Loan Servicing Software Market Size, Share, Trends and Forecast by Component, Deployment Mode, Enterprise Size, End User, and Region, 2026-2034

Loan Servicing Software Market Size and Share:

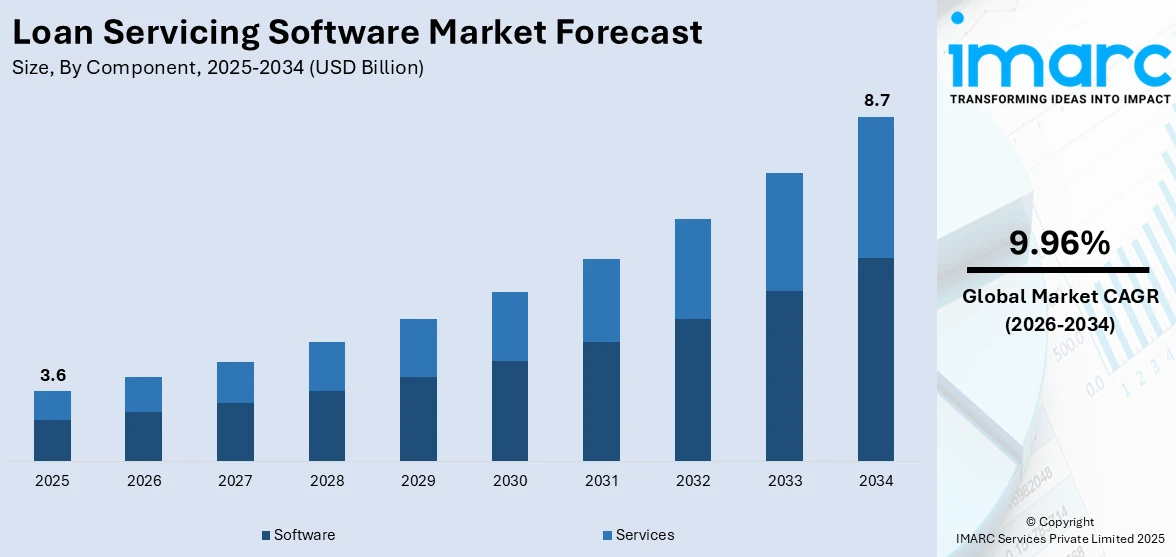

The global loan servicing software market size was valued at USD 3.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 8.7 Billion by 2034, exhibiting a CAGR of 9.96% during 2026-2034. North America currently dominates the market, holding a significant market share of 40.2% in 2025. This leadership is driven by strong digital infrastructure, widespread use of advanced financial technologies, and high investment in fintech innovation. The region's established banking ecosystem and regulatory focus further support the enhancing loan servicing software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 3.6 Billion |

|

Market Forecast in 2034

|

USD 8.7 Billion |

| Market Growth Rate 2026-2034 | 9.96% |

The market is witnessing growth due to increasing demand for integrated platforms that support multiple loan types and workflows. The rise in cross-border lending, coupled with the need for real-time portfolio tracking, has prompted financial institutions to adopt advanced solutions. Enhanced cybersecurity measures within modern software platforms are also influencing adoption, particularly in sectors managing sensitive borrower information. Additionally, growing reliance on APIs for system interoperability, coupled with the shift toward subscription-based pricing models, is reshaping vendor-client relationships. As financial organizations focus on reducing turnaround times and improving audit readiness, the requirement for robust, adaptable servicing platforms continues to increase.

To get more information on this market Request Sample

The United States loan servicing software market growth is expanding due to the rising complexity of loan products and the corresponding need for customizable servicing tools. Increased activity in secondary mortgage markets has driven demand for software capable of handling asset-backed securities and investor reporting. For instance, in March 2025, Rocket Mortgage acquired Mr. Cooper in a USD 9.4 Billion all-stock deal. The merger will create a lending giant servicing one in every six U.S. mortgages and adding nearly 7 million customers. The deal aims to increase loan volumes, reduce customer acquisition costs, and deliver an end-to-end digital homeownership experience. After the merger, Rocket shareholders will control 75% of the company. This consolidation responds to a sluggish housing market marked by high mortgage rates and affordability challenges. Integration of AI and analytics into servicing platforms enables improved borrower risk assessment and predictive servicing strategies. Additionally, heightened consumer expectations for transparency and digital self-service tools are pressuring lenders to modernize legacy systems. Federal oversight and evolving data governance requirements further necessitate reliable compliance features, prompting financial institutions to invest in software with real-time regulatory update capabilities and automated reporting functions.

Loan Servicing Software Market Trends:

Rising Adoption in BFSI and SME Sectors

The growing use of loan servicing software in the banking, financial services, and insurance (BFSI) sector is a key market driver. Institutions are leveraging these platforms to simplify loan management, enhance transparency, and improve borrower engagement by offering easy access to loan details and flexible payment options. In parallel, small and medium enterprises (SMEs) are increasingly adopting these solutions to track loan performance in real time and proactively manage risk. In India, of the 64 million MSMEs, only around 7.7 million are digitally mature, suggesting significant untapped potential. As digital adoption deepens among smaller businesses, demand for intelligent and scalable loan servicing tools is expected to rise steadily, further expanding the loan servicing software market.

Shift Toward Mobile-First Lending Experiences

As of early 2024, there are 5.61 billion unique mobile phone users, representing 69.4% of the global population. Internet users total 5.35 billion, covering over 66% of people worldwide. Loan servicing is rapidly adapting to mobile-first platforms as lenders and borrowers prioritize speed, convenience, and flexibility. Mobile applications allow borrowers to manage payments, view loan status, and receive updates directly from their smartphones, minimizing the need for in-person interactions. This trend aligns with rising expectations for digital self-service in financial services, especially among younger demographics. Mobile-first solutions also enhance operational efficiency for lenders, reducing support burdens and improving borrower satisfaction. As mobile penetration continues to grow in both developed and emerging economies, service providers are focusing on responsive, secure, and user-friendly app experiences. The shift toward mobile is not only transforming customer engagement but also creating a positive loan servicing software market outlook globally.

Integration of Advanced Technologies

Advanced technologies are transforming the functionality and value of loan servicing software. Artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA) are now standard features in many solutions, enabling automation of repetitive tasks, fraud detection, and predictive analytics. An industry statistics reported 94% of organizations are using AI/ML to assess lending risk, while 87% credit AI with faster threat response. RPA, in particular, is driving a 32% reduction in operational costs by streamlining data entry and monitoring processes. Cloud-based platforms and blockchain integration further improve data security, transparency, and transaction accuracy. These innovations not only improve performance but also offer lenders valuable insights that guide more informed decision-making, reinforcing market growth.

Loan Servicing Software Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global loan servicing software market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on component, deployment mode, enterprise size, and end user.

Analysis by Component:

- Software

- Services

Software stands as the largest component in 2025, holding around 75.8% of the market. The software segment dominates the loan servicing software market due to its critical role in automating complex loan management tasks, improving accuracy, and enhancing operational efficiency for financial institutions. Lenders increasingly rely on specialized software to handle loan origination, payment tracking, compliance monitoring, and customer communications within a single platform. The shift toward cloud-based and customizable solutions further supports this dominance, allowing institutions to scale operations and adapt to regulatory changes. Additionally, software platforms offer real-time analytics, integration with core banking systems, and enhanced user interfaces, making them a preferred choice over traditional manual methods or limited-functionality alternatives.

Analysis by Deployment Mode:

- On-premises

- Cloud-based

Cloud-based stand as the largest deployment mode in 2025, holding around 70.0% of the market. The cloud-based segment dominates the loan servicing software market due to its scalability, cost-efficiency, and ease of deployment. Financial institutions prefer cloud solutions for their ability to support remote access, reduce infrastructure costs, and allow real-time updates across systems. These platforms simplify compliance management by offering automatic updates aligned with regulatory changes. They also enhance data security and disaster recovery capabilities, which are essential for handling sensitive borrower information. As demand for digital lending grows, cloud-based systems provide the flexibility and speed required to adapt quickly. This has made them the preferred choice for both established institutions and emerging fintech firms.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises lead the market with around 68.9% of market share in 2025. Large enterprises dominate the loan servicing software market due to their greater financial capacity to invest in advanced, scalable solutions that support high loan volumes and complex portfolios. These organizations typically handle a broad range of lending products and require robust systems with integrated compliance, analytics, and automation capabilities. They also prioritize features like real-time monitoring, multi-channel borrower engagement, and data security, which are often available in premium software offerings. Additionally, large enterprises have dedicated IT teams to manage implementation and customization, enabling smoother adoption and integration with existing systems. Their operational scale and regulatory exposure further drive the demand for sophisticated servicing platforms.

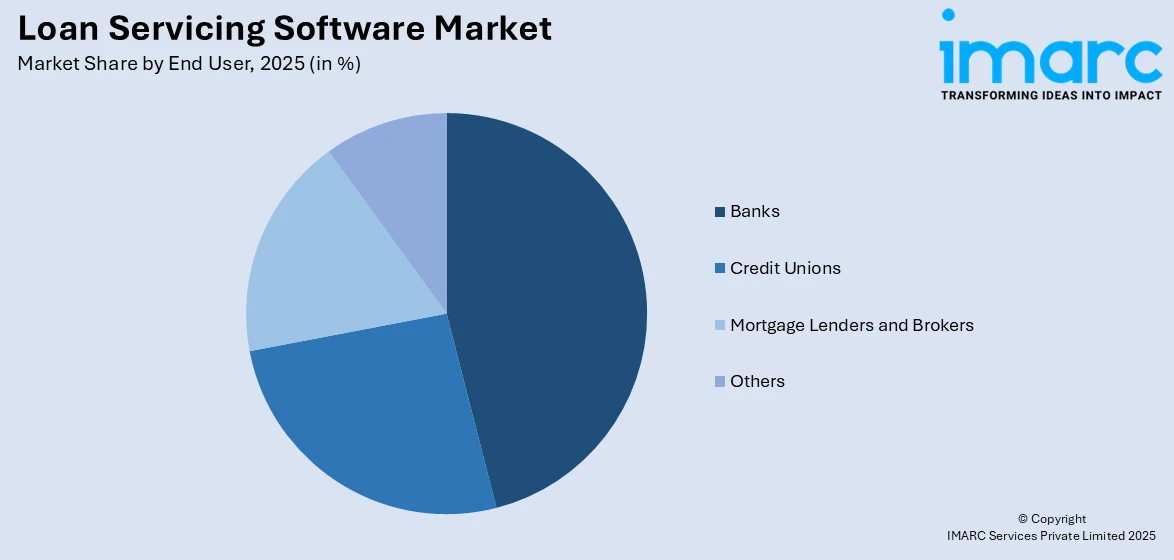

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Banks

- Credit Unions

- Mortgage Lenders and Brokers

- Others

Banks lead the market with around 38.7% of market share in 2025. Banks dominate the loan servicing software market due to their extensive lending operations, regulatory obligations, and need for efficient portfolio management. These institutions handle large volumes of consumer and commercial loans, requiring robust software to automate workflows, ensure compliance, and reduce operational risks. Their strong financial capacity enables investment in advanced technologies, including AI, analytics, and real-time reporting tools. Banks also prioritize customer experience, driving adoption of platforms that support digital self-service and mobile access. The demand for scalable, secure, and customizable solutions further reinforces banks’ reliance on loan servicing software, positioning them as the primary users and market leaders in this segment.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 40.2%. North America dominates the loan servicing software market due to its advanced financial infrastructure, early adoption of digital lending technologies, and high concentration of established financial institutions and fintech firms. The region benefits from strong regulatory frameworks that drive the need for compliant and automated loan servicing solutions. Widespread use of cloud computing, AI, and analytics in banking operations supports the growth of sophisticated loan management platforms. Additionally, the presence of key software vendors and a large consumer base accustomed to digital financial services contributes to steady demand. Continuous innovation and investment in technology further reinforce North America's leadership in this market. For instance, in November 2024, CrossCountry Mortgage (CCM), the top distributed retail mortgage lender in the U.S., partnered with the National Association of Real Estate Brokers (NAREB) to support minority homeownership and community development. The collaboration aligns with NAREB’s focus on civic engagement, women’s initiatives, and wealth building.

Key Regional Takeaways:

United States Loan Servicing Software Market Analysis

In 2025, the United States held a market share of around 91.7% in North America. The United States loan servicing software market is being driven by a mature financial infrastructure, high digital adoption, and a strong presence of fintech startups. U.S. startup funding surged 75.6% in the first half of 2025, which in turn has favoured the market growth. In line with this, the growing demand for regulatory compliance and data security is prompting financial institutions to invest in secure and compliant software solutions, which is impelling the market. The rise in consumer lending and mortgage servicing, driven by economic growth, is also fueling market expansion. Similarly, the heightened adoption of cloud-based solutions, which enhance scalability and cost efficiency for financial institutions, is strengthening market demand. The growing demand for real-time access to loan information is driving the market further. Additionally, the ongoing shift toward mobile-friendly loan servicing tools is improving customer engagement and accessibility. Besides this, the rise of mobile banking and digital wallets is also increasing the demand for efficient loan servicing solutions, broadening the market's scope.

Europe Loan Servicing Software Market Analysis

The loan servicing software market in Europe is experiencing growth due to the region’s expanding digital banking and online lending ecosystems, supported by both national and EU initiatives. As such, in May 2025, Revolut committed EUR 1.1 Billion to expand its digital banking services in France, aiming to double its French user base to 10 million by 2026. This includes securing a local banking license and hiring 200+ employees. In accordance with this, the increasing demand for automated solutions to improve operational efficiency is driving adoption in the market. The growing need for effective loan portfolio management, prompting financial institutions to invest in advanced servicing software, is impelling the market development. Additionally, the rapid implementation of stricter data privacy regulations is further encouraging the use of secure and compliant software. The growth of alternative lending models, such as peer-to-peer lending, is driving the need for scalable servicing systems that support market demand. Apart from this, the widespread use of cloud computing solutions, making loan servicing more cost-effective and flexible for financial institutions, is creating a positive outlook for the market.

Asia Pacific Loan Servicing Software Market Analysis

The Asia Pacific market is largely propelled by the rapid expansion of the region’s financial sector, particularly in emerging markets. In addition to this, the widespread integration of digital technologies in banking services is encouraging the adoption of software for efficient loan management. Similarly, the rising demand for consumer lending, particularly in countries such as China and India, is driving market growth. According to the Reserve Bank of India, loans in India increased by 9% in June 2025 compared to June 2024. From 2012 to 2025, India's loan growth averaged 11.80%, with a peak of 20.80% in December 2023. The favourable government initiatives aimed at promoting financial inclusion and digital banking are also playing a key role in the market’s development. Additionally, the growing emphasis on data-driven decision-making is pushing financial institutions to adopt loan servicing software with integrated analytics. Furthermore, the rise of mobile banking solutions is encouraging demand for mobile-compatible loan servicing platforms, offering more accessible loan management options for consumers across the region.

Latin America Loan Servicing Software Market Analysis

In Latin America, the loan servicing software market is growing due to the increasing digitalisation of financial services, which is driving demand for automated solutions. The growth is driven by the need for financial institutions to streamline operations, improve customer experiences, and ensure compliance with local financial regulations. In 2025, Bettr, an AI-driven lending business under Ant International, officially launched its operations in Latin America, focusing on expanding small and medium-sized enterprise (SME) lending to foster local and regional economic growth. As part of its initial move, Bettr formed a strategic partnership with AliExpress to introduce Bettr Working Capital, a new financing solution aimed at local merchants operating on AliExpress. This launch highlights the broader trend in Latin America, where countries such as Brazil and Argentina are increasingly adopting digital financial solutions, thereby favoring the market.

Middle East and Africa Loan Servicing Software Market Analysis

The Middle East and Africa market is significantly influenced by the growing adoption of digital banking services, which is increasing demand for advanced software solutions. Similarly, the rapid expansion of the real estate sector, which drives the need for efficient mortgage servicing platforms, is strengthening market demand. Official data from the local real estate authorities of the four emirates revealed that by the end of 2024, real estate transactions had reached approximately AED 893 Billion, with over 331,300 transactions recorded. Mortgage transactions totalled more than AED 229.3 Billion, accounting for over 50,000 deals, excluding those in Ajman. The rising trend of financial inclusion is encouraging institutions to adopt modern software to serve underserved populations better. Besides this, the expansion of fintech companies in the region is fueling demand for scalable and cost-effective loan servicing solutions, thereby contributing to market development.

Competitive Landscape:

The competitive landscape of the loan servicing software market is shaped by a mix of established players and emerging providers focusing on innovation, automation, and user-centric design. Companies are competing on product flexibility, integration capabilities, and regulatory compliance features. There is increasing emphasis on cloud-native platforms, AI-powered automation, and scalable solutions tailored for both large institutions and SMEs. The growing demand for mobile access, real-time data visibility, and enhanced security is driving continuous product enhancements. Strategic partnerships, mergers, and investments are common as vendors seek to expand their geographic and sector reach. The loan servicing software market forecast predicts strong growth, driven by rising digital adoption, evolving customer expectations, and expanding credit markets across both developed and emerging regions. For instance, in April 2024, PrivoCorp formed a strategic partnership with Calyx Software to offer expert mortgage processing and origination services to Calyx’s loan origination system (LOS) clients. The collaboration allows lenders to access skilled back-office support, reduce operational costs, and stay compliant.

The report provides a comprehensive analysis of the competitive landscape in the loan servicing software market with detailed profiles of all major companies, including:

- Altisource

- Applied Business Software

- Bryt Software LCC

- C-Loans Inc.

- Emphasys Software (Constellation Software)

- Financial Industry Computer Systems Inc.

- Fiserv Inc.

- GOLDPoint Systems Inc.

- Graveco Software Inc.

- LoanPro

- Nortridge Software LLC

- Q2 Software Inc. (Q2 Holdings Inc.)

- Shaw Systems Associates LLC.

Latest News and Developments:

- July 2025: Solifi acquired Leasepath, a leader in equipment finance loan and lease management technology for the mid-market sector. The acquisition enhances Solifi's product portfolio and expands its presence in EMEA and APAC, supporting growth and reinforcing its leadership in secured finance solutions.

- July 2025: Core Financial Software acquired Servicing Director and EZTeller from Finastra, enhancing its loan servicing and teller operations solutions. The acquisition supports operational efficiency, scalability, and fraud protection, positioning Core Financial Software for growth with its experienced leadership and investment in product development.

- February 2025: Lenders Cooperative merged with Ventures Lending Technologies, creating a unified end-to-end commercial loan origination and servicing platform. The merger strengthens their offering to financial institutions, enabling seamless small business and commercial lending with AI-driven workflows, integrated payments, and modernized loan servicing solutions.

- November 2024: Capstack Technologies expanded its product suite with Capstack Analytics and Capstack Loan Servicing, enhancing banks' ability to trade whole loans and participations. These tools provide deep portfolio insights and streamline loan management, improving decision-making, risk management, and operational efficiency for financial institutions.

- October 2024: Finastra launched Loan IQ Simplified Servicing to improve the efficiency of SME loan management. The solution streamlines loan servicing by automating manual tasks, enhancing data accuracy, and reducing operational risks, offering a unified platform for financial institutions to manage high-volume bilateral and SME loans effectively.

- September 2024: Fintech platform Haven launched Haven Wallet, a digital solution to simplify mortgage servicing and enhance borrower engagement. The platform enables seamless loan servicing transfers, financial monitoring, and long-term relationships between mortgage originators and borrowers, increasing customer retention and optimizing Mortgage Servicing Rights (MSR).

- August 2024: Cync Software launched Cync Syndicated Lending, a cloud-native solution designed to automate syndicated and participation loan servicing. It enhances operational efficiency by reducing asset monitoring and loan management time by 75%, automates documentation, and supports flexible loan restructuring, improving productivity for financial institutions.

Loan Servicing Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Deployment Modes Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| End Users Covered | Banks, Credit Unions, Mortgage Lenders and Brokers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Altisource, Applied Business Software, Bryt Software LCC, C-Loans Inc., Emphasys Software (Constellation Software), Financial Industry Computer Systems Inc., Fiserv Inc., GOLDPoint Systems Inc., Graveco Software Inc., LoanPro, Nortridge Software LLC, Q2 Software Inc. (Q2 Holdings Inc.), and Shaw Systems Associates LLC. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the loan servicing software market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global loan servicing software market.

- The study maps the leading as well as the fastest growing regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the loan servicing software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The loan servicing software market was valued at USD 3.6 Billion in 2025.

The loan servicing software market is projected to exhibit a CAGR of 9.96% during 2026-2034, reaching a value of USD 8.7 Billion by 2034.

The market is driven by rising demand for automation in loan management, increasing regulatory compliance requirements, growing adoption of digital lending platforms, and the need for improved customer experience. Financial institutions are investing in scalable, secure, and cloud-based solutions to reduce errors, streamline operations, and manage loan portfolios more efficiently.

North America currently dominates the loan servicing software market, accounting for a share of over 40.2% in 2025. This dominance is driven by early adoption of digital technologies, strong presence of major software vendors, and a well-established financial sector. Regulatory demands and growing fintech activity also contribute to sustained investment in advanced loan management solutions across the region.

Some of the major players in the loan servicing software market include Altisource, Applied Business Software, Bryt Software LCC, C-Loans Inc., Emphasys Software (Constellation Software), Financial Industry Computer Systems Inc., Fiserv Inc., GOLDPoint Systems Inc., Graveco Software Inc., LoanPro, Nortridge Software LLC, Q2 Software Inc. (Q2 Holdings Inc.), Shaw Systems Associates LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)