Malaysia Drones Market Size, Share, Trends and Forecast by Type, Component, Payload, Point of Sale, End-Use Industry, and Region, 2025-2033

Malaysia Drones Market Overview:

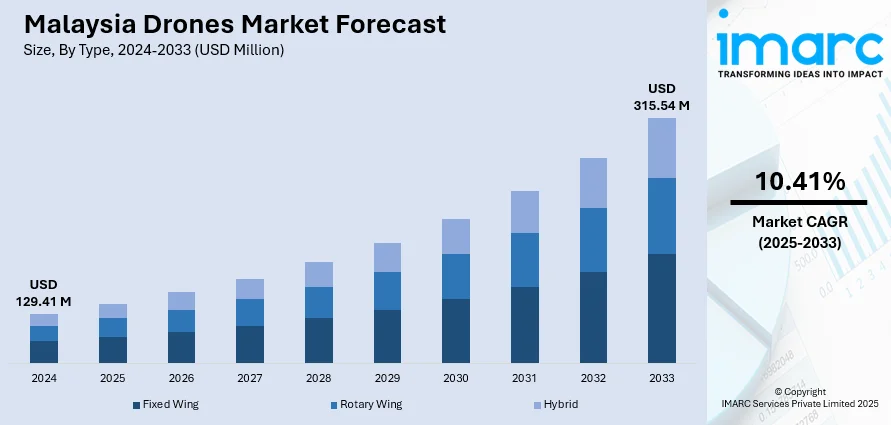

The Malaysia drones market size reached USD 129.41 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 315.54 Million by 2033, exhibiting a growth rate (CAGR) of 10.41% during 2025-2033. The market is propelled by robust government initiatives, increasing demand in key sectors, and the innovation of local technology players. Industries, such as agriculture, construction and public safety, are using drones for precision applications, enhancing efficiency and saving costs, while universities and startups are further adding to an expanding ecosystem with an emphasis on practical applications and high-quality talent development. The synergy of policy backup, sector demand, and local innovation is driving fast-paced growth, enabling the expansion of the Malaysia drones market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 129.41 Million |

| Market Forecast in 2033 | USD 315.54 Million |

| Market Growth Rate 2025-2033 | 10.41% |

Malaysia Drones Market Trends:

Government Strategy and National Drone Initiatives

Malaysia's drone market owes much to the government's visionary initiatives, especially the Malaysia Drone Technology Action Plan (MDTAP) and the establishment of specific drone test sites. These policies reflect a high priority on building an ecosystem that drives innovation, safety, and commercialization. There have also been sandbox areas assigned by the government of Malaysia, such as Area 57, that enable companies to test and prove drone applications in actual environments without the bureaucratic red tape often connected with aviation regulation. All these are aimed at facilitating drone integration into public and private sectors. Apart from this, the National Technology and Innovation Sandbox (NTIS) also aids start-ups and companies working on drone solutions through technical expertise, regulatory assistance, and access to funding channels. These institutional platforms play an important role in placing Malaysia in one of the most drone-prepared countries in Southeast Asia. The country's favorable policy environment is further fueling the Malaysia drones market growth in services as well as manufacturing of hardware.

To get more information on this market, Request Sample

Industry Adoption Across Agriculture, Construction, and Security

Malaysia's economy is conducive to hosting a variety of drone uses, especially in agriculture, construction, and security. In agriculture, drones are changing the face of plantations by facilitating precision farming, e.g., precise spraying of pesticides, monitoring crop health, and automatic mapping of fields. This is particularly relevant in Malaysia's extensive palm oil, rubber, and rice plantations, where conventional practices are inefficient and labor-intensive. In the building sector, drones are being used more and more for surveying, site inspection, and project monitoring, enabling builders to save money and ensure safety. Roadway, port, and urban development projects benefit from aerial data captured through drone flights. Law enforcement agencies and security forces have incorporated drone technology for crowd monitoring, border control, and disaster management in urban and rural areas. These actual application scenarios depict Malaysia's pragmatic and dynamic perspective on drone deployment, fueled by tangible commercial advantage and growing demand in strategic industries.

Emergence of Domestic Drone Tech Firms and Innovation Hub

A second factor driving Malaysia's drone market is the rise of homegrown tech firms that are becoming pioneers in drone innovation and services. Malaysian companies like Aerodyne and Meraque have emerged as prominent forces, providing end-to-end drone solutions for sectors such as agriculture, infrastructure, and energy. They are not only catering to the local market but are also spreading their presence globally, introducing Malaysia as a regional hub for drone technology. Local research institutions and universities are also in the process of creating new drone applications and training competent professionals, further intensifying the innovation pipeline. The setting up of public-private partnerships has created a space where start-ups could grow and pilot-test their technology using government-sponsored platforms. This dynamic innovation ecosystem underpinned by policy and entrepreneurial vigor allows Malaysia to solve its local challenges using indigenous drone solutions. The continued growth of these companies plays a critical role in shaping the national drone landscape and driving adoption at scale.

Malaysia Drones Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, payload, point of sale, and end-use industry.

Type Insights:

- Fixed Wing

- Rotary Wing

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the type. This includes fixed wing, rotary wing, and hybrid.

Component Insights:

- Hardware

- Software

- Accessories

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and accessories.

Payload Insights:

- <25 Kilograms

- 25-170 Kilograms

- >170 Kilograms

A detailed breakup and analysis of the market based on the payload have also been provided in the report. This includes <25 Kilograms, 25-170 Kilograms, and >170 Kilograms.

Point of Sale Insights:

- Original Equipment Manufacturers (OEM)

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the point of sale. This includes original equipment manufacturers (OEM) and aftermarket.

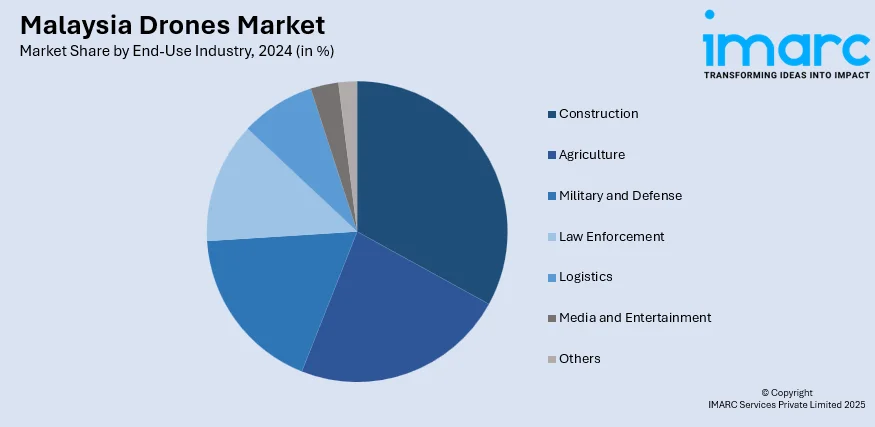

End-Use Industry Insights:

- Construction

- Agriculture

- Military and Defense

- Law Enforcement

- Logistics

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes construction, agriculture, military and defense, law enforcement, logistics, media and entertainment, and others.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which includes Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Drones Market News:

- In July 2025, Malaysia revealed plans to receive its initial Turkish-manufactured ANKA-S Medium Altitude Long Endurance Unmanned Aerial Systems (MALE-UAS) by March 2026, representing a significant advancement in the nation’s mission to enhance maritime monitoring and protect its territorial integrity in the South China Sea. Created by Turkish Aerospace Industries (TAI), the ANKA-S drones - able to fly for more than 30 hours at heights of 30,000 feet- are presently in the process of radar integration and communications system installation, with essential parts obtained from Germany. Datuk Seri Mohamed Khaled Nordin, the Defence Minister of Malaysia, affirmed that personnel from the Royal Malaysian Air Force (RMAF) designated to manage the platform are currently undergoing practical operational training with the manufacturer in Türkiye.

- In May 2024, two Malaysian SMEs showcased their proposals for domestic UAV manufacturing at DSA 2024. Pen Aviation introduced the PEN35V, a 35kg quadcopter created mainly for. Celestial Dynamics is set to manufacture under license a variety of Chinese drones designed by Jin Hong, a branch of AVIC.

Malaysia Drones Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing, Rotary Wing, Hybrid |

| Components Covered | Hardware, Software, Accessories |

| Payloads Covered | <25 Kilograms, 25-170 Kilograms, >170 Kilograms |

| Points of Sales Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| End-Use Industries Covered | Construction, Agriculture, Military and Defense, Law Enforcement, Logistics, Media and Entertainment, Others |

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia drones market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia drones market on the basis of type?

- What is the breakup of the Malaysia drones market on the basis of component?

- What is the breakup of the Malaysia drones market on the basis of payload?

- What is the breakup of the Malaysia drones market on the basis of point of sale?

- What is the breakup of the Malaysia drones market on the basis of end-use industry?

- What is the breakup of the Malaysia drones market on the basis of region?

- What are the various stages in the value chain of the Malaysia drones market?

- What are the key driving factors and challenges in the Malaysia drones market?

- What is the structure of the Malaysia drones market and who are the key players?

- What is the degree of competition in the Malaysia drones market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia drones market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia drones market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia drones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)