Long-Fiber Thermoplastics Market Size, Share, Trends and Forecast by Resin Type, Fiber Type, Manufacturing Processing, Application, and Region, 2025-2033

Long-Fiber Thermoplastics Market Size and Share:

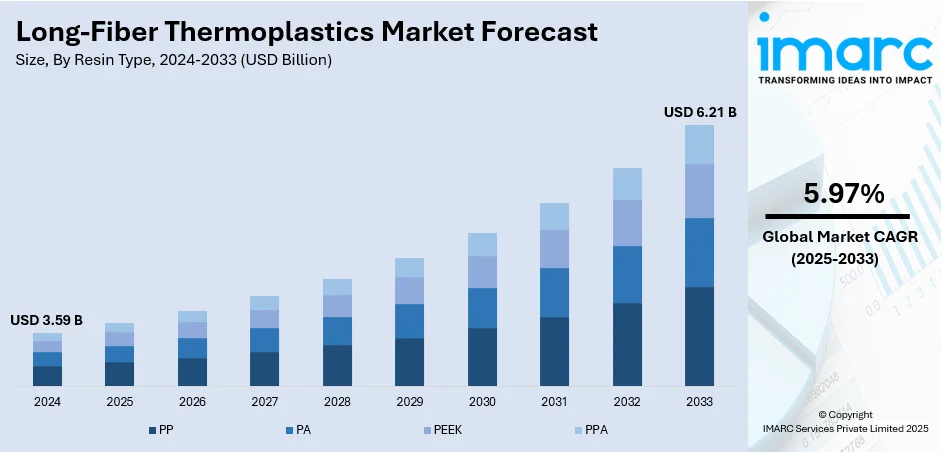

The global long-fiber thermoplastics market size was valued at USD 3.59 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.21 Billion by 2033, exhibiting a CAGR of 5.97% from 2025-2033. Europe currently dominates the market, holding a market share of 40% in 2024. The dominance of the market can be attributed to its advanced manufacturing infrastructure, strong research capabilities, and emphasis on high-performance materials. Favorable regulatory frameworks, skilled workforce, and continuous innovation contribute to the expansion of the long-fiber thermoplastics market share, fostering sustainable growth and reinforcing its position as a hub for premium thermoplastic solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.59 Billion |

|

Market Forecast in 2033

|

USD 6.21 Billion |

| Market Growth Rate 2025-2033 | 5.97% |

Strict environmental regulations and emission policies are driving the use of long-fiber thermoplastics. Their ability to be recycled and reduced environmental impact make them more desirable than conventional materials. Businesses are progressively incorporating these thermoplastics into product designs to meet sustainability objectives, lower carbon emissions, and adhere to changing regulatory demands, enhancing their market position. Apart from this, ongoing advancements in processing technologies are improving fiber distribution, shortening cycle durations, and facilitating large-scale manufacturing. These advancements enhance material uniformity and create new design opportunities, improving the versatility of long-fiber thermoplastics across various sectors. With advancements in processing efficiency, manufacturers experience increased productivity and cost reductions, encouraging wider adoption.

To get more information on this market, Request Sample

The United States plays a crucial role in the market, supported by a growing emphasis on lightweight materials that enhance fuel efficiency and adhere to stringent emission standards. The swift uptake of electric and hybrid vehicles influences the demand, as producers look for robust, dependable, and economical solutions for advanced designs. As per the IEA, in 2024, the United States saw electric car sales increase to 1.6 million, exceeding a 10% market share, emphasizing the transition towards sustainable transportation. This shift highlights the significance of long-fiber thermoplastics, which provide performance, safety, and weight savings, making them crucial for addressing changing automotive and environmental demands.

Long-Fiber Thermoplastics Market Trends:

Increasing Demand for Lightweight and High-Performance Materials

The long-fiber thermoplastics market is driven by the growing need for lightweight yet durable materials that enhance performance, reduce energy usage, and meet regulatory standards across automotive, aerospace, and industrial applications. Industries are increasingly prioritizing materials that can reduce overall product weight while maintaining high standards of strength, safety, and durability. Long-fiber thermoplastics deliver superior strength-to-weight ratios compared to conventional materials, making them highly suitable for diverse applications where efficiency and resilience are essential. Their ability to endure stress, impact, and environmental challenges without compromising performance enhances their value further. In addition, these materials support design flexibility and efficient manufacturing, allowing complex shapes and structures to be produced with consistency. According to reports, global light vehicle sales in 2025 are projected to reach 89.6 Million units, marking a 1.7% increase compared to 2024. This growth underscores the importance of lightweight solutions in transportation and related industries, strengthening the role of long-fiber thermoplastics in meeting both performance and sustainability objectives.

Rising Infrastructure and Construction Activities

The rise in infrastructure and construction initiatives is impelling the market growth by driving the demand for long-fiber thermoplastics in applications requiring high strength, durability, and reduced structural weight. These materials are becoming favored owing to their longevity, resilience in harsh conditions, and capability to be molded into intricate structural parts. With the rapid pace of urbanization and the growing demand for innovative construction solutions, the need for dependable, affordable, and durable materials is becoming more evident. Long-fiber thermoplastics provide structural integrity, durability against impacts, and prolonged lifespan, making them ideal for contemporary construction requirements. Their flexibility in meeting diverse design needs and quick installation process further strengthens their contribution to large-scale projects. In 2025, Conscient Infrastructure declared a ₹1,200 crore investment in Elaira Residences, a high-end residential project in Sector 80, Gurugram, spanning 5.5 acres and consisting of 536 upscale apartments. Such advancements underscore the increasing need for cutting-edge materials, bolstering the role of long-fiber thermoplastics in promoting innovation and sustainable progress in the construction industry.

Growing Use in in Consumer Electronics

The rising demand for lightweight, durable, and thermally stable materials in consumer electronics is driving the need for long-fiber thermoplastics. These materials are ideal for smartphones, tablets, laptops, and wearables, where producers need durability without increased weight. IBEF reports that India's market for consumer electronics and home appliances is anticipated to increase by US$ 2.3 Billion from 2022 to 2027, achieving a CAGR of 1.31%. This anticipated growth is fueling increased production levels and catalyzing the demand for materials that enable quicker, more efficient manufacturing while maintaining quality. Long-fiber thermoplastics provide remarkable impact resistance, dimensional consistency, and design versatility, rendering them perfect for slim, compact devices. Their capability to facilitate intricate geometries in a single molding operation also lessens the quantity of components needed. With people seeking slimmer and more resilient devices, long-fiber thermoplastics are increasingly favored in the creation of next-gen electronic products.

Long-Fiber Thermoplastics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global long-fiber thermoplastics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on resin type, fiber type, manufacturing processing, and application.

Analysis by Resin Type:

- PP

- PA

- PEEK

- PPA

PP dominates the market with a share of 58.1%, due to its exceptional balance of mechanical performance, cost efficiency, and processing versatility. Its lightweight nature, along with superior chemical resistance and durability, makes it a suitable option for manufacturers seeking both performance and economic advantages. PP’s adaptability to various molding techniques allows for efficient large-scale production, enabling consistent quality and reduced cycle times. The resin also exhibits impressive recyclability, aligning well with the growing global emphasis on sustainability and environmental responsibility. Its ability to deliver high stiffness and strength-to-weight ratios enhances its suitability for demanding applications where reliability and efficiency are critical. Furthermore, PP benefits from a well-established supply chain, ensuring availability and competitive pricing across regions. The combination of performance, versatility, environmental benefits, and cost-effectiveness positions PP as the leading resin type in the long-fiber thermoplastics market, underpinning its continued dominance and widespread adoption.

Analysis by Fiber Type:

- Glass

- Carbon

Glass represents the largest segment, accounting 50.2%, as it offers excellent combination of strength, durability, and affordability. It provides outstanding mechanical characteristics, such as high tensile strength and impact resistance, which greatly improve the performance of long-fiber thermoplastic composites. The lightness of glass fiber, along with its thermal stability and corrosion resistance, makes it extremely appropriate for challenging industrial uses. Its compatibility with various thermoplastic resins provides design and processing flexibility, enabling manufacturers to maintain consistent quality and efficiency during production. Glass fiber is easily accessible and advantages from an established supply chain, promoting scalability and cost benefits for manufacturers. Moreover, its recyclability and support for sustainability objectives enhance its significance. These characteristics collectively reinforce glass fiber's status as the preferred option in long-fiber thermoplastics, securing its ongoing dominance in the market.

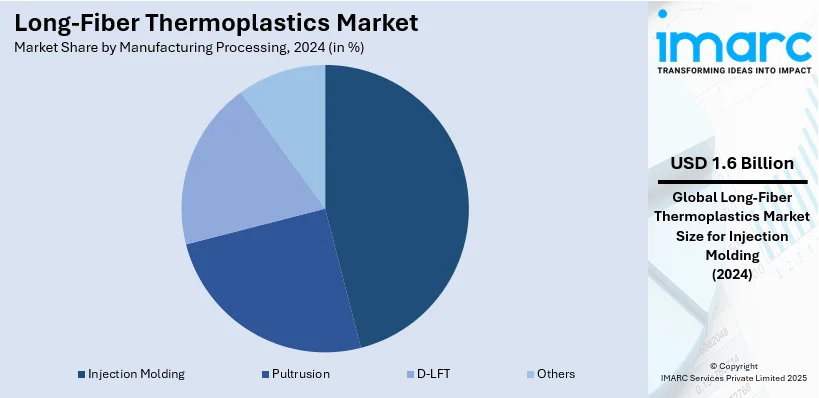

Analysis by Manufacturing Processing:

- Injection Molding

- Pultrusion

- D-LFT

- Others

Injection molding exhibits a clear dominance in the market with a share of 45.8%, accredited to its unparalleled efficiency, accuracy, and flexibility for high-volume production. The method enables manufacturers to create intricate forms with great dimensional precision, guaranteeing excellent quality and uniformity in the finished goods. Its ability to attain shorter cycle times greatly boosts productivity and lowers total manufacturing expenses. Injection molding facilitates the integration of long-fiber thermoplastics into complex designs without sacrificing structural strength, making it particularly appealing for applications that demand both durability and lightweight properties. The method's compatibility with different resin types expands its use, promoting innovation across sectors. Moreover, improvements in injection molding technologies are enhancing material flow, fiber distribution, and overall process dependability, reinforcing its benefits compared to other methods. The design flexibility, cost efficiency, and scalability provided by injection molding solidify its position as the top manufacturing method in the market.

Analysis by Application:

- Automotive

- Electrical and Electronics

- Consumer Goods

- Sporting Goods

- Others

Automotive holds the biggest market share with 37.2%, owing to its significant need for lightweight, durable, and high-performance materials that enhance fuel efficiency and overall vehicle performance. Long-fiber thermoplastics offer superior mechanical strength, impact durability, and design adaptability, making them ideal for various automotive parts. Their capacity to lower vehicle weight while maintaining safety and reliability is in line with the industry's objectives of adhering to strict regulatory standards and improving sustainability. Furthermore, the versatility of these materials enhances advanced manufacturing techniques, allowing for economical creation of intricate components with uniform quality. The ongoing drive for innovation in the automotive sector, particularly with electric and hybrid vehicle development, is catalyzing the demand for advanced thermoplastics. With a developed infrastructure, significant usage, and continuous investment in material technologies, the automotive industry continues to be the main driver of demand, maintaining its leading role in the long-fiber thermoplastics sector.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe leads the market with a share of 40%, because of its developed industrial base, significant focus on research operations, and established regulatory systems that promote innovation and sustainability. The area benefits from a skilled workforce and advanced manufacturing facilities, which aid in producing high-quality long-fiber thermoplastics. European industries emphasize lightweight materials to enhance efficiency and comply with strict environmental regulations, accelerating the use of these advanced composites. Moreover, the existence of prominent material manufacturers, research organizations, and a strong supply network improves market stability and competitiveness. Government policies that advocate for sustainable materials and technological innovation further strengthen Europe's leadership. For instance, in 2025, the European Composites Industry Association (EuCIA) and JEC Group launched the European Circular Composites Alliance (ECCA) at JEC World 2025. The initiative aims to promote circularity in composite materials through reuse, recycling, and sustainable design. These advantages together establish Europe as the leading area in the long-fiber thermoplastics industry, highlighting its enduring impact and authority in worldwide material advancement.

Key Regional Takeaways:

United States Long-Fiber Thermoplastics Market Analysis

In North America, the market portion held by the United States was 83.80%, owing to the increasing utilization of long-fiber thermoplastics, driven by pharmaceutical companies prioritizing lightweight, robust, and chemically resistant materials for medical device packaging and enclosures. For example, drug manufacturers have put over USD150 Billion into manufacturing and R&D in the US. The rise in R&D spending in pharmaceutical manufacturing is resulting in a higher need for thermoplastic parts in high-precision uses. Due to strict safety regulations and a move towards sophisticated drug delivery systems, long-fiber thermoplastics are becoming popular for their durability and flexibility. These polymers also ensure cleanroom compatibility, minimizing contamination risks and increasing their attractiveness in pharmaceutical settings. In addition, the incorporation of sustainable production techniques in pharmaceutical manufacturing complements the recyclability of long-fiber thermoplastics, opening avenues for creative material uses.

North America Long-Fiber Thermoplastics Market Analysis

The North America long-fiber thermoplastics market is primarily driven by the growing demand from automotive, aerospace, and industrial sectors seeking lightweight yet high-strength materials. Automakers are increasingly adopting long-fiber thermoplastics to reduce vehicle weight and enhance fuel efficiency while meeting strict emission standards. This trend is reinforced by the robust expansion of the North American automotive sector, which reached a market size of USD 1,163.77 Billion in 2024 and is projected by IMARC Group to grow to USD 1,916.64 billion by 2033. The aerospace industry also contributes significantly to long-fiber thermoplastics adoption, utilizing these materials for structural components that require fatigue resistance and dimensional stability. Moreover, the versatility of long-fiber thermoplastics is leading to increased usage in consumer goods and electrical applications, where strength, impact resistance, and design flexibility are critical. Ongoing advancements in material chemistry and processing technologies continue to improve performance and cost-efficiency, broadening the scope of potential applications across sectors.

Europe Long-Fiber Thermoplastics Market Analysis

Europe is experiencing a rising demand for long-fiber thermoplastics as environmental issues are encouraging governing bodies to launch green initiatives that promote the use of various recyclable materials. The European Commission states that raising textile-to-textile recycling rates in the EU to 10% could result in carbon savings of 440,000 tons annually, while also conserving 8.8 billion cubic meters of water. Producers are adapting to eco-design guidelines and more stringent sustainability standards that emphasize the use of recyclable and lightweight materials. Long-fiber thermoplastics provide recyclability, decreased energy use in manufacturing, and a smaller carbon footprint in comparison to conventional options. These benefits make them ideal for sustainable building, packaging, and transportation solutions. Government-supported green purchasing policies and circular economy efforts significantly enhance material replacement trends and offer a favorable long-fiber thermoplastics market outlook.

Asia Pacific Long-Fiber Thermoplastics Market Analysis

The adoption of long-fiber thermoplastics in the Asia-Pacific region is significantly increasing due to the growth of the electrical and electronics industry. The India Brand Equity Foundation states that India aims to achieve USD 300 Billion in electronics manufacturing and USD 120 Billion in exports by FY26. The swift industrial growth and miniaturization of electronics are driving the need for materials that are lightweight, heat-resistant, and possess high strength. Long-fiber thermoplastics are excellent materials for connectors, circuit breakers, and structural housings, providing thermal stability and exceptional mechanical performance. With the region accelerates semiconductor manufacturing, consumer electronics assembly, and infrastructure improvements, the use of thermoplastics is crucial for precision-focused and high-volume applications. Moreover, the rise of automation and smart device integration is catalyzing the demand for advanced components that long-fiber thermoplastics efficiently satisfy.

Latin America Long-Fiber Thermoplastics Market Analysis

Latin America is witnessing a rise in the demand for long-fiber thermoplastics owing to the growing applications in the consumer goods industry, shaped by urbanization and higher disposable income. For example, by 2025, the typical yearly salary in Brazil is about BRL 40,200, equivalent to roughly USD 7,025.63 annually. The growth of personal care, kitchenware, and home appliances sectors necessitates sturdy, affordable, and aesthetically pleasing materials. Long-fiber thermoplastics fulfill these criteria by providing improved design versatility and greater impact durability.

Middle East and Africa Long-Fiber Thermoplastics Market Analysis

The automotive sector's growth is leading to the rapid adoption of long-fiber thermoplastics in the Middle East and Africa. For instance, in February 2025, the leading five best-selling automotive brands in Saudi Arabia were exclusively from Japan and South Korea. Toyota topped the rankings with 14,570 units sold. With the pursuit of weight reduction to enhance fuel efficiency and longevity, vehicle manufacturers are turning to long-fiber thermoplastics as alternatives to metal components. Their excellent strength-to-weight ratio and recyclability correspond with local trends in automotive innovation.

Competitive Landscape:

Key participants in the industry are refining their tactics concerning product innovation, lightweight solutions, and broadening their presence in automotive and aerospace markets. They are investing in enhancing material strength-to-weight ratios and creating advanced composites that satisfy stringent regulatory and performance standards. Numerous companies are also establishing partnerships to create bespoke solutions designed for particular end-use requirements. In 2025, Biesterfeld and Celanese announced an expanded partnership to include LCPs, TPS, UHMW-PE, and long-fiber-reinforced thermoplastics in their portfolio. This builds on their existing mandates for key engineering polymers like PBT, PA, PPA, and PET. The move enhances their materials offering across multiple industries. In addition, they are expanding production capabilities and enhancing processing techniques to minimize cycle durations and expenses. Sustainability is also a priority, with funding directed towards recyclable thermoplastic composites and environment-friendly manufacturing methods to meet client expectations and stricter environmental laws.

The report provides a comprehensive analysis of the competitive landscape in the long-fiber thermoplastics market with detailed profiles of all major companies, including:

- Avient Corporation

- BASF SE

- Celanese Corporation

- Coperion GmbH (Hillenbrand Inc.)

- Lanxess AG

- Mitsubishi Chemical Holdings Corporation

- Owens Corning

- SGL Carbon SE

- Solvay S.A.

- Toray Industries Inc.

Latest News and Developments:

- June 2025: The University of Sheffield’s AMRC unveiled the UK’s first open-access hybrid fibre-reinforced thermoplastic tape development capability, accelerating innovation in sustainable composites. The solution, built by Cygnet Texkimp, supported long-fiber thermoplastics via dual-mode processing for diverse polymer applications.

- June 2025: Toray, Daher, and TARMAC Aerosave jointly launched an End-of-Life Aircraft Recycling Program for continuous fiber-reinforced long-fiber thermoplastics, focusing on repurposing A380 parts like the Toray Cetex® TC1100 pylon cover. The initiative advanced aerospace sustainability by validating recycling methods and reusing dismantled thermoplastic composites in structural applications.

- June 2025: AGY and A+ Composites launched a new line of unidirectional thermoplastic tapes reinforced with long-fiber thermoplastics like LM-PAEK and PEI, enhancing strength, stiffness, and sustainability. The tapes, using AGY’s S2 Glass roving, targeted aerospace, defense, and industrial sectors for wrapped and layered composite applications.

- February 2025: Japan's Polyplastics launched PLASTRON LFT RA627P, an eco-friendly long-fiber thermoplastics composite made from polypropylene and long cellulose fibre, offering high rigidity and 30% lower carbon footprint than glass fibre-reinforced PP. It was designed for applications like speaker diaphragms and industrial housings.

- February 2025: Polyplastics launched PLASTRONⓇ LFT RA627P in January 2025, a long-fiber thermoplastics-grade cellulose fiber reinforced polypropylene resin offering reduced weight, higher rigidity, and strong damping. The eco-friendly material demonstrated superior vibration damping compared to glass fiber reinforced PBT, making it ideal for audio and industrial component applications.

Long-Fiber Thermoplastics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered | PP, PA, PEEK, PPA |

| Fiber Types Covered | Glass, Carbon |

| Manufacturing Processing Covered | Injection Molding, Pultrusion, D-LFT, Others |

| Applications Covered | Automotive, Electrical and Electronics, Consumer Goods, Sporting Goods, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Avient Corporation, BASF SE, Celanese Corporation, Coperion GmbH (Hillenbrand Inc.), Lanxess AG, Mitsubishi Chemical Holdings Corporation, Owens Corning, SGL Carbon SE, Solvay S.A., Toray Industries Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the long-fiber thermoplastics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global long-fiber thermoplastics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the long-fiber thermoplastics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The long-fiber thermoplastics market was valued at USD 3.59 Billion in 2024.

The long-fiber thermoplastics market is projected to exhibit a CAGR of 5.97% during 2025-2033, reaching a value of USD 6.21 Billion by 2033.

Key factors driving the long-fiber thermoplastics market include rising demand for lightweight and durable materials, increasing focus on fuel efficiency, and the growing adoption in high-performance applications. Advancements in processing technologies, emphasis on sustainability, and supportive regulatory standards further support the market growth, encouraging innovation and broader utilization across multiple industries.

Europe currently dominates the long-fiber thermoplastics market, accounting for a share of 40%. The dominance of the region is because of its advanced manufacturing infrastructure, strong research capabilities, and emphasis on high-performance materials. Favorable regulatory frameworks, skilled workforce, and continuous innovation support the region’s leadership, fostering sustainable growth and reinforcing its position as a hub for premium thermoplastic solutions.

Some of the major players in the long-fiber thermoplastics market include Avient Corporation, BASF SE, Celanese Corporation, Coperion GmbH (Hillenbrand Inc.), Lanxess AG, Mitsubishi Chemical Holdings Corporation, Owens Corning, SGL Carbon SE, Solvay S.A., Toray Industries Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)