Malaysia Cyber Insurance Market Size, Share, Trends and Forecast by Component, Insurance Type, Organization Size, End-Use Industry, and Region, 2025-2033

Malaysia Cyber Insurance Market Overview:

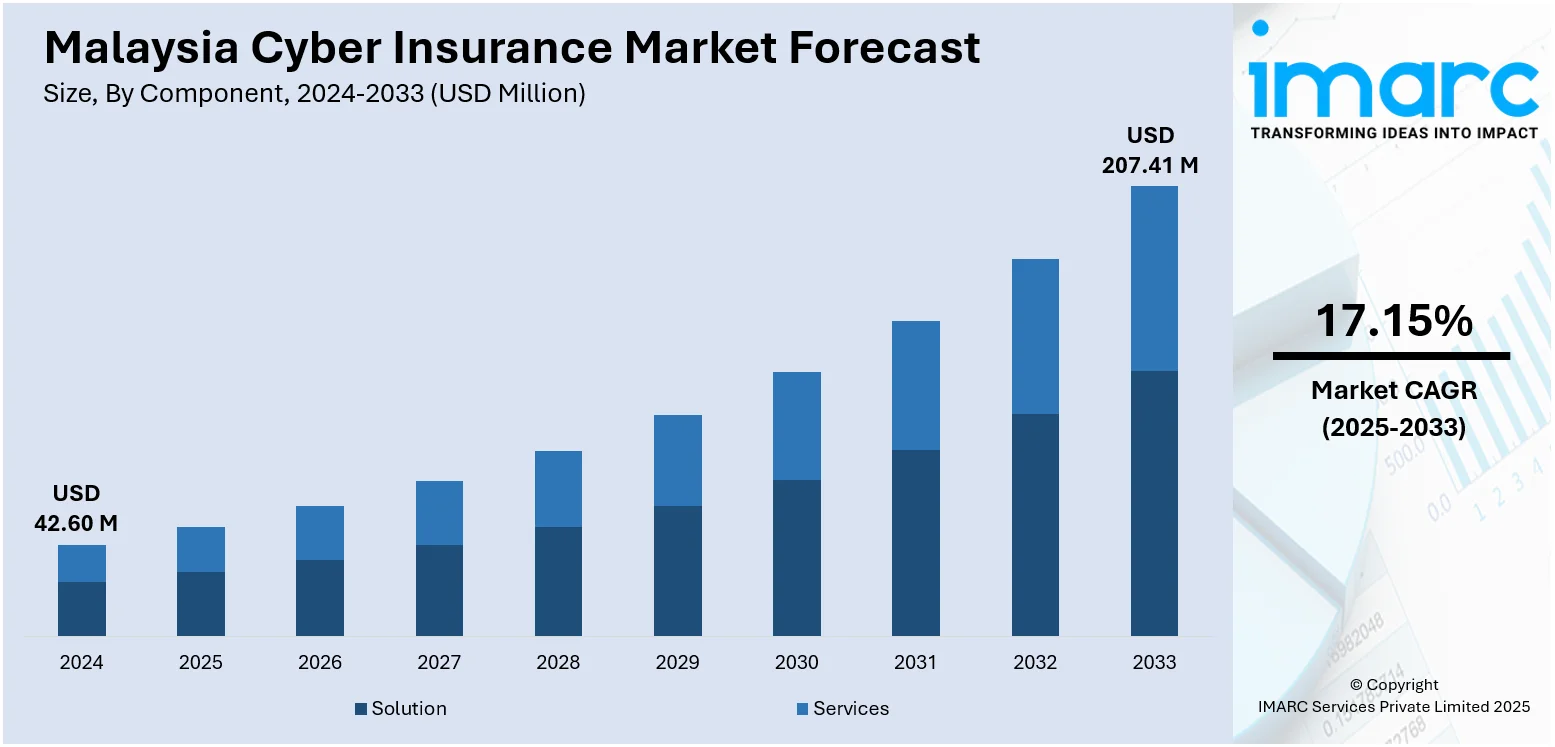

The Malaysia cyber insurance market size reached USD 42.60 Million in 2024. The market is projected to reach USD 207.41 Million by 2033, exhibiting a growth rate (CAGR) of 17.15% during 2025-2033. The market is expanding due to increasing cases of cyberattacks and stronger data protection regulations. Growing reliance on digital platforms and demand for risk-based insurance products continue to support Malaysia cyber insurance market share across banking, healthcare, and e-commerce sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 42.60 Million |

| Market Forecast in 2033 | USD 207.41 Million |

| Market Growth Rate 2025-2033 | 17.15% |

Malaysia Cyber Insurance Market Trends:

Escalating Cyber Threats Fuel Market Growth

The rising rate and intensity of cyber events in Malaysia have emerged as a key catalyst for the rise in cyber insurance take-up. Through industries specifically finance, healthcare, and e-commerce business entities are being confronted with increased vulnerability to ransomware, phishing attacks, and data leakage. As electronic operations widen and cloud-based platforms become more integrated into business systems, the monetary and reputational consequences associated with cyber breaches are driving anticipatory risk mitigation measures. Cyber insurance is increasingly seen as a critical part of operational resilience, rather than a discretionary cost. This is supported by the tightening of data protection legislation, such as the Personal Data Protection Act (PDPA), which emphasizes more accountability and incurs financial sanctions for data loss or unauthorized access. Insurers are responding by fine-tuning their cover by including cybersecurity technology, real-time monitoring, and incident response services in their policies. The demand for comprehensive coverage addressing business interruption, legal costs, and data recovery continues to rise. As organizations recognize the tangible value of pre- and post-breach support, the Malaysia cyber insurance market growth is expected to sustain its upward trajectory. Continued digital expansion, paired with the growing awareness of cyber risks, will remain central to shaping the market’s evolution in the foreseeable future.

To get more information on this market, Request Sample

Tailored Coverage Becomes Market Standard

The Malaysian cyber insurance landscape is undergoing a strategic transformation, with insurers moving away from standardized offerings toward more customized policies. This change is driven by the need to align insurance coverage with specific operational risks, which vary considerably across industries. Firms in sectors such as logistics, banking, and manufacturing face distinct vulnerabilities, and insurers are now actively designing policies that reflect those differences. Risk assessments have become a prerequisite during underwriting, allowing insurers to evaluate cybersecurity maturity, infrastructure integrity, and exposure levels. This enables more accurate pricing and the development of modular policy structures that can be adjusted over time. Businesses with stronger internal controls and established incident response protocols often benefit from reduced premiums and broader coverage terms. This trend also supports the growing demand for adaptive risk management strategies, where insurance is not only a financial safety net but part of a larger cybersecurity framework. Additionally, increased use of data analytics and threat intelligence by insurers is enabling more refined risk segmentation. As organizations in Malaysia become more aware of their digital risk profile, demand is shifting toward flexible, industry-specific coverage solutions. This evolution reflects a more mature and informed approach to managing cyber risk through insurance.

Malaysia Cyber Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on component, insurance type, organization size, and end-use industry.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Insurance Type Insights:

- Packaged

- Stand-alone

The report has provided a detailed breakup and analysis of the market based on the insurance type. This includes packaged and stand-alone.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium enterprises and large enterprises.

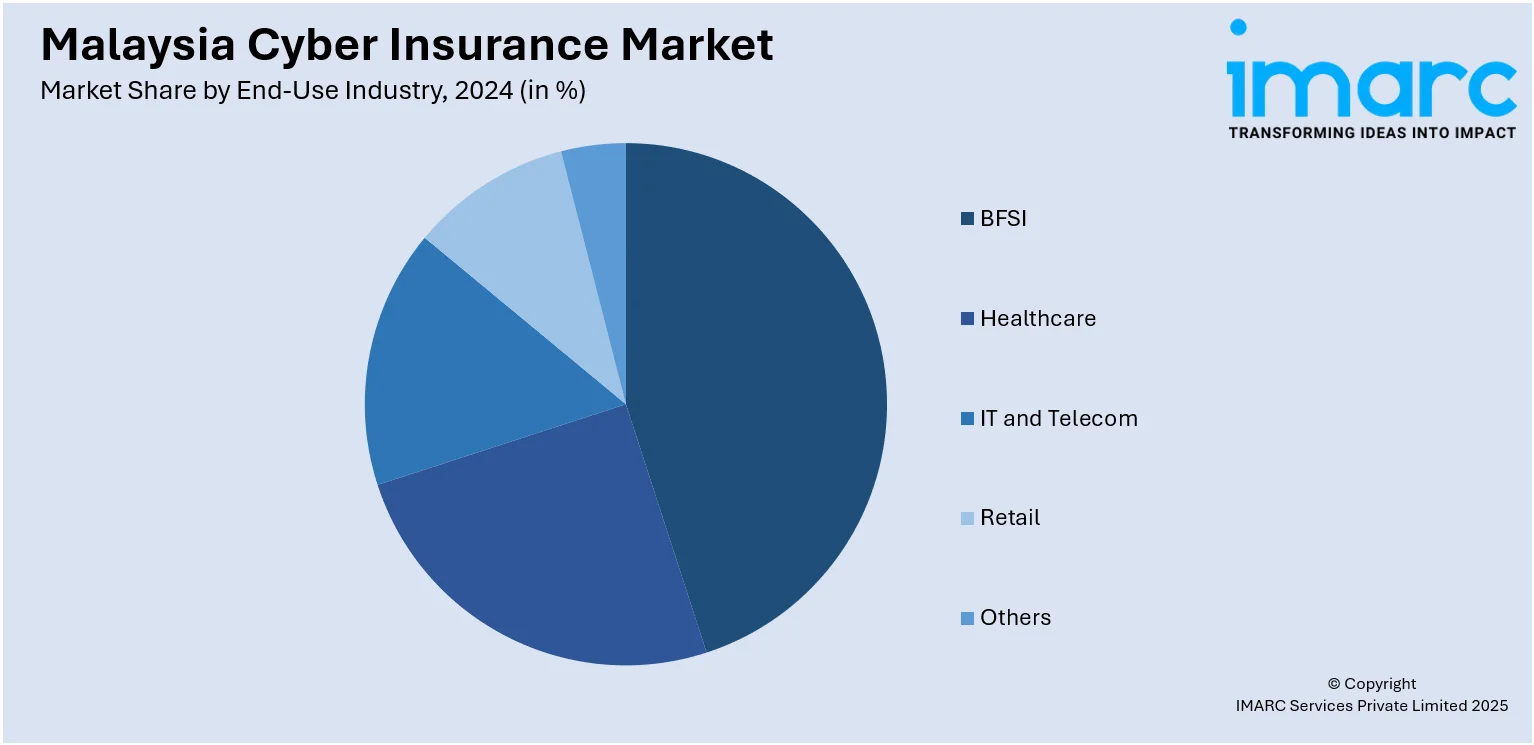

End-Use Industry Insights:

- BFSI

- Healthcare

- IT and Telecom

- Retail

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes BFSI, healthcare, IT and telecom, retail, and others.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Cyber Insurance Market News:

- July 2024: Zurich Malaysia and GXBank launched Cyber Fraud Protect, a digital cyber insurance product covering losses from unauthorized electronic transactions. This marked a key development in Malaysia's cyber insurance sector, increasing accessibility and awareness, and driving wider adoption through embedded in-app protection.

Malaysia Cyber Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Insurance Types Covered | Packaged, Stand-alone |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End-Use Industries Covered | BFSI, Healthcare, IT and Telecom, Retail, Others |

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia cyber insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia cyber insurance market on the basis of component?

- What is the breakup of the Malaysia cyber insurance market on the basis of insurance type?

- What is the breakup of the Malaysia cyber insurance market on the basis of organization size?

- What is the breakup of the Malaysia cyber insurance market on the basis of end-use industry?

- What is the breakup of the Malaysia cyber insurance market on the basis of region?

- What are the various stages in the value chain of the Malaysia cyber insurance market?

- What are the key driving factors and challenges in the Malaysia cyber insurance market?

- What is the structure of the Malaysia cyber insurance market and who are the key players?

- What is the degree of competition in the Malaysia cyber insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia cyber insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia cyber insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia cyber insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)