Latin America Telemedicine Market Size, Share, Trends and Forecast by Component, Communication Technology, Hosting Type, Application, End User, and Region, 2026-2034

Latin America Telemedicine Market Overview:

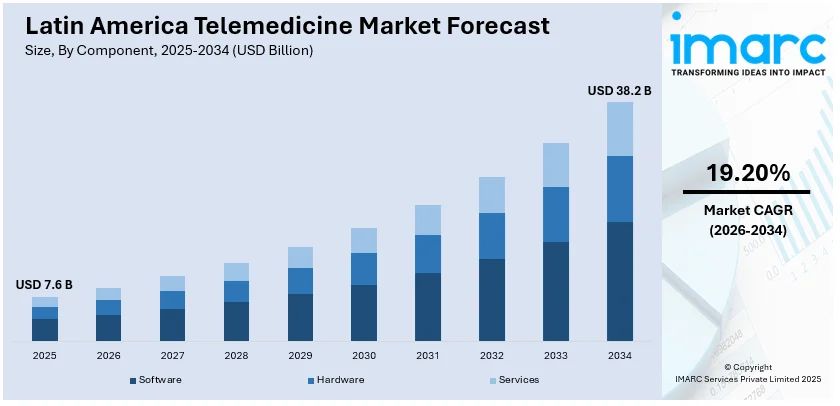

The Latin America telemedicine market size reached USD 7.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 38.2 Billion by 2034, exhibiting a growth rate (CAGR) of 19.20% during 2026-2034. The market is expanding significantly, primarily driven by escalating healthcare access need, rising adoption of remote healthcare services, and technological innovations. Moreover, magnifying internet connectivity and beneficial government initiatives further contribute to market growth across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 7.6 Billion |

| Market Forecast in 2034 | USD 38.2 Billion |

| Market Growth Rate 2026-2034 | 19.20% |

Latin America Telemedicine Market Trends:

Heightened Adoption of Remote Healthcare Solutions

The Latin America telemedicine market is witnessing heightened adoption of remote healthcare solutions, primarily driven by the demand for enhanced access to medical services in neglected regions. Telemedicine platforms are currently being leveraged to offer diagnostics, consultations, and follow-ups services, minimizing the requirement for personal visits to healthcare facilities. Moreover, this trend has notably gained traction, especially since both patients and providers are actively seeking secure and convenient alternatives for medical facilities. In addition, governments across Latin America are also endorsing digital healthcare by implementing regulatory protocols and promoting private sector participation. Furthermore, the amplifying penetration of smartphones and enhanced internet connectivity have further fostered the growth of remote healthcare solutions across the region. As per industry reports, 418 million people in Latin America and 65% of the population, utilized mobile internet in 2023 with a growth of 75 million compared to five years ago. In addition, as of April 2024, 29 operators across 10 countries launched 5G services accounting for 5% of all connections, and projections were set to reach 55% by the end of the decade.

To get more information on this market Request Sample

Technological Innovations in Telemedicine Platforms

Innovations in telemedicine technology are a crucial trend in the Latin American market, improving the availability and quality of healthcare services. Telemedicine platforms are rapidly incorporating advanced features such as electronic health records (EHR), artificial intelligence (AI), data analytics, to offer optimized, personalized, and effective care. For instance, AI-based chatbots aid in evaluating patients and preliminary diagnostics, while data analytics tools facilitate better supervision of patient health trends. For example, Portal Telemedicina, an AI-powered medtech company, has provided equal telehealth care to over 33 million patients across 900 or more cities in Brazil. It has impacted 3 million patients significantly through telediagnosis, 1 million through teleconsultation, and 28 million through its Population Health Management module, significantly enhancing healthcare accessibility and efficiency nationwide. In addition, cloud-based services are being rapidly deployed for scalable and safe telemedicine solutions, providing improved data storage and better access for healthcare providers. Furthermore, such technological innovations are contributing to upgrading healthcare delivery and are fostering the market expansion.

Amplifying Collaboration Between Public and Private Sectors

Strategic partnerships between private and public sectors are emerging as a critical trend in the Latin American telemedicine market. Governments across the region are increasingly collaborating with private enterprises to proliferate telemedicine services, especially in unserved and rural areas where healthcare infrastructure is under-developed. Moreover, public health systems are rapidly incorporating telemedicine platforms to enhance access to medical facilities, whereas private firms are heavily investing in infrastructure development as well as technological advancements to address the accelerating demand. In addition, such partnerships are also aided by regulatory frameworks and funding programmes aimed at endorsing digital health solutions. For instance, in April 2024, IDB Lab, IDB Lab, the innovation laboratory of the Inter-American Development Bank, offered $2 million to Ecuador's DoctorOne through its Social Entrepreneurship Program. This financing will enable DoctorOne to expand access to health for vulnerable communities, becoming one of the leading telemedicine platforms in Ecuador and across Latin America and the Caribbean. Consequently, this trend is solidifying the overall telemedicine structure, resulting in a broader adoption and enhanced healthcare outcomes across the region.

Latin America Telemedicine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on component, communication technology, hosting type, application, end user.

Component Insights:

- Software

- Hardware

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software, hardware and services.

Communication Technology Insights:

- Video Conferencing

- mHealth Solutions

- Others

A detailed breakup and analysis of the market based on the communication technology have also been provided in the report. This includes video conferencing, mHealth solutions, and others.

Hosting Type Insights:

- Cloud-Based and Web-Based

- On-Premises

The report has provided a detailed breakup and analysis of the market based on the hosting type. This includes cloud-based and web-based, and on-premises.

Application Insights:

.jpeg)

Access the comprehensive market breakdown Request Sample

- Teleconsultation and Telementoring

- Medical Education and Training

- Teleradiology

- Telecardiology

- Teleneurology

- Telepsychiatry

- Tele-Dermatology

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes teleconsultation and telementoring, medical education and training, teleradiology, telecardiology, teleneurology, telepsychiatry, tele-dermatology, and others.

End User Insights:

- Providers

- Patients

- Payers

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes providers, patients, payers, and others.

Regional Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Telemedicine Market News:

- In May 2024, Pager, Inc. and AXA Partners Mexico (APM) entered into a strategic alliance to strengthen APM's health support programs throughout Mexico. With the integration of Pager's AI-powered triage system, the alliance will help to enhance telemedicine services, including 24-hour medical guidance, doctor-at-home services, and ground ambulance assistance for APM members.

- In March 2023, Osigu, Inc. made a deal with Carvajal Group to purchase Servinte, a top EHR and healthcare administration software provider in Colombia. Osigu intends to enhance Servinte's solutions by incorporating innovative technologies and adding transactional functionality in Colombian market, which will improve the telemedicine service infrastructure and enhance the efficiency of remote healthcare provision.

Latin America Telemedicine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Hardware, Services |

| Communication Technologies Covered | Video Conferencing, mHealth Solutions, Others |

| Hosting Types Covered | Cloud-Based and Web-Based, On-Premises |

| Applications Covered | Teleconsultation and Telementoring, Medical Education and Training, Teleradiology, Telecardiology, Teleneurology, Telepsychiatry, Tele-Dermatology, Others |

| End Users Covered | Providers, Patients, Payers, Others |

| Regions Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America telemedicine market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America telemedicine market on the basis of component?

- What is the breakup of the Latin America telemedicine market on the basis of communication technology?

- What is the breakup of the Latin America telemedicine market on the basis of hosting type?

- What is the breakup of the Latin America telemedicine market on the basis of application?

- What is the breakup of the Latin America telemedicine market on the basis of end user?

- What is the breakup of the Latin America telemedicine market on the basis of region?

- What are the various stages in the value chain of the Latin America telemedicine market?

- What are the key driving factors and challenges in the Latin America telemedicine?

- What is the structure of the Latin America telemedicine market and who are the key players?

- What is the degree of competition in the Latin America telemedicine market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America telemedicine market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America telemedicine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America telemedicine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)