Malaysia Bancassurance Market Size, Share, Trends and Forecast by Product Type, Model Type, and Region, 2025-2033

Malaysia Bancassurance Market Overview:

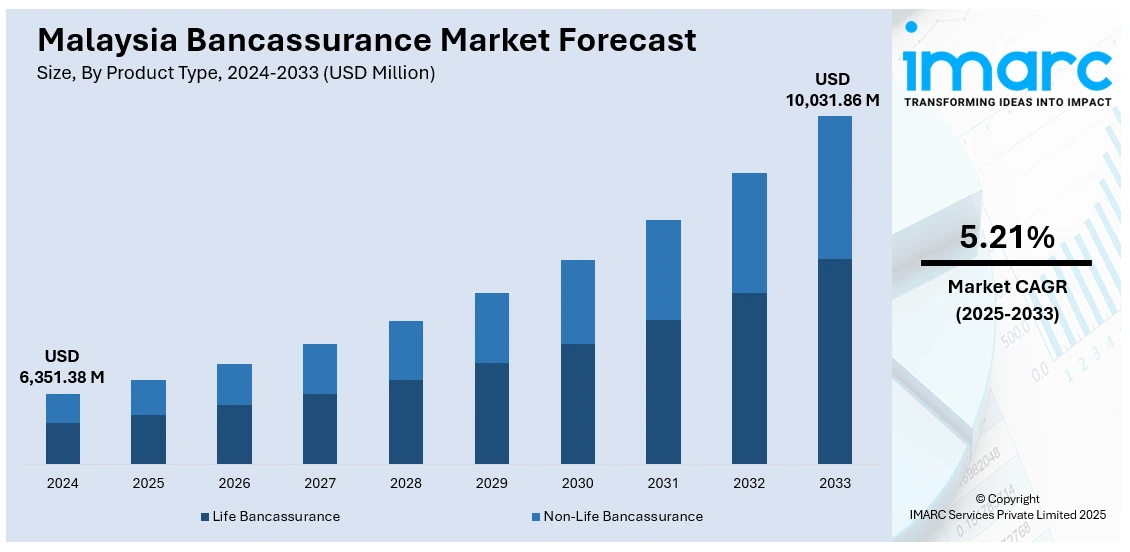

The Malaysia bancassurance market size reached USD 6,351.38 Million in 2024. Looking forward, the market is projected to reach USD 10,031.86 Million by 2033, exhibiting a growth rate (CAGR) of 5.21% during 2025-2033. The market is driven by strong partnerships between leading banks and insurers, reinforced by regulatory frameworks that encourage bancassurance integration into mainstream financial services. Rising middle-class wealth and retirement planning needs are creating sustained demand for protection and investment-linked products. Collectively, these dynamics are consolidating bancassurance as a vital growth channel, further enhancing the Malaysia bancassurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6,351.38 Million |

| Market Forecast in 2033 | USD 10,031.86 Million |

| Market Growth Rate 2025-2033 | 5.21% |

Malaysia Bancassurance Market Trends:

Integrated Banking-Insurance Partnerships

Bancassurance in Malaysia has expanded significantly due to strong collaborations between leading banks and multinational as well as local insurers. Major financial institutions such as Maybank, CIMB, and Public Bank have built long-standing partnerships with insurers like Etiqa, Prudential, and Allianz to deliver a diverse portfolio of protection and investment-linked products. These partnerships are not only transaction-driven but also deeply integrated, with banks offering tailored insurance solutions as part of their wealth management and financial planning services. In May 2025, HSBC Malaysia launched its Q2 Bancassurance Bundling Promotion with Allianz Life Insurance, running until August 12, 2025, or until reaching a cap of MYR 49 million (USD 10.6 Million) in term deposit placements. Eligible Premier and Advance customers who purchase selected Allianz Life bancassurance products alongside HSBC term deposits can access promotional deposit rates of up to 8.38% per annum for three months, depending on whether they are new or existing bancassurance customers. Regulatory support from Bank Negara Malaysia has further reinforced the growth of bancassurance by establishing a clear framework for distribution, customer suitability, and product governance. This has enabled bancassurance to evolve from being an ancillary service to a mainstream component of financial offerings in the country. As households increasingly seek comprehensive financial solutions from a single trusted source, banks have positioned insurance as a natural extension of their core services. This trust-driven integration ensures customer loyalty and higher penetration. Looking forward, Malaysia bancassurance market growth will be supported by continued institutional partnerships, regulatory stability, and evolving customer demand for holistic financial solutions.

To get more information on this market, Request Sample

Rising Middle-Class Wealth and Retirement Planning Needs

The growing middle-class population in Malaysia has created a strong demand for insurance products that address long-term financial security, health, and retirement planning. In May 2025, Malayan Banking Bhd (Maybank) reported a first-quarter net profit of RM2.59 Billion (USD 612 Million), marking a 4% year-on-year increase, supported by stronger insurance service performance and lower impairment losses. The bank’s net interest income rose to RM3.22 Billion from RM3.15 Billion, with bancassurance highlighted as a key driver alongside wealth management and non-retail growth. As disposable incomes rise, more consumers are actively seeking protection-oriented products such as life insurance, medical coverage, and savings plans offered through bancassurance channels. With increased life expectancy and greater awareness of retirement preparedness, bancassurance has become an attractive solution for individuals who prefer structured financial products tied directly to their existing banking relationships. Banks and insurers have responded by introducing flexible and investment-linked policies that allow customers to balance protection with wealth accumulation. This segment has proven particularly appealing to younger professionals who are beginning to prioritize financial planning early in their careers. In addition, Malaysia’s aging population is reinforcing demand for retirement-oriented products, including annuities and health coverage, which are easily accessible through bancassurance. This dual demand from both younger and older demographics highlights the versatility of bancassurance in meeting varied financial needs. By positioning itself as a trusted partner for wealth and retirement solutions, bancassurance has captured a growing share of Malaysia’s financial services sector.

Malaysia Bancassurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and model type.

Product Type Insights:

- Life Bancassurance

- Non-Life Bancassurance

The report has provided a detailed breakup and analysis of the market based on the product type. This includes life bancassurance and non-life bancassurance.

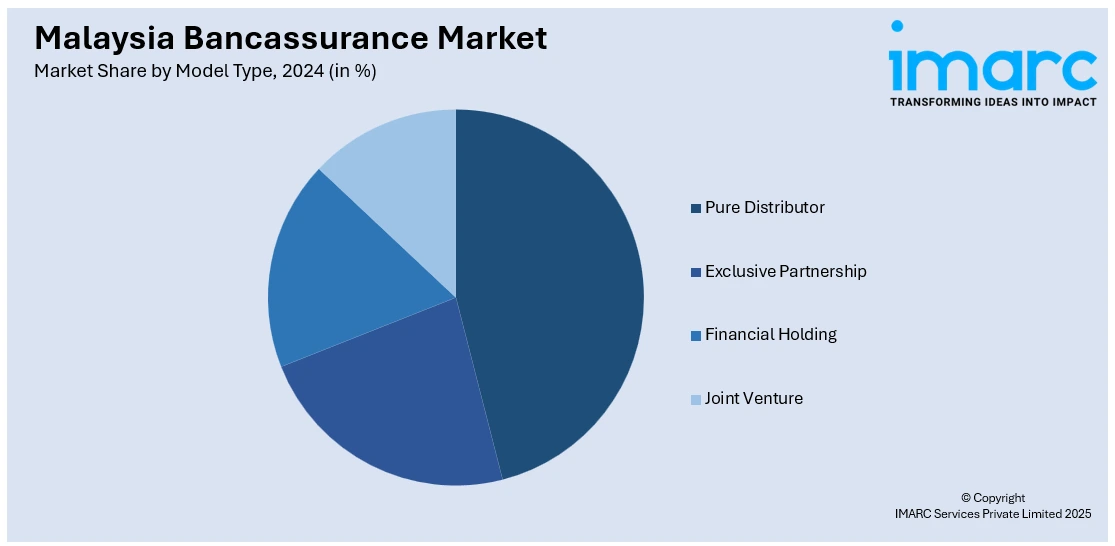

Model Type Insights:

- Pure Distributor

- Exclusive Partnership

- Financial Holding

- Joint Venture

The report has provided a detailed breakup and analysis of the market based on the model type. This includes pure distributor, exclusive partnership, financial holding, and joint venture.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Bancassurance Market News:

- In August 2025, RHB Banking Group signed 20-year exclusive bancassurance and bancatakaful agreements with Tokio Marine Life Insurance Malaysia Bhd and Takaful Malaysia, covering life, family, and general takaful products. The agreements include a Total Access Fee of up to RM1.6 Billion (USD 341 Million), reflecting projected insurance and takaful volumes to be generated through RHB’s branch and digital distribution channels.

Malaysia Bancassurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Life Bancassurance, Non-Life Bancassurance |

| Model Types Covered | Pure Distributor, Exclusive Partnership, Financial Holding, Joint Venture |

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia bancassurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia bancassurance market on the basis of product type?

- What is the breakup of the Malaysia bancassurance market on the basis of model type?

- What is the breakup of the Malaysia bancassurance market on the basis of region?

- What are the various stages in the value chain of the Malaysia bancassurance market?

- What are the key driving factors and challenges in the Malaysia bancassurance market?

- What is the structure of the Malaysia bancassurance market and who are the key players?

- What is the degree of competition in the Malaysia bancassurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia bancassurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia bancassurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia bancassurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)