Malaysia Carbon Black Market Size, Share, Trends and Forecast by Type, Grade Wise Application, and Region, 2025-2033

Malaysia Carbon Black Market Overview:

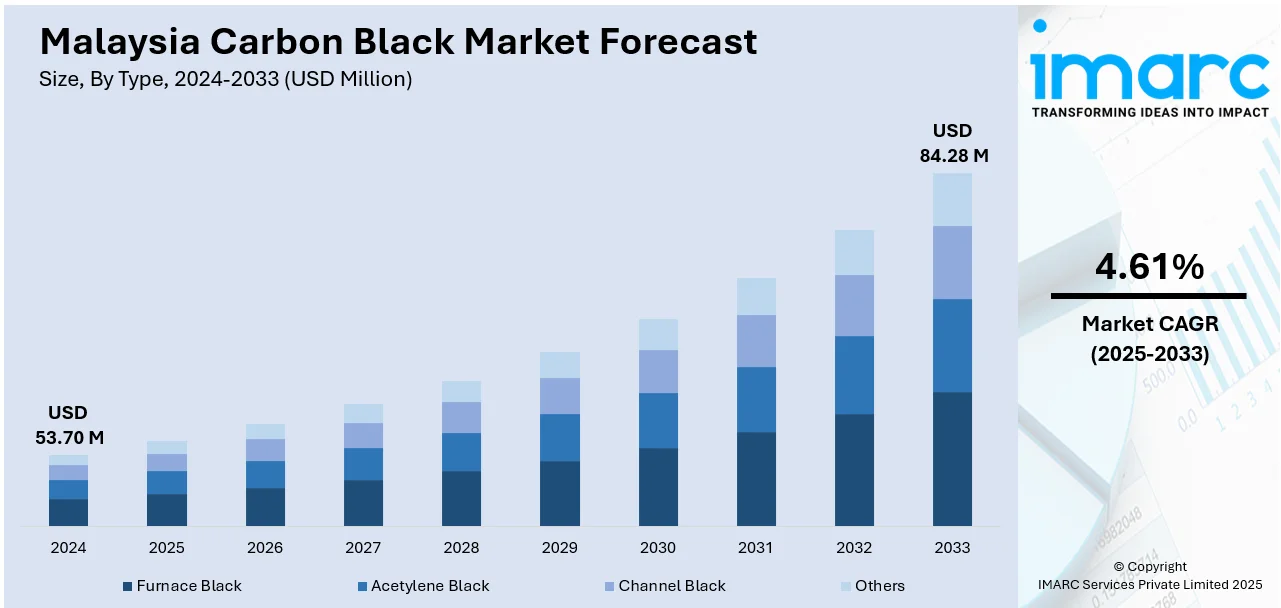

The Malaysia carbon black market size reached USD 53.70 Million in 2024. Looking forward, the market is projected to reach USD 84.28 Million by 2033, exhibiting a growth rate (CAGR) of 4.61% during 2025-2033. The market is gaining momentum across Malaysia’s downstream industries, with carbon black usage rising in plastic conversion, coatings, and functional compounds. As demand for conductive and specialty-grade variants increases, applications in ESD packaging, cable jacketing, and adhesives are growing more sophisticated. These transitions are reinforcing carbon black’s strategic role in diversified value-added manufacturing, further expanding the Malaysia carbon black market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 53.70 Million |

| Market Forecast in 2033 | USD 84.28 Million |

| Market Growth Rate 2025-2033 | 4.61% |

Malaysia Carbon Black Market Trends:

Growing Role in High-Performance Plastic Applications

Malaysia’s expanding downstream polymer sector is creating strong demand for carbon black in high-performance plastic products such as wire insulation, consumer packaging, and molded components. Local converters are emphasizing dispersion efficiency, UV stability, and color depth in polyethylene, polypropylene, and engineering resins. With rising output from appliance, cable, and automotive supply chains, carbon black is used to enhance durability, gloss, and thermal resistance. Low-PAH and food-safe formulations are gaining momentum in packaging and household applications. These diverse and quality-sensitive use cases are reinforcing Malaysia carbon black market growth across plastic-intensive industries.

To get more information on this market, Request Sample

Expansion in Coatings, Printing Inks, and Protective Surfaces

Carbon black plays an increasingly vital role in Malaysia’s coatings and printing ink segments, which are aligned with domestic construction, packaging, and FMCG production. Demand for deep black pigment, enhanced jetness, and UV shielding has accelerated in architectural coatings, automotive refinish systems, and metal protection paints. In October 2024, Amcor completed construction of an advanced coating facility in Selangor, Malaysia. The facility is the first in Asia to use cutting-edge air knife coating technology, setting new standards for pigment uniformity, process efficiency, and enhanced supply for packaging and print labeling applications. The move highlights the growing importance of high-quality coatings, pigments, and specialty additives, including carbon black, in Malaysia’s healthcare packaging and print labeling markets. Simultaneously, printing ink producers serving flexible packaging and retail labeling segments rely on carbon black for sharpness, rub resistance, and uniform dispersion. The focus is shifting toward solvent- and water-compatible grades that offer higher tint strength with lower environmental impact. This evolution is enabling better aesthetic performance and durability, while supporting higher-margin applications across Malaysia’s specialty coatings sector.

Rise in Specialty-Grade and Conductive Carbon Black Usage

Malaysia’s electronics, automotive components, and industrial equipment sectors are adopting specialty carbon black grades that offer tailored conductivity, antistatic properties, and structural integrity. These materials are essential in applications such as cable jacketing, fuel system parts, and ESD packaging. Conductive carbon black ensures electrostatic discharge control and thermal stability, particularly in humid environments. The market also sees rising use in adhesives, sealants, and elastomers requiring clean, fine-particle carbon black with precise surface treatment. These specialty uses support Malaysia’s goal of attracting advanced manufacturing and functional material R&D. As a result, carbon black’s application profile is shifting from commodity filler to functional performance enabler.

Malaysia Carbon Black Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and grade wise application.

Type Insights:

- Furnace Black

- Acetylene Black

- Channel Black

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes furnace black, acetylene black, channel black, and others.

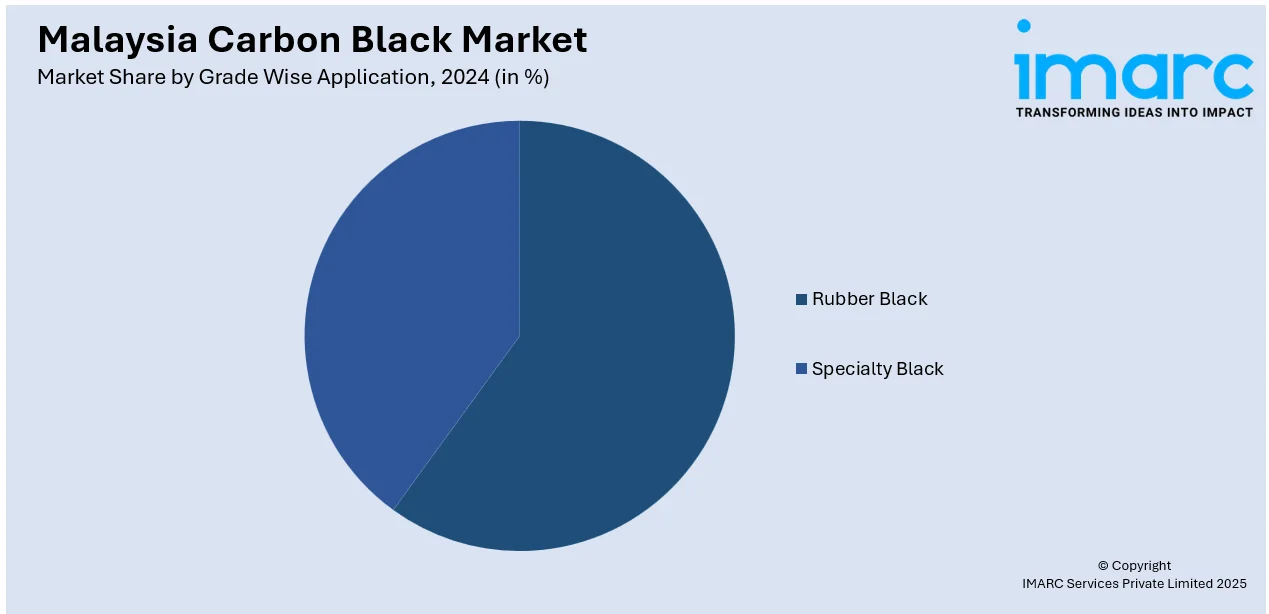

Grade Wise Application Insights:

- Rubber Black

- Tire Treads

- Inner Liner and Tubes

- Conveyor Belts

- Hoses

- Others

- Specialty Black

- Plastics

- Ink and Toners

- Paint and Coatings

- Wires and Cables

- Others

The report has provided a detailed breakup and analysis of the market based on the grade wise application. This includes rubber black (tire treads, inner liner and tubes, conveyor belts, hoses, and others) and specialty black (plastics, ink and toners, paint and coatings, wires and cables, and others).

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Carbon Black Market News:

- June 2024: Klean Industries signed a Letter of Intent to build two new recovered carbon black (rCB) plants in Malaysia, with each site expected to process up to 50,000 metric tons of pyrolysis char annually. The expanded Malaysian facilities will support the growing demand for sustainable raw materials in the tire, plastics, and rubber industries.

Malaysia Carbon Black Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Acetylene Black, Channel Black, Others |

| Grade Wise Applications Covered |

|

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia carbon black market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia carbon black market on the basis of type?

- What is the breakup of the Malaysia carbon black market on the basis of grade wise application?

- What is the breakup of the Malaysia carbon black market on the basis of region?

- What are the various stages in the value chain of the Malaysia carbon black market?

- What are the key driving factors and challenges in the Malaysia carbon black market?

- What is the structure of the Malaysia carbon black market and who are the key players?

- What is the degree of competition in the Malaysia carbon black market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia carbon black market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia carbon black market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia carbon black industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)