Latin America Textiles Market Size, Share, Trends, and Forecast by Raw Material, Product, Application, and Country, 2026-2034

Latin America Textiles Market Overview:

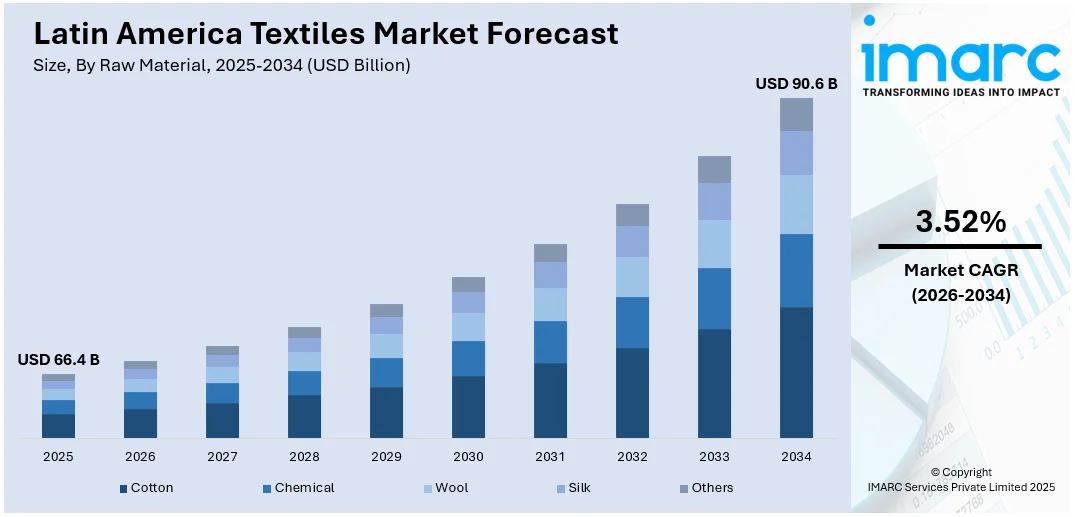

The Latin America textiles market size reached USD 66.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 90.6 Billion by 2034, exhibiting a growth rate (CAGR) of 3.52% during 2026-2034. The industry is expanding as there is increasing demand for sustainable textile materials, broader apparel production, and production tech innovations. Moreover, companies focus on eco-friendly materials, automation, and regional trade agreements to enhance efficiency, competitiveness, and supply chain resilience.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 66.4 Billion |

| Market Forecast in 2034 | USD 90.6 Billion |

| Market Growth Rate 2026-2034 | 3.52% |

Latin America Textiles Market Trends:

Growing Demand for Sustainable and Eco-Friendly Textiles

The Latin America textiles market is witnessing a strong shift toward sustainable and eco-friendly fabrics, driven by increasing consumer awareness and regulatory pressure. For instance, in June 2024, Brazil implemented its National Circular Economy Strategy, representing the country's commitment to drive the textile industry toward sustainable and low-carbon operations. Brands and companies are concentrating on organic cotton, recycled polyester, and vegetal fibers to minimize environmental footprints. Governments are enforcing more stringent regulations regarding textile waste and water consumption, compelling companies to shift towards more environmentally friendly manufacturing practices. Many prominent textile manufacturers in Brazil, Mexico, and Colombia are committing to closed-loop manufacturing, waterless dyeing methods, and biodegradable packaging. Retailers are also reacting by widening their sustainable fashion ranges to meet the increasing demand for ethical clothing. Moreover, international brands sourcing from Latin America are giving increasing importance to sustainability certifications, like OEKO-TEX and GOTS, consolidating the region's position as a responsible producer of textiles. As consumers seek transparency, digital technologies such as blockchain are being increasingly incorporated to trace sustainable sourcing and production processes. As the industry matures, sustainability will continue to be a driving factor, dictating the competitive dynamics and challenging producers to be more innovative in producing environmentally friendly textiles.

To get more information on this market Request Sample

Expansion of Regional Textile Manufacturing and Exports

Latin America’s textile manufacturing sector is expanding due to rising investments in production facilities, trade agreements, and reshoring efforts by global brands. For instance, in March 2024, Valmet announced an investment in a new filter fabric manufacturing facility in Belo Horizonte, Brazil, to meet the rising demand in mining and pulp industries. The facility, opening in early 2025, includes new machinery, improved energy efficiency, and reduced emissions. Additionally, Brazil, Mexico, and Peru are investing in their textile sectors to de-import and raise export capacity. Consequently, the robust domestic Brazilian market and its established textile bases are drawing investments to boost efficiency and capacity. Firms are modernizing units with automation, digital printing, and high-speed weaving technology to match Asian rivals. Textile agglomerations in Argentina and Colombia are also picking up momentum, building on regional trade alliances and government incentives to fuel industry development. Exporters are looking to markets in the U.S. and Europe, riding changing global supply chain strategies. Furthermore, Latin America is emerging as a competitive production center, meeting the regional demand while increasing international trade potential, as demand for high-quality, low-cost textiles increases.

Latin America Textiles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on raw material, product, and application.

Raw Material Insights:

- Cotton

- Chemical

- Wool

- Silk

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes cotton, chemical, wool, silk, and others.

Product Insights:

- Natural Fibers

- Polyesters

- Nylon

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes natural fibers, polyesters, nylon, and others.

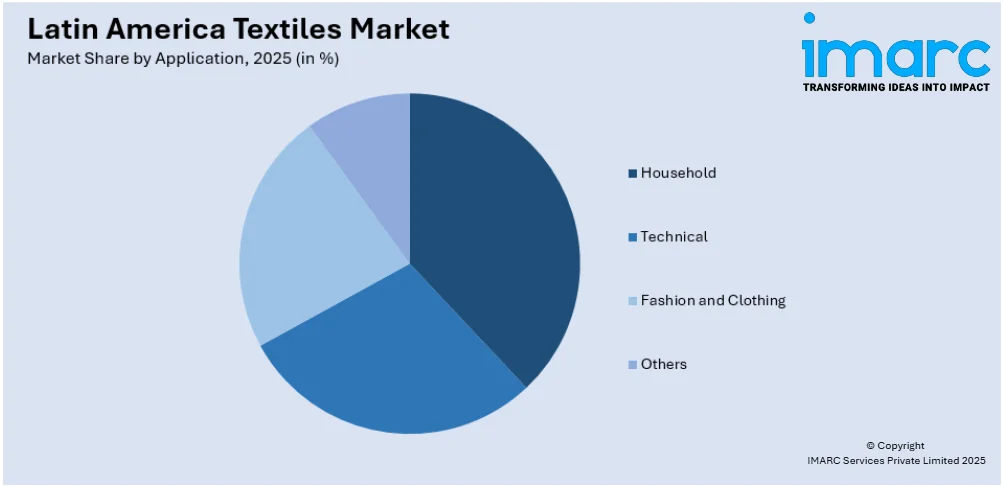

Application Insights:

Access the comprehensive market breakdown Request Sample

- Household

- Technical

- Fashion and Clothing

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes household, technical, fashion and clothing, and others.

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Textiles Market News:

- In June 2024, Magazine Luiza, a Brazil based textile company, announced its partnership with AliExpress to expand e-commerce in Brazil. This alliance represents Alibaba's first with a retailer outside of China, transforming Brazil's online retail market.

Latin America Textiles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Cotton, Chemical, Wool, Silk, Others |

| Products Covered | Natural Fibers, Polyesters, Nylon, Others |

| Applications Covered | Household, Technical, Fashion and Clothing, Others |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America textiles market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America textiles market on the basis of raw material?

- What is the breakup of the Latin America textiles market on the basis of product?

- What is the breakup of the Latin America textiles market on the basis of application?

- What is the breakup of the Latin America textiles market on the basis of country?

- What are the various stages in the value chain of the Latin America textiles market?

- What are the key driving factors and challenges in the Latin America textiles market?

- What is the structure of the Latin America textiles market and who are the key players?

- What is the degree of competition in the Latin America textiles market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America textiles market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America textiles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America textiles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)