Latin America Transformer Market Size, Share, Trends and Forecast by Transformer Type, and Country, 2026-2034

Latin America Transformer Market Overview:

The Latin America transformer market size reached USD 3.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 4.1 Billion by 2034, exhibiting a growth rate (CAGR) of 3.40% during 2026-2034. The market is expanding rapidly due to growing industrial and urban development, which necessitates dependable power distribution, the rising popularity of renewable energy, and the advent of sustainability goals. The trend is also being supported by investments in transformer technology, an emphasis on intelligent and energy-efficient transformers, and continuous grid modernization and infrastructure improvements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.0 Billion |

| Market Forecast in 2034 | USD 4.1 Billion |

| Market Growth Rate (2026-2034) | 3.40% |

Access the full market insights report Request Sample

Latin America Transformer Market Trends:

Expansion of Renewable Energy Projects

One of the major drivers of the Latin American transformer market is the growing emphasis on renewable energy projects across the region. Countries like Brazil, Mexico, Argentina, and Chile have made substantial investments in wind, solar, and hydroelectric power, aligning with global trends toward sustainable energy generation. These renewable energy sources often require specialized transformers to step up or down voltages for integration into the national power grids. For instance, in 2024, Chinese electricity company SPIC invested USD 147.41 Million in new wind and solar farms in Northeastern Brazil, positioning itself to become a leading energy generator in the country’s renewable sector. This investment leads to the rapid expansion of solar and wind farms which necessitates advanced transformer technologies, such as those designed for high efficiency and reliability in variable and remote environments. The need for transformers made to specifically address the requirements of renewable energy sources is only growing as a result of the region's governments enacting advantageous laws and incentives to encourage the use of renewable energy. The need for transformers to support energy distribution and grid stability will only increase as renewable energy generation is predicted to account for an increasing portion of the total power capacity.

Increasing Industrialization and Urbanization

The Latin America transformer market is largely driven by the continent's continued industrialization and urbanization. Reliable electrical power infrastructure is becoming crucial as the region's manufacturing, mining, and construction sectors grow. In order to support massive factories, heavy machinery, and production facilities, industrialization raises the demand for more reliable transformer solutions and increases electricity consumption. Meanwhile, in order to manage the growing population in cities, driven by rapid urbanization, major improvements to power distribution networks are required. Constructing transformers to increase power quality, dependability, and distribution capacity is one indication of the improved infrastructure needed in growing urban areas to meet the energy demands of homes, businesses, and industries. For instance, in 2024, Peru’s Ministry of Energy and Mines (MINEM) announced the launch of four renewable energy projects, adding 507 MW to the National Interconnected Electric System, with a total investment exceeding USD 530 Million.

Infrastructure Development and Grid Modernization

A significant driver is the ongoing infrastructure development and modernization of electrical grids across Latin America. Many countries in the region are investing heavily in upgrading aging electrical infrastructure to meet the growing energy needs of their populations and industries. For instance, in 2024, Siemens Energy signed a $60 million contract with Eletrobras to upgrade Brazil’s transmission grid, including a key project in Madeira River to install monitoring systems for transformer reliability and early failure detection. This modernization process often involves replacing outdated transformers with more efficient, advanced models capable of handling higher capacities and improving grid stability. Governments and utilities across Latin America are increasingly focused on modernizing power grids to ensure more efficient energy distribution and reduce transmission losses. The adoption of smart grid technologies, which require advanced transformers with integrated monitoring and control capabilities, is also on the rise. As utilities seek to enhance grid resilience and ensure reliable electricity delivery, the demand for advanced transformers is expected to continue growing.

Latin America Transformer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on transformer type.

Transformer Type Insights:

To get detailed segment analysis of this market Request Sample

- Power Transformer

- Distribution Transformer

A detailed breakup and analysis of the market based on the transformer type have provided have also been provided in the report. This includes power transformer and distribution transformer.

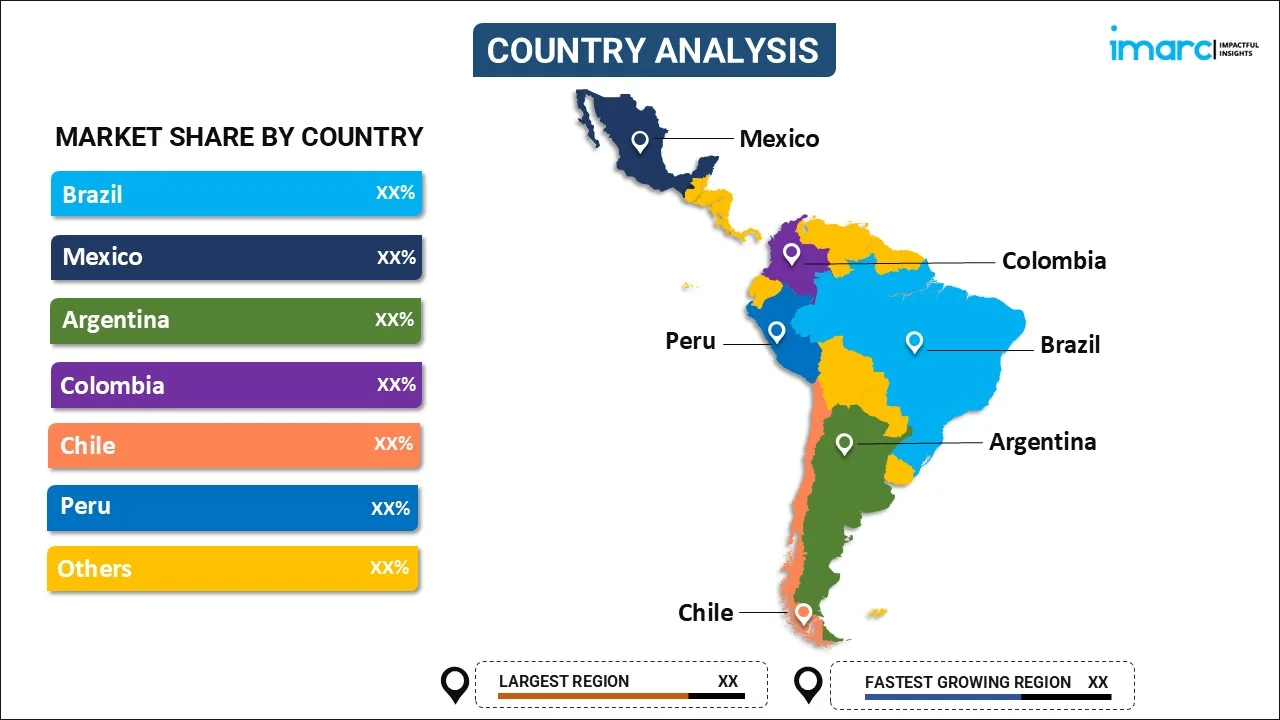

Country Insights:

To get detailed regional analysis of this market Request Sample

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Transformer Market News:

- In 2024, ACCIONA won major contracts to revolutionize Peru’s energy infrastructure with sustainable power transmission projects. The company will design, build, and operate transmission lines for the next 30 years, contributing to the country’s long-term sustainability goals. Operations are expected to begin between December 2026 and August 2027.

- In 2024, China’s Eaglerise Net Electric announced plans to invest USD 190 Million to establish a solar electric transformer plant in Ramos Arizpe, Coahuila, Mexico. The plant will produce 10-ton transformers, essential for solar farms, supporting the country’s efforts to expand its solar energy capacity and drive renewable energy growth.

- In 2024, Hitachi Energy is investing over USD 200 Million to expand its transformer operations in Brazil, part of a USD 1.5 Billion investment plan. The expansion includes upgrading the Guarulhos facility and building a new state-of-the-art plant, creating over 600 jobs.

Latin America Transformer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Transformer Types Covered | Power Transformer, Distribution Transformer |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America transformer market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America transformer market on the basis of transformer type?

- What are the various stages in the value chain of the Latin America transformer market?

- What are the key driving factors and challenges in the Latin America transformer market?

- What is the structure of the Latin America transformer market and who are the key players?

- What is the degree of competition in the Latin America transformer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America transformer market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America transformer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America transformer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)