Malaysia Confectionery Market Size, Share, Trends and Forecast by Product Type, Age Group, Price Point, Distribution Channel, and Region, 2025-2033

Malaysia Confectionery Market Overview:

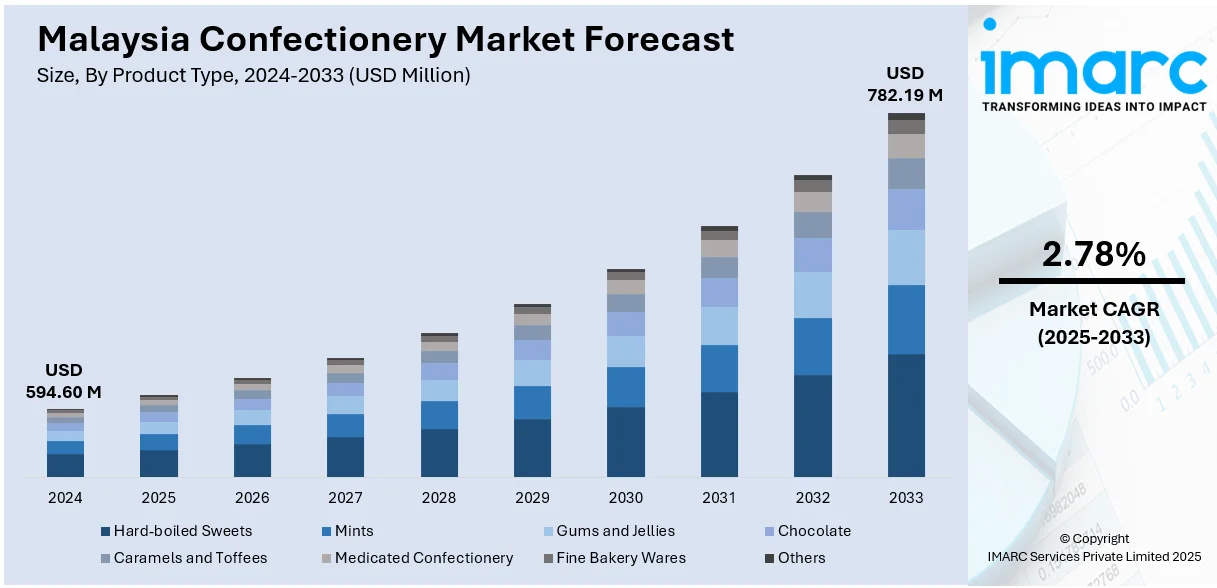

The Malaysia confectionery market size reached USD 594.60 Million in 2024. The market is projected to reach USD 782.19 Million by 2033, exhibiting a growth rate (CAGR) of 2.78% during 2025-2033. The market is driven by the rising disposable incomes, rapid urbanization, and growing demand for convenience snacks are key drivers boosting the Malaysia Confectionery Market. Increasing health-consciousness is also driving innovation in sugar-free and functional confectionery. Expanding retail networks, e-commerce platforms, and aggressive product marketing further enhance consumer reach. Seasonal gifting trends and Western influence on taste preferences contribute to sustained growth. These factors collectively impact the Malaysia confectionery market share positively.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 594.60 Million |

| Market Forecast in 2033 | USD 782.19 Million |

| Market Growth Rate 2025-2033 | 2.78% |

Malaysia Confectionery Market Trends:

Growing Demand for Functional and Sugar-Free Confectionery

Health and wellness awareness among consumers is transforming the preference landscape of confectioneries in Malaysia. Growing fears of obesity, diabetes, and overall well-being have spurred the demand for sugar-free, low-calorie, and functional confectionery. Companies are reacting with fortified confectionery products containing vitamins, minerals, probiotics, and plant-based substances to target health-aware segments. These products address specifically urban shoppers who make active choices for guilt-free indulgences that fit their dietary objectives. The increasing popularity of fitness fads and health consciousness has rendered "better-for-you" snacks a mainstream requirement instead of an elite segment. In May 2024, Malaysia’s Ministry of Health announced a comprehensive “War on Sugar” campaign to combat rising obesity and diabetes rates, underlining a key push toward healthier food and beverage options. As part of that campaign, companies that reduce sugar content in products are now eligible for the “Healthy Choice” logo—encouraging manufacturers to develop lower‑sugar confectionery and snacks that meet public health standards. While regulatory assistance for more transparent labeling of food and nutritional content becomes more common, functional confectionery will find greater acceptance. Malaysia confectionery market growth will be strongly impacted by this shifting preference, as health-led innovation creates new market opportunities and pushes the limits of conventional sweet consumption.

To get more information on this market, Request Sample

Premiumization and Indulgence-Driven Consumption

A growing segment of Malaysian consumers is demonstrating a desire for indulgent and premium confectionery products. This is fueled by increasing disposable incomes, changing taste sophistication, and an emphasis on quality rather than quantity. Premium products typically include super premium ingredients like single-origin cocoa, exotic nuts, or unusual flavor combinations, and are seen as status and self-indulgent symbols. These items also carry connotations of gifting and celebration, hence are sought out in festive and cultural contexts. Consumers in Malaysia are increasingly adventurous and are prepared to try artisanal textures, gourmet looks, and global confectionery themes. Improved packaging and narration of origin and handcrafting enhance the premium confectionery's appeal. With consumers increasingly looking for experiential moments of eating, the trend is reflective of a wider shift in consumption behavior that lends itself to continued innovation in the segment. Malaysia confectionery market trends are no exception to this development towards indulgent and value-based buying.

Impact of Online Shopping and E-Commerce Channels

The rapid growth of electronic commerce in Malaysia is revolutionizing how confectionery goods are discovered, promoted, and consumed. With greater internet penetration, mobile phone usage, and electronic payment acceptance, consumers increasingly desire the convenience of navigating and buying sweets online. Online shopping sites provide a wide range of confectionery products, ranging from locally made products to imported treats, which are not always found in conventional stores. Online endorsements, influencer marketing, and direct-to-consumer models further increase visibility and buying motivation for products. The rise of digital models also enables manufacturers to know the preferences of consumers better through data analysis and provide customized offerings. Subscription boxes and limited releases are also popular with digital channels. The change is not just widening market reach for producers but transforming customer engagement as well. Digitalization is hence at the center of enhancing market reach and transforming the Malaysia confectionery buying experience.

Malaysia Confectionery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, age group, price point, and distribution channel.

Product Type Insights:

- Hard-boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes hard-boiled sweets, mints, gums and jellies, chocolate, caramels and toffees, medicated confectionery, fine bakery wares, and others.

Age Group Insights:

- Children

- Adult

- Geriatric

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes children, adult, and geriatric.

Price Point Insights:

- Economy

- Mid-range

- Luxury

The report has provided a detailed breakup and analysis of the market based on the price point. This includes economy, mid-range, and luxury.

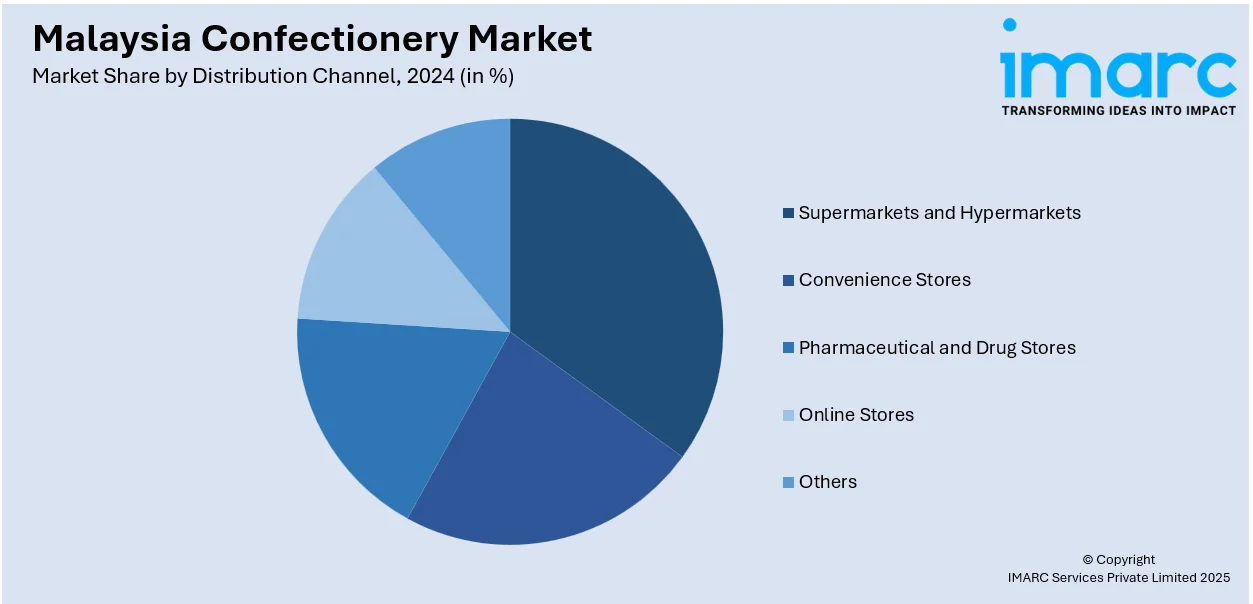

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceutical and Drug Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, pharmaceutical and drug stores, online stores, and others.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Confectionery Market News:

- In January 2024, Cake Tella introduced an innovative festive offering with the launch of its Bakkwa Bacon Cookies, blending sweet-salty bakkwa (barbecue pork) chunks and powder into cookie dough. The cookies delivered a smoky-sweet crunch reminiscent of chocolate chip cookies but with a distinctively Malaysian twist. Paired with a matching Bakkwa Bacon Ice Cream, the launch garnered attention during Chinese New Year celebrations for its bold fusion of traditional and modern flavors.

- In March 2024, ahead of Ramadan and Hari Raya, artisan bakeries across Malaysia launched a wave of seasonal cookies that reimagined traditional offerings. Cake Jalan Tiung unveiled Speculoos animal-shaped cookies, Hazelnut Cookie Cups, Pecan Cookies, and Butter Toffee Cookies, while Chonks! introduced creative variants such as Churros × Biscoff, Matcha Gianduja, Hojicha Bueno, and Jaffa-inspired cookies. These launches catered to rising demand for premium, festive indulgence.

Malaysia Confectionery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Hard-Boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, Others |

| Age Groups Covered | Children, Adult, Geriatric |

| Price Points Covered | Economy, Mid-Range, Luxury |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmaceutical and Drug Stores, Online Stores, Others |

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak and Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia confectionery market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia confectionery market on the basis of product type?

- What is the breakup of the Malaysia confectionery market on the basis of age group?

- What is the breakup of the Malaysia confectionery market on the basis of price point?

- What is the breakup of the Malaysia confectionery market on the basis of distribution channel?

- What is the breakup of the Malaysia confectionery market on the basis of region?

- What are the various stages in the value chain of the Malaysia confectionery market?

- What are the key driving factors and challenges in the Malaysia confectionery market?

- What is the structure of the Malaysia confectionery market and who are the key players?

- What is the degree of competition in the Malaysia confectionery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia confectionery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia confectionery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia confectionery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)