Latin America Two Wheeler Tire Market Size, Share, Trends and Forecast by Tire, Vehicle, Tire Size, Sales Channel, Location, and Country, 2025-2033

Latin America Two Wheeler Tire Market Overview:

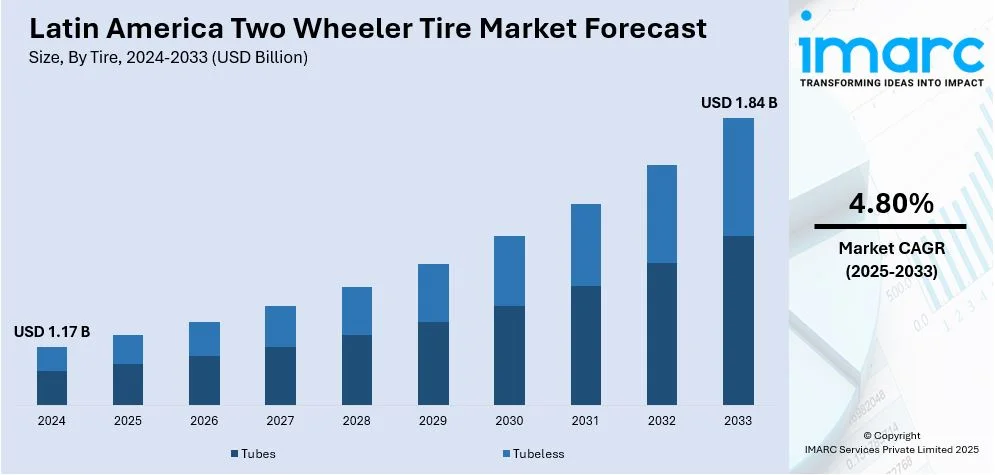

The Latin America two wheeler tire market size reached USD 1.17 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.84 Billion by 2033, exhibiting a growth rate (CAGR) of 4.80% during 2025-2033. The market is growing rapidly due to the rising demand for cost-effective and fuel-efficient transportation, and the growing popularity of electric two-wheelers. In line with this, increasing urbanization further contributes to market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.17 Billion |

| Market Forecast in 2033 | USD 1.84 Billion |

| Market Growth Rate 2025-2033 | 4.80% |

Latin America Two Wheeler Tire Market Trends:

Rising Demand for Cost-Effective and Fuel-Efficient Transportation

The notable increase in the demand for affordable as well as fuel-efficient modes of transportation is emerging as a critical factor influencing the two-wheeler tire industry. For instance, in 2024, Michelin developed a demonstration tire made from 42% renewable materials and aims to achieve full sustainability by 2050, focusing on making the transition most profitable. This advancement is relevant for the two-wheeler market, where both price reasonability and fuel efficacy are crucial priorities for end users. The firms are actively striving to upgrade tire performance to significantly lower rolling resistance, improve fuel efficiency, and minimize overall transportation expenditures for motorcycles and scooters, which are widely used in urban and rural areas. By integrating renewable materials into their tire production, Michelin aims to provide more sustainable options that do not compromise on performance, safety, or durability. This approach is expected to address the magnifying need for eco-friendly transportation solutions while providing a cost-effective alternative for consumers, helping to drive the adoption of fuel-efficient, low-maintenance two-wheeler vehicles in markets worldwide.

Growing Popularity of Electric Two-Wheelers

The shift towards electric two-wheelers is another significant factor contributing to the growth of the tire market in Latin America. As environmental awareness increases and governments introduce policies promoting green transportation, electric motorcycles, and scooters are gaining popularity in several countries across the region. For instance, according to recent industry data, Brazil's electric vehicle market is set to grow by 60% in 2024, marking a significant shift from its traditional reliance on internal combustion engines and sugarcane-based ethanol. This surge in electric vehicle adoption, particularly in the two-wheeler segment, is driven by rising environmental awareness, government incentives, and the increasing popularity of electric motorcycles. As more consumers opt for electric bikes and scooters, the demand for specialized tires tailored to the unique needs of electric motorcycles is expected to rise. Unlike traditional motorcycles, electric two-wheelers require tires that can withstand the higher torque and weight distribution of electric drivetrains, as well as offer enhanced durability and performance to handle various road conditions.

Latin America Two Wheeler Tire Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on tire, vehicle, tire size, sales channel, and location.

Tire Insights:

- Tubes

- Tubeless

The report has provided a detailed breakup and analysis of the market based on the tire. This includes tubes and tubeless.

Vehicle Insights:

- Motorcycle

- Standard/Commuter

- Sport/Performance

- Adventure/Touring

- Off-Road/Dirt Bikes

- Scooter

- Standard Scooters

- Maxi Scooters

A detailed breakup and analysis of the market based on the vehicle have also been provided in the report. This includes motorcycle (standard/commuter, sport/performance, adventure/touring, and off-road/dirt bikes) and scooter (standard scooters and maxi scooters).

Tire Size Insights:

- Up to 12 inches

- 12 to 17 inches

- Above 17 inches

A detailed breakup and analysis of the market based on the tire size have also been provided in the report. This includes up to 12 inches, 12 to 17 inches, and above 17 inches.

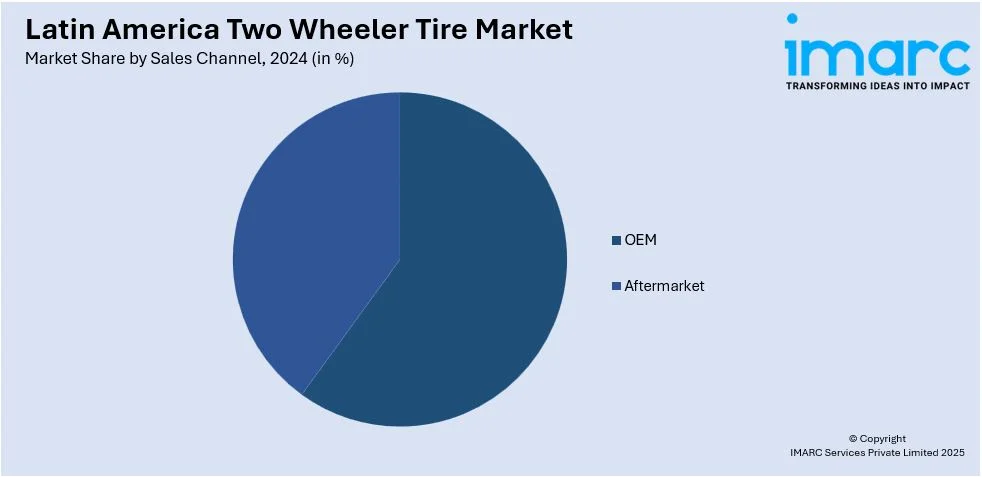

Sales Channel Insights:

- OEM

- Tubed

- Tubeless

- Aftermarket

- Tubed

- Tubeless

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes OEM (tubed and tubeless) and aftermarket (tubed and tubeless).

Location Insights:

- Front

- Rear

A detailed breakup and analysis of the market based on the location have also been provided in the report. This includes front and rear.

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Two Wheeler Tire Market News:

- In May 2024, Ceat, a leading Indian tire manufacturer, announced its expansion into North Latin America, marking a strategic move to enhance its market presence in the region. This initiative aligns with the company's growth strategy to tap into emerging markets and expand its global footprint. The expansion is part of Ceat's efforts to leverage the increasing demand for automotive products and strengthen its distribution network in North Latin America, contributing to its international growth trajectory.

- In February 2024, Vipal Rubber has been named the official tire supplier for Honda motorcycles in Brazil, starting with the Honda CG 160 Fan. The bike will feature Vipal’s Street ST600 tires, manufactured in Bahia. These tires offer superior quality, safety, and durability, following extensive testing for Honda’s production needs.

Latin America Two Wheeler Tire Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Tires Covered | Tubed, Tubeless |

| Vehicles Covered |

|

| Tire Sizes Covered | Up to 12 inches, 12 to 17 inches, Above 17 inches |

| Sales Channels Covered |

|

| Locations Covered | Front, Rear |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America two wheeler tire market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America two wheeler tire market on the basis of tire?

- What is the breakup of the Latin America two wheeler tire market on the basis of vehicle?

- What is the breakup of the Latin America two wheeler tire market on the basis of tire size?

- What is the breakup of the Latin America two wheeler tire market on the basis of sales channel?

- What is the breakup of the Latin America two wheeler tire market on the basis of location?

- What is the breakup of the Latin America two wheeler tire market on the basis of country?

- What are the various stages in the value chain of the Latin America two wheeler tire market?

- What are the key driving factors and challenges in the Latin America two wheeler tire market?

- What is the structure of the Latin America two wheeler tire market and who are the key players?

- What is the degree of competition in the Latin America two wheeler tire market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America two wheeler tire market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America two wheeler tire market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America two wheeler tire industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)