Latin America Wearable Sensors Market Size, Share, Trends and Forecast by Type, Device, Application, and Country, 2026-2034

Latin America Wearable Sensors Market Overview:

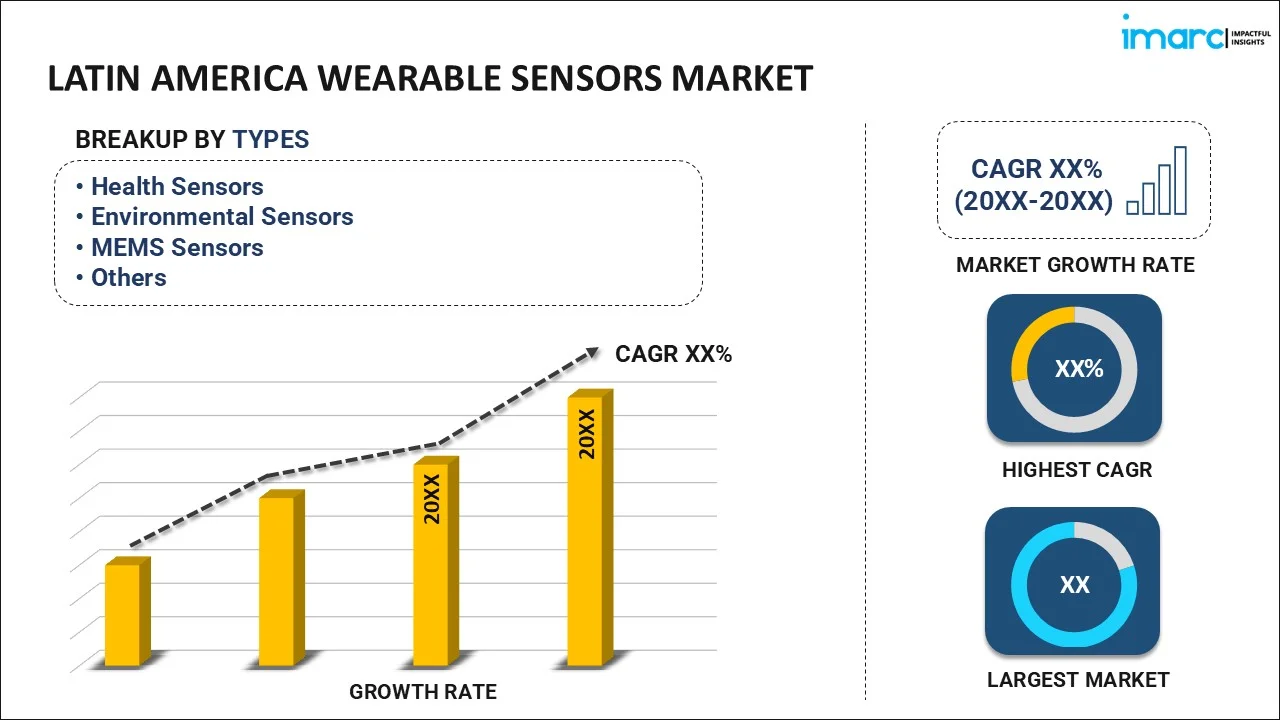

The Latin America wearable sensors market size reached USD 312.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,021.4 Million by 2034, exhibiting a growth rate (CAGR) of 14.06% during 2026-2034. The market is experiencing significant growth, majorly driven by the rising health awareness and increasing adoption of fitness and health monitoring devices. Additionally, innovations in biosensors and favorable regulatory support are further propelling demand across healthcare, fitness, and consumer electronics sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 312.6 Million |

| Market Forecast in 2034 | USD 1,021.4 Million |

| Market Growth Rate (2026-2034) | 14.06% |

Access the full market insights report Request Sample

Latin America Wearable Sensors Market Trends:

Adoption in Healthcare Monitoring

Wearable sensors are progressively being incorporated into healthcare systems across Latin America, facilitating remote monitoring and enhancing patient results. Healthcare facilities are utilizing wearable technology for the ongoing tracking of patients' vital signs, enabling real-time data gathering that improves preventive care and the early identification of health problems. This is especially advantageous in rural regions where healthcare facilities are scarce. Wearable sensors monitor metrics like blood pressure and glucose levels, assisting in closing the gaps in conventional healthcare delivery. Additionally, this trend of adoption is bolstered by the growing telehealth industry and government health programs, enhancing the wearable sensor market in Latin America's healthcare field. For example, as per the International Trade Administration (ITA), Brazil unveiled the National Plan for AI in 2024, designating around USD$4 billion for enhancing business innovation initiatives and investing in AI infrastructure and growth in the nation. These initiatives are accelerating the use of wearable sensors, increasing healthcare access, enhancing patient results, and encouraging proactive health management in the area.

Advancements in Sensor Technology and Connectivity

Innovations in sensor miniaturization and wireless technology are driving the wearable sensors market in Latin America. Improved precision, extended battery duration, and smooth connectivity with smartphones and IoT gadgets are making wearables increasingly attractive to both consumers and businesses. Additionally, the emergence of 5G connectivity is facilitating quicker data transmission, which advantages real-time health tracking and fitness applications. For example, as per GSMA reports released in 2023, by March 2023, eight countries in Latin America had initiated commercial 5G services. The number of 5G connections was projected to rise consistently over the next few years, with a significant increase expected in the last portion of the decade as new 5G markets emerged and existing networks grew to cover more areas. As a result, the adoption of 5G was expected to exceed that of 2G in 2024, 3G in 2026, and 4G in 2029. By the year 2030, it was anticipated that 5G would account for nearly 60% of all mobile connections in Latin America. Additionally, firms are creating multisensory gadgets that integrate multiple metrics, including motion, body temperature, and heart rate, into one device. These innovations are broadening the uses of wearable sensors, driving the demand in various sectors, such as fitness, healthcare, and workplace safety monitoring.

Latin America Wearable Sensors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, device, and application.

Type Insights:

To get detailed segment analysis of this market Request Sample

- Health Sensors

- Environmental Sensors

- MEMS Sensors

- Motion Sensors

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes health sensors, environmental sensors, MEMS sensors, motion sensors, and others.

Device Insights:

- Wristwear

- Bodywear and Footwear

- Others

A detailed breakup and analysis of the market based on the device have also been provided in the report. This includes wristwear, bodywear and footwear, and others.

Application Insights:

- Health and Wellness

- Safety Monitoring

- Home Rehabilitation

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes health and wellness, safety monitoring, home rehabilitation, and others.

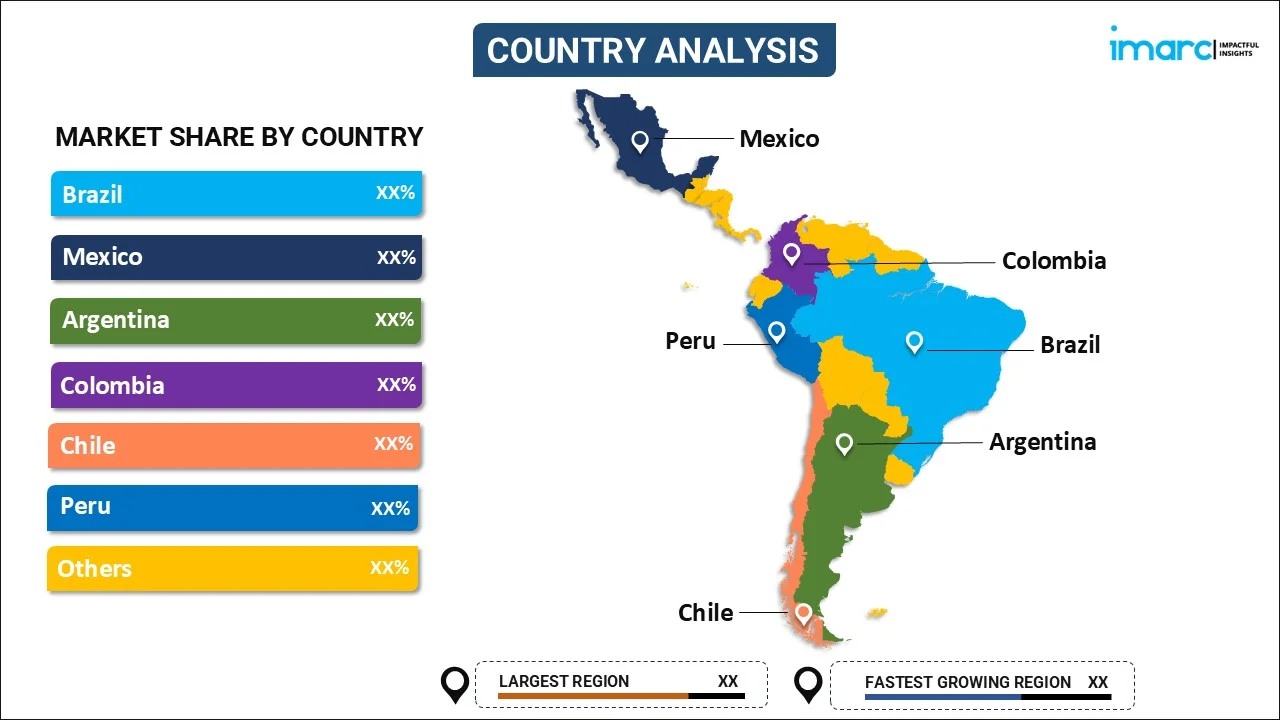

Country Insights:

To get detailed regional analysis of this market Request Sample

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Wearable Sensors Market News:

- In February 2025, Samsung launched the Galaxy Ring and Galaxy Tab S10 series in Brazil and Latin America. The Galaxy Ring is available in Black, Silver, and Gold, and can be purchased both in physical stores and online.

Latin America Wearable Sensors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Health Sensors, Environmental Sensors, MEMS Sensors, Motion Sensors, Others |

| Devices Covered | Wristwear, Bodywear and Footwear, Others |

| Applications Covered | Health and Wellness, Safety Monitoring, Home Rehabilitation, Others |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America wearable sensors market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America wearable sensors market on the basis of type?

- What is the breakup of the Latin America wearable sensors market on the basis of device?

- What is the breakup of the Latin America wearable sensors market on the basis of application?

- What is the breakup of the Latin America wearable sensors market on the basis of country?

- What are the various stages in the value chain of the Latin America wearable sensors market?

- What are the key driving factors and challenges in the Latin America wearable sensors market?

- What is the structure of the Latin America wearable sensors market and who are the key players?

- What is the degree of competition in the Latin America wearable sensors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America wearable sensors market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America wearable sensors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America wearable sensors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)