Malaysia CCTV Camera Market Size, Share, Trends and Forecast by Type, End User Vertical, and Region, 2025-2033

Malaysia CCTV Camera Market Overview:

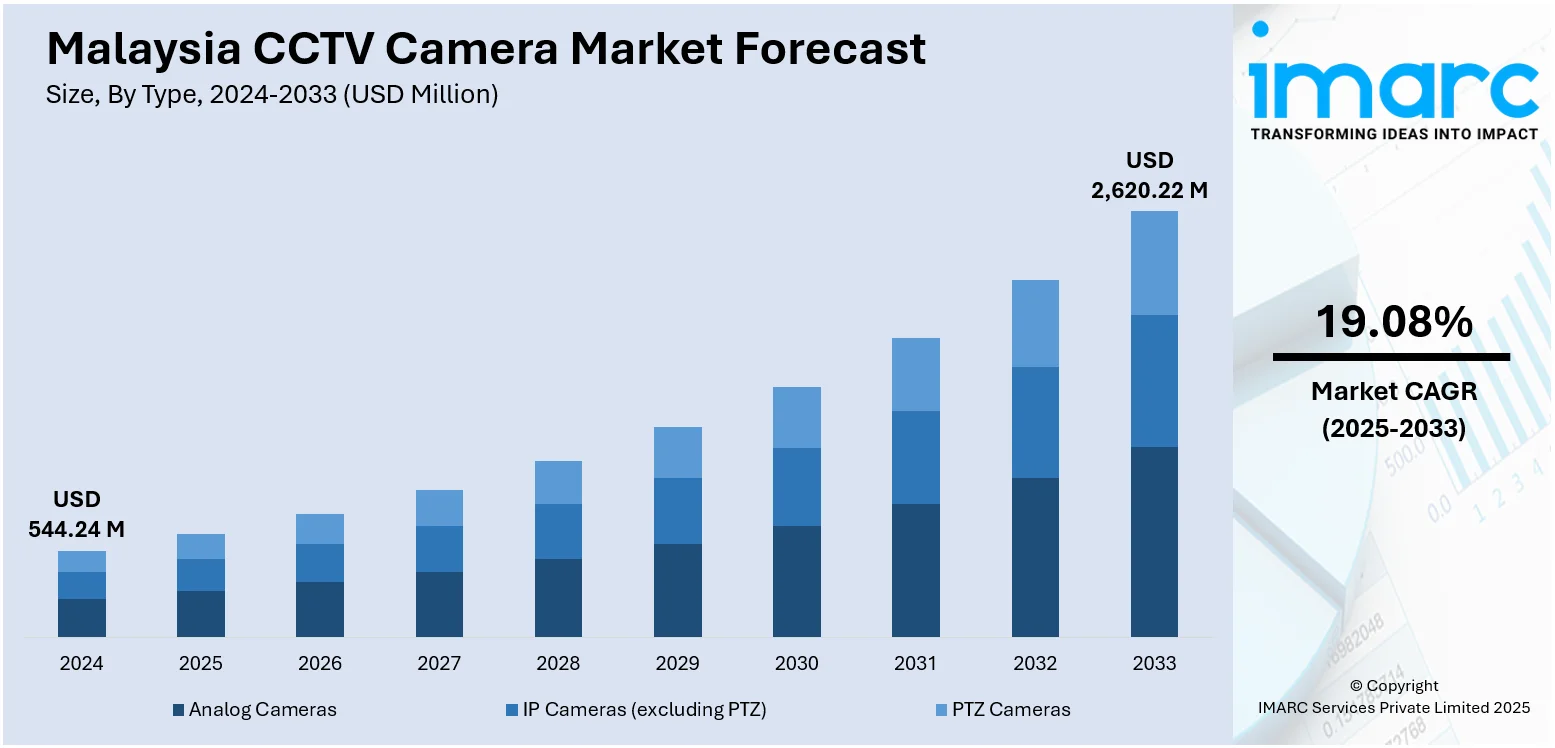

The Malaysia CCTV camera market size reached USD 544.24 Million in 2024. Looking forward, the market is projected to reach USD 2,620.22 Million by 2033, exhibiting a growth rate (CAGR) of 19.08% during 2025-2033. The market is experiencing steady growth driven by rising security concerns, expanding urban development, and increasing adoption of smart surveillance technologies. Demand is growing across residential, commercial, and public sectors, supported by government initiatives and private investments in safety infrastructure. Advancements in AI-enabled and IP-based systems are also shaping market dynamics, contributing to the competitive landscape of the Malaysia CCTV camera market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 544.24 Million |

| Market Forecast in 2033 | USD 2,620.22 Million |

| Market Growth Rate 2025-2033 | 19.08% |

Malaysia CCTV Camera Market Trends:

Rise of Smart Surveillance Systems

The growing implementation of advanced surveillance systems is a significant factor driving market growth. Modern CCTV devices equipped with artificial intelligence are revolutionizing traditional monitoring into proactive security management. For instance, in January 2025, Kota Kinabalu City Hall announced its plans install 1,500 AI-powered smart CCTV cameras to enhance security, particularly in high-risk areas. The initiative, part of a collaboration with the Malaysian Communications and Multimedia Commission, aims to boost safety for residents and tourists while aiding law enforcement in crime prevention. Features such as facial recognition, license plate recognition, motion tracking, and behavior analysis are increasingly being integrated to improve situational awareness and threat detection. These functionalities enable security teams to react to incidents in real time and lessen reliance on manual monitoring. Various entities, including government authorities, transportation agencies, and private businesses, are adopting these sophisticated systems to enhance safety and operational effectiveness across different sectors. Additionally, AI-driven analytics provide valuable insights from video data, optimizing resource distribution and minimizing false alarms. As the demand for intelligent, data-oriented security solutions rises, smart surveillance remains pivotal in boosting Malaysia CCTV camera market growth.

To get more information on this market, Request Sample

Smart City Integration

The incorporation of CCTV networks into Malaysia’s developing smart city initiatives is transforming the way surveillance enhances public safety and infrastructure management. These systems are increasingly integrated with larger urban monitoring platforms that encompass transportation hubs, traffic signals, public utilities, and shared spaces. By connecting CCTV cameras to smart city command centers, authorities can achieve real-time insights into urban activities, allowing for quicker reactions to traffic congestion, emergencies, and security issues. In public spaces, such systems assist in monitoring crowd dynamics, detecting unattended items, and ensuring adherence to safety regulations. For instance, in August 2024, Johor Bahru announced its plans to install 1,800 AI CCTV cameras and upgrading smart traffic lights to enhance public safety and traffic management by 2030. The initiative, part of the Greater Johor Bahru project, aims to improve security and response times for emergencies. Furthermore, integration with utility management systems enables effective oversight of energy, water, and waste services. This interconnected strategy fosters data-driven decision-making and boosts urban resilience. As smart cities grow across Malaysia, the careful implementation of advanced CCTV infrastructure is vital for effortless, effective, and secure urban governance.

Malaysia CCTV Camera Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end user vertical.

Type Insights:

- Analog Cameras

- IP Cameras (excluding PTZ)

- PTZ Cameras

The report has provided a detailed breakup and analysis of the market based on the type. This includes analog cameras, IP cameras (excluding PTZ), and PTZ cameras.

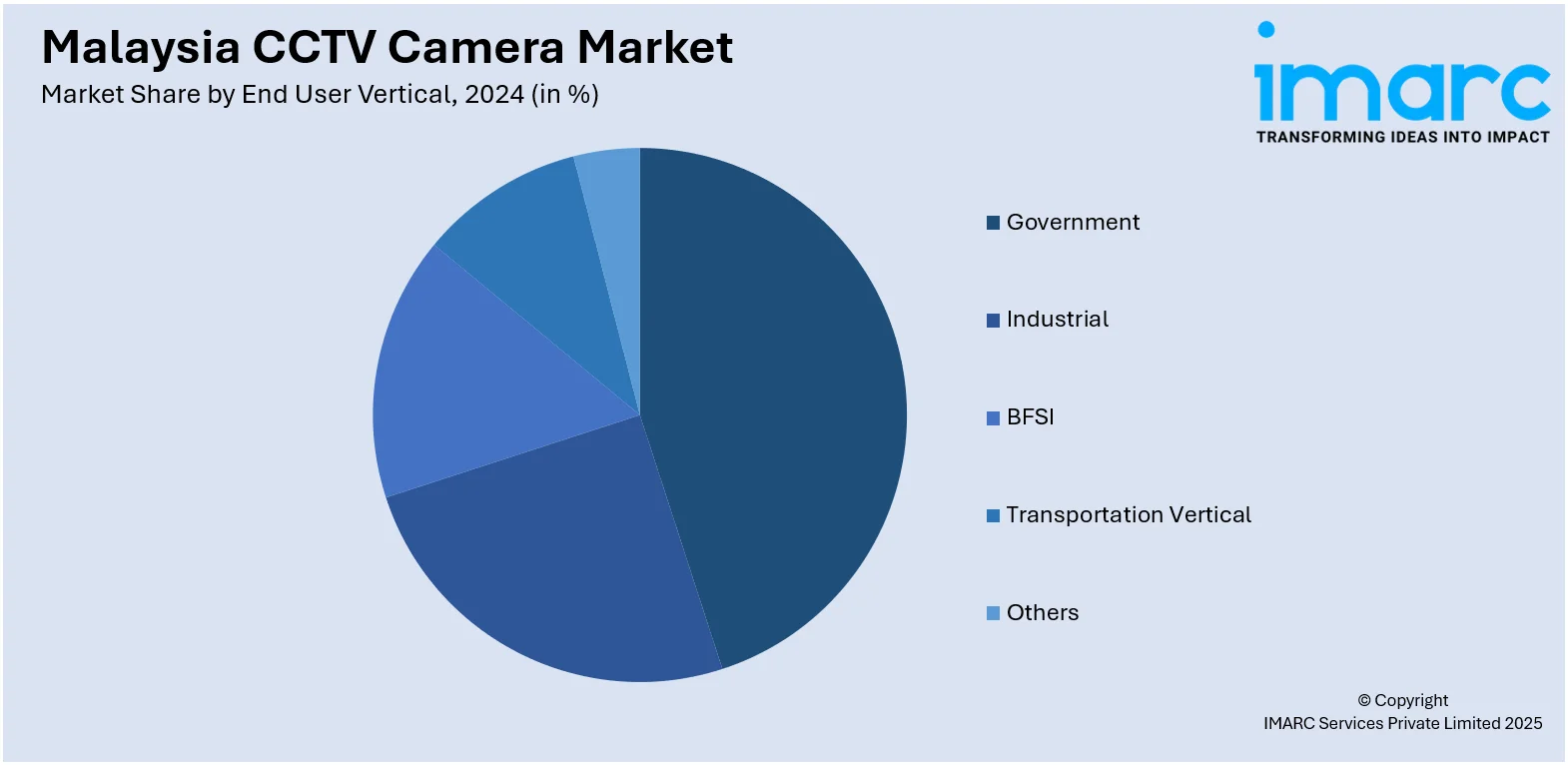

End User Vertical Insights:

- Government

- Industrial

- BFSI

- Transportation Vertical

- Others

A detailed breakup and analysis of the market based on the end user vertical have also been provided in the report. This includes government, industrial, BFSI, transportation vertical, and others.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia CCTV Camera Market News:

- In February 2025, Federal Territories Minister Dr. Zaliha Mustafa announced the installation of 5,000 advanced AI-equipped CCTV cameras across Kuala Lumpur. The initiative aims to enhance public safety, improve emergency response times, and address urban maintenance issues. A proposed task force will review outdated laws governing the territories by mid-year.

- In August 2024, the Malaysian Crime Prevention Foundation's Johor chapter chairman proposed expanding AI CCTV installations to other local councils in Johor. This initiative aims to enhance security and attract foreign investments, particularly with the upcoming Johor-Singapore Special Economic Zone and Rapid Transit System Link. Public involvement in crime prevention is also encouraged.

Malaysia CCTV Camera Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog Cameras, IP Cameras (excluding PTZ), PTZ Cameras |

| End User Verticals Covered | Government, Industrial, BFSI, Transportation Vertical, Others |

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia CCTV camera market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia CCTV camera market on the basis of type?

- What is the breakup of the Malaysia CCTV camera market on the basis of end user vertical?

- What is the breakup of the Malaysia CCTV camera market on the basis of region?

- What are the various stages in the value chain of the Malaysia CCTV camera market?

- What are the key driving factors and challenges in the Malaysia CCTV camera market?

- What is the structure of the Malaysia CCTV camera market and who are the key players?

- What is the degree of competition in the Malaysia CCTV camera market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia CCTV camera market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia CCTV camera market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia CCTV camera industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)