Latin America Vegan Cosmetics Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Country, 2025-2033

Latin America Vegan Cosmetics Market Overview:

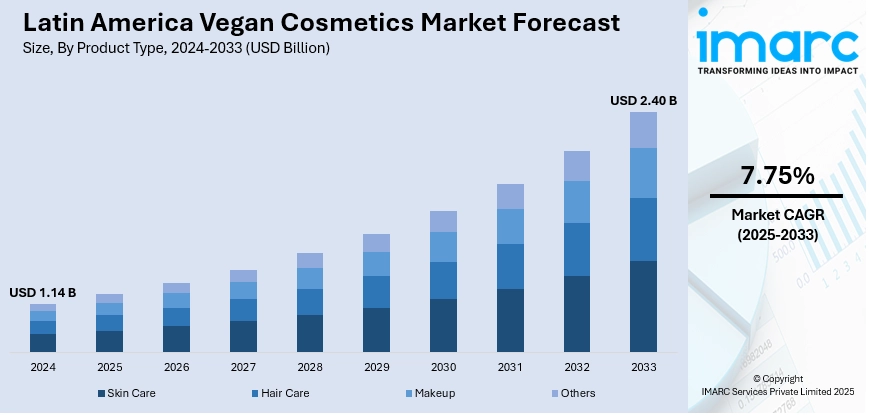

The Latin America vegan cosmetics market size reached USD 1.14 Billion in 2024. Looking forward, the market is expected to reach USD 2.40 Billion by 2033, exhibiting a growth rate (CAGR) of 7.75% during 2025-2033. The market is fueled by growing consumer knowledge about animal welfare, sustainable living, and clean beauty. Urbanization and the global beauty trends influence the demand for cruelty-free, plant-based products. Bans on animal testing imposed by governments, particularly in Mexico, also boost the market growth. Local brands utilizing traditional knowledge and sustainable sourcing practices are gaining consumer confidence, helping expand the Latin America vegan cosmetics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.14 Billion |

| Market Forecast in 2033 | USD 2.40 Billion |

| Market Growth Rate 2025-2033 | 7.75% |

Latin America Vegan Cosmetics Market Trends:

Regional Growth and Consumer Awareness

The vegan cosmetics market of Latin America is picking up speed, with Brazil and Mexico leading the trend, as more consumers look for ethical, plant‑based beauty products. In Mexico, a political prohibition of animal testing has driven up sales of cruelty‑free and vegan skincare products backed by transparent labeling and influencer support. South America is dominated by Brazil, where local brands are capitalizing on locally derived botanicals, such as Amazonian sources like açai, cupuaçu, and buriti, to develop products with geographic character and eco-credentials. Urban consumers throughout Latin America are more and more concerned with being environmentally and health‑friendly, demanding clean formulations and transparency in their own care products. The Latin America vegan cosmetics market growth is also driven by cultural change under which personal values for protecting the environment, fair sourcing, and animal well-being are significantly driving purchasing decisions, especially among the younger generation.

To get more information on this market, Request Sample

Product Categories and Local Ingredients

Skin care and hair care lead the market for vegan cosmetics in Latin America, with skin care holding the biggest share and hair care growing dynamically as a result of development in plant‑derived ingredients such as babassu oil and Amazonian extracts. Local players partner with indigenous communities, blending traditional beauty traditions and ancient botanical expertise to create distinctive product lines. Such co‑creation ensures fair trade and emphasizes Latin America's biodiversity heritage and cultural authenticity. Packaging trends also capture regional values: numerous brands increasingly highlight recyclable material, biodegradable packaging, and reduced carbon footprints, resonating with consumers' values of sustainability and protecting natural resources. This strategy also builds a robust brand identity based on environmental values and regional tradition, making vegan cosmetics more attractive to local and global consumers looking for value propositions.

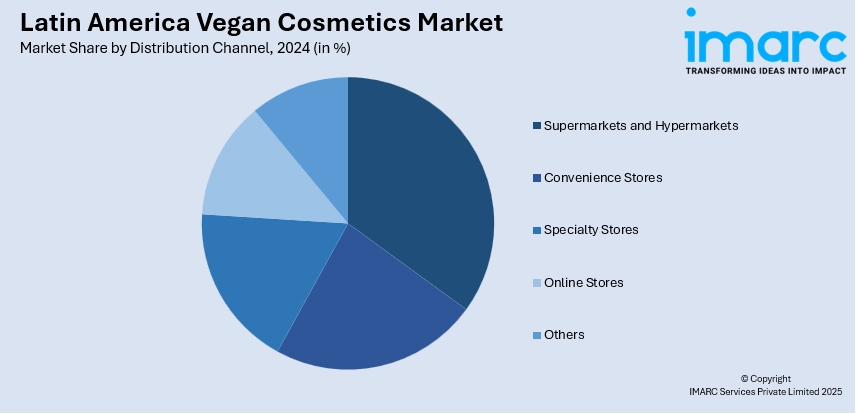

Distribution Channels and Market Dynamics

The growth of e‑commerce websites and social media marketing is transforming market access throughout Latin America. Online shopping is now the predominant distribution channel for vegan makeup and skincare products in Mexico, aided by influencer promotion and digital capabilities such as virtual try‑ons and ingredient level transparency, which are helping to make specialist vegan brands more mainstream in urban and semi‑urban settings. In Brazil and Colombia, while market share remains with global multinationals, local vegan brands are emerging through direct‑to‑consumer online channels and green boutiques in urban centers. With or without gaps in regulation across some countries, and regardless of varying levels of consumer sophistication, consumers are demanding certification (cruelty‑free and vegan labels) and transparent ethical credentials, driving brands to adopt standardized communications. This improves consumer trust and boosts adoption across the region. As awareness continues to grow, especially among Gen Z and millennial consumers, the market is expected to evolve with an increasing emphasis on authenticity, local relevance, and digital-first strategies.

Latin America Vegan Cosmetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Skin Care

- Hair Care

- Makeup

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes skin care, hair care, makeup, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Vegan Cosmetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin Care, Hair Care, Makeup, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America vegan cosmetics market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America vegan cosmetics market on the basis of product type?

- What is the breakup of the Latin America vegan cosmetics market on the basis of distribution channel?

- What is the breakup of the Latin America vegan cosmetics market on the basis of country?

- What are the various stages in the value chain of the Latin America vegan cosmetics market?

- What are the key driving factors and challenges in the Latin America vegan cosmetics market?

- What is the structure of the Latin America vegan cosmetics market and who are the key players?

- What is the degree of competition in the Latin America vegan cosmetics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America vegan cosmetics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America vegan cosmetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America vegan cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)