Local Anesthesia Drugs Market Size, Share, Trends and Forecast by Drug Type, Mode of Administration, Distribution Channel, and Region, 2026-2034

Local Anesthesia Drugs Market Size and Share:

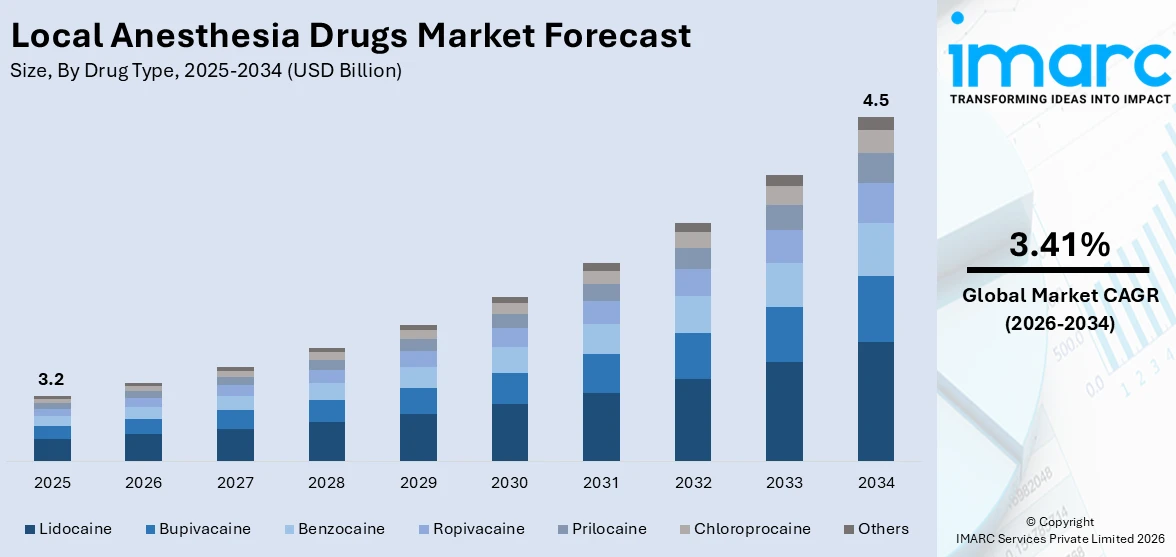

The global local anesthesia drugs market size was valued at USD 3.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 4.5 Billion by 2034, exhibiting a CAGR of 3.41% from 2026-2034. North America currently dominates the market, holding a market share of 35.41% in 2025. The market is driven by the growing demand for less invasive methods, advancements in drug formulations, and the increasing awareness about pain management options. Enhanced safety profiles, cost-effectiveness, and the rising number of surgeries in both medical and dental fields further contribute to the local anesthesia drugs market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.2 Billion |

| Market Forecast in 2034 | USD 4.5 Billion |

| Market Growth Rate (2026-2034) | 3.41% |

The shift towards less invasive surgical and diagnostic methods, which frequently necessitate targeted pain control to guarantee patient ease and swift recovery, is catalyzing the demand for local anesthesia medications. Local anesthetics are favored because they offer efficient pain relief without requiring general anesthesia. Furthermore, continuous advancements in anesthetic compositions are improving the safety, effectiveness, and longevity of local anesthesia. Businesses are concentrating on creating long-lasting, safer, and more precisely targeted anesthetic agents that enhance patient results while reducing adverse effects, boosting the attractiveness of local anesthesia medications across different clinical environments. Advancements in administration methods, including needle-free injectors and ultrasound-guided techniques, are also enhancing the accuracy and convenience of delivering local anesthesia.

To get more information on this market Request Sample

The United States plays a vital role in the market, influenced by the rise of outpatient surgical centers that need local anesthesia medications. These centers emphasize conducting minimally invasive treatments with fast recovery periods, in which local anesthesia is essential for pain management, shortening recovery time, and enhancing overall patient satisfaction. Furthermore, the emergence of new generic versions of well-known anesthetics provides affordable alternatives to branded choices, enhancing accessibility and cost-effectiveness for healthcare professionals, while broadening treatment options for patients undergoing different procedures. In 2025, Avenacy announced the US launch of Lidocaine Hydrochloride Injection, USP, a generic version of Xylocaine®, for local or regional anesthesia in surgical, dental, and diagnostic procedures. This marks Avenacy’s 25th product launch since its founding in October 2023 and its first Lidocaine product. The injection will be shipped in 25 multi-dose vial cartons.

Local Anesthesia Drugs Market Trends:

Rising Incidence of Chronic Diseases

The increasing incidence of chronic illnesses like cardiovascular diseases, diabetes, and musculoskeletal disorders is a crucial factor impelling the growth of the market. The International Diabetes Federation (IDF) predicts that by 2045, approximately 783 million adults, or one in every eight, will be affected by diabetes, indicating a 46% rise from present statistics. Chronic conditions frequently demand extended medical treatments, surgical interventions, and diagnostic tests that require efficient pain management strategies. Local anesthesia offers a dependable method for controlling pain during these procedures, allowing patients to receive essential treatments with little discomfort. With the ongoing rise in the global incidence of chronic diseases, the need for local anesthetics is anticipated to grow. Furthermore, the increasing emphasis on enhancing the quality of life for individuals with chronic ailments further drives the demand for safe, effective, and specific pain management options that local anesthetic medications provide.

Growing Geriatric Population

Elderly individuals frequently need numerous medical treatments, such as surgical and diagnostic procedures, to address age-related health concerns. The United Nations (UN) estimates that by 2050, the worldwide number of people aged 65 and above will rise to 1.6 billion, effectively doubling in the next thirty years. At that time, senior citizens will represent more than 16% of the global population. Local anesthesia is especially advantageous for older patients, as it lowers the risks linked to general anesthesia, which can be more complicated for individuals with comorbid conditions. Moreover, local anesthesia facilitates faster recovery, which is essential for older adults who might experience slower healing. The growing demand for age-related medical services, coupled with the desire for minimally invasive treatment choices in this group, is offering a favorable local anesthetic drugs market outlook. This trend emphasizes the significance of local anesthesia as a more effective and safer pain management option for older adults.

Increasing Government Healthcare Spending

Many countries are greatly increasing their healthcare budgets to enhance access to vital medical services, such as surgical care. A segment of this budget is designated specifically for surgeries, allowing hospitals and clinics to enhance their capacities and conduct a broader range of medical procedures, many of which necessitate local anesthesia. With an increase in healthcare funding, institutions can allocate resources to improve facilities, acquire advanced medical equipment, and expand treatment options, all of which directly lead to a greater demand for anesthesia drugs. Moreover, governments, especially in developing nations, are emphasizing enhancements to healthcare infrastructure, guaranteeing broader access to surgical services, and concentrating on improving overall patient outcomes. These efforts are leading to a growing necessity for reliable and secure anesthesia solutions, thus catalyzing the demand for local anesthesia medications.

Local Anesthesia Drugs Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global local anesthesia drugs market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on drug type, mode of administration, and distribution channel.

Analysis by Drug Type:

- Lidocaine

- Bupivacaine

- Benzocaine

- Ropivacaine

- Prilocaine

- Chloroprocaine

- Others

Lidocaine leads the market with a share of 28.88%, attributed to its proven effectiveness, rapid onset, and diverse uses in medical and dental treatments. Its capacity to rapidly and effectively block nerve signals makes it a favored option for local anesthesia, providing patients swift pain relief with little discomfort. Lidocaine's safety characteristics are important as it presents a reduced likelihood of side effects when compared to numerous other anesthetics, aiding its extensive application among diverse patient groups. Additionally, lidocaine's capacity to be delivered via various administration methods, such as injectables, topical treatments, and transdermal systems, enhances its flexibility and practicality in different clinical environments. The medication's efficacy, swift action, and minimal toxicity are establishing it as the benchmark in local anesthesia, securing its ongoing prevalence in the market.

Analysis by Mode of Administration:

- Injectables

- Surface Anesthetic

Injectables stand as the largest component in 2025, holding 59.26% of the market, as they provide a quick onset of action and effectively deliver local anesthesia right to the target area. This method of delivery guarantees accurate dosage regulation and quicker pain alleviation, making it a favored option for numerous medical and surgical interventions. Injectables provide a dependable way to attain the desired therapeutic outcome, with little disruption from the digestive system, in contrast to oral medications. Their application is firmly established in both hospital and outpatient environments, where prompt pain management is essential for patient comfort and recovery. The capability to deliver injectables with different concentrations enables personalization according to the patient's condition and the requirements of the procedure. Additionally, the creation of sophisticated injectable formulations with improved safety features is increasing their popularity.

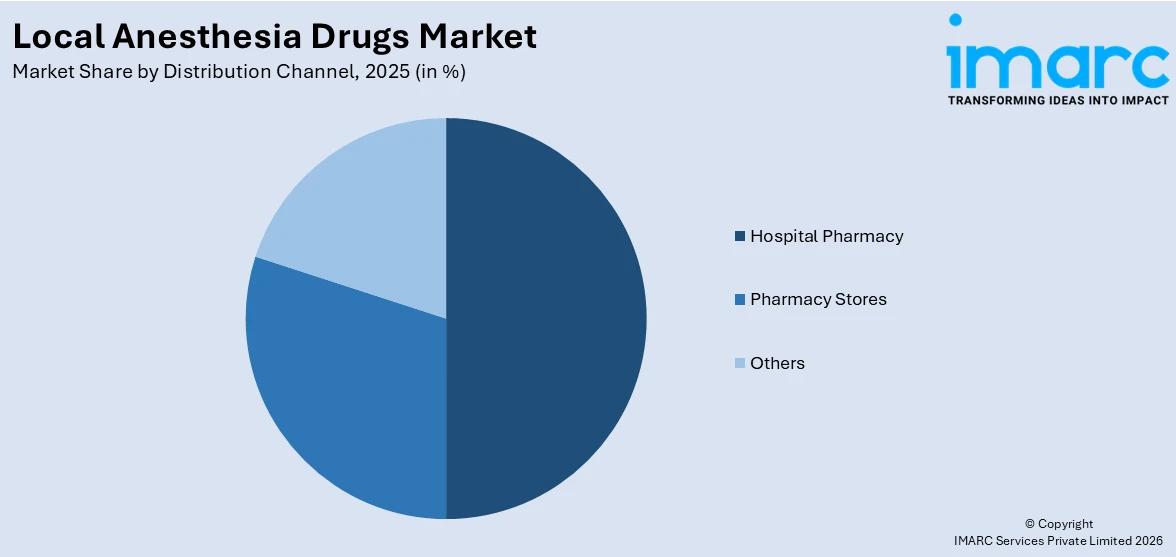

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Hospital Pharmacy

- Pharmacy Stores

- Others

Hospital pharmacy represents the largest segment, accounting for 50.00% market share, because of its crucial position in the healthcare system and its ability to offer an extensive selection of specialized medications, including local anesthetics, to patients. This segment gains from having direct access to a substantial patient population, which includes individuals undergoing surgeries or medical procedures necessitating anesthesia. Moreover, hospital pharmacy frequently leads in embracing innovative medical therapies and technologies, guaranteeing access to the most recent formulations and delivery methods for pain relief. Its strategic role in hospitals enables effective inventory oversight and prompt medication delivery, enhancing patient care and results. Hospital pharmacy is vital in fostering robust connections with healthcare providers, guaranteeing that anesthetic medications are prescribed and given safely. Additionally, it complies with strict regulatory requirements, which boosts the reliability and confidence in the distribution of local anesthesia medications, thereby strengthening its leading position in this market sector.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America dominates the market with a share of 35.41%, owing to its robust healthcare infrastructure, cutting-edge medical technologies, and strong demand for both surgical and non-surgical treatments. The region benefits from strong healthcare expenditures and a significant patient demographic needing diverse medical care, especially for chronic health issues. Moreover, the aging population in the area, along with increasing healthcare requirements, drives the need for local anesthetics. For instance, the population of Americans aged 65 and above is expected to grow from 58 million in 2022 to 82 million by 2050 (a 42% rise), with the proportion of the 65-plus age group in the total population estimated to climb from 17% to 23%. Additionally, North America possesses a robust pharmaceutical research and development (R&D) landscape, allowing for ongoing innovation in local anesthesia medications. The involvement of major industry stakeholders and regulatory backing enhances market development. The growing healthcare awareness and the heightened inclination towards minimally invasive procedures is catalyzing the demand for effective and efficient pain management solutions.

Key Regional Takeaways:

United States Local Anesthesia Drugs Market Analysis

In North America, the market portion held by the United States was 88.25%, because of the rising incidence of chronic illnesses that require regular medical treatments, such as both surgical and non-surgical procedures. For example, 60% of Americans have a chronic illness, and 40% have two or more chronic illnesses that represent ninety percent of the annual USD 4.5 Trillion health care expenses in the country. Ongoing issues like heart disease, diabetes complications, and cancer are catalyzing the demand for enhanced pain relief and anesthetic options in hospitals and clinics. The rising awareness about minimally invasive therapies and the presence of advanced formulations are further supporting the market growth. As the number of patients seeking diagnostic and therapeutic procedures increases, the dependence on local anesthesia medications continues to grow, emphasizing their essential function in safe and effective medical practices within the healthcare system. Moreover, the local anesthesia drugs market trend shows a shift towards more advanced, patient-friendly solutions to meet the growing demand for effective pain management.

Europe Local Anesthesia Drugs Market Analysis

The market in Europe is witnessing growth because of the expanding elderly population that needs regular medical and surgical treatments. As stated by the WHO, the demographic of individuals aged 60 and above is swiftly increasing in the WHO European Region. In 2021, the number was 215 million; by 2030, it is estimated to reach 247 million, and by 2050, exceed 300 million. Disorders linked to aging, such as orthopedic issues, heart diseases, and dental problems, are driving the need for localized pain management options. Healthcare facilities and surgical centers are progressively utilizing sophisticated anesthetic formulas to enhance safety during procedures for elderly patients with various comorbidities. With the increasing aging population, the dependence on minimally invasive surgical techniques using local anesthetics is anticipated to rise, reinforcing their importance in improving patient outcomes and minimizing procedural risks within healthcare systems. The local anesthesia drugs market forecast indicates a sustained demand driven by these demographic shifts and growing healthcare needs.

Asia Pacific Local Anesthesia Drugs Market Analysis

The adoption of local anesthesia drugs is rising in the Asia-Pacific region as healthcare spending increases and infrastructure improvements enhance patient care standards. The India Brand Equity Foundation (IBEF) states that the Indian government has set aside Rs. 99,858 crore (USD 11.50 Billion) allocated to the healthcare sector in the Union Budget 2025-26 for growth. The growth of hospital networks, the rise of specialized surgical centers, and investments in advanced medical technology are driving the need for efficient anesthesia solutions. Improved access to healthcare services and government emphasis on modernizing healthcare are also contributing to the local anesthesia drugs market growth. Increasing recognition of sophisticated pain management options in surgical and outpatient settings is encouraging the use of local anesthesia medications, establishing them as a vital element in the region’s advancing healthcare practices.

Latin America Local Anesthesia Drugs Market Analysis

Latin America is witnessing a rise in the use of local anesthesia medications due to the growing incidence of diabetes, leading to a higher demand for surgical and diagnostic interventions that necessitate efficient pain control. The International Diabetes Federation (IDF) Atlas indicated that around 16.6 million adults (ages 20-79) in Brazil are expected to have diabetes in 2024, with an estimate rising to 24.0 million by 2050. Diabetic individuals frequently encounter issues like neuropathy, foot ulcers, and infections that require minor surgical procedures, for which local anesthesia is favored for enhanced safety and quicker recovery.

Middle East and Africa Local Anesthesia Drugs Market Analysis

The adoption of local anesthesia drugs is increasing in the Middle East and Africa as healthcare facilities expand and privatization transforms the medical landscape. The Saudi healthcare system is undergoing significant privatization aligned with Vision 2030, with more than 290 hospitals and 2,300 health facilities moving to private management. Investments in new hospitals, diagnostic facilities, and specialized clinics are driving the need for anesthesia solutions to aid surgical and outpatient services. Privatization is improving patient access to contemporary medical treatments, supporting wider use of local anesthesia medications.

Competitive Landscape:

Major participants in the market are concentrating on broadening their product ranges by creating new formulations and delivery methods. They are allocating resources to research and development (R&D) to enhance the safety, effectiveness, and longevity of local anesthetics, while reducing side effects. For example, in 2024, the FDA approved an expanded indication for Zynrelef (bupivacaine and meloxicam extended-release solution) to include additional soft tissue and orthopedic procedures. Developed by Heron Therapeutics, Zynrelef was a dual-acting, non-opioid anesthetic for post-operative pain relief up to 72 hours. The approval aimed to improve recovery and reduce opioid use after surgery. Collaborations and partnerships with healthcare providers are increasing to improve market reach and support clinical trials. Additionally, they are investigating the incorporation of cutting-edge technologies, including needle-free administration systems and prolonged-release formulations, to address the changing needs of patients and healthcare providers.

The report provides a comprehensive analysis of the competitive landscape in the local anesthesia drugs market with detailed profiles of all major companies, including:

- Aspen Holdings

- B. Braun SE

- Baxter International Inc.

- Fresenius Kabi USA, LLC

- Pacira Pharmaceuticals, Inc

- Pfizer Inc

- Pierrel

- Septodont Holding

Latest News and Developments:

- July 2025: Cronus Pharma LLC announced the U.S. launch of Butorphic® (Butorphanol Tartrate) Sterile Injectable Solution for equine pain management, marking its fifth product introduction this year and strengthening its anesthesia and sedative portfolio alongside AnaSed® Equine, Cropamezole™, DexmedVet™, DetomiSed™, and Ketamine Injection.

- June 2025: The U.S. FDA approved UroGen’s ZUSDURI™ as the first and only medication for recurrent low-grade intermediate-risk non-muscle invasive bladder cancer, offering an alternative to repeated transurethral resections traditionally performed under general anesthesia and marking a breakthrough supported by strong Phase 3 trial results.

- April 2025: Avenacy announced the launch of Propofol Injectable Emulsion, USP in the U.S. market as an FDA-approved generic equivalent to Diprivan®, marking its 21st product since October 2023, with the anesthesia drug indicated for general anesthesia, monitored anesthesia care sedation, and ICU sedation in adults.

- March 2025: Hikma Pharmaceuticals PLC launched Cisatracurium Besylate Injection, USP, in 200mg/20mL and 20mg/10mL doses in the US, approved as an adjunct to general anesthesia for facilitating tracheal intubation, providing skeletal muscle relaxation during surgeries, and supporting ICU ventilation.

- January 2025: Septodont Inc., a global leader in dental anesthetic products, and Premier Dental, a provider of innovative dental solutions, announced the launch of BufferPro™, an 8.4% sodium bicarbonate solution that simplified the buffering of dental local anesthesia through a one-step, sterile, and economical method, with availability starting in early February 2025.

Local Anesthesia Drugs Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Types Covered | Lidocaine, Bupivacaine, Benzocaine, Ropivacaine, Prilocaine, Chloroprocaine, Others |

| Mode of Administrations Covered | Injectables, Surface Anesthetic |

| Distribution Channels Covered | Hospital Pharmacy, Pharmacy Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aspen Holdings, B. Braun SE, Baxter International Inc., Fresenius Kabi USA, LLC, Pacira Pharmaceuticals, Inc, Pfizer Inc, Pierrel, Septodont Holding, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the local anesthesia drugs market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global local anesthesia drugs market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the local anesthesia drugs industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The local anesthesia drugs market was valued at USD 3.2 Billion in 2025.

The local anesthesia drugs market is projected to exhibit a CAGR of 3.41% during 2026-2034, reaching a value of USD 4.5 Billion by 2034.

The local anesthesia drugs market is growing because of the rising demand for less invasive procedures, advancements in drug formulations, and the increasing awareness about pain management options. Enhanced safety profiles, cost-effectiveness, and the rising number of surgeries in both medical and dental fields are further contributing to the market growth.

North America currently dominates the local anesthesia drugs market, accounting for a share of 35.41%. The dominance of the region is attributed to its advanced healthcare infrastructure, high demand for medical procedures, and strong pharmaceutical research capabilities. Additionally, the region benefits from well-established regulatory frameworks, a growing aging population, and a high level of healthcare awareness.

Some of the major players in the local anesthesia drugs market include Aspen Holdings, B. Braun SE, Baxter International Inc., Fresenius Kabi USA, LLC, Pacira Pharmaceuticals, Inc, Pfizer Inc, Pierrel, Septodont Holding, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)