LPG Cylinder Manufacturing Market Size, Share, Trends and Forecast by Material, Size, End User, and Region, 2025-2033

LPG Cylinder Manufacturing Market Size and Share:

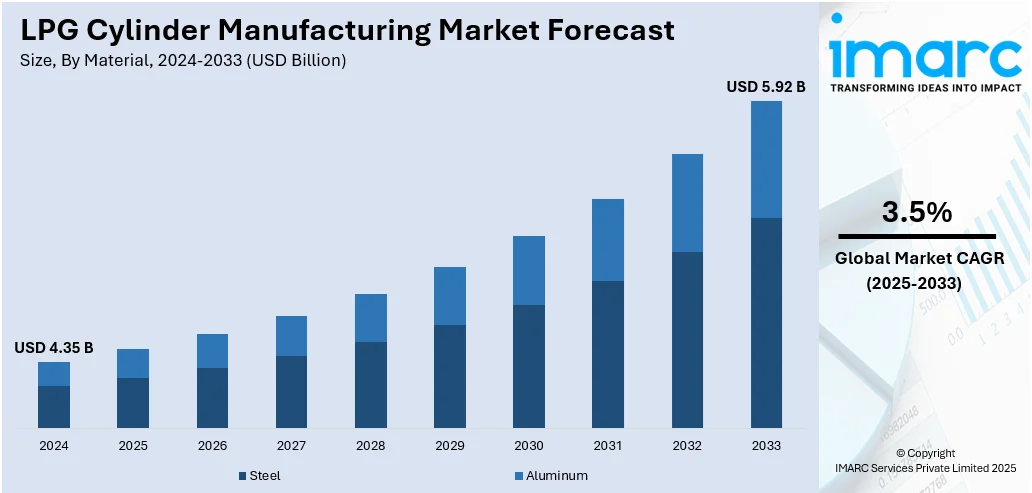

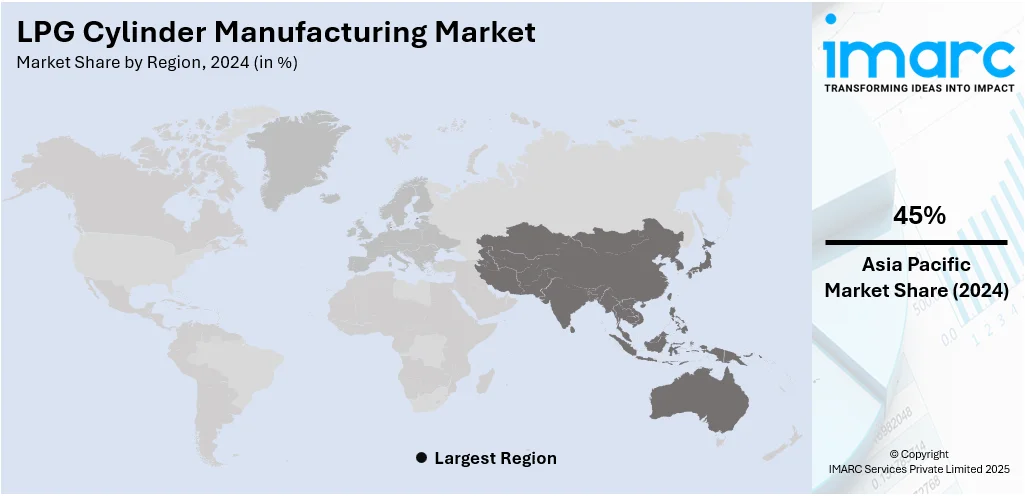

The global LPG cylinder manufacturing market size was valued at USD 4.35 Billion in 2024. The market is projected to reach USD 5.92 Billion by 2033, exhibiting a CAGR of 3.5% from 2025-2033. Asia-Pacific currently dominates the market, holding a market share of 45% in 2024. Rising adoption of liquefied petroleum gas (LPG) cylinders in households, along with the growing demand for automotive LPG cylinders, is positively influencing the market. Besides this, the introduction of automation technologies is fueling the LPG cylinder manufacturing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.35 Billion |

|

Market Forecast in 2033

|

USD 5.92 Billion |

| Market Growth Rate 2025-2033 | 3.5% |

At present, the market is growing steadily due to rising demand for clean cooking fuel in both rural and urban areas. As more people are shifting from traditional fuels to LPG, especially through government schemes, the need for cylinders is increasing. Urbanization and better living standards are also boosting LPG adoption in households and commercial places like hotels and food stalls. Old and damaged cylinders need regular replacement, which keeps manufacturing active. Lightweight and new material-based cylinders also attract more buyers. Safety regulations and quality standards, which are motivating manufacturers to come up with strong and reliable products, are impelling the LPG cylinder manufacturing market growth.

To get more information on this market, Request Sample

The United States has emerged as a major region in the LPG cylinder manufacturing market owing to many factors. The market is growing due to the increasing use of LPG in residential, commercial, and industrial sectors. Many households are utilizing LPG for heating, cooking, and grilling, which is catalyzing the demand for reliable and safe cylinders. The popularity of outdoor activities and camping is also supporting the employment of portable LPG cylinders. In industries, LPG is used as a fuel for forklifts, heating systems, and other equipment, adding to the need for durable cylinders. Additionally, the steady supply and exports of domestic LPG due to shale gas production ensure a strong base for cylinder utilization and manufacturing in the country. As per industry reports, by April 2024, the total LPG exports reached 20.2 Million Metric Tons in the United States.

LPG Cylinder Manufacturing Market Trends:

Growing use of LPG

Rising LPG utilization is positively influencing the market. In India, LPG comprised 13% of total petroleum product usage during 2021–2022, as reported by the Observer Research Foundation (ORF). In total, LPG adoption in the nation increased by over 76% from 2013–14 to 2021–22. As more households, restaurants, and industries are shifting to LPG for cooking, heating, and other energy needs, the demand for cylinders is growing steadily. Government initiatives aimed at promoting clean fuel access, especially in rural and underserved areas, are further boosting LPG usage and creating the requirement for more cylinders. The growth of small food vendors, commercial kitchens, and backup fuel solutions in urban areas is also adding to this demand. With higher utilization, the replacement cycle of old or damaged cylinders is becoming more frequent, motivating manufacturers to produce in larger volumes.

Increasing demand in automotive industry

With increasing fuel prices and the growing focus on reducing emissions, many car owners, taxi operators, and commercial fleet owners are preferring LPG-powered vehicles. This shift is creating a strong need for specially designed LPG cylinders that are compact, safe, and durable for automotive use. Manufacturers are responding by producing high-pressure and lightweight cylinders that meet strict safety standards. They are also launching LPG dispensing stations for vehicles to endorse cleaner fuel alternatives. In June 2025, Confidence Petroleum India Limited unveiled eight new auto LPG dispensing stations for vehicles at important sites in India. This launch showcased the nation's rising emphasis on eco-friendly transportation. Regular maintenance and periodic replacement of automotive cylinders are also adding to steady demand. In many countries, government policies and incentives are supporting LPG adoption in vehicles, further boosting cylinder usage.

Regulations on cylinder safety and quality

Regulations on cylinder safety and quality are offering a favorable LPG cylinder manufacturing market outlook. For instance, in June 2024, the Indian Ministry of Commerce and Industry released the ‘Gas Cylinders (Amendment) Rules, 2024’, which signified a crucial step forward in improving safety and operational effectiveness in the compressed gas sector. A significant aspect of these regulations was the mandate for barcoding, which included radio frequency identification (RFID) and quick response code (QR Code) technologies. This enhancement was intended to refine the monitoring and management of gas cylinders, fostering improved inventory oversight, while increasing safety through efficient usage tracking. Authorities are implementing guidelines to ensure that cylinders are safe, durable, and able to withstand high pressure, which leads to consistent demand for certified and high-quality products. These regulations require regular testing, inspection, and replacement of old or damaged cylinders, encouraging ongoing manufacturing activity. Companies are investing in better materials and technology to comply with safety norms, resulting in the production of more advanced and reliable cylinders.

LPG Cylinder Manufacturing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global LPG cylinder manufacturing market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on material, size, and end user.

Analysis by Material:

- Steel

- Aluminum

Steel held 70.0% of the market share in 2024. It offers excellent resistance to impact, fire, and rough handling, making it a reliable and safe choice for storing LPG. Steel cylinders have a long life span and can be reused after proper testing and revalidation, which adds to their economic value. The material is widely available and cost-effective for mass production, allowing manufacturers to meet large-scale demand efficiently. Steel is also compatible with existing manufacturing infrastructure and safety standards, making its use convenient and practical. In addition, steel cylinders are trusted by users and regulators due to their proven safety record and performance in both domestic and industrial environments. Their ability to be recycled after usage also supports sustainability goals. These advantages make steel the dominant material in the LPG cylinder manufacturing market, which is preferred for its safety, reliability, and practicality.

Analysis by Size:

- 4 Kg – 15 Kg

- 16 Kg – 25 Kg

- 25 Kg – 50 Kg

- More than 50 Kg

4kg-15kg accounts for the largest market share. This size range meets the fuel needs of a wide range of users, especially in residential and small commercial sectors. It is easy to handle, store, and transport, making it convenient for daily utilization. These cylinders are also commonly employed by street food vendors, small eateries, and rural households where large storage capacity is not required. Government subsidy programs and promotional schemes often target this size range to expand clean cooking access in rural and low-income areas. The 4kg–15kg cylinders strike a good balance between portability and fuel capacity, ensuring longer usage without being too heavy or bulky. Their high demand ensures large-scale production, which helps reduce the cost per unit. This size segment is becoming the most practical and economical choice, driving its dominance in the market.

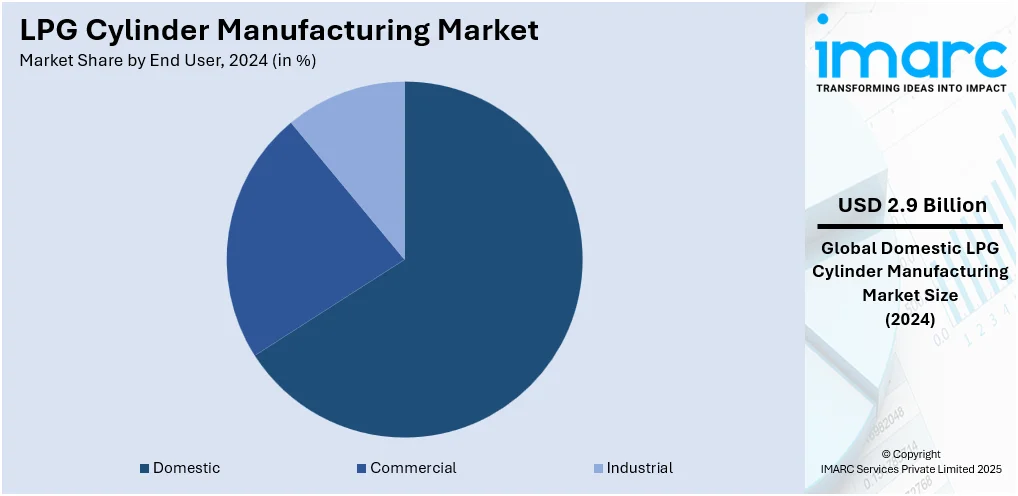

Analysis by End User:

- Domestic

- Commercial

- Industrial

Domestic holds 65.8% of the market share in 2024. Domestic cooking remains the primary use of LPG in many countries, especially in developing regions. As more families are shifting from traditional fuels like wood and kerosene to cleaner LPG, the demand for domestic cylinders continues to rise. Government initiatives and subsidies aimed at promoting LPG access in rural and low-income households are further boosting cylinder utilization at the domestic level. Domestic LPG cylinders are usually small to medium in size, making them easy to handle and suitable for daily cooking needs. In urban areas, LPG is the preferred fuel due to its convenience, safety, and efficiency, catalyzing cylinder demand in apartments and homes. The replacement cycle of cylinders due to wear and tear is also contributing to steady manufacturing. As per the LPG cylinder manufacturing market forecast, with the growing urbanization activities and lifestyle changes, the domestic segment will continue to hold dominance.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific, accounting for a share of 45%, enjoys the leading position in the market. The region is noted for its large population, rising energy needs, and increasing shift towards cleaner cooking fuels. According to industry reports, as of July 2025, the population in Japan reached 123,069,656. Countries like India, China, and Indonesia have growing residential sectors where LPG is widely adopted, especially in rural and semi-urban areas. Government schemes in many of these nations are actively promoting LPG usage, which is catalyzing cylinder demand and supporting local manufacturing. Rapid urbanization and improving living standards are also creating the need for safe and reliable fuel storage solutions. Additionally, the presence of low-cost labor, supportive policies, and strong domestic manufacturing capacities allows Asia-Pacific countries to produce LPG cylinders at competitive prices. Many international and regional companies are investing in expanding their production units in the region to meet both local and export demands.

Key Regional Takeaways:

United States LPG Cylinder Manufacturing Market Analysis

The United States holds 80.00% of the market share in North America. The market is fueled by evolving energy demands, regulatory trends, and technological advancements. One of the primary drivers is the rising need for clean and portable energy sources across residential, commercial, and industrial sectors due to increasing greenhouse gas emissions (GHG) from traditional fuels, such as coal and gasoline. As per the United States Environmental Protection Agency (EPA), carbon dioxide emissions resulting from fossil fuel combustion grew by 8% in 2022 relative to 2020. As individuals and businesses are prioritizing energy efficiency and environmental sustainability, LPG cylinders are offering a cleaner-burning alternative to traditional fossil fuels. Additionally, regulatory support and safety standards established by government agencies are significantly influencing the industry, motivating manufacturers to innovate and produce cylinders that meet stringent quality and safety guidelines. The rise in outdoor recreational activities and the expansion of the food truck and mobile catering industry are also contributing to the high demand for smaller, portable LPG cylinders. Moreover, technological innovations in cylinder design, such as the use of lightweight composite materials and smart monitoring features, are enhancing user convenience and safety, thereby increasing adoption. Other than this, the shift towards decentralized energy systems and emergency preparedness initiatives, particularly in disaster-prone regions, is catalyzing the demand for reliable, transportable fuel sources, reinforcing the overall momentum of the market in the United States.

Europe LPG Cylinder Manufacturing Market Analysis

In Europe, the growth of the market is largely driven by rising demand for safer, user-friendly, and visually appealing cylinders, particularly for residential and recreational use. This has led to an increased focus on aesthetic design, tamper-proof safety features, and user-centric innovations, such as ergonomic grips and easy-to-connect valves. The trend of urban decentralization and off-grid energy solutions in remote and underdeveloped parts of Europe is further driving the demand for portable and compact LPG cylinders suited for small-scale cooking and heating applications. Manufacturers are also responding to the growing popularity of outdoor living and tourism by expanding production of lightweight cylinders that meet various pressure ratings and transportation regulations. Additionally, the circular economy movement is encouraging investments in refurbishment, recertification, and infrastructure for cylinder reuse to reduce waste and extend product life cycles. The presence of large multinational energy distributors with region-wide logistics networks is further creating new opportunities for scale, efficiency, and cross-border collaboration among European manufacturers. For instance, in May 2024, Hexagon Composites, based in Norway, revealed that Worthington Enterprises was set to acquire its subsidiary, Hexagon Ragasco, for a transaction valued at NOK 1,050 Million. Hexagon Ragasco was a top producer of composite LPG cylinders for both industrial and residential utilization. Through this deal, Hexagon Ragasco could extend its operations outside of Europe, offering clean energy solutions worldwide.

Asia-Pacific LPG Cylinder Manufacturing Market Analysis

The Asia-Pacific LPG cylinder manufacturing market is rapidly growing due to expanding energy access in rural and peri-urban areas, where off-grid households and small businesses are relying on LPG for cooking, heating, and small-scale power generation. Government agencies across the region are promoting LPG adoption to reduce indoor air pollution, which is increasing investments in localized cylinder production facilities to ensure reliable supply chains. For instance, in March 2024, the Union Cabinet of India approved the extension of the Pradhan Mantri Ujjwala Yojana (PMUY) aimed at offering a subsidy of INR 300 for each 14.2 kg cylinder for a maximum of 12 refills per year during FY 2024-25. The Government of India launched the Pradhan Mantri Ujjwala Yojana in May 2016 to provide deposit-free LPG connections to women from low-income households, with the goal of ensuring LPG access in rural areas. As of March 2024, the total count of PMUY beneficiaries reached 10.27 Crore. Besides this, rapid industrial growth across the region is catalyzing the demand for high-capacity cylinders in the hospitality sector.

Latin America LPG Cylinder Manufacturing Market Analysis

The Latin America LPG cylinder manufacturing market is experiencing robust growth due to increasing investments in infrastructure, such as rural tourism lodges and outdoor event venues, where portable and decorative gas cylinders are in high demand. For instance, according to the Global Infrastructure Hub, infrastructure spending represented 2.9% of Brazil’s GDP in 2019. In Argentina, investments in infrastructure held 2.3% of the nation's GDP. Additionally, the expansion of micro-enterprises, such as food trucks and roadside eateries, is catalyzing the demand for compact, reliable LPG cylinders tailored for mobile utilization. Evolving user expectations for higher-quality, branded cylinders are also leading producers to incorporate advanced labeling technologies, tamper-evident seals, and QR-code verification systems to better track inventory and ensure authenticity across distribution networks throughout the region.

Middle East and Africa LPG Cylinder Manufacturing Market Analysis

The Middle East and Africa LPG cylinder manufacturing market is being shaped by the growing expenditure on energy infrastructure projects, where standardized LPG equipment is essential for reliable cooking and heating in both urban and rural areas. For instance, investment in energy projects in the Middle East was set to attain nearly USD 175 Billion in 2024, of which 15% was expected to be allocated for clean energy, according to the International Energy Agency (IEA). The growing interest in sustainable practices is also advancing research into reusable composite cylinders that reduce weight and carbon footprint. Other than this, oil-rich Gulf countries are catalyzing the demand for export-grade, high-pressure cylinders. There is also a rising emphasis on public safety awareness, promoting the adoption of cylinders with enhanced thermal insulation, pressure relief systems, and tamper-evident packaging.

Competitive Landscape:

Key players are manufacturing innovative products to cater to the evolving LPG cylinder manufacturing market trends. They are investing in advanced technologies to produce lightweight, durable, and safe cylinders that meet modern safety standards. These companies often collaborate with government bodies and LPG distributors to ensure steady supply and meet the growing demand. Their ability to manufacture in bulk aids in reducing production costs and making cylinders more affordable. Key players are also emphasizing research and development (R&D) activities to create eco-friendly and corrosion-resistant materials. They ensure timely replacement of aging cylinders and work to meet rising needs from households, commercial users, and industries. By broadening their market presence locally and internationally, they are helping to build user trust through quality and reliability. For instance, in April 2025, Pune Gas inaugurated a new experience center for industrial and commercial LPG and Natural Gas solutions in Hyderabad, India. This marked the company’s inaugural experience center in Telangana and its fifth in total across India, highlighting Pune Gas’s commitment to broad regional distribution and convenient access.

The report provides a comprehensive analysis of the competitive landscape in the LPG cylinder manufacturing market with detailed profiles of all major companies, including:

- Aygaz A.S.

- Confidence Petroleum India Limited

- ECP Industries Limited

- Hexagon Ragasco AS (Hexagon Composites ASA)

- Manchester Tank (McWane Inc.)

- Mauria Udyog Ltd.

- Sahamitr Pressure Container PLC

- Satyasai Pressure Vessels Group

- Shandong Huanri Group Co. Ltd.

- Worthington Industries Inc.

Latest News and Developments:

- July 2025: Pune Gas unveiled its inaugural Experience Center for industrial and commercial LPG and Natural Gas equipment and solutions in North India, situated in Okhla, Delhi. This launch marked a significant achievement in the company's nationwide strategy for retail growth, bringing its eco-friendly and advanced gas solutions nearer to North India’s rapidly expanding industrial, food service, and hospitality industries.

- April 2025: Trigas officially began building a facility for manufacturing LPG composite cylinders in Sokhna, Egypt. The facility, covering around 10,400 square meters, was strategically situated in Sokhna’s industrial district and represented a total investment of €14 Million.

- April 2025: BPCL formally inaugurated the groundwork for a state-of-the-art LPG bottling plant in Bihar, India. With an expenditure of INR 340 Crore, the facility is anticipated to start operations by March 31, 2027, boasting a capacity of 180 Thousand Metric Tons annually.

LPG Cylinder Manufacturing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Steel, Aluminum |

| Sizes Covered | 4 Kg – 15 Kg, 16 Kg – 25 Kg, 25 Kg – 50 Kg, More than 50 Kg |

| End Users Covered | Domestic, Commercial, Industrial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aygaz A.S., Confidence Petroleum India Limited, ECP Industries Limited, Hexagon Ragasco AS (Hexagon Composites ASA), Manchester Tank (McWane Inc.), Mauria Udyog Ltd., Sahamitr Pressure Container PLC, Satyasai Pressure Vessels Group, Shandong Huanri Group Co. Ltd., Worthington Industries Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the LPG cylinder manufacturing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global LPG cylinder manufacturing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the LPG cylinder manufacturing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The LPG cylinder manufacturing market was valued at USD 4.35 Billion in 2024.

The LPG cylinder manufacturing market is projected to exhibit a CAGR of 3.5% during 2025-2033, reaching a value of USD 5.92 Billion by 2033.

As more households are shifting from traditional fuels like wood and coal to LPG, the need for safe and standardized cylinders is rising significantly. Rapid urbanization and changing lifestyles are further contributing to this transition, increasing cylinder utilization in both residential and commercial sectors. Additionally, technological advancements, such as the development of lightweight and corrosion-resistant cylinders, are offering safer and more durable alternatives.

Asia-Pacific currently dominates the LPG cylinder manufacturing market, accounting for a share of 45% in 2024, due to high population, rising LPG adoption, strong government support, and low production costs. Increasing urbanization and domestic manufacturing capabilities are further strengthening the region’s leadership in cylinder production.

Some of the major players in the LPG cylinder manufacturing market include Aygaz A.S., Confidence Petroleum India Limited, ECP Industries Limited, Hexagon Ragasco AS (Hexagon Composites ASA), Manchester Tank (McWane Inc.), Mauria Udyog Ltd., Sahamitr Pressure Container PLC, Satyasai Pressure Vessels Group, Shandong Huanri Group Co. Ltd., Worthington Industries Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)