Malaysia Advertising Market Size, Share, Trends and Forecast by Type and Region, 2025-2033

Malaysia Advertising Market Overview:

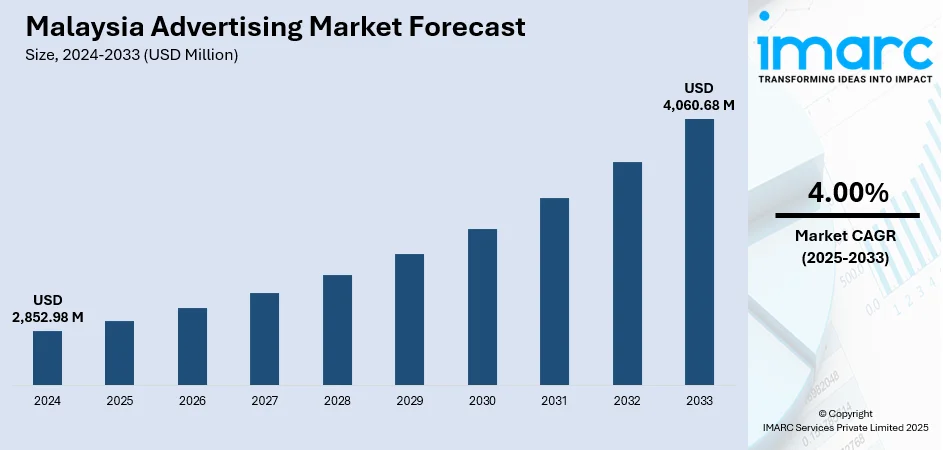

The Malaysia advertising market size reached USD 2,852.98 Million in 2024. The market is projected to reach USD 4,060.68 Million by 2033, exhibiting a growth rate (CAGR) of 4.00% during 2025-2033. The market continues to evolve, driven by digital transformation, changing consumer behavior, and growing brand competition across diverse industries. Some of the key trends are a move towards online platforms, influencer marketing, and targeted advertising strategies that maximize customer engagement. Conventional media is still relevant but slowly changing to fit new formats. Media consumption and regional differences also shape market strategies. As companies search for creative means of reaching audiences, these forces will be central to determining the future of the Malaysia advertising market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,852.98 Million |

| Market Forecast in 2033 | USD 4,060.68 Million |

| Market Growth Rate 2025-2033 | 4.00% |

Malaysia Advertising Market Trends:

Digital Formats Take the Lead

In June 2024, digital formats accounted for seventy-six percent of total advertising revenue in Malaysia, overtaking television, print, radio, and out-of-home channels. This shift reflects a broader trend: advertisers increasingly prefer online platforms where they can achieve real-time targeting, measurable outcomes, and greater flexibility. Mobile-first strategies dominate, driven by widespread smartphone adoption and social media usage. Short-form video, static and dynamic display, and search command the lion’s share of digital spend. While traditional media continue to serve niche purposes, their collective share has declined sharply. Agencies and marketing teams are now leaning into programmatic and automated buying, which offers efficient scaling and the ability to pivot quickly. In creative planning, brands are focusing on more engaging, interactive formats such as video stories, user-generated content, and highly targeted search placements. Local digital media providers are also evolving rapidly, developing integrated ecosystems that support content creation, measurement, and distribution across local influencers and streaming platforms. This marks a defining point in ongoing Malaysia advertising market trends.

To get more information on this market, Request Sample

Resilient Creativity Is Driving Smarter Campaigns

In June 2025, Malaysia’s ad industry found itself navigating a challenging six months marked by economic strain, shifting consumer priorities, and tighter budgets. Instead of pulling back, marketers doubled down on creativity and agility. Campaigns are becoming sharper, more intentional, and better aligned with real consumer sentiment. Teams are embracing fast learning cycles testing, adapting, and scaling ideas across formats like social stories, retail media, and AI-enhanced copy. Collaboration is happening in real-time, often through informal peer groups or cross-functional sprints. There’s a noticeable shift away from top-down campaign planning and toward ideas that originate closer to the audience through micro-communities, creators, and on-the-ground insights. Marketers are using uncertainty as a launchpad for innovation, with emphasis on empathy, cultural nuance, and direct value. Authenticity is no longer optional; it’s the filter through which every message is judged. That mindset is helping teams unlock more with less, staying focused while still being bold. This is a defining reflection of Malaysia advertising market growth.

Trust and Transparency Are Redefining Engagement

In March 2025, Malaysia’s media trust index rose to 52, marking a rare increase in public confidence across any sector. That single shift is causing advertisers to rethink how they engage audiences. Campaigns are moving away from high-gloss messaging and toward honest, clear storytelling built around human relevance. Influencer partnerships are being vetted for transparency, with more emphasis on real experiences rather than scripted promotions. Data use is now a central focus for brands as they are expected to communicate clearly how personal data is collected and used and give users more control. At the same time, companies are investing in trust-building content like behind-the-scenes features, brand values storytelling, and peer testimonials. Owned channels such as newsletters and brand communities are being revived, creating direct and credible engagement environments. In this climate, trust isn’t a vague brand ideal it’s a strategical assist to cut through noise and connect meaningfully. Audiences are choosing who they spend time with more carefully, and authenticity is quickly becoming a core metric of campaign success.

Malaysia Advertising Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type.

Type Insights:

- Television Advertising

- Print Advertising

- Newspaper Advertising

- Magazine Advertising

- Radio Advertising

- Outdoor Advertising

- Internet Advertising

- Search Advertising

- Display Advertising

- Classified Advertising

- Video Advertising

- Mobile Advertising

- Cinema Advertising

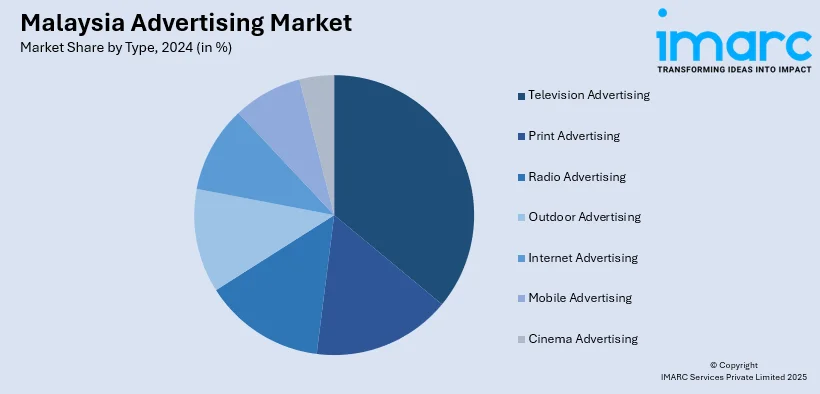

The report has provided a detailed breakup and analysis of the market based on the type. This includes television advertising, print advertising (newspaper advertising and magazine advertising), radio advertising, outdoor advertising, internet advertising (search advertising, display advertising, classified advertising, and video advertising), mobile advertising, and cinema advertising.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Advertising Market News:

- June 2025: AirAsia Media, a division of Malaysia’s Capital A, has formed a strategic partnership with Xoomplay Technologies to launch in-car tablet advertising aboard AirAsia Ride vehicles in key Malaysian cities. Officially signed in Kuala Lumpur by leaders from both companies, this collaboration delivers curated content and entertainment to passengers while enabling brands to connect with an engaged captive audience. Positioned within Capital A’s travel ecosystem including AirAsia MOVE and in-flight media this initiative extends advertisers’ reach throughout Malaysia’s transportation network.

Malaysia Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia advertising market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia advertising market on the basis of type?

- What is the breakup of the Malaysia advertising market on the basis of region?

- What are the various stages in the value chain of the Malaysia advertising market?

- What are the key driving factors and challenges in the Malaysia advertising market?

- What is the structure of the Malaysia advertising market and who are the key players?

- What is the degree of competition in the Malaysia advertising market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia advertising market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia advertising market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)