Malaysia Bottled Water Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Packaging Type, and Region, 2025-2033

Malaysia Bottled Water Market Overview:

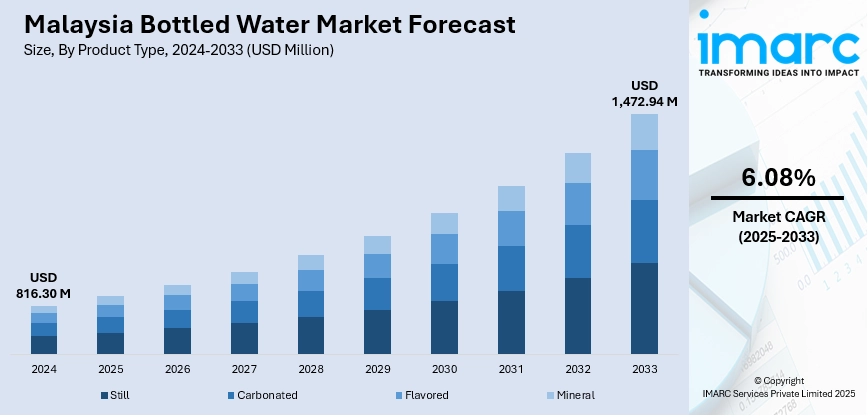

The Malaysia bottled water market size reached USD 816.30 Million in 2024. Looking forward, the market is projected to reach USD 1,472.94 Million by 2033, exhibiting a growth rate (CAGR) of 6.08% during 2025-2033. The market is growing strongly, propelled by rising health awareness, concerns over tap water safety, and the expanding middle-class urban population. Increasing demand for premium, flavored, mineral-enriched, and functional water, along with wider reach of retail and online distribution channels and expanding tourism and hospitality sectors are also escalating product demand. Brands are innovating with sustainable packaging and private-label alternatives to attract environmentally conscious and price-sensitive consumers, are further boosting the overall Malaysia bottled water market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 816.30 Million |

| Market Forecast in 2033 | USD 1,472.94 Million |

| Market Growth Rate 2025-2033 | 6.08% |

Malaysia Bottled Water Market Trends:

Sustainable Packaging Trends

The transition towards sustainability is increasingly becoming a vital factor for growth in the Malaysian bottled water market. As consumer awareness regarding environmental issues rises, brands are more frequently embracing biodegradable bottles, recycled plastic packaging, and refillable options. For instance, in June 2023, Spritzer, a Malaysia-based bottled water company introduced label-free recyclable bottles for its Natural Mineral Water. The new 1.25-litre and 550ml packaging supports its sustainability goals for 2030. This initiative is part of Spritzer's commitment to reducing plastic waste while maintaining the water's quality and taste. There is also a notable rise in the popularity of bulk water formats and in-store refill stations among eco-conscious consumers aiming to limit single-use plastics. These advancements are in line with broader sustainability objectives set by both governments and corporations, promoting responsible production and packaging practices. Furthermore, younger consumers and urban populations are actively favoring brands that uphold green principles and offer transparent commitments to environmental responsibility. Consequently, companies that emphasize sustainable practices are not only building stronger brand loyalty but also tapping into new market segments. This increasing inclination towards eco-friendly options is significantly driving the overall growth of the Malaysia bottled water market growth and transforming long-term business strategies.

To get more information on this market, Request Sample

Retail and E-commerce Expansion

The growth of retail and online distribution channels is notably reshaping the bottled water market in Malaysia. As the urban population increases and the demand for convenience rises, bottled water has become readily accessible through supermarkets, hypermarkets, convenience stores, and specialty retailers. Concurrently, e-commerce platforms are gaining significant popularity, providing consumers with easy access to various bottled water selections, including premium and functional types. According to the data published by the Ministry of Communications, Malaysia's e-commerce revenue exceeded RM1 Trillion in 2021 and is expected to reach RM1.65 Trillion by 2025. The #SayaDigital campaign has assisted 500,000 businesses, while Meta's #JomCelikDigital initiative focuses on empowering 1,000 B40 community members with digital skills. Subscription services and home delivery options add to consumer convenience, especially in metropolitan areas. Retailers are also rolling out bundled promotions, loyalty rewards, and digital advertising to enhance sales and engage customers. This multi-faceted distribution approach enables brands to reach both mainstream and niche markets, ultimately promoting volume growth and improving market presence across various consumer demographics in Malaysia.

Malaysia Bottled Water Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and packaging type.

Product Type Insights:

- Still

- Carbonated

- Flavored

- Mineral

The report has provided a detailed breakup and analysis of the market based on the product type. This includes still, carbonated, flavored, and mineral.

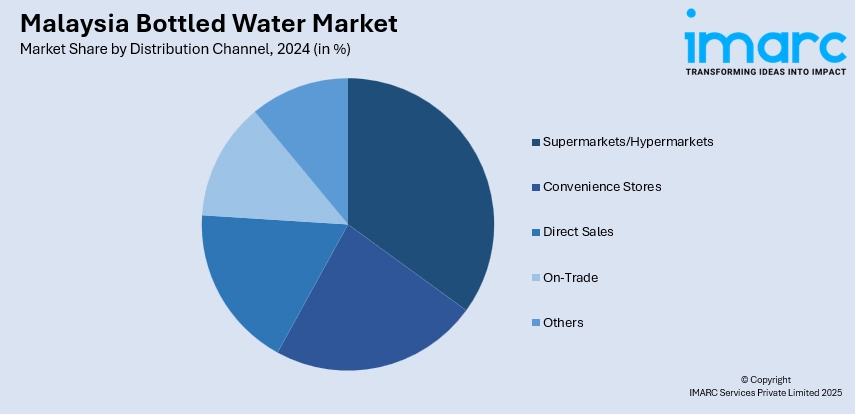

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Convenience Stores

- Direct Sales

- On-Trade

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, direct sales, on-trade, and others.

Packaging Type Insights:

- PET Bottles

- Metal Cans

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes PET bottles, metal cans, and others.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Bottled Water Market News:

- In March 2025, Jetama Sdn Bhd inaugurated its bottled water plant in Kota Kinabalu, becoming Sabah's first government-linked company to do so. The factory emphasizes safety and sustainability while enhancing local economic growth.

- In April 2025, Grinto Coolandia Fizzy Water launched in Malaysia, offering a refreshing alternative to traditional sodas. Infused with golden flower, it promises a unique hydration experience by lowering body temperature. Distributed by Pharma Logik Sdn Bhd, the drink is available in regular and lemon flavors, perfect for the tropical climate.

- In January 2025, Life Water Bhd, founded in 2002 in Sandakan, became a major player in the Malaysian bottled water sector, boasting an 11% market share. Recently listed on Bursa Malaysia, the company plans significant expansion, increasing production capacity to 804 million liters by 2027, while focusing on operational efficiencies and market penetration.

Malaysia Bottled Water Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Still, Carbonated, Flavored, Mineral |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Direct Sales, On-Trade, Others |

| Packaging Types Covered | PET Bottles, Metal Cans, Others |

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia bottled water market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia bottled water market on the basis of product type?

- What is the breakup of the Malaysia bottled water market on the basis of distribution channel?

- What is the breakup of the Malaysia bottled water market on the basis of packaging type?

- What is the breakup of the Malaysia bottled water market on the basis of region?

- What are the various stages in the value chain of the Malaysia bottled water market?

- What are the key driving factors and challenges in the Malaysia bottled water market?

- What is the structure of the Malaysia bottled water market and who are the key players?

- What is the degree of competition in the Malaysia bottled water market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia bottled water market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia bottled water market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia bottled water industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)