Malaysia E-Commerce Market Size, Share, Trends and Forecast by Business Model, Mode of Payment, Service Type, Product Type, and States, 2025-2033

Malaysia E-Commerce Market Overview:

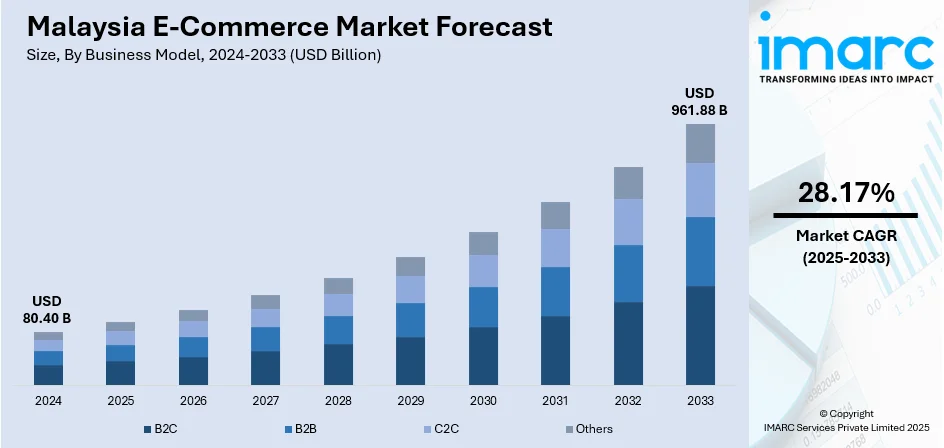

The Malaysia e-commerce market size reached USD 80.40 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 961.88 Billion by 2033, exhibiting a growth rate (CAGR) of 28.17% during 2025-2033. The e-commerce market is growing as major brands embrace direct-to-consumer (DTC) platforms, enhancing control and client loyalty. Additionally, improved financial tools for small and medium-sized enterprises (SMEs) are lowering entry barriers, enabling broader participation. Together, these trends strengthen buyer trust, boost seller diversity, influence overall digital retail standards, thereby contributing to the expansion of the Malaysia e-commerce market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 80.40 Billion |

| Market Forecast in 2033 | USD 961.88 Billion |

| Market Growth Rate 2025-2033 | 28.17% |

Malaysia E-Commerce Market Trends:

Expansion of Direct-to-Consumer (DTC) Channels

The increasing shift by large, well-known brands toward direct-to-consumer (DTC) online channels is impelling the market growth. These companies are no longer relying solely on third-party marketplaces or physical retail networks. By launching their own branded e-commerce platforms, they gain more control over pricing, promotions, product presentation, and client engagement. This allows for a more personalized shopping experience, faster introduction of new products, and exclusive deals that drive buyer loyalty. It also enables brands to collect better user data, improving their ability to tailor offerings and communication. Individuals benefit from perks like official warranties, bundled services, and consistent post-sale support, factors that build trust and encourage repeat purchases. The presence of a dedicated brand store also signals authenticity and reduces the risk of counterfeits, which is a common concern when shopping online. As more major brands adopt this model, they contribute to broader platform usage, client confidence, and digital retail innovation. This shift also pressures smaller competitors to improve their service standards, raising the overall quality of the e-commerce ecosystem and encouraging both buyers and sellers to stay more active in the market. In 2024, LG Malaysia officially launched its first online brand store, offering a wide range of home appliances and entertainment products with benefits like free delivery and installation. Members enjoyed exclusive discounts, early product trials, and special promotions. The store complemented LG’s presence on Shopee and Lazada to enhance client convenience.

To get more information on this market, Request Sample

Strengthening of Small and Medium-Sized Enterprises (SMEs) Financial Infrastructure

The targeted improvement in financial infrastructure designed specifically for small and medium-sized enterprises (SMEs) is a crucial factor bolstering the Malaysia e-commerce market growth. These businesses form a large portion of the country’s retail and service economy, but many have traditionally faced challenges in managing cash flow, accessing credit, and handling digital transactions securely. New digital financial tools are addressing these gaps by offering faster onboarding, integrated payment systems, and credit solutions tailored to business cycles. Features like deferred payments, interest-free terms, and automated billing help SMEs reduce operational strain and focus on scaling their online presence. These tools also enable better tracking of receivables, expense control, and tax reporting, key areas that were once barriers to sustained digital participation. With improved financial visibility and easier access to working capital, more SMEs are entering and competing in the e-commerce space. The result is a more diverse seller ecosystem, increased product availability, and greater innovation in client engagement. As financial service providers continue to collaborate with local development agencies and digital economy programs, these improvements are becoming more accessible even to micro-businesses, accelerating digital inclusion and expanding the overall e-commerce market. In 2024, PayMate launched its Business Payments app in Malaysia to support SMEs with streamlined B2B payments, interest-free credit for up to 55 days, and secure transactions. The initiative, in collaboration with Selangor Information Technology & Digital Economy Corporation (SIDEC), aimed to enhance financial management and empower local business growth.

Malaysia E-Commerce Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and state levels for 2025-2033. Our report has categorized the market based on business model, mode of payment, service type, and product type.

Business Model Insights:

- B2C

- B2B

- C2C

- Others

The report has provided a detailed breakup and analysis of the market based on the business model. This includes B2C, B2B, C2C, and others.

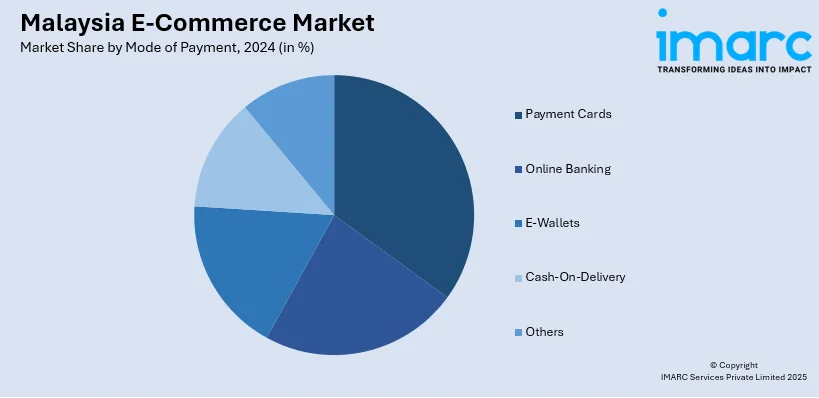

Mode of Payment Insights:

- Payment Cards

- Online Banking

- E-Wallets

- Cash-On-Delivery

- Others

A detailed breakup and analysis of the market based on the mode of payment have also been provided in the report. This includes payment cards, online banking, e-wallets, cash-on-delivery, and others.

Service Type Insights:

- Financial

- Digital Content

- Travel and Leisure

- E-Tailing

- Others

The report has provided a detailed breakup and analysis of the market based on the service type. This includes financial, digital content, travel and leisure, e-tailing, and others.

Product Type Insights:

- Groceries

- Clothing and Accessories

- Mobiles and Electronics

- Health and Personal Care

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes groceries, clothing and accessories, mobiles and electronics, health and personal care, and others.

States Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia E-Commerce Market News:

- In December 2024, the Malaysian International Chamber of Commerce and Industry (MICCI) launched the “E-Commerce Chapter” to boost Malaysia's digital economy by fostering collaboration between e-commerce platforms like Shopee, Lazada, and Mudah.my and regulatory bodies. The initiative aimed to enhance policy dialogue, address industry challenges, and support underserved groups such as rural SMEs and women entrepreneurs.

- In September 2024, Malaysia's Domestic Trade Minister announced a proposed collaboration with UNCTAD to review and strengthen Malaysia’s e-commerce laws. The initiative aimed to align regulations with global best practices and digital growth, and was part of the 12th Malaysia Plan, with completion expected by March 2025.

Malaysia E-Commerce Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Busines Models Covered | B2C, B2B, C2C, Others |

| Modes Of Payments Covered | Payment Cards, Online Banking, E-Wallets, Cash-On-Delivery, Others |

| Service Types Covered | Financial, Digital Content, Travel and Leisure, E-Tailing, Others |

| Product Types Covered | Groceries, Clothing and Accessories, Mobiles and Electronics, Health and Personal Care, Others |

| States Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia e-commerce market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia e-commerce market on the basis of business model?

- What is the breakup of the Malaysia e-commerce market on the basis of mode of payment?

- What is the breakup of the Malaysia e-commerce market on the basis of service type?

- What is the breakup of the Malaysia e-commerce market on the basis of product type?

- What is the breakup of the Malaysia e-commerce market on the basis of states?

- What are the various stages in the value chain of the Malaysia e-commerce market?

- What are the key driving factors and challenges in the Malaysia e-commerce market?

- What is the structure of the Malaysia e-commerce market and who are the key players?

- What is the degree of competition in the Malaysia e-commerce market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia e-commerce market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia e-commerce market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia e-commerce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)