Magnesium Hydroxide Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

Magnesium Hydroxide Price Trend, Index and Forecast

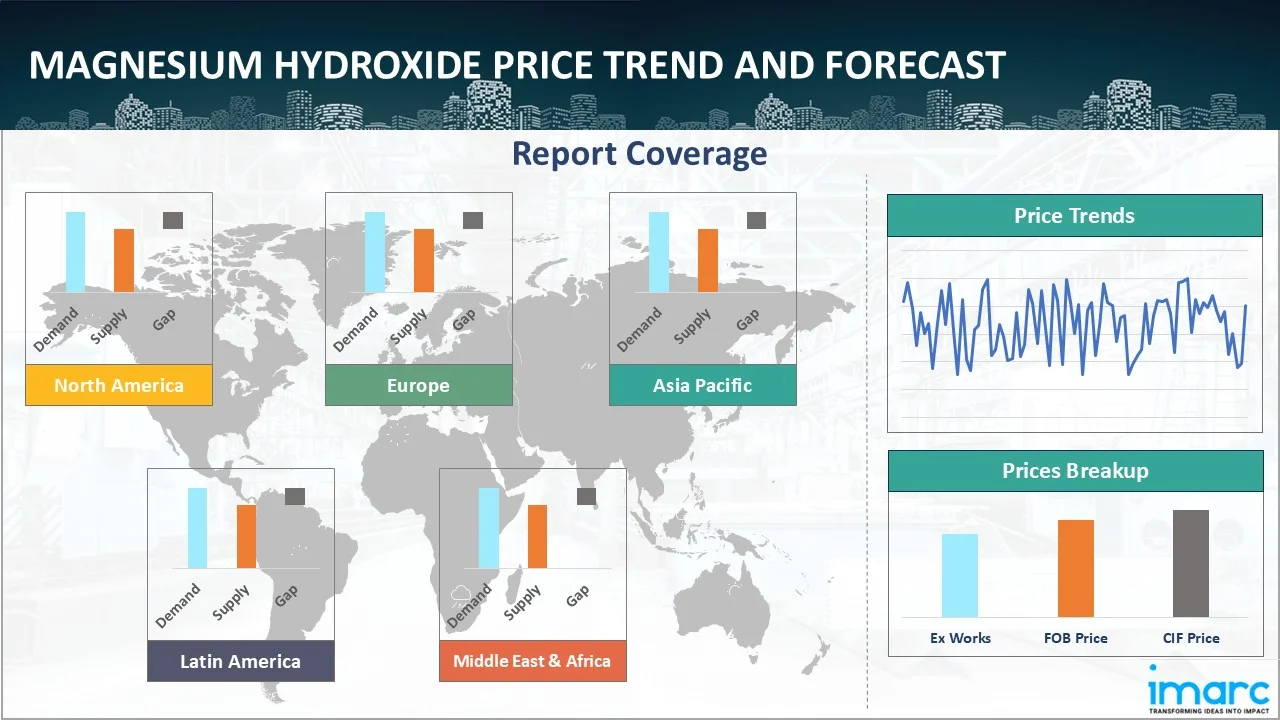

Track the latest insights on magnesium hydroxide price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

Magnesium Hydroxide Prices Outlook Q3 2025

- USA: USD 796/MT

- China: USD 490/MT

- France: USD 751/MT

- India: USD 750/MT

- Brazil: USD 1034/MT

Magnesium Hydroxide Price Chart

Get real-time access to monthly/quarterly/yearly prices Request Sample

During the third quarter of 2025, the magnesium hydroxide prices in the USA reached 796 USD/MT in September. Market participants reported upward pressure driven by tighter domestic supply as several production facilities underwent scheduled maintenance and capacity rationalization. Demand from flame retardant and wastewater treatment sectors strengthened, absorbing available volumes and reducing inventory buffers. Freight and inland logistics costs firmed selectively, amplifying landed cost sensitivity for regional buyers.

During the third quarter of 2025, the magnesium hydroxide prices in China reached 490 USD/MT in September. Price gains reflected a combination of sustained downstream consumption and intermittent upstream feedstock tightness. Domestic producers cited capacity curtailments and stricter environmental inspections that constrained throughput and reduced spot offers. Consumption in flame retardant compounding and industrial wastewater treatment continued at a steady pace, leading to faster drawdown of working inventories.

During the third quarter of 2025, the magnesium hydroxide prices in France reached 751 USD/MT in September. Price advancement was underpinned by firm demand from construction-related sectors and the polymer additives industry, which sought more halogen-free flame retardant solutions. European producers faced higher energy and compliance-related operating costs that were passed through into offers, while a cautious stance among traders tightened prompt availability.

During the third quarter of 2025, the magnesium hydroxide prices in India reached 750 USD/MT in September. Prices rose as domestic demand strengthened across flame retardant compounding and effluent treatment segments, prompting buyers to replenish inventories. Local producers reported tighter gross margins due to elevated input costs and occasional feedstock bottlenecks, which limited aggressive selling. Import offers were selectively absorbed but landed cost economics and port handling variability encouraged increased reliance on domestic volumes at higher price points.

During the third quarter of 2025, the magnesium hydroxide prices in Brazil reached 1034 USD/MT in September. The market saw price appreciation driven by constrained local production and stronger consumption in mining and construction applications. Supply-side limitations, including maintenance cycles and slower replenishment of imported stocks, tightened immediate availability. Buyers faced elevated freight and customs-related landed costs, which supported higher domestic quotations.

Magnesium Hydroxide Prices Outlook Q2 2025

- USA: USD 780/MT

- China: USD 465/MT

- France: USD 715/MT

- India: USD 730/MT

- Brazil: USD 1015/MT

During the second quarter of 2025, the magnesium hydroxide prices in the USA reached 780 USD/MT in June. Prices moderated on weaker spot demand and destocking behavior by some end users following an earlier period of heavier purchases. Increased offers from producers seeking to clear the interim build in inventories led to softer transactional levels. Lower short-term interest from the construction sector and a temporary lull in polymer additives procurement reduced immediate uptake.

During the second quarter of 2025, the magnesium hydroxide prices in China reached 465 USD/MT in June. The market registered softer prices as downstream demand cooled relative to prior months and several suppliers increased spot availability. Producers offered more competitive terms to maintain throughput amid reduced intake from certain industrial buyers. Seasonal maintenance completions upstream improved availability and eased immediate tightness, while export enquiries were subdued.

During the second quarter of 2025, the magnesium hydroxide prices in France reached 715 USD/MT in June. Prices in the market showed modest upward movement as industrial activity rebounded in select sectors and procurement cycles restarted. European suppliers cited ongoing cost pressures related to energy and environmental compliance that they sought to recover through offers. Demand for halogen-free flame retardant solutions regained momentum, supporting increased purchasing interest.

During the second quarter of 2025, the magnesium hydroxide prices in India reached 730 USD/MT in June. Prices softened as some buyers took a wait-and-see approach and inventory adjustments reduced spot consumption. Local producers faced pressure to maintain volumes, prompting more competitive offers and promotional selling to stimulate uptake. Imports entered the market at accessible landed costs in particular regions, placing additional downward pressure on domestic quotations.

During the second quarter of 2025, the magnesium hydroxide prices in Brazil reached 1015 USD/MT in June. The market exhibited a slight upward bias driven by steady demand and limited immediate replenishment of stock following prior drawdowns. Domestic producers maintained discipline on offers, citing higher local operating costs and logistical constraints. Import windows narrowed at times, supporting local pricing resilience.

Magnesium Hydroxide Prices Outlook Q1 2025

- USA: USD 834/MT

- China: USD 480/MT

- France: USD 703/MT

- India: USD 751/MT

- Brazil: USD 1004/MT

During the first quarter of 2025, the magnesium hydroxide prices in the USA reached 834 USD/MT in March. Market conditions were shaped by feedstock sourcing practices and coordinated production planning across key manufacturing hubs. Consumption patterns in flame retardant, wastewater treatment, and environmental applications followed typical procurement cycles, with buyers aligning purchases to operational demand forecasts.

During the first quarter of 2025, the magnesium hydroxide prices in China reached 480 USD/MT in March. Pricing dynamics reflected structured supply chain operations and production schedules at major facilities. Consumption from industrial and environmental segments was governed by planned project needs, which informed buying behaviors among downstream players. Feedstock availability and transportation logistics across inland and coastal markets influenced transactional terms.

During the first quarter of 2025, the magnesium hydroxide prices in France reached 703 USD/MT in March. The market was influenced by scheduled production output and established supply arrangements with domestic and European producers. End-use sectors such as plastics, flame retardants, and wastewater treatment adhered to budgeted purchasing frameworks, which informed order timing and contract structuring.

During the first quarter of 2025, the magnesium hydroxide prices in India reached 751 USD/MT in March. Market conditions reflected production planning among domestic manufacturers and import sourcing strategies by downstream industries. Demand from wastewater treatment, flame retardant compounding, and other industrial applications followed scheduled project requirements.

During the first quarter of 2025, the magnesium hydroxide prices in Brazil reached 1004 USD/MT in March. The Brazilian market was shaped by production coordination among regional suppliers and strategic import management. Demand from environmental, industrial, and flame retardant applications informed purchasing arrangements across sectors. Port handling capacities and inland logistics influenced material movement and contract terms.

Regional Coverage

The report provides a detailed analysis of the market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of FOB and CIF prices, as well as the key factors influencing magnesium hydroxide prices.

Europe Magnesium Hydroxide Price Trend

Q3 2025:

The magnesium hydroxide price index was characterized by tighter prompt availability and stronger industrial uptake. Persistent demand from construction, polymer additives and wastewater treatment sectors absorbed available volumes and reduced working inventories across key consuming countries. Energy and compliance-related input costs remained a material factor in producer pricing strategies, prompting firmer offers and limited discounting in spot trades. Cross-border logistics constraints and seasonal congestion increased landed costs for some buyers, reinforcing domestic seller leverage.

Q2 2025:

In the second quarter of 2025, European magnesium hydroxide prices exhibited upward movement driven by improving industrial demand and ongoing cost recovery imperatives for producers. Energy and environmental compliance costs remained influential, prompting sellers to sustain offers with limited discounting. Seasonal moderation in certain downstream sectors restrained rapid uptake, but contract-driven procurement and selective restocking by large consumers supported baseline demand.

Q1 2025:

During the first quarter of 2025, the magnesium hydroxide price index in Europe reflected the interplay between diverse industrial demand segments and regional supply chain logistics. Consumption from environmental applications such as wastewater treatment and flame retardant compounding in plastics informed procurement planning among European manufacturers and distributors. Production scheduling at key facilities across France, Germany, and neighboring countries influenced material availability. Import volumes from adjacent markets contributed to supply allocation priorities at major ports.

This analysis can be extended to include detailed magnesium hydroxide price information for a comprehensive list of countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America Magnesium Hydroxide Price Trend

Q3 2025:

The North American market saw upward movement in magnesium hydroxide quotations as domestic supply balances tightened and downstream demand remained resilient. Maintenance pauses at several production sites and selective allocation to long-term contracts reduced prompt spot availability, elevating transactional levels. Demand from flame retardant compounding, wastewater remediation and specific industrial end users held steady, leading to faster inventory turnover. Logistic cost volatility and increased inland transport pressure raised effective landed costs for certain buyers, which contributed to seller confidence in maintaining higher offers.

Q2 2025:

North American magnesium hydroxide prices softened relative to earlier periods as buyers adjusted inventories, and spot demand weakened. Improved import availability in some trade lanes alleviated immediate shortages, and producers increased promotional activity to maintain throughput, which contributed to lower transactional levels. Downstream sectors moderated procurement in response to seasonal fluctuations, reducing urgency in spot buying. However, producers’ cost structures limited the extent of price concessions, resulting in restrained downward movement rather than steep declines.

Q1 2025:

During the first quarter of 2025, the magnesium hydroxide price index in North America was determined by coordinated production planning and established distribution networks across the USA and Canada. Industrial demand from flame retardant applications in polymers and environmental remediation segments, such as wastewater treatment, guided procurement timing and contract negotiations. Feedstock sourcing strategies and logistical coordination at major distribution hubs shaped commercial engagements. Transportation capacity, including port operations and inland freight, was central to allocation planning.

Specific magnesium hydroxide prices and historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa Magnesium Hydroxide Price Trend

Q3 2025:

The report explores the magnesium hydroxide trends and magnesium hydroxide price chart in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

Q2 2025:

As per the magnesium hydroxide price chart, the prices in the Middle East and Africa fluctuated due to a complex interplay of factors, primarily driven by supply chain disruptions, seasonal demand shifts, and geopolitical influences.

Q1 2025:

According to the magnesium hydroxide price chart, prices in the Middle East and Africa showed fluctuations driven by a complex mix of factors, mainly including supply chain disruptions and seasonal changes in demand. The report further examines how region-specific factors shape market pricing, such as varying levels of industrial growth, differences in the availability and accessibility of natural resources, and ongoing geopolitical tensions.

In addition to region-wise data, information on magnesium hydroxide prices for countries can also be provided.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific Magnesium Hydroxide Price Trend

Q3 2025:

Asia Pacific magnesium hydroxide pricing strengthened amid robust industrial activity and constrained upstream availability in key producing countries. Demand for flame retardant solutions, industrial effluent treatment and specialty compounds increased, absorbing incremental output and tightening spot liquidity. Environmental and regulatory inspections in some producing jurisdictions limited near-term throughput, while inter-regional freight dynamics and port congestion elevated landed costs for import-dependent markets.

Q2 2025:

During Q2 2025, Asia Pacific magnesium hydroxide prices experienced mild downward pressure as several producing countries completed maintenance programs and released additional volumes into the market. Increased prompt availability improved spot liquidity and allowed buyers to secure more favorable terms. Downstream procurement from the polymer and wastewater treatment sectors was measured, with many buyers focusing on contract optimization rather than aggressive spot purchasing. Freight and port handling conditions were relatively stable, which reduced landed cost volatility.

Q1 2025:

The magnesium hydroxide pricing in the Asia Pacific region reflected the diversity of production hubs and end-use demand profiles. Consumption in flame retardant, environmental, and industrial chemical applications informed downstream procurement planning. Production centers coordinated output with regional trade flows, prioritizing allocation to markets with established demand schedules. Feedstock sourcing and port connectivity played central roles in shaping delivery commitments and transaction terms.

This magnesium hydroxide price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America Magnesium Hydroxide Price Trend

Q3 2025

In Q3 2025, Latin American magnesium hydroxide markets recorded upward price behavior as domestic production constraints and steady end-user consumption combined to tighten near-term availability. Infrastructure and mining-related demand contributed to robust offtake, while import windows were occasionally narrow, increasing reliance on local volumes. Logistic and customs-related landed cost pressures reduced import competitiveness in some corridors, allowing domestic suppliers to maintain elevated offers.

Q2 2025:

Latin American magnesium hydroxide markets displayed modest upward bias as local demand remained steady and import timing constrained immediate replenishment. Mining and construction projects supported consistent offtake, and limited import windows in certain ports reduced spot-market elasticity. Suppliers maintained disciplined offers citing higher operating costs and logistical challenges, which buttressed domestic price levels. At the same time, buyer caution tempered aggressive purchasing, resulting in measured gains rather than sharp increases.

Q1 2025:

During Q1 2025, magnesium hydroxide pricing in Latin America was shaped by the region’s unique blend of import dependency, natural resource markets, and industrial demand from environmental and construction sectors. Procurement planning in wastewater treatment, flame retardant compounds, and related applications followed project-based consumption schedules. Import logistics and port handling conditions were central to supply allocation and delivery planning.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin America countries. |

Magnesium Hydroxide Pricing Report, Market Analysis, and News

IMARC's latest publication, “Magnesium Hydroxide Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition,” presents a detailed examination of the magnesium hydroxide market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of magnesium hydroxide at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed magnesium hydroxide prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting magnesium hydroxide pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Magnesium Hydroxide Industry Analysis

The global magnesium hydroxide market size reached USD 1.4 Billion in 2025. By 2034, IMARC Group expects the market to reach USD 2.5 Billion, at a projected CAGR of 6.16% during 2026-2034. The market is primarily driven by the rising demand from flame retardant and polymer additive applications, expansion of industrial and municipal wastewater treatment projects, and regulatory shifts favoring halogen-free flame retardants.

Latest News and Developments:

- May 2025: J.M. Huber Corporation, a manufacturer of non-halogenated fire retardants, such as magnesium hydroxide and fine precipitated alumina trihydrate, announced the acquisition of The R.J. Marshall Company’s Antimony-free flame retardant, alumina trihydrate (ATH), and molybdate-based smoke suppressant assets.

Product Description

Magnesium hydroxide is a chemical compound with the formula Mg (OH)₂, commonly referred to as milk of magnesia in its suspension form. It is a white, odorless powder that is insoluble in water but can be suspended in water to create a milky solution. Magnesium hydroxide is an important compound used in a variety of industries due to its diverse properties and applications.

In the pharmaceutical industry, it is widely used as an antacid and laxative. Its ability to neutralize stomach acid makes it effective in treating conditions like heartburn and indigestion. It also helps in relieving constipation by drawing water into the intestines and softening stools. Magnesium hydroxide is also employed in environmental applications, especially in wastewater treatment, where it serves as an alkaline agent to neutralize acidic water. It is used in the removal of sulfur from industrial gases, particularly in flue gas desulfurization systems, making it an important component in controlling air pollution.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Magnesium Hydroxide |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Ammonium Perchlorate Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of magnesium hydroxide pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting magnesium hydroxide price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The magnesium hydroxide price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)