Latin America Washing Machine Market Size, Share, Trends and Forecast by Type, Capacity, Distribution Channel, End Use, and Region, 2026-2034

Latin America Washing Machine Market Overview:

The Latin America washing machine market size reached USD 6.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 8.7 Billion by 2034, exhibiting a growth rate (CAGR) of 3.77% during 2026-2034. The market is experiencing growth driven by technological advancements, evolving consumer preferences, and increased investments in energy-efficient appliances amid a rapid expansion of the middle class and ongoing urbanization trends across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6.2 Billion |

| Market Forecast in 2034 | USD 8.7 Billion |

| Market Growth Rate (2026-2034) | 3.77% |

Access the full market insights report Request Sample

Latin America Washing Machine Market Trends:

Growing Demand for Smart and Connected Appliances

Latin American washing machine market is influenced by widespread adoption of smart home technology. Consumers are becoming tech savvy and seeking products with innovative value of convenience and connectivity. The market is mainly driven by the need for appliances which integrate into home ecosystems that help users to access their machines and operate and control them via smartphones or home automation systems. Machines enabled with wireless fidelity (Wi-Fi), advanced sensors with features, such as load detection, automatic detergent dispensing, have taken over the market by storm with its durability. The appliances, featuring energy- and water-saving efficiencies, align well with the region’s emphasis on sustainability and durability. These advancements are expanding the Latin America washing machine market share by driving demand for smart, connected, and energy-efficient appliances that enhance user convenience and sustainability. As urban households in particular seek time-saving and customizable washing options, the demand for technologically advanced, convenient washing machines continues to rise.

Rising Emphasis on Energy and Water Efficiency

The growing environmental awareness and the need for resource conservation is impelling the demand for energy and water efficient washing machines. Government agencies and organizations are promoting the usage of appliances that reduce energy consumption as a commitment to climate change and sustainability goals. Customers with growing environmental awareness are also becoming increasingly attentive to this, motivating themselves for washing machines with energy and water efficiency certifications. This market is witnessing growth with models equipped with inverter technology with all eco-friendly programs, assisting in optimizing water usage, contributing to lower utility costs, and making them a choice for value-conscious families. For instance, in October 2024, Samsung launched its Bespoke AI Washer and Dryer in São Paulo featuring a 20 kg washing capacity and 15 kg drying capacity. The appliance utilizes AI for enhanced washing and drying efficiencies reduces energy consumption by up to 70% and includes a seven-inch touchscreen for smart home integration. This is prompting manufacturers to cater appliances that will meet the new energy standards and consumer expectation for ecofriendly living. The growing focus on energy and water efficiency drives the Latin America washing machine market growth, as consumers prioritize eco-friendly appliances that reduce utility costs and align with sustainability initiatives.

Expansion of E-Commerce and Digital Sales Channels

One of the major impacts on Latin American washing machine market formation is due to the expansion in e-commerce and digital sales platforms. Online platforms are widely used to refer, compare, and purchase the products, with the detailed descriptions of a product, user reviews, and competitive pricing. The growth of e-commerce is enabling promotion and discounts accessible, which is making the machines more affordable for a larger segment of people in the region. According to the report published by the ITA, Brazil's e-commerce is booming, projected to exceed US$200 billion by 2026, growing 14.3% annually. The top players are Mercado Livre, Americanas.com, OLX, and Magazine Luiza, with southeastern Brazil driving 51% of market growth. The brands are also getting more scopes toward customers as they are able to cater to changing preferences and capture the market share better through digital marketing strategies and partnerships with e-commerce platforms. This trend will continue as internet penetration and digital literacy support the consumer confidence in online transactions, thereby creating a positive Latin America washing machine market outlook.

Latin America Washing Machine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, capacity, distribution channel and end use.

Type Insights:

To get detailed segment analysis of this market Request Sample

- Fully Automatic

- Front Load

- Top Load

- Semi-Automatic

The report has provided a detailed breakup and analysis of the market based on the type. This includes fully automatic (front load, top load) and semi-automatic.

Capacity Insights:

- Below 6 Kg

- 6 Kg to 8 Kg

- Above 8 Kg

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes below 6 kg, 6 kg to 8 kg and above 8 kg.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, online stores and others.

End Use Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential and commercial.

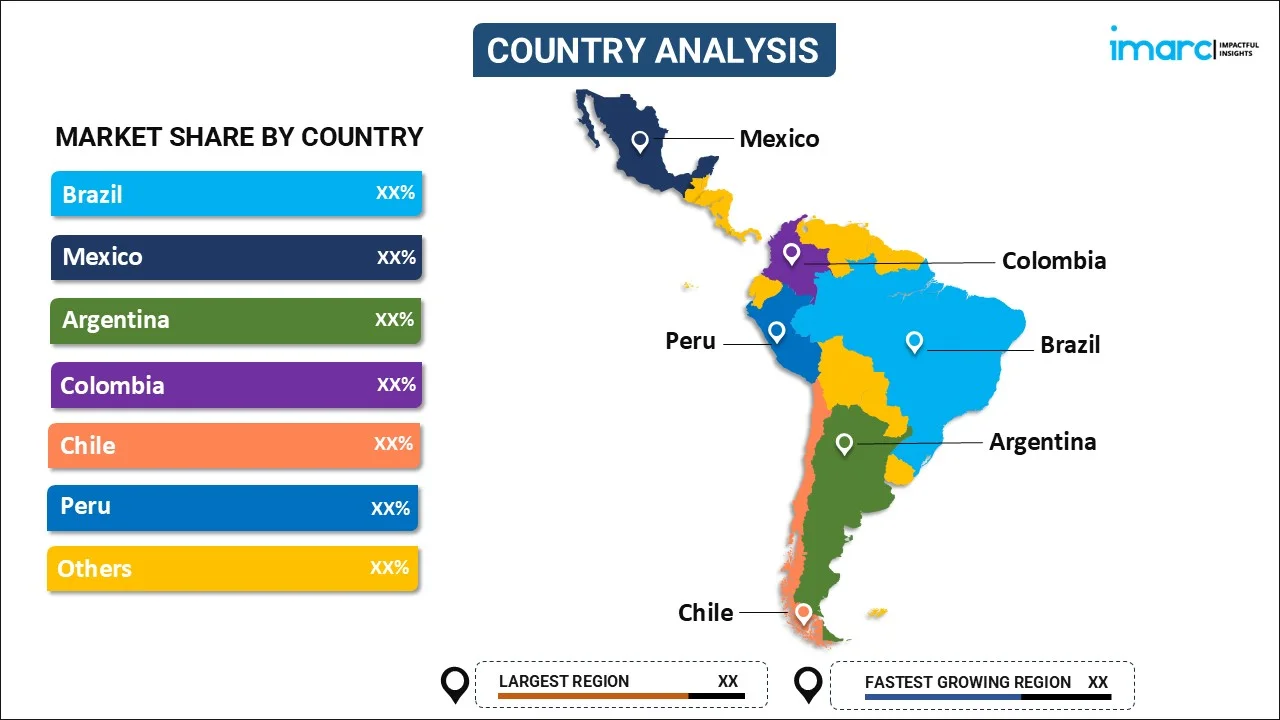

Country Insights:

To get detailed regional analysis of this market Request Sample

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Washing Machine Market News:

- In August 2024, Midea launched five new household appliances including three refrigerators and two washing machines produced in Brazil. CEO Felipe Costa emphasized Brazil's significance in their market strategy, aiming for innovation and efficiency. A new factory in Pouso Alegre will enhance production capacity to 700,000 refrigerators and 600,000 washing machines annually.

- In February 2024, GE Appliances launched a new washer tailored for Hispanic households in the U.S., featuring a Spanish-language control panel and special “Añadir Remojo” and “Más Intenso” settings for deep soaking and intense washes. This 4.5 cu. ft. model caters to growing Hispanic homeownership and laundry care traditions.

Latin America Washing Machine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fully Automatic (Front Load, Top Load), Semi-Automatic |

| Capacities Covered | Below 6 Kg, 6 Kg to 8 Kg, Above 8 Kg |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| End Uses Covered | Residential, Commercial |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America washing machine market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America washing machine market on the basis of type?

- What is the breakup of the Latin America washing machine market on the basis of capacity?

- What is the breakup of the Latin America washing machine market on the basis of distribution channel?

- What is the breakup of the Latin America washing machine market on the basis of end use?

- What is the breakup of the Latin America washing machine market on the basis of country?

- What are the various stages in the value chain of the Latin America washing machine market?

- What are the key driving factors and challenges in the Latin America washing machine market?

- What is the structure of the Latin America washing machine market and who are the key players?

- What is the degree of competition in the Latin America washing machine market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America washing machine market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America washing machine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America washing machine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)