Liquid Glucose Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition

Liquid Glucose Price Trend, Index and Forecast

Track the latest insights on liquid glucose price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

Liquid Glucose Prices Outlook Q4 2025

- USA: USD 653/Ton

- China: USD 535/Ton

- Germany: USD 611/Ton

- Indonesia: USD 537/Ton

- India: USD 522/Ton

Liquid Glucose Price Chart

Get real-time access to monthly/quarterly/yearly prices Request Sample

During the fourth quarter of 2025, the liquid glucose prices in the USA reached 653 USD/Ton in December. Prices edged upward as demand from confectionery, bakery products, and beverage manufacturing improved. Additionally, steady offtake from food processors supported procurement activity. Moreover, sourcing behavior reflected inventory replenishment aligned with stable downstream production schedules.

During the fourth quarter of 2025, the liquid glucose prices in China reached 535 USD/Ton in December. Prices declined as demand from food processing and fermentation-based industries softened. Furthermore, sufficient domestic availability reduced procurement urgency. In addition, sourcing volumes were adjusted to align with cautious inventory management and moderated downstream utilization.

During the fourth quarter of 2025, the liquid glucose prices in Germany reached 611 USD/Ton in December. Prices eased as consumption from confectionery, bakery, and processed food applications moderated. Additionally, comfortable inventory levels limited buying pressure. Moreover, procurement strategies emphasized inventory optimization and alignment with confirmed production requirements.

During the fourth quarter of 2025, the liquid glucose prices in Indonesia reached 537 USD/Ton in December. Prices moved lower as demand from food processing and beverage applications weakened. Furthermore, adequate supply availability reduced sourcing intensity. In addition, procurement behavior reflected cautious purchasing aligned with near-term operational needs.

During the fourth quarter of 2025, the liquid glucose prices in India reached 522 USD/Ton in December. Prices rose supported by demand from confectionery, pharmaceutical syrups, and processed food applications. Moreover, steady domestic consumption encouraged regular sourcing. Additionally, procurement activity reflected inventory planning aligned with ongoing downstream production cycles.

Liquid Glucose Prices Outlook Q3 2025

- USA: USD 642/Ton

- China: USD 550/Ton

- Germany: USD 624/Ton

- Indonesia: USD 554/Ton

- India: USD 510/Ton

During the third quarter of 2025, the liquid glucose prices in the USA reached 642 USD/Ton in September. Prices declined as demand from confectionery and beverage manufacturers softened. Additionally, food processors adjusted procurement volumes amid adequate domestic availability. Moreover, sourcing behavior reflected cautious inventory management and alignment with reduced short-term production requirements.

During the third quarter of 2025, the liquid glucose prices in China reached 550 USD/Ton in September. Prices edged lower due to weaker demand from food processing and fermentation-based industries. Furthermore, steady domestic production levels eased supply-side pressure. In addition, procurement strategies emphasized cost control and inventory optimization in response to moderated downstream consumption.

During the third quarter of 2025, the liquid glucose prices in Germany reached 624 USD/Ton in September. Prices moved downward as demand from bakery, confectionery, and processed food segments slowed. Additionally, comfortable stock levels reduced buying urgency among processors. Moreover, sourcing decisions were closely aligned with confirmed production schedules and inventory turnover considerations.

During the third quarter of 2025, the liquid glucose prices in Indonesia reached 554 USD/Ton in September. Prices rose as demand from food and beverage manufacturing strengthened. Furthermore, improved downstream utilization supported active procurement. In addition, sourcing volumes reflected inventory replenishment needs aligned with expanding production activity across food processing units.

During the third quarter of 2025, the liquid glucose prices in India reached 510 USD/Ton in September. Prices declined as demand from confectionery, pharmaceutical syrups, and processed food applications moderated. Moreover, sufficient domestic availability supported balanced supply conditions. Additionally, procurement behavior focused on short-cycle purchasing aligned with immediate operational needs.

Liquid Glucose Prices Outlook Q2 2025

- USA: USD 678/Ton

- China: USD 568/Ton

- Germany: USD 662/Ton

- Indonesia: USD 535/Ton

- India: USD 535/Ton

During the second quarter of 2025, the liquid glucose prices in the USA reached 678 USD/Ton in June. The production cost of liquid glucose in the US was subject to mild pressure during this period, primarily due to fluctuations in corn prices. Although the overall production costs did not experience extreme volatility, the softening of corn prices played a key role in lowering production margins. Corn, being a primary raw material for liquid glucose production, directly influenced the cost structure of production. Lower corn prices helped keep production costs stable or even reduced them, allowing producers to avoid major increases in liquid glucose prices. This soft cost environment helped prevent any upward pricing pressures across the market.

During the second quarter of 2025, the liquid glucose prices in China reached 568 USD/Ton in June. Chinese buyers, observing the subdued demand in neighboring markets, became cautious with their procurement strategies. The trend contributed to a sense of market caution in China, leading to conservative purchasing behaviors among downstream buyers. The need for immediate procurement was limited, as buyers had sufficient stock from previous inventories. The lack of significant seasonal triggers, especially after April, meant that industries in China were not inclined to make bulk purchases during May and June. This further contributed to the steady or flat pricing trends.

During the second quarter of 2025, liquid glucose prices in Germany reached 662 USD/Ton in June. Several factors influenced the price dynamics of liquid glucose in Germany, which were reflective of broader European market trends. The seasonal demand from the bakery and dairy sectors provided an initial uplift in April, but this was followed by a gradual softening in May and June. This shift was primarily driven by the normalization of weather patterns, which reduced the initial demand surge. In addition, growing macroeconomic uncertainty had a cooling effect on industrial demand, further contributing to the softening trend in liquid glucose prices during the latter part of the quarter.

During the second quarter of 2025, the liquid glucose prices in Indonesia reached 535 USD/Ton in June. As per the liquid glucose price chart, the market experienced a subtle bearish price trend, largely attributed to several factors within the local and global market environment. A key driver was the relatively muted demand from critical sectors such as food, beverage, and nutraceuticals. These industries, which are typically large consumers of liquid glucose, were operating on a need-only basis, purchasing only what was necessary for their immediate production needs. This cautious approach, particularly from food and beverage companies, limited the overall demand for liquid glucose, contributing to a softer pricing environment.

During the second quarter of 2025, the liquid glucose prices in India reached 535 USD/Ton in June. Prices rose in April on the back of warmer weather and stronger demand from beverage and dessert manufacturers. Seasonal consumption, along with favorable currency exchange rates encouraging bulk purchases, tightened immediate supply. This short-lived rally was the only notable upswing in the quarter. Besides, from May, the market turned softer. International maize prices fell, lowering production costs for Indian manufacturers. Without a feedstock cost push, mills had less reason to maintain higher price offers.

Liquid Glucose Prices Outlook Q1 2025

- USA: USD 638/Ton

- China: USD 563/Ton

- Germany: USD 667/Ton

- South Korea: USD 622/Ton

- India: USD 533/Ton

During the first quarter of 2025, the liquid glucose prices in the USA reached 638 USD/Ton in March. As per the liquid glucose price chart, due to erratic supply chains and changes in commerce, prices fluctuated significantly. Prices were raised by the haste to stockpile ahead of tariff changes in January, which was made worse by rising energy and congested ports. March saw small hikes once more as fresh buying was sparked by modest confidence and increased trade fears.

During the first quarter of 2025, liquid glucose prices in China reached 563 USD/Ton in March. The market experienced erratic fluctuations due to changes in domestic demand as well as supply influences from overseas. Manufacturers stocked up in anticipation of slowdowns over the Lunar New Year, which bolstered industrial buying early in the year.

During the first quarter of 2025, the liquid glucose prices in Germany reached 667 USD/Ton in March. The increase in January occurred as food producers became more optimistic, which led to restocking ahead of any delays. By February, a robust Euro and a surge in demand from India drove down prices, aided by easier shipping.

During the first quarter of 2025, the liquid glucose prices in South Korea reached 622 USD/Ton in March. Prices hiked in January as processors stocked their shelves in anticipation of the holidays. Moreover, with minor cost increases as traders prepared for any changes in tariffs or delays in logistics, March witnessed a modest buying comeback.

During the first quarter of 2025, the liquid glucose prices in India reached 533 USD/Ton in March. India's output of liquid glucose contributed to stabilizing worldwide availability. In response to growing worldwide orders, domestic processors increased their output, particularly while foreign customers prepared for supply shortages abroad. Stable consumption was further supported by local demand, which remained strong during holiday periods.

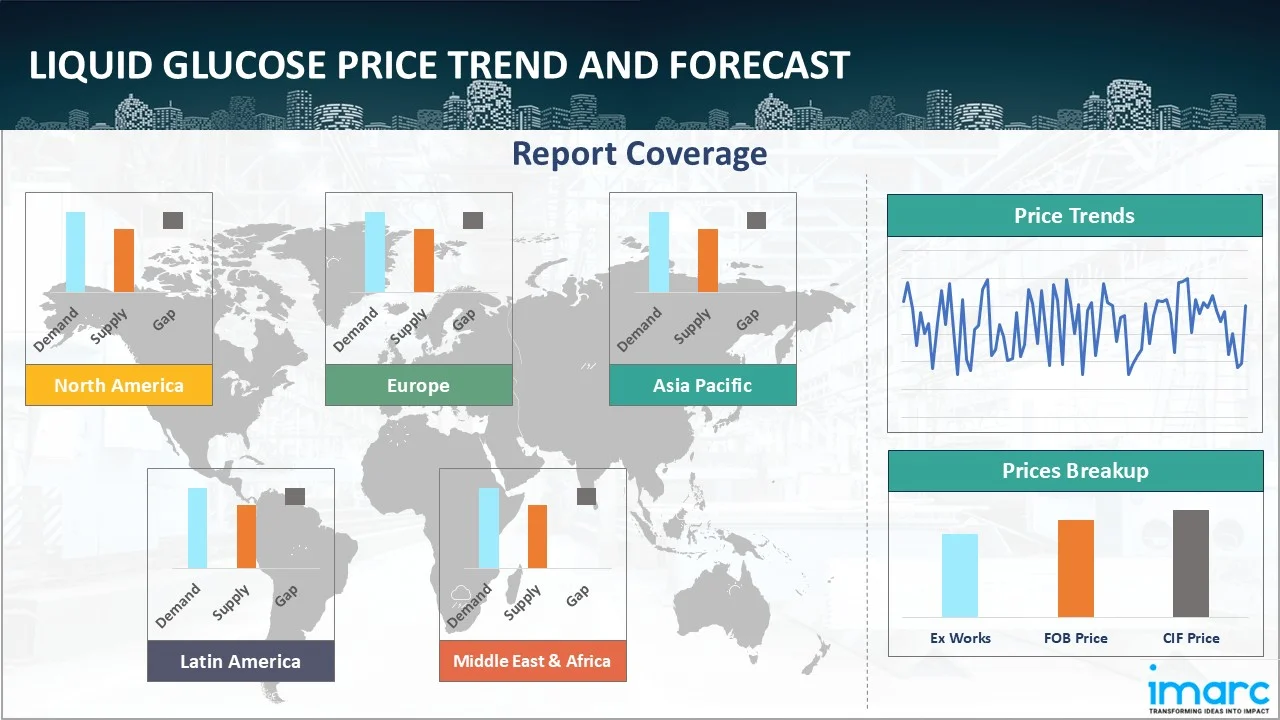

Regional Coverage

The report provides a detailed analysis of the market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of FOB and CIF prices, as well as the key factors influencing the liquid glucose prices.

Europe Liquid Glucose Price Trend

Q4 2025:

As per the liquid glucose price index, prices across Europe weakened, influenced by moderated demand from confectionery, bakery, and processed food manufacturing. Additionally, reduced procurement from downstream food processors tempered buying intensity across key consuming hubs. Moreover, sourcing strategies emphasized inventory discipline, logistics coordination, and alignment with confirmed production schedules, with buyers relying more on existing stocks amid subdued downstream utilization. Regulatory compliance and quality requirements continued to shape procurement decisions, particularly for food-grade applications.

Q3 2025:

Prices across Europe declined, driven by reduced demand from confectionery, bakery, and processed food manufacturing. Additionally, lower procurement activity from downstream food processors weighed on buying interest, as manufacturers adjusted production rates. Moreover, sufficient availability across regional supply chains allowed buyers to operate with restrained sourcing strategies, focusing on inventory turnover and aligning purchases closely with confirmed processing schedules rather than expanding stock position.

Q2 2025:

In Q2 2025, the pricing of liquid glucose in Europe experienced a range of fluctuations, largely driven by seasonal trends, supply dynamics, and macroeconomic conditions. Initially, the demand from the bakery and dairy sectors saw a significant seasonal uptick in April. This demand surge, however, was short-lived. As the weather stabilized and macroeconomic uncertainty crept back into the picture, demand from these sectors softened through May and June. This cooling of demand, paired with the return of more typical weather patterns, dampened the momentum that had built up earlier in the quarter. On the production side, the situation was more favorable for European starch processors. The lower cost of maize and wheat, in line with global agricultural trends, allowed for reduced production costs of liquid glucose. This price reduction at the source made it easier for producers to maintain competitive pricing, particularly within the domestic market.

Q1 2025:

As per the liquid glucose price index, prices in Europe showed erratic trends. January saw consistent gains as businesses stored up to protect against supply disruptions and favorable economic signs rekindled demand for food and beverages. Stress returned in March as major ports had labor shortages and delays, which reduced supplies and forced new purchases. By the end of March, demand for food and drink improved, which helped to sustain a modest price increase throughout the spring.

This analysis can be extended to include detailed liquid glucose price information for a comprehensive list of countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America Liquid Glucose Price Trend

Q4 2025:

As per the liquid glucose price index, prices in North America strengthened, supported by demand from confectionery manufacturers, beverage producers, and processed food applications. Furthermore, steady downstream utilization encouraged consistent procurement activity across food processing clusters. In addition, sourcing strategies emphasized supply continuity, contract adherence, and inventory planning aligned with production visibility and seasonal consumption patterns across retail and institutional channels.

Q3 2025:

Prices in North America declined, reflecting softer demand from confectionery producers, beverage manufacturers, and processed food applications. Furthermore, reduced procurement from food processors coincided with adequate domestic supply availability, limiting buying urgency. In addition, sourcing strategies emphasized short-cycle purchasing, inventory optimization, and alignment with moderated downstream utilization across food and beverage manufacturing clusters.

Q2 2025:

As per the liquid glucose price index, the market in North America exhibited a state of balance, characterized by stable supply and demand dynamics. Demand from the food and beverage sector was steady but lacked significant growth, which contributed to a moderate level of transaction activity. The market’s equilibrium was maintained throughout the quarter, ensuring that there were no major disruptions in either supply or demand. One of the key drivers of the market during this period was the trend in liquid glucose production costs. In the US, production costs were under mild pressure primarily due to fluctuations in corn prices. While these fluctuations did not cause significant volatility, the softness in corn prices played a role in stabilizing production margins at lower levels. Since corn is a primary raw material for liquid glucose production, its cost directly influences the price of the final product. The reduction in corn prices helped keep the production costs lower than expected, but without triggering a significant drop in prices across the board.

Q1 2025:

Due to erratic supply networks, fluctuating demand, and evolving trade policies, liquid glucose rates fluctuated wildly throughout the United States. Rising energy prices and crowded ports like Los Angeles further pushed costs upward in early January as customers stored up ahead of potential tariff changes and shipping delays. Demand also declined as a result of remaining stocks and cautious consumer sentiment, which pushed prices down. As purchasers prepared for further trade actions and a slight recovery in inflation, which pushed rates back up, procurement increased by March.

Specific liquid glucose prices and historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa Liquid Glucose Price Trend

Q4 2025:

As per liquid glucose price chart, the prices in the Middle East and Africa fluctuated due to a complex interplay of factors, primarily driven by supply chain disruptions, seasonal demand shifts, and geopolitical influences.

Q3 2025:

The report explores the liquid glucose pricing trends and liquid glucose price chart in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

In addition to region-wise data, information on liquid glucose prices for countries can also be provided.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific Liquid Glucose Price Trend

Q4 2025:

Across Asia Pacific, liquid glucose prices reflected mixed conditions as demand trends varied across key consuming markets. Furthermore, procurement behavior differed based on domestic production availability, downstream food processing activity, and beverage manufacturing output. In addition, sourcing strategies emphasized inventory visibility, cost management, and alignment with localized consumption patterns across diverse markets with varying supply structures.

Q3 2025:

In Asia Pacific, liquid glucose prices reflected mixed conditions as demand trends diverged across regional markets. On one hand, stronger buying interest supported prices in parts of the region where food and beverage production remained active, while on the other, reduced consumption in several markets led to restrained procurement. Furthermore, sourcing strategies varied, with buyers balancing inventory coverage, cost management, and alignment with localized production schedules rather than following a uniform regional pattern.

Q2 2025:

In Q2 2025, the market in the Asia Pacific region, particularly in Indonesia, experienced a relatively subdued performance. The spot price showed a slight bearish trend, largely driven by weak demand from key sectors such as food, beverage, and nutraceutical industries. These sectors operated on a need-only basis, limiting their offtake. This cautious procurement behavior was largely influenced by the absence of seasonal demand triggers, such as festivals or major consumption periods. As a result, the market lacked the usual upward pressure that typically accompanies periods of high demand, leading to a moderation in prices. The demand outlook for liquid glucose remained conservative during this period, with downstream buyers heavily relying on inventories built up earlier in the year. This conservative approach also meant that market activity was relatively muted, with fewer transactions taking place, reinforcing the price softness.

Q1 2025:

The market for liquid glucose in Indonesia fluctuated due to strong demand from the food, beverage, and pharmaceutical sectors, as well as decreased inflation and a supportive monetary policy stance. By February, the Rupiah's decline against the dollar, which escalated the cost of imports, was exacerbated by falling purchasing and concerns about international trade. The cheaper supply from India also increased the strain.

This liquid glucose price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America Liquid Glucose Price Trend

Q4 2025:

Latin America's liquid glucose market is predominantly influenced by its rich natural reserves, particularly in countries like Chile and Brazil. However, political instability and inconsistent regulatory frameworks can lead to significant volatility in liquid glucose prices.

Q3 2025:

Infrastructure challenges and logistical inefficiencies often impact the supply chain, affecting Latin America’s ability to meet international demand consistently. Moreover, the liquid glucose price index, economic fluctuations, and currency devaluation are critical factors that need to be considered when analyzing liquid glucose pricing trends in this region.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin American countries. |

Liquid Glucose Pricing Report, Market Analysis, and News

IMARC's latest publication, “Liquid Glucose Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition,” presents a detailed examination of the liquid glucose market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of liquid glucose at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed liquid glucose prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting liquid glucose pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Liquid Glucose Industry Analysis

The global liquid glucose industry size reached USD 40.18 Billion in 2025. By 2034, IMARC Group expects the market to reach USD 65.44 Billion, at a projected CAGR of 5.57% during 2026-2034. Market growth is driven by rising demand from confectionery and bakery products, expanding use in beverages and processed foods, increasing application in pharmaceutical syrups, growing food processing capacity across emerging markets, and sustained consumer demand for sweeteners in packaged food products.

Latest News and Developments:

- January 2025: Researchers from Indonesia developed an optimized enzymatic process for producing glucose syrup (liquid glucose) from purple sweet potato by examining the effects of α-amylase and amyloglucosidase enzyme concentrations on saccharification. Their findings show that adjusting enzyme levels could increase yield and improve sugar-solution characteristics, offering potential for more efficient and diversified production of liquid glucose from non-corn starch sources.

Product Description

Liquid glucose, also known as glucose syrup, is a clear, viscous, and concentrated aqueous solution of glucose derived from the hydrolysis of starch, typically obtained from corn, wheat, rice, or potatoes. It contains varying proportions of glucose, maltose, and other polysaccharides, depending on the degree of hydrolysis and the process used. This syrup is commonly used as a sweetener, humectant, and thickening agent in a wide range of food and industrial applications.

In the food industry, liquid glucose is valued for its ability to prevent crystallization of sugar, improve texture, and enhance shelf life. It is extensively used in confectionery, bakery products, ice creams, jams, canned fruits, and soft drinks. It adds a smooth texture and helps retain moisture, making products more appealing and long-lasting.

Apart from food, liquid glucose also finds utility in pharmaceuticals, where it acts as a carrier and stabilizer in syrups and oral formulations. It is also used in the production of vitamins, antibiotics, and fermentation processes.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Liquid Glucose |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Liquid Glucose Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of liquid glucose pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting liquid glucose price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The liquid glucose price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)