Lead Acid Battery Market Report by Product (SLI, Stationary, Motive), Construction Method (Flooded, Valve Regulated Sealed Lead–acid Battery (VRLA)), Sales Channel (OEM, Aftermarket), Application (Automotive, UPS, Telecom, and Others), and Region 2026-2034

Lead Acid Battery Market Overview:

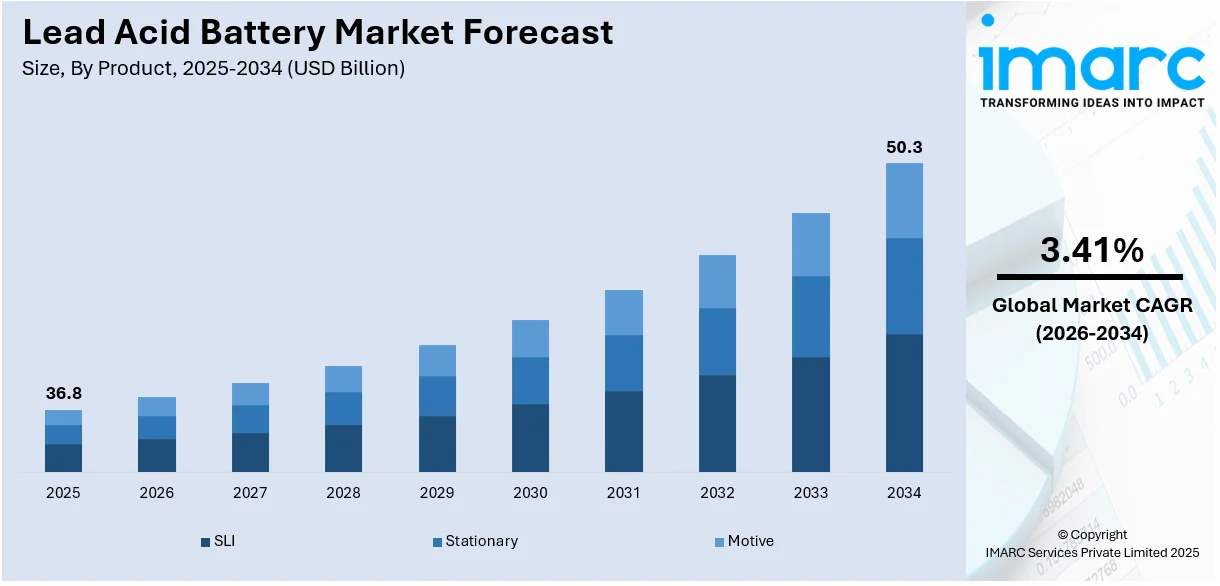

The global lead acid battery market size reached USD 36.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 50.3 Billion by 2034, exhibiting a growth rate (CAGR) of 3.41% during 2026-2034. The growing need for power backup in critical infrastructures, rising demand for batteries that deliver high current in a short time, and increasing preference for renewable energy sources are fueling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 36.8 Billion |

| Market Forecast in 2034 | USD 50.3 Billion |

| Market Growth Rate 2026-2034 | 3.41% |

Lead Acid Battery Market Analysis:

- Major Market Drivers: There is an increase in the need for energy storage solutions. This, coupled with the rising sales of cars, is one of the key market drivers.

- Key Market Trends: The escalating demand for batteries that deliver high current in a short time, along with increasing preferences for renewable energy sources, represents recent market trends.

- Geographical Trends: According to the report, Asia Pacific exhibits a clear dominance, accounting for the largest market share on account of the escalating demand for vehicles among individuals.

- Competitive Landscape: Some of the major market players in the lead acid battery industry are C&D Technologies, Inc., Clarios, Crown Equipment Corporation, East Penn Manufacturing Company, EnerSys, Exide Industries Limited, GS Yuasa International Ltd., HBL Batteries, HOPPECKE Batterien GmbH & Co. KG, Leoch International Technology Limited Inc, Teledyne Technologies Incorporated, among many others.

- Challenges and Opportunities: One of the key challenges hindering the market growth is environmental concerns. Nonetheless, recycling and circular economy initiatives, represent the lead acid battery market recent opportunities.

To get more information on this market Request Sample

Lead Acid Battery Market Trends:

Rising Demand for Batteries that Deliver High Current in a Short Time

The increasing need for lead acid batteries in the automotive industry, due to their ability to provide high current quickly, is driving market expansion. These batteries are utilized for systems that start, light up, and ignite vehicles. In addition, people are buying electric vehicles (EVs) because of urbanization and industrialization. Additionally, there is a growing need for advanced lead acid battery technologies owing to the use of improved flooded batteries (EFBs) or absorbent glass mat (AGM) batteries in electric vehicles (EVs). In addition, many lead acid battery manufacturers are aiming to broaden their market presence worldwide. For example, Amara Raja Batteries (ARBL) declared the extension of its lead acid operations abroad beyond India on 6 July 2022.

Increasing Need for Power Backup in Critical Infrastructures

There is an increase in the reliance on UPS solutions to safeguard data and maintain communication during power outages. In line with this, there is a rise in the need for power these batteries for backup power in critical infrastructure sectors, such as data centers, telecommunications, and emergency lighting systems. Apart from this, numerous industries like healthcare, manufacturing, and transportation rely on backup power systems that are equipped with lead acid batteries to ensure uninterrupted operations. These batteries offer improved reliability and cost-effectiveness, making them suitable for these sectors. As per the IMARC Group, the global uninterrupted power supply (UPS) system market is anticipated to hit US$ 12.3 Billion by 2032.

Growing Preference for Renewable Energy Sources

The lead acid battery market growth demand is growing as consumers' preferences for renewable energy sources, such solar and wind power, are increasing. These batteries also play a crucial role in renewable energy systems as a means of storing excess energy produced during high production intervals and releasing it when required. In addition, these batteries are frequently used by wind farms and off-grid solar projects to store energy for usage at night or in low wind situations. In addition, there is a growing consciousness regarding the preservation of environmental sustainability. These batteries have lower initial costs and can offer dependable energy storage. According to the International Energy Agency (IEA), the share of renewable electricity generation by solar photovoltaic (PV) is expected to account for 12.6% in 2028.

Lead Acid Battery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global lead acid battery market report, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on product, construction method, sales channel, and application.

Breakup by Product:

- SLI

- Stationary

- Motive

SLI accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product. This includes SLI, stationary, and motive. According to the report, SLI represented the largest segment.

SLI batteries are utilized in automotive uses for the purpose of starting the engine, supplying power for vehicle lighting, and enabling the ignition system. They have the ability to supply brief periods of intense electrical flow and are appropriate for activating a car's engine starter. They come in various sizes and types to meet the needs of different vehicles and performance demands. Different types of batteries, such as flooded lead-acid, enhanced flooded batteries (EFBs), and absorbent glass mat (AGM) batteries, are commonly utilized in the automotive sector.

Breakup by Construction Method:

- Flooded

- Valve Regulated Sealed Lead–acid Battery (VRLA)

Flooded holds the largest share of the industry

A detailed breakup and analysis of the market based on the construction method have also been provided in the report. This includes flooded and valve regulated sealed lead–acid battery (VRLA). According to the report, flooded accounted for the largest market share.

Flooded lead-acid batteries, also known as wet cell batteries, are a conventional type of lead acid battery construction that is widely utilized. They are made up of lead plates that are submerged in a liquid electrolyte solution containing diluted sulfuric acid. The plates are commonly composed of lead dioxide (PbO2) and lead sponge (Pb). Chemical reactions happen between the lead plates and sulfuric acid while charging and discharging, leading to the production or discharge of electrical energy. These batteries also come with vent caps in order to let out gases generated during operation.

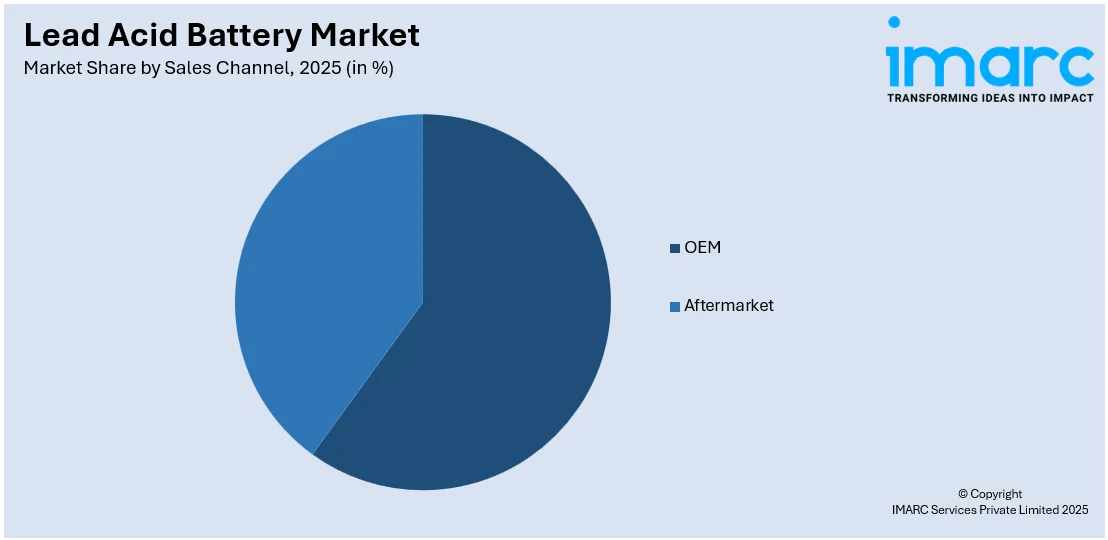

Breakup by Sales Channel:

Access the comprehensive market breakdown Request Sample

- OEM

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes OEM and aftermarket.

The OEM sales channel supplies lead-acid batteries directly to manufacturers of different products and equipment that need batteries as essential parts. Lead acid batteries from OEMs are directly supplied to car manufacturers for installation as original equipment in newly manufactured vehicles within the automotive sector. Likewise, the industrial and telecommunications industries also necessitate the incorporation of batteries into equipment during production, leading to a rise in the lead acid battery demand.

The distribution of lead-acid batteries to individuals, retailers, and service centers for replacement or retrofitting purposes is part of the aftermarket sales channel. The batteries are sold individually by different manufacturers and are intended for use in current vehicles, machinery, or systems that need new batteries because of damage or reaching the end of their useful life. Individuals can easily find these batteries in retail stores, automotive service centers, and online platforms.

Breakup by Application:

- Automotive

- UPS

- Telecom

- Others

Automotive exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, UPS, telecom, and others. According to the report, automotive represented the largest segment.

In the automotive industry, these batteries are widely utilized to power various functions within vehicles. These batteries primarily serve three key purposes, such as starting, lighting, and ignition. They are widely available in various sizes and types to accommodate different vehicle types and performance requirements. They are recognized for their enhanced reliability, cost-effectiveness, and ability to deliver high current, which makes them the preferred choice for automotive manufacturers. Additionally, they are often used in vehicles equipped with start-stop systems, where they can withstand frequent cycling. According to the Association of European Automobile Manufacturers (ACEA), there were around 85.4 million motor vehicles produced worldwide in 2022, an increase of 5.7% as compared to 2021.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest lead acid battery market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for lead acid battery.

Asia Pacific held the biggest market share due to the increasing demand for vehicles among individuals. In addition, the presence of key manufacturers is strengthening the growth of the market in the region. Besides this, the growing demand for backup power solutions to avoid uninterrupted operations is offering a favorable market outlook. In line with this, the increasing need for renewable energy storage systems to curb harmful emissions is contributing to the growth of the market in the Asia Pacific region. On 28 January 2021, Power distribution company CESC and storage battery giant Exide on inaugurated grid connected 315 kWh battery energy storage system (BESS) at a low tension (LT) distribution system. BESS provided better peak load management, improved voltage profile, frequency management, agility to integrate intermittent solar energy sources and ensure high quality power for consumers. The BESS is located at CES near Kankurgachi, Kolkata. This battery-based energy storage system uses the latest Gel-type lead acid technology, providing a higher level of efficiency and safety.

Competitive Landscape:

Major players in the industry are improving battery performance, lifespan, and energy density. They are advancing the materials and design of the product to enhance efficiency and environmental sustainability and increase lead acid battery market revenue. Apart from this, companies are expanding their product portfolios to offer a range of batteries tailored to specific applications, such as automotive, industrial, and renewable energy storage, which allows them to cater to a broader customer base. In line with this, key manufacturers are adopting advanced manufacturing technologies to streamline production processes and reduce costs. They are utilizing automation and quality control systems that are used to ensure consistent product quality. Furthermore, they are focusing on eco-friendly practices by implementing recycling programs for these batteries. On 13 October 2022, UL Solutions, a global leader in applied safety science, announced that BAE USA’s stationary lead-acid battery energy storage system is the first to be certified to the third edition of ANSI/CAN/UL 1973, the standard for batteries for use in stationary and motive auxiliary power applications.

The report provides a comprehensive analysis of the competitive landscape in the global lead acid battery market with detailed profiles of all major companies, including:

- C&D Technologies, Inc.

- Clarios

- Crown Equipment Corporation

- East Penn Manufacturing Company

- EnerSys

- Exide Industries Limited

- GS Yuasa International Ltd.

- HBL Batteries

- HOPPECKE Batterien GmbH & Co. KG

- Leoch International Technology Limited Inc

- Teledyne Technologies Incorporated

Lead Acid Battery Market Recent Developments:

- 24 May 2023: C&D Technologies, a global leader in energy storage solutions for uninterruptible power supply (UPS) in the data center industry, introduced its premium Pure Lead Max (PLM) VRLA battery. It is the long-lasting VRLA battery for UPS systems in C&D’s line-up and has an industry-leading eight-year warranty.

- 31 January 2022, London-based Technology Minerals PLF announced that Recyclus Group Ltd., London, a 49% Technology Minerals-owned company, opened its first lead-acid battery recycling plant in Tipton, England. The Tipton plant is expected to increase Recyclus’ lead-acid battery recycling production capacity from an estimated 16,000 metric tons in the first full year of production, to about 80,000 metric tons by 2027.

Lead Acid Battery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Lead Acid Battery Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | SLI, Stationary, Motive |

| Construction Methods Covered | Flooded, Valve Regulated Sealed Lead–acid Battery (VRLA) |

| Sales Channels Covered | OEM, Aftermarket |

| Applications Covered | Automotive, UPS, Telecom, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Lead Acid Battery Companies Covered | C&D Technologies, Inc., Clarios, Crown Equipment Corporation, East Penn Manufacturing Company, EnerSys, Exide Industries Limited, GS Yuasa International Ltd., HBL Batteries, HOPPECKE Batterien GmbH & Co. KG, Leoch International Technology Limited Inc, Teledyne Technologies Incorporated, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the lead acid battery market from 2020-2034.

- The research report study provides the latest information on the market drivers, challenges, and opportunities in the global lead acid battery market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the lead acid battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global lead acid battery market was valued at USD 36.8 Billion in 2025.

We expect the global lead acid battery market to exhibit a CAGR of 3.41% during 2026-2034.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in the temporary closure of numerous manufacturing units for lead acid batteries.

The rising consumer awareness towards utilizing eco-friendly components, such as lead acid batteries over lithium-ion and nickel-based battery systems to reduce carbon emissions, is primarily driving the global lead acid battery market.

Based on the product, the global lead acid battery market can be categorized into SLI, stationary, and motive. Currently, SLI accounts for the majority of the total market share.

Based on the construction method, the global lead acid battery market has been segregated into flooded and Valve Regulated Sealed Lead–acid Battery (VRLA), where flooded holds the largest market share.

Based on the application, the global lead acid battery market can be bifurcated into automotive, UPS, telecom, and others. Currently, the automotive sector exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global lead acid battery market include C&D Technologies, Inc., Clarios, Crown Equipment Corporation, East Penn Manufacturing Company, EnerSys, Exide Industries Limited, GS Yuasa International Ltd., HBL Batteries, HOPPECKE Batterien GmbH & Co. KG, Leoch International Technology Limited Inc, and Teledyne Technologies Incorporated.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)