Malaysia Cryptocurrency Market Size, Share, Trends and Forecast by Type, Component, Process, Application, and Region, 2025-2033

Malaysia Cryptocurrency Market Overview:

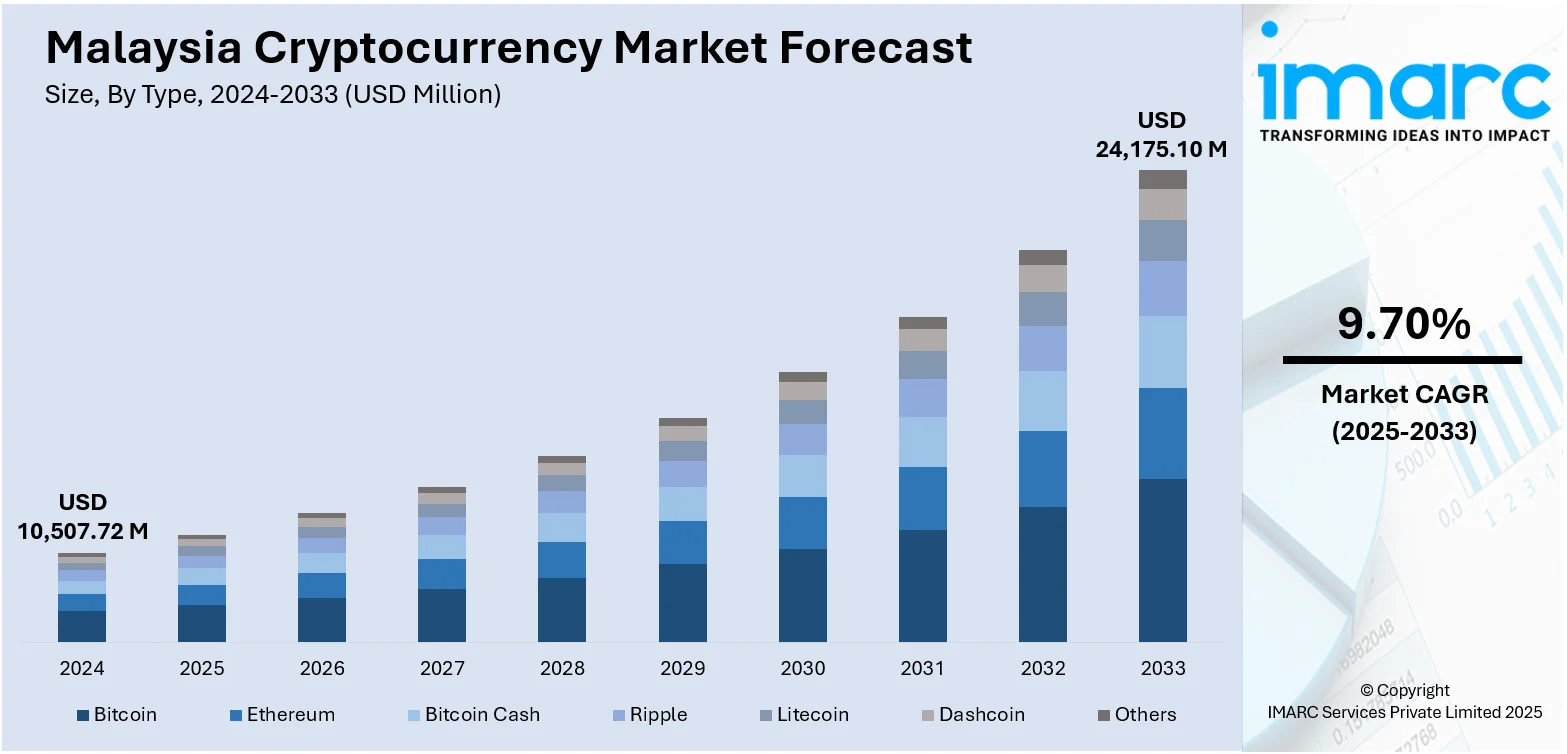

The Malaysia cryptocurrency market size reached USD 10,507.72 Million in 2024. The market is projected to reach USD 24,175.10 Million by 2033, exhibiting a growth rate (CAGR) of 9.70% during 2025-2033. Regulatory clarity, licensing of exchanges, and blockchain-friendly initiatives are building investor trust and encouraging innovations. Besides this, the growing interest among young, tech-savvy individuals seeking alternative investment options is fueling the adoption of cryptocurrency. In addition, easy access to user-friendly trading platforms is contributing to the expansion of the Malaysia cryptocurrency market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10,507.72 Million |

| Market Forecast in 2033 | USD 24,175.10 Million |

| Market Growth Rate 2025-2033 | 9.70% |

Malaysia Cryptocurrency Market Trends:

Supportive government policies

Supportive government policies are propelling the market growth in Malaysia. The recognition of cryptocurrencies as securities by regulatory bodies has brought legitimacy to the industry, encouraging investor confidence and participation. By licensing and regulating digital asset exchanges, the government ensures that trading platforms follow stringent compliance and security standards, reducing risks of fraud and scams. These regulations also enable clearer tax guidelines and promote responsible investing. Moreover, Malaysia’s proactive approach in exploring central bank digital currencies (CBDCs) and blockchain innovation shows its openness to financial technology, which further fuels market confidence. In January 2025, Malaysian Prime Minister Datuk Seri Anwar Ibrahim revealed his nation's plan to take a forward-looking approach to blockchain and the cryptocurrency sector, emphasizing regulations, policies, and international partnerships. During the Abu Dhabi Sustainability Week (ADSW) 2025, Anwar highlighted the necessity of updating Malaysia’s financial systems. Initiatives aimed at financial literacy and digital inclusion are helping more Malaysians understand and access cryptocurrency investments. Additionally, the government's efforts to collaborate with industry players, academic institutions, and international partners are fostering innovations and knowledge exchange within the sector. This regulatory clarity and positive stance have created an environment that not only protects users but also encourages startups, investors, and developers to actively participate in the crypto ecosystem.

To get more information on this market, Request Sample

Growing interest in digital asset trading

Rising interest in digital asset trading is bolstering the Malaysia cryptocurrency market growth. As per industry reports, in Malaysia, digital assets trading reached a record RM13.9 Billion (USD 2.9 Billion) in 2024, over twice the volume noted in 2023. Individuals, especially younger and tech-savvy investors, are seeking alternative investment avenues beyond traditional stocks and real estate. The appeal of cryptocurrency lies in its high return potential, 24/7 trading availability, and the convenience of mobile-based platforms, which align well with Malaysia's digitally connected population. With increasing awareness through social media, online influencers, and financial education initiatives, digital assets are gaining traction as legitimate and exciting investment options. The growing accessibility of user-friendly crypto exchanges and trading apps in local languages is further fueling participation among first-time investors. Additionally, global trends, such as the rise of decentralized finance (DeFi), are generating curiosity and engagement among individuals, expanding the utilization of crypto beyond simple trading. As Malaysians have become more comfortable managing digital wallets and making peer-to-peer transactions, the ecosystem continues to thrive.

Malaysia Cryptocurrency Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, process, and application.

Type Insights:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes bitcoin, ethereum, bitcoin cash, ripple, litecoin, dashcoin, and others.

Component Insights:

- Hardware

- Software

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware and software.

Process Insights:

- Mining

- Transaction

The report has provided a detailed breakup and analysis of the market based on the process. This includes mining and transaction.

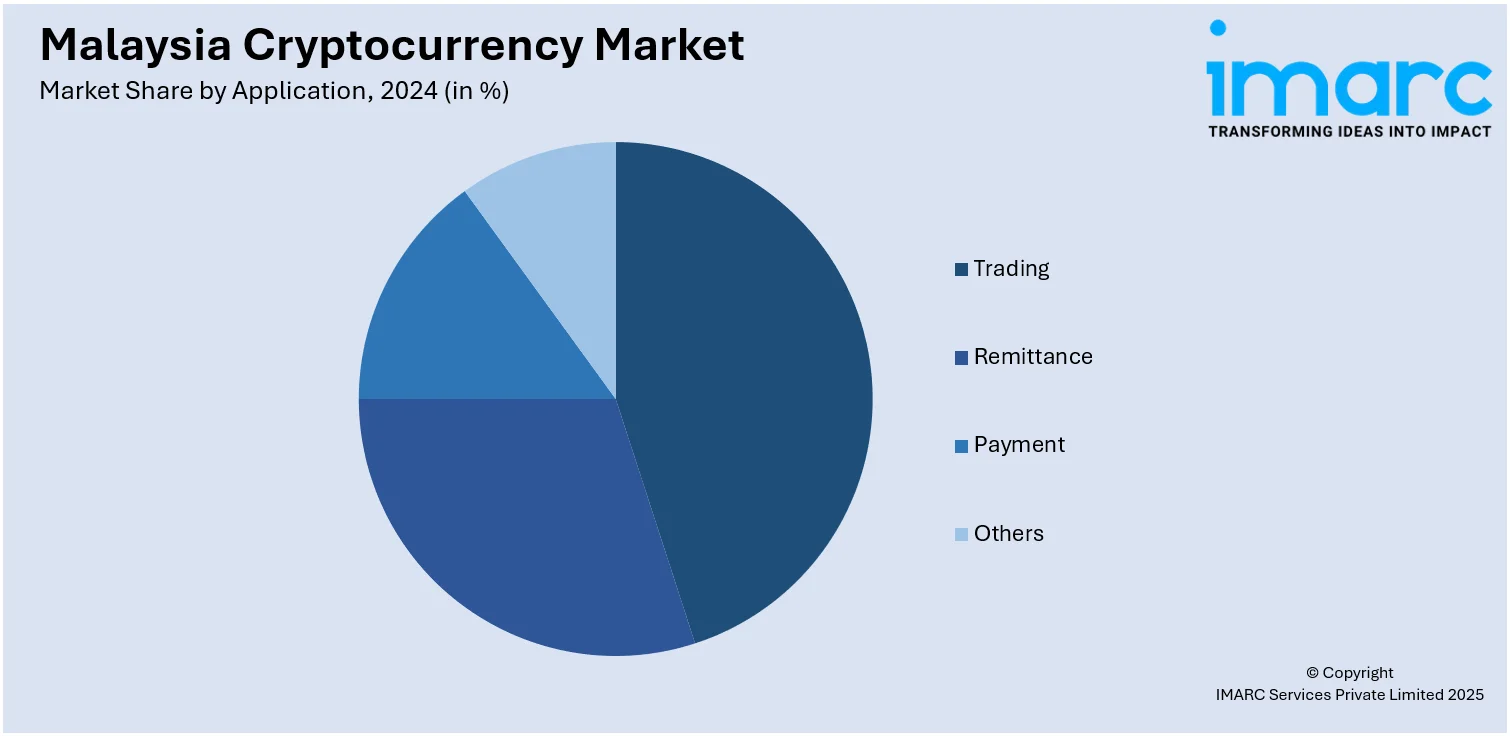

Application Insights:

- Trading

- Remittance

- Payment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes trading, remittance, payment, and others.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Cryptocurrency Market News:

- In July 2025, the Securities Commission Malaysia (SC) sought public input on a plan that would permit cryptocurrency exchanges to list specific digital assets without needing prior explicit approval from the regulator. This was intended to speed up time-to-market, enhance crypto exchange operator responsibility, and expand product range.

- In April 2025, Luno, the prominent cryptocurrency firm, broadened its range of digital assets by introducing two new coins, Algorand and NEAR Protocol, in Malaysia. The expanded selection allowed investors to delve deeper into the crypto landscape and safely diversify their portfolios.

Malaysia Cryptocurrency Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, Others |

| Components Covered | Hardware, Software |

| Processes Covered | Mining, Transaction |

| Applications Covered | Trading, Remittance, Payment, Others |

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia cryptocurrency market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia cryptocurrency market on the basis of type?

- What is the breakup of the Malaysia cryptocurrency market on the basis of component?

- What is the breakup of the Malaysia cryptocurrency market on the basis of process?

- What is the breakup of the Malaysia cryptocurrency market on the basis of application?

- What is the breakup of the Malaysia cryptocurrency market on the basis of region?

- What are the various stages in the value chain of the Malaysia cryptocurrency market?

- What are the key driving factors and challenges in the Malaysia cryptocurrency market?

- What is the structure of the Malaysia cryptocurrency market and who are the key players?

- What is the degree of competition in the Malaysia cryptocurrency market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia cryptocurrency market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia cryptocurrency market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia cryptocurrency industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)