Lemonade Market Report by Type (Alcoholic Beverages, Non-Alcoholic Beverages, Powder Mix), Packaging (Glass Bottle, Can, Plastic bottle, and Others), Distribution Channel (B2B, B2C), and Region 2025-2033

Market Overview:

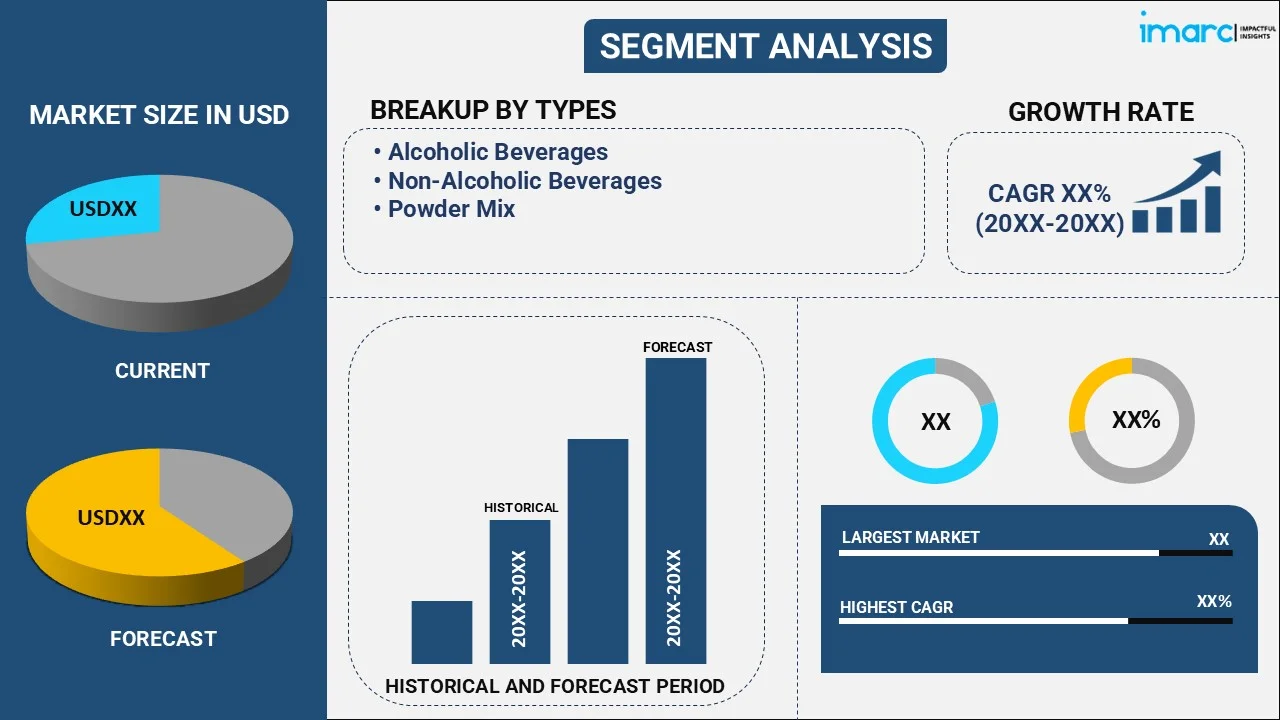

The global lemonade market size reached USD 11.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 18.8 Billion by 2033, exhibiting a growth rate (CAGR) of 5.22% during 2025-2033. The growing popularity due to seasonal demand, increasing health consciousness among the masses, several flavor innovations and packaging convenience, effective marketing, emerging trend toward natural and organic products, and rising influence of the foodservice industry are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 18.8 Billion |

| Market Growth Rate (2025-2033) | 5.22% |

Lemonade is a popular and refreshing citrus-flavored beverage that has been enjoyed for centuries. It is made primarily from freshly squeezed lemon juice, water, and sweeteners, such as sugar or honey. The tartness of the lemons is balanced with the sweetness of the added sugars, creating a delightful harmony of flavors. Lemonade comes in various forms, from homemade versions to commercially produced ones available in bottles or cartons. Some variations include the addition of fruit slices, mint leaves, or even a hint of ginger to enhance its taste and aroma. Aside from its delicious taste, lemonade also offers several health benefits. Lemons are an excellent source of vitamin C, known for its immune-boosting properties and antioxidant effects. Additionally, drinking lemonade can help keep individuals hydrated, making it a popular choice during hot summer days. It has become a symbol of warm weather, picnics, and relaxation, bringing a sense of nostalgia with its tangy and sweet essence.

Lemonade is often associated with hot weather and summer months. As temperature rises, consumers seek refreshing beverages, making lemonade a popular choice during these seasons. Seasonal demand drives sales and production, prompting companies to introduce new flavors and packaging to cater to changing consumer preferences. Additionally, with an increasing focus on health and wellness, many consumers are looking for beverages that are perceived as healthier alternatives to sugary sodas or artificial drinks. Lemonade, particularly when made with natural ingredients and less added sugar, is often perceived as a better option, encouraging health-conscious consumers to choose it over other beverages. Other than this, manufacturers are continuously introducing new and innovative flavors of lemonade to appeal to a diverse range of taste preferences. Variants like strawberry, lavender, or ginger lemonades provide consumers with exciting options, thus expanding the market and attracting new consumers. Besides this, the easy product availability in various packaging formats, such as bottles, cartons, cans, and even powdered mixes, enhances convenience and accessibility for consumers. Single-serve options and on-the-go packaging also contribute to the market's growth, catering to busy lifestyles. In line with this, effective marketing strategies and appealing branding play a crucial role in driving the market. Moreover, engaging advertising campaigns, endorsements by popular influencers, and social media presence help build brand loyalty and increase product visibility. In line with this, consumers are increasingly seeking natural and organic beverage options that are made from organic lemons and natural sweeteners.

Lemonade Market Trends/Drivers:

Seasonal demand

Lemonade's popularity is strongly linked to seasonal demand, particularly during hot weather and summer months. As temperatures soar, people seek refreshing beverages to quench their thirst and combat the heat. Lemonade's tangy and citrusy flavor, combined with its cool and hydrating nature, makes it a top choice for consumers during this time. Manufacturers often ramp up production and promotional efforts ahead of summer, capitalizing on the anticipated surge in demand. Moreover, seasonal events like outdoor picnics, barbecues, and festivals further fuel the desire for lemonade, making it a staple at social gatherings and contributing to increased sales.

Health consciousness

The growing focus on health and wellness has influenced consumers' beverage choices, leading them to seek alternatives to sugary and calorie-laden drinks. Lemonade made with natural ingredients, reduced sugar, or even artificial sweeteners appeals to health-conscious individuals. The perception of lemons as a good source of vitamin C and antioxidants adds to the drink's appeal. To cater to this segment, companies are introducing low-calorie, sugar-free, and organic variants of lemonade, capitalizing on the trend of mindful consumption and addressing concerns over excessive sugar intake.

Flavor innovations

Lemonade has evolved beyond the traditional recipe, with companies continuously introducing innovative and exotic flavors. By incorporating fruits like strawberries, raspberries, or peaches, manufacturers offer a delightful twist to the classic lemonade taste. Additionally, infusing lemonade with herbs like mint, basil, or lavender enhances its aroma and provides a unique sensory experience for consumers. These flavor innovations attract existing lemonade enthusiasts and also entice new consumers looking for diverse and exciting beverage options. Such creative variations allow companies to differentiate their products in a competitive market, thereby driving sales and market expansion.

Lemonade Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global lemonade market report, along with forecasts at the global, regional, and country from 2025-2033. Our report has categorized the market based on type, packaging, and distribution channel.

Breakup by Type:

- Alcoholic beverages

- Non-alcoholic beverages

- Powder mix

Non-alcoholic bevearges dominate the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes alcoholic beverages, non-alcoholic beverages, and powder mix. According to the report, non-alcoholic beverages represented the largest segment.

The rising health consciousness and growing awareness about the adverse effects of excessive alcohol consumption have encouraged consumers to opt for healthier alternatives. Non-alcoholic lemonades offer a refreshing and thirst-quenching option without the potential drawbacks of alcohol consumption, making them appealing to a wider audience, including children, pregnant women, and health-conscious individuals. Additionally, the global trend toward healthier lifestyles has led to an increasing demand for natural and organic products. Non-alcoholic lemonades often leverage natural ingredients, lower sugar content, and absence of artificial additives, making them align better with health-conscious consumers' preferences. Furthermore, the changing cultural norms and increasing demand for non-alcoholic beverage options in social gatherings and public events have contributed to the growth of this segment. Non-alcoholic lemonades offer a versatile beverage choice suitable for diverse occasions, thereby bolstering their popularity. Moreover, with the rising preference for innovative and diverse flavors, manufacturers have introduced various fruit-infused and exotic flavor combinations, creating a wide array of appealing choices for consumers.

Breakup by Packaging:

- Glass bottle

- Can

- Plastic bottle

- Others

Plastic bottle holds the largest share in the market

A detailed breakup and analysis of the market based on the packaging has also been provided in the report. This includes glass bottle, can, plastic bottles, and others. According to the report, plastic bottle accounted for the largest market share.

Plastic bottles offer convenience and portability, making them a preferred choice for consumers on the go. Their lightweight and durable nature ensure ease of handling and transportation, enabling consumers to enjoy lemonade at various locations without concerns of breakage or spillage. Additionally, plastic bottles are cost-effective compared to other packaging materials, such as glass or aluminum. The lower production and transportation costs associated with plastic bottles allow manufacturers to offer lemonade at competitive prices, appealing to price-conscious consumers. Furthermore, plastic bottles provide excellent protection against external factors, such as sunlight and air, which can affect the lemonade's quality. The barrier properties of plastic help preserve the product's freshness and flavor, extending its shelf life and maintaining the beverage's taste for a more extended period. Moreover, plastic bottles have widespread availability and accessibility. They are manufactured in large quantities and are widely used across various industries, leading to a well-established supply chain. This accessibility translates into easy availability of lemonade in plastic bottles across different retail outlets, enhancing consumer convenience and increasing product visibility.

Breakup by Distribution Channel:

- B2B

- B2C

B2C dominates the market

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes B2B and B2C. According to the report, B2C represented the largest segment.

The B2C distribution channel directly caters to individual consumers, who form the majority of the market's target audience. Lemonade is a popular beverage consumed by people of all age groups, making it a product with widespread demand among individual buyers. By focusing on the B2C segment, manufacturers can tap into a larger customer base, thereby driving higher sales and revenue. Additionally, the rise of e-commerce and online retail platforms has significantly contributed to the growth of the B2C distribution channel. Consumers now prefer the convenience of purchasing products, including lemonade, from the comfort of their homes. E-commerce platforms offer a seamless shopping experience, with various options for flavors and packaging sizes, enhancing customer satisfaction and loyalty. Furthermore, aggressive marketing strategies and effective brand positioning by lemonade manufacturers have played a crucial role in boosting the B2C segment. Through targeted advertising, social media campaigns, and influencer endorsements, companies have successfully created a strong brand presence, resonating with individual consumers and driving demand through B2C channels. Moreover, this segment benefits from the ability to establish direct connections with end-users, allowing manufacturers to gather valuable feedback, understand consumer preferences, and adapt their products accordingly. This direct interaction fosters brand loyalty and helps companies stay responsive to changing market trends and demands.

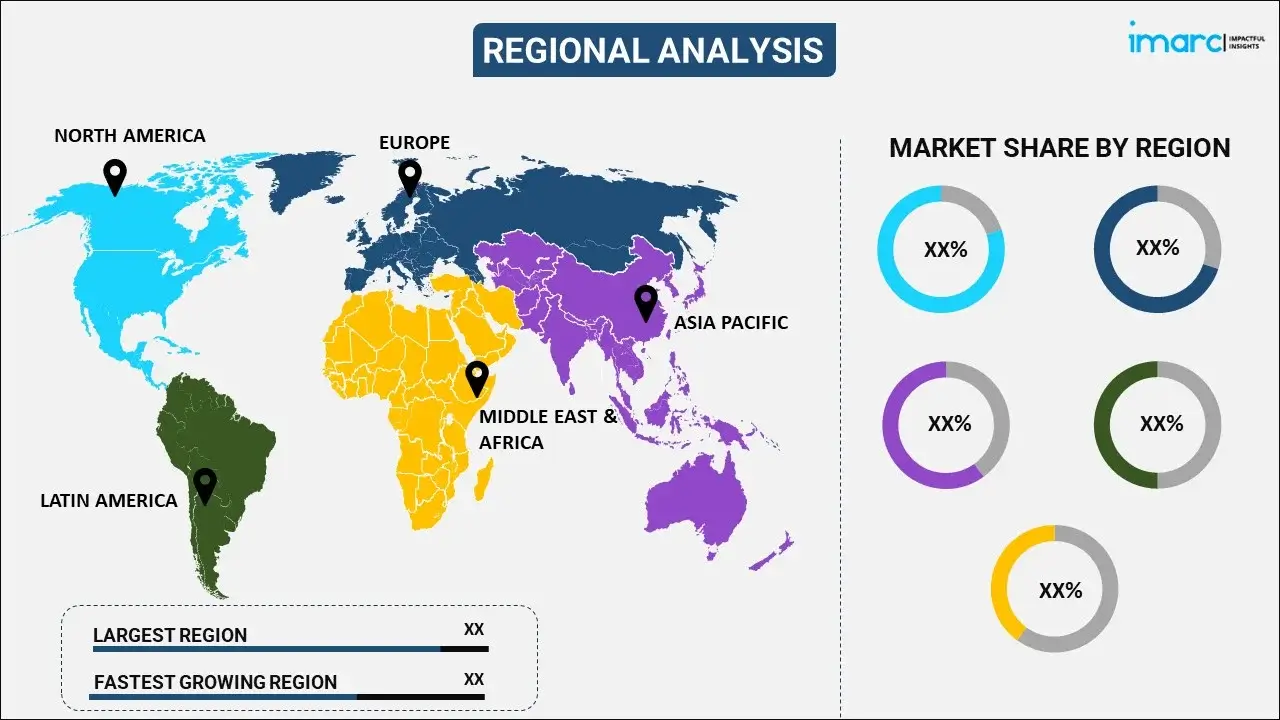

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America was the largest market for lemonade.

Lemonade holds a strong cultural significance in North America, with a rich history of consumption dating back to the 17th century. The refreshing and tangy taste of lemonade has become an integral part of American culinary traditions, making it a beverage of choice during warm weather and social gatherings. Additionally, the region's climatic conditions play a significant role in driving the demand for lemonade. North America experiences hot and humid summers in many areas, creating a natural inclination towards thirst-quenching and hydrating beverages. Lemonade's cooling properties make it a refreshing choice for combating the summer heat, further boosting its consumption in the region. Furthermore, the robust and well-established beverage industry in North America contributes to lemonade's market dominance. The presence of numerous beverage manufacturers, distributors, and retailers ensures easy accessibility and availability of lemonade products across a wide range of outlets, including supermarkets, convenience stores, and restaurants. Moreover, the prevalence of health and wellness trends in North America has positively impacted the lemonade market. Consumers are increasingly seeking healthier alternatives to sugary and carbonated beverages, and lemonade, especially the non-alcoholic and natural variants, fits well into this preference for healthier choices. Besides this, innovative product offerings, such as flavored and organic lemonades, have further fueled the demand in the region. Manufacturers continue to introduce new and exciting flavors, appealing to diverse consumer tastes and preferences, thus sustaining the market's growth.

Competitive Landscape:

Leading lemonade manufacturers have invested in continuous product innovation to cater to diverse consumer preferences. They have introduced new and exciting flavors, such as berry-infused lemonade, tropical fruit blends, or herbal combinations, to expand their product portfolios. Additionally, key players have experimented with alternative sweeteners, like stevia or agave, to appeal to health-conscious consumers seeking lower-calorie options. Effective marketing and branding strategies have been instrumental in driving the popularity of lemonade. Key players have leveraged digital and social media platforms to reach a wider audience, employing engaging campaigns and influencer partnerships to build brand awareness and loyalty. Clever storytelling and association with refreshing experiences during hot weather have helped position lemonade as a go-to beverage for summertime enjoyment. Besides this, expanding distribution networks and ensuring easy accessibility to their products have been priorities for major lemonade companies. They have forged partnerships with retail chains, supermarkets, convenience stores, and online platforms to increase their market reach. Efforts have also been made to secure shelf space in strategic locations within stores, further boosting visibility and sales. Moreover, to maintain a competitive edge, major players have expanded their beverage portfolios beyond traditional lemonade. They have diversified into lemonade concentrates, ready-to-drink mixes, and even alcoholic lemonades, tapping into new markets and consumer segments.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Arizona Beverage Company

- Keurig Dr Pepper Inc.

- Lori’s Original Lemonade LLC

- Me & the Bees Lemonade

- Mike’s Hard Lemonade Co.

- Nestle SA

- PepsiCo Inc.

- Perricone Farms

- The Kraft Heinz Company

- The Coca-Cola Company

- Turkey Hill Dairy

Lemonade Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Alcoholic Beverages, Non-Alcoholic Beverages, Powder Mix |

| Packagings Covered | Glass Bottle, Can, Plastic bottle, Others |

| Distribution Channels Covered | B2B, B2C |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arizona Beverage Company, Keurig Dr Pepper Inc., Lori’s Original Lemonade LLC, Me & the Bees Lemonade, Mike’s Hard Lemonade Co., Nestle SA, PepsiCo Inc., Perricone Farms, The Kraft Heinz Company, The Coca-Cola Company, Turkey Hill Dairy, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global lemonade market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global lemonade market?

- What is the impact of each driver, restraint, and opportunity on the global lemonade market?

- What are the key regional markets?

- Which countries represent the most attractive lemonade market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the lemonade market?

- What is the breakup of the market based on the packaging?

- Which is the most attractive packaging in the lemonade market?

- What is the breakup of the market based on the distribution channel?

- Which is the most attractive distribution channel in the lemonade market?

- What is the competitive structure of the global lemonade market?

- Who are the key players/companies in the global lemonade market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the lemonade market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global lemonade market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the lemonade industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)