Liquid Dietary Supplements Market Size, Share, Trends and Forecast by Ingredient, Application, Distribution Channel, and Region, 2025-2033

Liquid Dietary Supplements Market 2024, Size and Trends:

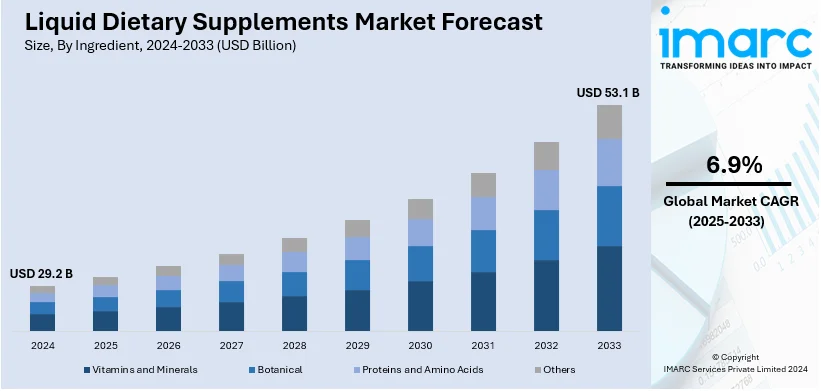

The global liquid dietary supplements market size was valued at USD 29.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 53.1 Billion by 2033, exhibiting a CAGR of 6.9% from 2025-2033. North America currently dominates the market, holding a market share of over 33.8% in 2024. The market is experiencing steady growth driven by increasing consumer awareness of health and wellness, rising preference for convenient and easily digestible forms, and a growing aging population seeking nutritional support for overall well-being are some of the key factors boosting the liquid dietary supplements market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 29.2 Billion |

|

Market Forecast in 2033

|

USD 53.1 Billion |

| Market Growth Rate 2025-2033 | 6.9% |

There is a growing need for liquid dietary supplements because of the rising frequency of chronic conditions, such as obesity, heart disease, and diabetes. Based on industry estimates, heart disease and stroke claim the lives of over 944,800 Americans each year in the US. Additionally, the current statistics from the U.S. Centers for Disease Control and Prevention (CDC) shows that approximately 16% of American adults, or nearly one in six, have diabetes. These health disorders frequently necessitate strict dietary regimens, which can be easily addressed with liquid supplements. Supplements including antioxidants, omega-3 fatty acids, and other bioactive substances, for example, are being used as additional measures for the treatment of chronic illnesses.

With more than 92.30% market share, the United States is the biggest liquid dietary supplement market in North America. It represents a section that is significantly targeted by these products as the country has a growing population of geriatric people that are more prone to chronic diseases. As per National Council on Aging (NCOA) studies, about 94.9% of adults aged 60 and above have one chronic illness, and 78.7% live with two or more such diseases. In addition, obesity affects nearly 42% of individuals over 60 years old, which elevates their propensity toward various heart illnesses, type 2 diabetes, and even some cancers. Liquid nutritional supplements thus represent an effective and user-friendly resource for delivering essential nutrients to the geriatric population who may find difficulties absorbing such nutrients through their ordinary diets.

Liquid Dietary Supplements Market Trends:

Heightening health and wellness awareness

One of the foremost trends shaping the liquid dietary supplements market is the increasing awareness of health and wellness among consumers. In today's fast-paced world, people are proactively seeking ways to improve their overall health, prevent illness, and enhance their quality of life. This heightened awareness is driving a significant shift toward preventive healthcare, where individuals are adopting healthier lifestyles and incorporating dietary supplements into their daily routines. This trend is fueled by various factors, including rising healthcare costs, the desire for improved longevity, and a growing understanding of the importance of nutrition in maintaining good health. Consumers are increasingly looking for supplements to fill nutritional gaps and seeking products that offer specific health benefits, such as immune support, joint health, and cognitive function enhancement. Additionally, the COVID-19 pandemic has further emphasized the importance of health and wellness, leading to increased interest in supplements that support immune health. According to McKinsey, overall, around 50 percent of US consumers now report wellness as a top priority in their day-to-day lives, a significant rise from 42 percent in 2020. This shift reflects a growing focus on health and wellness among consumers. As a result, the liquid dietary supplements market is experiencing significant growth, with consumers actively seeking effective and convenient ways to optimize their well-being.

Rising aging population

The global demographic shift toward an aging population represents another major factor positively impacting the liquid dietary supplements market outlook. With continuous advancements in healthcare and increased life expectancy, the world is witnessing a substantial increase in the number of elderly individuals. As people age, their nutritional requirements often change, and they may face challenges in obtaining essential nutrients from their regular diets. According to the World Population Prospects 2022, the global population aged 65 and above is rising faster than younger age groups, set to grow from 10% in 2022 to 16% by 2050. This phenomenon has led to a substantial demand for dietary supplements, including liquid forms that are easy to consume for seniors. Liquid dietary supplements are particularly appealing to older individuals as they are more convenient to take, especially for those who may have difficulty swallowing pills or capsules. Additionally, liquid supplements often offer better absorption, which is crucial for meeting the unique nutritional needs of the elderly population. Manufacturers are recognizing this growing market opportunity and are increasingly developing liquid dietary supplements tailored to the specific health concerns and preferences of the aging demographic. As the global population continues to age, there has been a rise in demand for these products, which is fueling liquid dietary supplements market growth.

Convenience and customization

Convenience and personalization are emerging as leading trends in the liquid dietary supplements market which are consistently shaping consumer preferences and innovations. A busy lifestyle and the consumption pattern on-the-go is making convenience the prime factor in the selection of products for many individuals. Liquid dietary supplements are a perfect choice in this regard as they offer an easy and convenient way to deliver necessary nutrients to the human body. As such, there is no requirement for water or food to consume these supplements, which adds to their appeal. From ampules with single doses, to drinkable shots, and droppers easy to dispense, the convenience of liquid supplements caters to today's busy lifestyle. Along with convenience, consumers are also looking for personal solutions for specific health goals and preferences. In this context, liquid dietary supplements have been helping several users with customized dosage regimes as it is known to offer precision in dosage control and formulation customization. The response has been diverse which has motivated companies to create an entire spectrum of special products, like energy-boosting shots and collagen-enhanced elixirs, which target a variety of specific health concerns. This customization has given consumers the freedom to mould their supplementation regimen, thus bolstering liquid dietary supplements market demand.

Liquid Dietary Supplements Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global liquid dietary supplements market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on ingredient, application, and distribution channel.

Analysis by Ingredient:

- Vitamins and Minerals

- Botanical

- Proteins and Amino Acids

- Others

Vitamins and minerals stand as the largest ingredient in 2024, holding around 43.1% of the market. Because of their critical function in promoting general health and correcting particular nutritional deficits, the market for liquid dietary supplements is dominated by vitamins and minerals. These substances are appealing to several consumers, including kids, adults, and the elderly by giving specific advantages like better immunity, bone health, and energy metabolism. For people who have trouble swallowing pills or are looking for convenient supplement solutions, liquid formulations are particularly appealing due to their ease of integration into everyday routines. The need for liquid vitamins and minerals is also being driven by a rising number of lifestyle-related illnesses including anemia and weariness as well as the growing knowledge of preventative healthcare.

Analysis by Application:

- Bone and Joint Health

- Heart Health

- Immune Health

- Sports Nutrition

- Weight Loss

- Digestive Health

- Others

Sports nutrition leads the market with around 32.1% of market share in 2024. Due to the increased emphasis on athletic performance, fitness, and active lives, the sports nutrition segment dominates the market for liquid dietary supplements. These supplements are used among professional athletes, fitness-motivated individuals, and casual gym-goers because they increase energy levels, help muscle repair, and improve endurance. Because of their simplicity of use and quick absorption, liquid formulations are especially popular in this market, letting users to quickly refuel during or after exercise. Demand in this market is also fueled by the growing popularity of plant-based or clean-label supplements and customized goals for fitness. The sports nutrition category continues to expand its customer base and market share as a result of increasing investments in sports facilities and wellness initiatives worldwide.

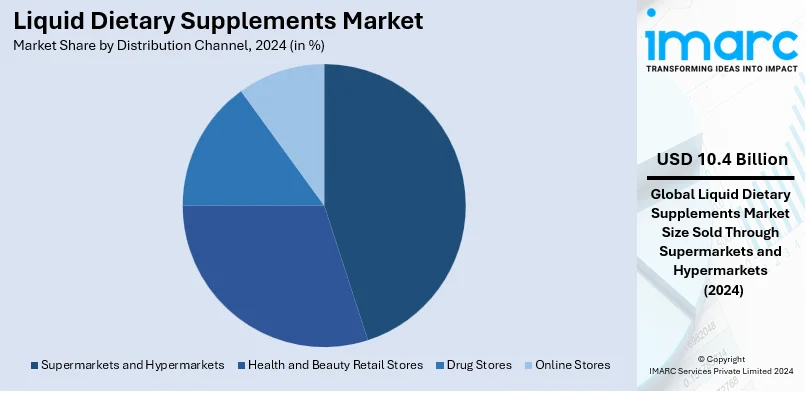

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Health and Beauty Retail Stores

- Drug Stores

- Online Stores

Supermarkets and hypermarkets lead the segment with a total share of 35.6%. They are dominating the liquid dietary supplement distribution channel because of their extensive availability and convenience. These stores provide a wide range of goods which has been allowing customers to compare prices, brands, and ingredients in one place. Their well-planned displays and marketing initiatives are also raising product awareness, which in turn is promoting impulsive buys and recurring customers. Supermarkets and hypermarkets frequently provide customers the chance to view things in person, which increases confidence and trust. In certain stores, pharmacists or in-store specialists are helping direct clients to choose the right supplements. Because of their accessibility, appealing prices, and regular sales, supermarkets and hypermarkets are the go-to option for most individuals.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 33.8%. Due to its ease and health advantages, liquid supplements are becoming a growing trend among consumers in the US and Canada. Likewise, a strong healthcare system, a well-established dietary supplement sector, and high consumer awareness are all factors supporting the market growth. Additionally advantageous to the area is a health-conscious populace that actively looks for dietary remedies to treat lifestyle-related illnesses like diabetes, obesity, and heart disease. Meanwhile, the market in this area is strengthened by the existence of significant industry players and ongoing product advancements. The market for these goods is also fueled by advantageous government laws, rising wellness and preventative healthcare spending, and other factors. The aging of the populations in the US and Canada also fuels market expansion, as more senior citizens turn to liquid supplements for convenience and improved absorption of nutrients. Online retail platforms and direct-to-consumer models are also accelerating product accessibility, solidifying North America's position in the market.

Key Regional Takeaways:

United States Liquid Dietary Supplements Market Analysis

The United States is a leading market in North America with over 92.30% market share. Liquid dietary supplements are transforming healthcare by providing efficient, convenient nutrition solutions for diverse populations. With increased interest in personalized health, these supplements cater to individuals with specific nutritional needs, such as athletes optimizing performance and older adults managing age-related deficiencies. For example, protein-rich supplements support muscle recovery in fitness enthusiasts, while calcium-fortified products improve bone health in seniors. In the U.S., advancements in production have enhanced bioavailability, ensuring faster absorption of nutrients compared to traditional forms like pills. Their ease of consumption benefits those with swallowing difficulties, including patients in clinical care. Data from the National Health and Nutrition Examination Survey reveals that 57.6% of U.S. adults aged 20+ use dietary supplements, with higher usage among women (63.8%) and those aged 60+ (80.2%). This trend underscores the growing demand for liquid dietary supplements, offering convenient, age-inclusive nutrition solutions. Emerging trends highlight their role in promoting wellness, as consumers seek proactive health measures. As demand rises, innovations in flavor and formulation ensure these products not only address health requirements but also align with evolving consumer preferences for taste and convenience.

Asia Pacific Liquid Dietary Supplements Market Analysis

Asia-Pacific is embracing liquid dietary supplements as an essential component of modern health regimens, driven by rising consumer awareness and diverse applications. Elderly populations benefit from liquid formulations like calcium and vitamin D supplements, which address age-related bone density concerns effectively. As middle-class populations in countries like China, India, and Southeast Asia expand, the demand for liquid dietary supplements to address nutritional deficiencies and promote overall well-being is growing. In India, for instance, according to People Research on India's Consumer Economy, the middle class currently represents 31% of the population and is expected to reach 40% by 2031, further fueling this demand. This benefits liquid dietary supplements by fostering streamlined approvals and expanding market opportunities. Key advantages include convenience, as liquid supplements are easy to consume and ideal for individuals with swallowing difficulties. Enhanced bioavailability ensures faster nutrient absorption compared to traditional tablets, maximizing health benefits. Furthermore, the availability of a wide variety of products tailored to specific health needs caters to diverse demographics, fostering sustained market growth. These factors highlight the transformative role of liquid dietary supplements in improving health outcomes across the region.

Europe Liquid Dietary Supplements Market Analysis

The growing need for individualized nutrition and a greater emphasis on health and wellbeing are driving the market for liquid dietary supplements in Europe. Around 35.0% of EU citizens reported having a long-standing (chronic) health issue in 2023, according to the European Union. This is showing the need for easily accessible, efficient treatments, such as vitamins and supplements, to control and handle chronic illnesses and support general health. Customers are growing more conscious of the health advantages of liquid supplements, which are often considered to be quicker to absorb and simpler to digest than conventional pills or tablets. Clean-label supplements that support sustainability principles are becoming more and more popular, because of the movement toward natural and organic goods. Additionally, the increasing acceptance of liquid dietary supplements is being driven by the surge in preventive health practices and self-care, particularly among millennials and Generation Z. Access to these items are further increased by the expansion of online retail channels and the wider adoption of digital health solutions. With robust healthcare infrastructure and supportive regulatory frameworks ensuring product safety and efficacy, Europe is becoming a key market for liquid dietary supplements.

Latin America Liquid Dietary Supplements Market Analysis

Latin America is increasingly embracing liquid dietary supplements to address health challenges, providing efficient nutrient delivery for diverse needs. There is growing interest in preventive healthcare, particularly in countries like Brazil and Mexico, where rising healthcare costs are pushing consumers to turn to dietary supplements. Advantages such as easier access for patients who have problems swallowing regular pills, better bioavailability which makes sure that nutrients are absorbed in the body faster, and suitability for various age groups and types of diets are further increasing its acceptability. For example, a cross-sectional survey of 506 adults in Brasília, Brazil, reported that 68% of people used DS, and the most common ones were protein supplements (29%) and multivitamin-minerals (38%). These supplements are known to serve the growing health-conscious populations and meet regional demands for convenient, effective solutions. Their widespread use highlights the shift toward innovative, health-driven approaches across diverse demographics and economic sectors.

Middle East and Africa Liquid Dietary Supplements Market Analysis

Middle East and Africa are witnessing growing reliance on liquid dietary supplements, addressing nutritional deficiencies across diverse populations. These supplements provide rapid absorption, making them effective for individuals with digestive challenges or elderly users. For example, fortified vitamin blends combat widespread anemia, protein-enriched liquids support malnutrition recovery, and herbal extracts enhance immune health. According to cross-sectional study in Kuwait revealed a 68.24% prevalence of dietary supplement use, with significant associations to age, gender, and health conditions like asthma (OR=2.09) and digestive disorders (OR=3.22). These findings highlight the need for targeted interventions, regulations, and AE monitoring to enhance the safe use of liquid dietary supplements. Advantages include improved accessibility in remote areas, suitability for children and adults alike, and customizable formulations to meet regional dietary needs. This trend reflects a shift towards health-conscious lifestyles and practical nutrition solutions, fostering better well-being in communities across these regions.

Competitive Landscape:

The market's leading companies are aggressively enhancing their positions through expansion of the market, strategic alliances, and product innovation. To satisfy changing customer demands, companies are launching novel formulations that address certain health concerns, such as weight management, sports nutrition, and immunological support. Acquisitions and partnerships are also being sought in order to widen global reach and improve product offerings. For instance, businesses are spending money on research and development to improve the bioavailability and effectiveness of their liquid supplements so that customers are pleased and that the products are better absorbed. They are also making use of natural and organic ingredients to satisfy customer demands for transparency and health consciousness.

The report provides a comprehensive analysis of the competitive landscape in the liquid dietary supplements market with detailed profiles of all major companies, including:

- Abbott Laboratories

- Amway (Alticor Global Holdings Inc)

- Arkopharma

- BASF SE

- Bayer AG

- DuPont de Nemours Inc.

- Glanbia plc

- GlaxoSmithKline plc

- Koninklijke DSM

Latest News and Developments:

- July 2024: dsm-firmenich and Indena are advancing dietary supplement innovation through their strategic partnership, unveiled at Vitafoods Europe 2024. They integrate essential nutrients, biotics, and botanical extracts into user-friendly formats, targeting gut health, brain health, and healthy aging. Building on their collaboration since 2023, their combined expertise fosters next-generation solutions for human health.

- June 2024: Nestlé Health Science has launched a web platform offering liquid dietary supplements tailored for individuals managing their weight, particularly those using GLP-1 medications. The platform provides nutritional support for muscle preservation, gut health, micronutrient intake, hydration, and skin and hair health. It features products and expert resources designed to address specific health needs, including weight rebound management.

- May 2023: ChildLife Essentials launched a new organic liquid elderberry supplement aimed at supporting kids' immune health and promoting overall wellness. This powerful formula is specifically designed for children, providing a natural and effective way to bolster immune function during the peak of cold and flu season.

- May 2022: Vantage Nutrition acquired Philadelphia-based AquaCap, a company formerly owned by Nestlé Health Science. AquaCap specializes in the contract manufacturing of liquid-filled dietary supplement capsules, using its innovative liquid delivery technology to fill hard gelatin and vegetarian capsules with liquids, enhancing the bioavailability and ease of consumption of dietary supplements.

Liquid Dietary Supplements Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Ingredients Covered | Vitamins and Minerals, Botanical, Proteins and Amino Acids, Others |

| Applications Covered | Bone and Joint Health, Heart Health, Immune Health, Sports Nutrition, Weight Loss, Digestive Health, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Health and Beauty Retail Stores, Drug Stores, Online Stores |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Amway (Alticor Global Holdings Inc), Arkopharma, BASF SE, Bayer AG, DuPont de Nemours Inc., Glanbia plc, GlaxoSmithKline plc, Koninklijke DSM., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the liquid dietary supplements market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global liquid dietary supplements market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the liquid dietary supplements industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Liquid dietary supplements are nutritional products in liquid form that are designed to provide essential vitamins, minerals, and other nutrients. They are consumed to address dietary gaps, support specific health goals, or enhance overall wellness. Their easy absorption and suitability for varied age groups make them a popular choice.

The liquid dietary supplements market was valued at USD 29.2 Billion in 2024.

IMARC estimates the global liquid dietary supplements market to exhibit a CAGR of 6.9% during 2025-2033.

The global liquid dietary supplements market is driven by the increasing health consciousness, rising prevalence of chronic diseases, growing demand for convenient nutrition solutions, and rapid advancements in supplement formulations. Expanding e-commerce channels and the preference for natural, organic, and clean-label products further fuel the market growth.

In 2024, vitamins and minerals represented the largest segment by ingredient, as they are essential for addressing nutritional deficiencies and maintaining overall health.

Sports nutrition leads the market by application owing to the increasing focus on fitness and active lifestyles.

Supermarkets and hypermarkets are the leading segment by distribution channel, as they offer a convenient, one-stop shopping experience with a wide range of liquid dietary supplement options.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global liquid dietary supplements market include Abbott Laboratories, Amway (Alticor Global Holdings Inc), Arkopharma, BASF SE, Bayer AG, DuPont de Nemours Inc., Glanbia plc, GlaxoSmithKline plc, Koninklijke DSM., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)