Latin America Video Game Development Market Size, Share, Trends and Forecast by Platform, Genre, Deployment, Revenue Model, Game Type, End User, and Country, 2025-2033

Latin America Video Game Development Market Overview:

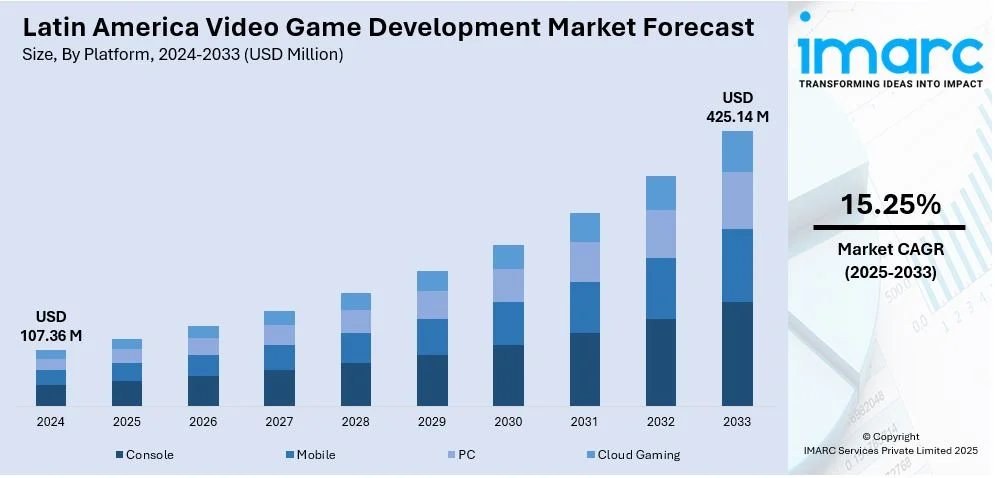

The Latin America video game development market size reached USD 107.36 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 425.14 Million by 2033, exhibiting a growth rate (CAGR) of 15.25% during 2025-2033. The market is driven by increasing smartphone and internet penetration, growing investment by international companies, growing e-sports and mobile gaming industries, pro-government policies, and an improving talent pool. Local studios are also becoming known for culturally diverse content, driving regional and global demand and fueling the Latin America video game development market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 107.36 Million |

| Market Forecast in 2033 | USD 425.14 Million |

| Market Growth Rate 2025-2033 | 15.25% |

Latin America Video Game Development Market Trends:

Boosting Regional Creativity and Cultural Identity

A prominent movement within Latin America’s video game development landscape is the increasing emphasis on games that reflect local stories, traditions, and cultural values. Developers from nations like Mexico, Brazil, and Argentina are crafting games that resonate with native players while capturing the attention of a global audience. This cultural shift is fueled by a broader push for inclusive storytelling and the rising capabilities of Latin American studios to produce polished, engaging titles. In parallel, global collaborations and strategic investments are accelerating the region’s growth as a center for authentic, narrative-rich gaming experiences. A notable example is Google’s launch of a USD 2 Million Indie Games Fund in August 2024, aimed at supporting independent developers and small studios throughout the region. This initiative combines financial support with mentorship to promote innovation and amplify the voices of local creators.

Surge in Capital and Studio Expansion

The Latin America video game development market growth is propelled by a significant upswing in funding and studio proliferation. Fueled by rising consumer interest and recognition of the region’s creative potential, global stakeholders are increasingly partnering with or acquiring Latin American studios. This capital influx is spurring the creation of new development hubs, particularly in Brazil, Argentina, and Mexico. Industry figures indicate Brazil is leading the region, with 13,225 developers and 1,042 active studios. Mexico and Argentina are not far behind, boasting more than 4,000 and 4,500 developers respectively. Government-backed incentives, such as grants, training programs, and tax breaks, are further catalyzing this expansion, enabling local developers to scale operations, invest in cutting-edge tools, and attract top-tier talent. As a result, Latin America is cementing its role as a key player in the international game development arena.

Rising Influence of Mobile Gaming and E-sports

The rapid adoption of mobile technology and the surge in e-sports viewership are transforming the video game development ecosystem in Latin America. With widespread smartphone access and improved digital infrastructure, developers are focusing on mobile-first game design tailored to regional preferences. According to industry data, In 2024, Latin America’s mobile services sector expanded notably, with smartphone shipments rising 15% to 137 million units. Mobile internet penetration peaked at 112% in South America, driven by multi-SIM users, while Central America and Mexico reached 103%, and the Caribbean averaged a penetration rate of 84%. This digital shift has dramatically expanded the potential audience for mobile games, encouraging developers to produce titles that are accessible, engaging, and optimized for smaller screens. Simultaneously, the region's thriving e-sports scene is driving demand for competitive, multiplayer-focused games. These combined trends are pushing developers to innovate in game mechanics, monetization models, and user engagement strategies, establishing Latin America as a fast-evolving market in mobile and competitive gaming.

Latin America Video Game Development Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on platform, genre, deployment, revenue model, game type, and end user.

Platform Insights:

- Console

- Mobile

- PC

- Cloud Gaming

A detailed breakup and analysis of the market based on the platform have provided have also been provided in the report. This includes console, mobile, PC, and cloud gaming.

Genre Insights:

- Action

- Adventure

- Shooter

- Role-Playing

- Simulation

- Strategy

- Sports

- Casual

- Others

A detailed breakup and analysis of the market based on the genre have provided have also been provided in the report. This includes action, adventure, shooter, role-playing, simulation, strategy, sports, casual, and others.

Deployment Insights:

- On-Premises

- Cloud-Based

A detailed breakup and analysis of the market based on the deployment have provided have also been provided in the report. This includes on-premises and cloud-based.

Revenue Model Insights:

- Pay-to-Play

- Free-to-Play

- Subscriptions

- In-App Purchases

A detailed breakup and analysis of the market based on the revenue model have provided have also been provided in the report. This includes pay-to-play, free-to-play, subscriptions, and in-app purchases.

Game Type Insights:

- Single-Player

- Multi-Player

- Massively Multiplayer Online (MMO)

A detailed breakup and analysis of the market based on the game type have provided have also been provided in the report. This includes single-player, multi-player, and massively multiplayer online (MMO).

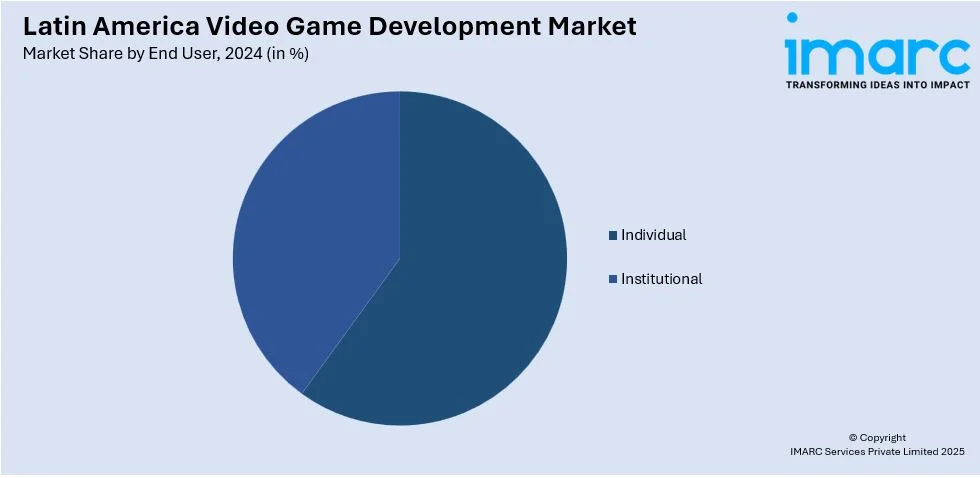

End User Insights:

- Individual

- Institutional

A detailed breakup and analysis of the market based on the end user have provided have also been provided in the report. This includes individual and institutional.

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Video Game Development Market News:

- In March 2025, Xsolla launched the Journey of Indies (JOIN) Program in Latin America to support indie and mid-tier game developers. The initiative, based in Brasília, offers commercialization tools, education, mentorship, and funding. In collaboration with local partners and supported by SECTI-DF, JOIN aims to expand the region’s creative potential. Key events include an accelerator launch, video game hub opening, and Gamescom LATAM panel. Developers will gain access to training, publishing support, and global industry connections through Xsolla’s ecosystem.

- In February 2025, gamescom latam 2025 featured a major partnership with The Pokémon Company, marking the franchise's first appearance at the event. Held in São Paulo, attendees experienced exclusive Pokémon GO AR missions, themed activities, and collectible credentials. A dedicated booth provided gameplay tutorials, merchandise, and in-game content. This collaboration enhanced fan engagement across Latin America. The expanded event also hosted major industry players like Valve and Warner Bros., reflecting gamescom latam's rising global significance in the gaming industry.

- In August 2024, leading game development agency Amber acquired Colombia-based studio Madbricks, aiming to expand its presence in the Latin American market and boost collaborative game co-development initiatives.

- In June 2024, OV Entertainment Group made its first two strategic acquisitions by acquiring Kokku, a Brazil-based game developer, and 3OGS, a technology and tools specialist from Argentina. The move aims to unite Latin American gaming companies, fostering growth and granting access to resources and opportunities previously out of reach.

Latin America Video Game Development Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platforms Covered | Console, Mobile, PC, Cloud Gaming |

| Genres Covered | Action, Adventure, Shooter, Role-Playing, Simulation, Strategy, Sports, Casual, Others |

| Deployments Covered | On-Premises, Cloud-Based |

| Revenue Models Covered | Pay-to-Play, Free-to-Play, Subscriptions, In-App Purchases |

| Game Types Covered | Single-Player, Multi-Player, Massively Multiplayer Online (MMO) |

| End Users Covered | Individual, Institutional |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America video game development market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America video game development market on the basis platform?

- What is the breakup of the Latin America video game development market on the basis genre?

- What is the breakup of the Latin America video game development market on the basis deployment?

- What is the breakup of the Latin America video game development market on the basis of revenue model?

- What is the breakup of the Latin America video game development market on the basis of game type?

- What is the breakup of the Latin America video game development market on the basis of end user?

- What is the breakup of the Latin America video game development market on the basis of region?

- What are the various stages in the value chain of the Latin America video game development market?

- What are the key driving factors and challenges in the Latin America video game development?

- What is the structure of the Latin America video game development market and who are the key players?

- What is the degree of competition in the Latin America video game development market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America video game development market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America video game development market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America video game development industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)