Liver Disease Treatment Market Size, Share, Trends and Forecast by Treatment Type, Disease Type, End User, and Region, 2025-2033

Global Liver Disease Treatment Market:

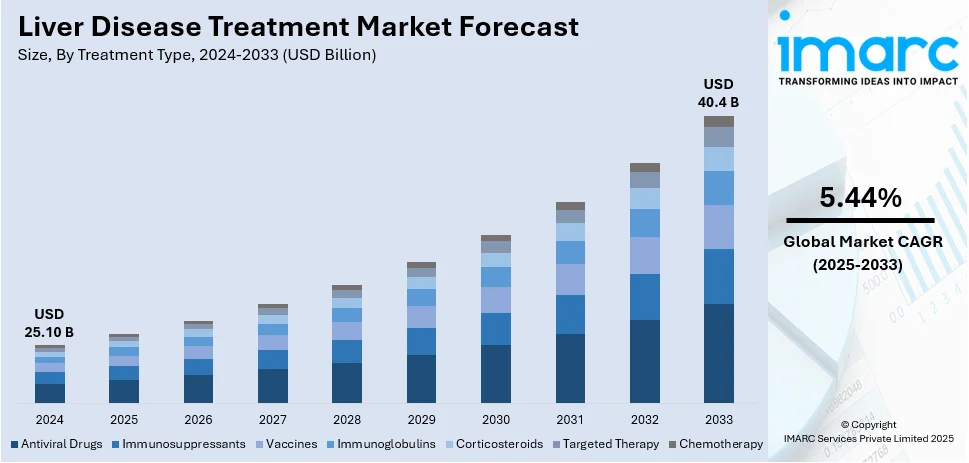

The global liver disease treatment market size was valued at USD 25.10 Billion in 2024. The market is projected to reach USD 40.4 Billion by 2033, exhibiting a CAGR of 5.44% from 2025-2033. North America currently dominates the market, holding a market share of 38.6% in 2024. The growing elderly population worldwide, which is prone to several chronic illnesses, including liver disease, is positively influencing the market. Besides this, rising emphasis on pharmaceutical expansion and ongoing technological advancements are propelling the liver disease treatment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 25.10 Billion |

|

Market Forecast in 2033

|

USD 40.4 Billion |

| Market Growth Rate 2025-2033 | 5.44% |

Liver Disease Treatment Market Analysis:

- Major Market Drivers: The fluctuating dietary habits and physical inactivity are propelling the market.

- Key Market Trends: The improving research and development activities, major growth in the healthcare industry, and the adoption of numerous government programs to promote public health are a few factors contributing to the liver disease treatment market growth.

- Competitive Landscape: Some of the major market companies include Abbott Laboratories, AbbVie Inc., Astellas Pharma Inc., Bristol-Myers Squibb Company, Eli Lilly and Company, Emergent BioSolutions Inc., F. Hoffmann-La Roche AG, Gilead Sciences Inc., GlaxoSmithKline plc, Merck & Co. Inc., Novartis AG, Pfizer Inc., Sanofi S.A., Takeda Pharmaceutical Company Limited, and Viatris Inc., among many others.

- Geographical Trends: North America is currently dominating the market as a result of a rise in liver disorders, such as non-alcoholic fatty liver disease (NAFLD) and hepatitis, especially considering an upsurge in obesity and diabetes rates, which are major risk factors for liver conditions.

- Challenges and Opportunities: The high cost of advanced therapies, which limits patient access, is hampering the market. However, increasing government financing, enhancing insurance coverage, and encouraging research into more affordable treatment options will continue to catalyze the market over the forecast period.

To get more information on this market, Request Sample

The market is driven by the rising prevalence of conditions, such as hepatitis, fatty liver disease, cirrhosis, and liver cancer, fueled by changing lifestyles, alcohol consumption, and increasing obesity rates. Heightened consciousness about early detection and accessibility of advanced treatment alternatives is catalyzing the demand. The development of innovative drugs, targeted therapies, and minimally invasive surgical procedures is expanding the treatment landscape. Supportive government initiatives, improved healthcare infrastructure, and wider availability of medical insurance policies are encouraging more patients to seek treatment. Additionally, an increase in liver transplants and advancements in immunosuppressive therapies are improving patient outcomes.

The United States has emerged as a major region in the liver disease treatment market owing to many factors. The high prevalence of chronic liver conditions, such as hepatitis C, non-alcoholic fatty liver disease (NAFLD), and alcohol-related liver disorders, is offering a favorable liver disease treatment market outlook. Increasing obesity rates and sedentary lifestyles are contributing to NAFLD growth, while aging population is facing higher risks of liver complications. As per the data from Cosmos, the percentage of obesity among US adults rose by 13.6% from 2010 to 2024. Strong healthcare infrastructure, widespread insurance coverage, and advanced diagnostic facilities are enabling early detection and treatment adoption. Significant research and development (R&D) investments, especially in targeted therapies and antiviral drugs, are enhancing treatment effectiveness.

Liver Disease Treatment Market Trends:

Increased Focus on NAFLD

With the rise of obesity and diabetes, NAFLD has become a primary focus in liver disease treatment. For instance, the International Diabetes Federation (IDF) Diabetes Atlas (2025) indicated that 11.1%, or 1 in 9 adults (20-79 years), were affected by diabetes, with more than 4 in 10 unaware about their diagnosis. NAFLD, often asymptomatic in its early stages, can progress to severe complications, driving a strong demand for effective interventions. Healthcare systems are integrating advanced imaging techniques, biomarkers, and screening programs to detect the condition sooner. Pharmaceutical firms are prioritizing clinical trials for novel therapeutics, while healthcare providers are emphasizing personalized treatment approaches, including dietary guidance and lifestyle modification support. Public health initiatives are also generating awareness about NAFLD risks, leading to increased patient engagement and treatment uptake.

Growing Emphasis on Pharmaceutical Expansion

Rising emphasis on pharmaceutical expansion is impelling the liver disease treatment market growth by accelerating innovations, improving drug availability, and broadening treatment options globally. Pharmaceutical companies are rapidly investing in the discovery of new medications to treat liver illnesses. For instance, in February 2024, Zydus Lifesciences, a pharmaceutical firm based in India, declared its intention to introduce its inaugural new drug in the United States by early 2026, aiming to enter the multi-billion-dollar market for treating a specific type of liver disease. Companies are increasing R&D budgets, forming strategic collaborations, and acquiring smaller biotech firms to gain access to advanced therapies and novel drug candidates. This expansion also involves scaling up manufacturing capabilities to meet rising demand and improving distribution networks to reach underserved regions. Regulatory agencies are streamlining approval processes for breakthrough therapies, enabling faster market entry.

Rising Demand for Liver Transplants

Escalating demand for liver transplants is among the major liver disease treatment market trends. As liver disease is advancing to end-stage liver failure in many people, the demand for liver transplants is growing. Transplants are becoming more accessible owing to technological advancements, such as minimally invasive methods and enhanced post-operative care. Government agencies and private healthcare providers are investing in infrastructure and financial assistance programs to make transplants more accessible. In May 2024, Wockhardt Hospitals, together with the South Asian Liver Institute, initiated an early recovery program (ERP) for liver transplants in Mumbai. The initiative sought to lessen the financial impact of liver transplants by around 20-30%. Rising awareness about transplant success rates and improved donor matching technologies are encouraging more patients to opt for this procedure. Enhanced organ preservation methods and better immunosuppressive drugs are refining patient survival and recovery outcomes, further boosting acceptance.

Liver Disease Treatment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global liver disease treatment market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on treatment type, disease type, and end user.

Analysis by Treatment Type:

- Antiviral Drugs

- Immunosuppressants

- Vaccines

- Immunoglobulins

- Corticosteroids

- Targeted Therapy

- Chemotherapy

Antiviral drugs held 39.8% of the market share in 2024. They are gaining popularity due to their critical role in managing viral hepatitis, particularly hepatitis B and C, which are among the most common causes of liver disorders worldwide. These drugs effectively reduce viral load, slow disease progression, and lower the risk of severe complications, such as cirrhosis and liver cancer. The availability of highly potent and well-tolerated direct-acting antivirals (DAAs) has revolutionized hepatitis C treatment, offering high cure rates with shorter treatment durations. In addition, the ongoing R&D activities have resulted in improved formulations with fewer side effects, boosting patient compliance. Widespread screening programs and increased awareness about early detection of viral hepatitis have also supported the dominance of antiviral drugs. Furthermore, government initiatives, global health campaigns, and inclusion of antivirals in reimbursement schemes have expanded patient access. Their proven efficacy, strong clinical guidelines, and large target patient population firmly position antiviral drugs as the leading treatment type in the market.

Analysis by Disease Type:

- Hepatitis

- Autoimmune Diseases

- Non-alcoholic Fatty Liver Disease (NAFLD)

- Cancer

- Genetic Disorders

- Others

Hepatitis accounts for the largest market share. It represents one of the most prevalent and widely diagnosed liver conditions globally, spread primarily by hepatitis viruses A, B, C, D, and E. Chronic hepatitis B and C cause significant issues to public health, affecting millions and significantly increasing the risk of cirrhosis, liver failure, and hepatocellular carcinoma. The high disease burden is driving substantial demand for diagnostic services, antiviral drugs, and ongoing patient monitoring. Advancements in DAAs and other targeted therapies have transformed treatment outcomes, particularly for hepatitis C, with high cure rates and improved safety profiles. Government-led vaccination programs for hepatitis B and awareness campaigns for early detection have also expanded diagnosis rates and treatment adoption. Additionally, global health initiatives and inclusion of hepatitis management in national healthcare priorities ensure strong funding and access to therapies. The combination of high prevalence, severe health risks, and effective treatment options positions hepatitis as the dominant segment in the market.

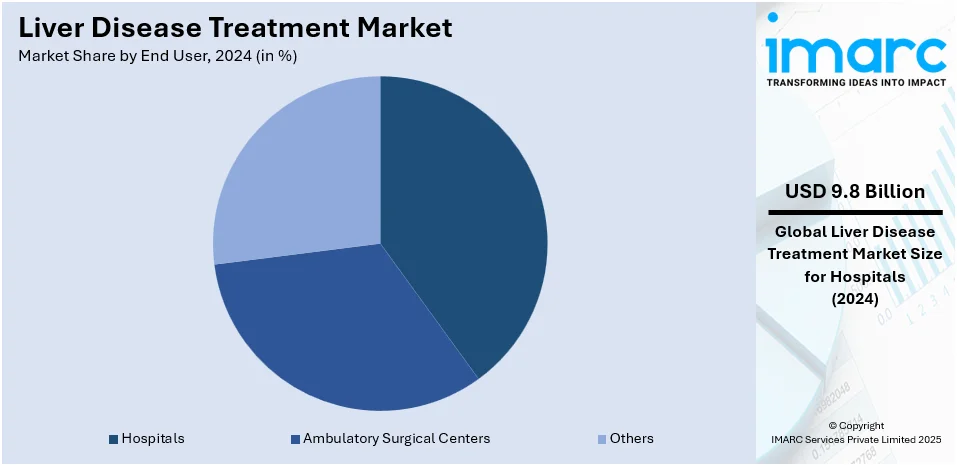

Analysis by End User:

- Hospitals

- Ambulatory Surgical Centers

- Others

Hospitals hold 38.9% of the market share. They offer comprehensive facilities for diagnosis, advanced treatment, and post-treatment care, making them the primary choice for managing complex liver conditions. Liver diseases, such as hepatitis, cirrhosis, fatty liver disease, and liver cancer, often require multidisciplinary care involving hepatologists, gastroenterologists, radiologists, and surgeons, which hospitals are best equipped to provide. They have access to advanced imaging technologies, laboratory testing, and surgical infrastructure, including liver transplantation units, which are critical for severe cases. Hospitals also ensure immediate access to emergency care for acute liver failure and complications. Moreover, government and private healthcare investments in hospital infrastructure, along with improved reimbursement policies, are enhancing treatment accessibility and patient trust. As per the liver disease treatment market forecast, the capacity of hospitals to handle both inpatient and outpatient services will continue to strengthen their dominance in the segment.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for a share of 38.6%, enjoys the leading position in the market. The area is recognized for its developed healthcare facilities, substantial healthcare spending, and significant presence of prominent pharmaceutical and biotechnology companies. The region has a high prevalence of liver disorders, such as NAFLD, hepatitis, and liver cancer, which is driving strong demand for effective treatments. As per the projections of Liver Canada, in 2024, there were set to be around 4700 new instances of liver and intrahepatic bile duct cancer in Canada. Robust R&D activities, supported by significant funding from both government and private sectors, are fostering innovations in novel therapies, including targeted drugs, biologics, and regenerative solutions. In addition, the widespread adoption of advanced diagnostic tools, the availability of skilled healthcare professionals, and strong awareness programs are contributing to early detection and treatment.

Key Regional Takeaways:

United States Liver Disease Treatment Market Analysis

The United States holds 88.70% of the market share in North America. The United States is witnessing increased liver disease treatment adoption primarily due to the rising burden of chronic illnesses. Conditions, such as obesity, type 2 diabetes, and hypertension, are escalating, directly contributing to the development of liver disorders like NAFLD and cirrhosis. For instance, almost 75% of adults in the US were classified as overweight or obese, based on a 2024 study. The demand for advanced therapeutics and diagnostics is expanding, as patients are seeking timely intervention and disease management. This trend is further supported by heightened awareness campaigns, improved healthcare access, and the emphasis on early detection. Moreover, medical advancements in liver-related therapies are encouraging the use of proactive treatment approaches. Pharmaceutical investments and clinical trials are also bolstering innovations in liver treatment. The continuous rise in chronic illnesses ensures steady growth in treatment requirements, highlighting a strong healthcare focus on combating liver-related complications.

Europe Liver Disease Treatment Market Analysis

Europe is witnessing steady growth in liver disease treatment adoption due to a rapidly expanding geriatric population. According to the WHO, the demographic of individuals aged 60 and above increased in the WHO European Region. In 2021, the number was 215 Million. By 2030, it is expected to reach 247 Million and by 2050, it will surpass 300 Million. Aging individuals are increasingly vulnerable to liver conditions, such as fibrosis, hepatitis, and cirrhosis, as age-related metabolic changes heighten susceptibility. The regional healthcare system is evolving to meet the specific needs of older patients, incorporating specialized diagnostics, monitoring, and therapeutic approaches. Government-supported healthcare programs are enabling better access to treatment for elderly individuals affected by liver dysfunction. Medical technology tailored for geriatric care, including minimally invasive procedures and personalized medication regimens, is also playing a key role.

Asia-Pacific Liver Disease Treatment Market Analysis

The Asia-Pacific region is experiencing market expansion, driven by the growing demand for liver transplants. For instance, as of March 2025, in India, the success rate for liver transplants was 85% within one year and 75% after five years. An increasing incidence of liver failure and end-stage liver disease is resulting in heightened transplant requirements across the region. Lifestyle changes, viral hepatitis prevalence, and alcohol-related liver damage are contributing significantly to this need. The medical infrastructure is expanding, and transplant procedures are becoming more accessible and technologically advanced. Improvements in donor management and transplantation techniques are making treatment more effective and widely available. Public and private sectors are collaborating to enhance transplant centers and organ donation networks. Additionally, awareness programs around transplantation and liver health are influencing patient decisions.

Latin America Liver Disease Treatment Market Analysis

In Latin America, the market is seeing a notable rise in liver disease treatment adoption due to increasing cases of liver cancer and genetic disorders. For instance, in Brazil, the anticipated cancer prevalence for the 2023–2025 period was 704,000 new cases. These health challenges are contributing significantly to liver complications requiring ongoing medical intervention. Genetic predispositions and liver-related malignancies are catalyzing greater demand for diagnostics, therapies, and disease management programs across the region.

Middle East and Africa Liver Disease Treatment Market Analysis

The Middle East and Africa region is experiencing the growth of the market, fueled by expanding healthcare facilities. For instance, in 2025, the UAE hosted more than 150 hospitals and contained over 5,000 healthcare facilities. New hospitals, clinics, and specialized care centers are being established, offering improved access to diagnostic tools and therapeutic services. Infrastructure development is enabling earlier detection and intervention, promoting better liver health outcomes for patients across diverse populations.

Competitive Landscape:

Key players are investing heavily in R&D activities to introduce advanced drugs, biologics, and innovative therapies targeting various liver disorders. They are focusing on developing more effective, safer, and targeted treatment options, including antivirals, immunotherapies, and regenerative solutions. Strategic collaborations with research institutes, biotechnology firms, and healthcare providers are accelerating drug discovery and clinical trials. These companies also engage in mergers, acquisitions, and licensing agreements to expand product portfolios and geographic reach. By launching awareness programs, patient support initiatives, and affordable treatment schemes, they are enhancing access to care. Furthermore, their continuous investments in technology, including AI-based drug discovery and precision medicine, help address unmet medical needs and improve patient outcomes in liver disease management. For instance, in April 2025, the US FDA granted approval for Opdivo® in combination with Yervoy® as a first-line therapy for liver disease in cases of unresectable or metastatic hepatocellular carcinoma, based on Phase 3 CheckMate-9DW trial findings demonstrating improved overall survival compared to lenvatinib or sorafenib. In the study, 38% of patients treated with the immunotherapy combination survived at three years, while 24% were alive in the comparison group.

The report provides a comprehensive analysis of the competitive landscape in the liver disease treatment market with detailed profiles of all major companies, including:

- Abbott Laboratories

- AbbVie Inc.

- Astellas Pharma Inc.

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Emergent BioSolutions Inc.

- F. Hoffmann-La Roche AG

- Gilead Sciences Inc.

- GlaxoSmithKline plc

- Merck & Co. Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited

- Viatris Inc.

Latest News and Developments:

- July 2025: Apollo Proton Cancer Centre opened an advanced liver cancer clinic in Chennai to standardize treatment for liver diseases, pursue research, and investigate new therapies. The initiative addressed the growing liver cancer challenge in India, especially in Tamil Nadu, where hepatocellular carcinoma and liver metastases related to liver diseases were on the rise.

- May 2025: Altimmune commenced the RESTORE Phase 2 trial in July 2025 to assess the effectiveness and safety of pemvidutide for treating liver disease in alcohol-associated liver disease (ALD), registering the first patient at 34 locations. The experimental GLP-1/glucagon dual receptor agonist demonstrated encouraging reductions in liver fat and fibrosis in previous trials, reinforcing hopes for efficacy in fulfilling unmet needs in ALD treatment.

- May 2025: GSK purchased efimosfermin, a treatment for liver disease that was ready for phase III, from Boston Pharmaceuticals for USD 1.2 Billion to tackle steatotic liver disease (SLD), which encompassed MASH and ALD. The purchase greatly broadened GSK’s hepatology pipeline, targeting the reversal of liver fibrosis and possibly setting a new benchmark for liver disease treatment, with an anticipated initial launch in 2029.

Liver Disease Treatment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Treatment Types Covered | Antiviral Drugs, Immunosuppressants, Vaccines, Immunoglobulins, Corticosteroids, Targeted Therapy, Chemotherapy |

| Disease Types Covered | Hepatitis, Autoimmune Diseases, Non-alcoholic Fatty Liver Disease (NAFLD), Cancer, Genetic Disorders, Others |

| End Users Covered | Hospitals, Ambulatory Surgical Centers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, AbbVie Inc., Astellas Pharma Inc., Bristol-Myers Squibb Company, Eli Lilly and Company, Emergent BioSolutions Inc., F. Hoffmann-La Roche AG, Gilead Sciences Inc., GlaxoSmithKline plc, Merck & Co. Inc., Novartis AG, Pfizer Inc., Sanofi S.A., Takeda Pharmaceutical Company Limited, Viatris Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the liver disease treatment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global liver disease treatment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution.It helps stakeholders to analyze the level of competition within the liver disease treatment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The liver disease treatment market was valued at USD 25.10 Billion in 2024.

The liver disease treatment market is projected to exhibit a CAGR of 5.44% during 2025-2033, reaching a value of USD 40.4 Billion by 2033.

The market is driven by the rising prevalence of conditions, such as hepatitis, cirrhosis, and liver cancer, fueled by lifestyle changes, alcohol consumption, and obesity rates. Increasing awareness about early diagnosis, coupled with improved access to healthcare services, is supporting the market growth. Advancements in pharmaceuticals, biologics, and minimally invasive procedures are enhancing treatment efficacy and patient outcomes.

North America currently dominates the liver disease treatment market, accounting for a share of 38.6% in 2024, due to advanced healthcare infrastructure, high disease prevalence, and strong R&D investments. The presence of leading pharma companies and favorable regulatory frameworks are offering a favorable market outlook.

Some of the major players in the liver disease treatment market include Abbott Laboratories, AbbVie Inc., Astellas Pharma Inc., Bristol-Myers Squibb Company, Eli Lilly and Company, Emergent BioSolutions Inc., F. Hoffmann-La Roche AG, Gilead Sciences Inc., GlaxoSmithKline plc, Merck & Co. Inc., Novartis AG, Pfizer Inc., Sanofi S.A., Takeda Pharmaceutical Company Limited, Viatris Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)