon, polycrystalline silicon, thin film, and others.

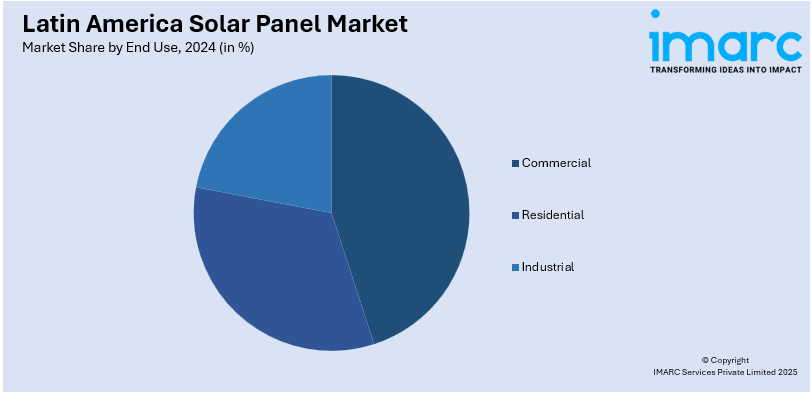

End Use Insights:

- Commercial

- Residential

- Industrial

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes commercial, residential, and industrial.

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Solar Panel Market News:

- In August 2024, Solar Americas Capital and Ambev announced the operational launch of a large-scale behind-the-meter solar power plant in Cachoeiras do Macacu, Rio de Janeiro, Brazil. The installation, located next to Ambev's factory boasts a peak generation capacity of 5MW with around 9,000 solar panels.

- In September 2024, Latin American utility Enel Colombia announced the final installation of solar panels at its 486.7-MWdc Guayepo I & II solar farm, located in the Colombian department of Atlantico. The last of the 820,600 solar panels was positioned in its place in recent days.

Latin America Solar Panel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Crystal Silicon, Monocrystalline Silicon, Polycrystalline Silicon, Thin Film, Others |

| End Uses Covered | Commercial, Residential, Industrial |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America solar panel market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America solar panel market on the basis of type?

- What is the breakup of the Latin America solar panel market on the basis of end use?

- What is the breakup of the Latin America solar panel market on the basis of country?

- What are the various stages in the value chain of the Latin America solar panel market?

- What are the key driving factors and challenges in the Latin America solar panel market?

- What is the structure of the Latin America solar panel market and who are the key players?

- What is the degree of competition in the Latin America solar panel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America solar panel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America solar panel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America solar panel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)